ASSA

No content yet

ASSA

#Forecast

#Dogecoin is facing bearish pressure, but important events are happening — from innovations in payment apps to technical models indicating possible volatility. Here are the main news:

Launch of the payment app (January 20, 2026) — House of Doge, a subsidiary of the Dogecoin Foundation, announced the "Such" mobile app for gig economy workers, allowing them to accept DOGE, expanding the coin's real-world use.

Co-founder mocks the dollar (January 20, 2026) — Billy Markus criticizes the devaluation of the dollar amid record gold prices.

A technical model has appeared (January 20, 2026) —

#Dogecoin is facing bearish pressure, but important events are happening — from innovations in payment apps to technical models indicating possible volatility. Here are the main news:

Launch of the payment app (January 20, 2026) — House of Doge, a subsidiary of the Dogecoin Foundation, announced the "Such" mobile app for gig economy workers, allowing them to accept DOGE, expanding the coin's real-world use.

Co-founder mocks the dollar (January 20, 2026) — Billy Markus criticizes the devaluation of the dollar amid record gold prices.

A technical model has appeared (January 20, 2026) —

DOGE0,31%

- Reward

- 1

- Comment

- Repost

- Share

🎯 Bullish Signal 📈(

)in the capitulation zone: The Fear and Greed Index has fallen to 31, RSI around 26 indicates strong oversold conditions, and institutional players #BTC for example, Strategy( have bought over 22,000 BTC — forming a stable medium-term support. Capital inflows into )and increased activity of large wallets confirm the potential for a rebound.

News Background #ETF Bullish Signal 📈(:

Institutional Purchases: Strategy and other companies have increased BTC holdings, with the total corporate ownership reaching over 3.3% of the supply.

)and Institutional Infrastructure: The lau

View Original)in the capitulation zone: The Fear and Greed Index has fallen to 31, RSI around 26 indicates strong oversold conditions, and institutional players #BTC for example, Strategy( have bought over 22,000 BTC — forming a stable medium-term support. Capital inflows into )and increased activity of large wallets confirm the potential for a rebound.

News Background #ETF Bullish Signal 📈(:

Institutional Purchases: Strategy and other companies have increased BTC holdings, with the total corporate ownership reaching over 3.3% of the supply.

)and Institutional Infrastructure: The lau

- Reward

- like

- 1

- Repost

- Share

ASSA :

:

👌👌👌🤑🤑🤑🥳🥳🥳Brief

The price of #Bitcoin is influenced by conflicting factors: on one hand — macroeconomic risks, on the other — long-term positive trends.

Geopolitical tariffs – escalation of trade disputes between the US and Europe causes short-term volatility.

Changes in demand for #CryptoMarketPullback – slowing institutional investments find support at the $92K level.

Risks among medium-term holders – the entry price into #ETF could lead to forced sales if the price drops.

Detailed Analysis

1. Geopolitical tariffs $114K Short-term negative(

Overview:

President Trump’s threat to impose 10% tariffs on

The price of #Bitcoin is influenced by conflicting factors: on one hand — macroeconomic risks, on the other — long-term positive trends.

Geopolitical tariffs – escalation of trade disputes between the US and Europe causes short-term volatility.

Changes in demand for #CryptoMarketPullback – slowing institutional investments find support at the $92K level.

Risks among medium-term holders – the entry price into #ETF could lead to forced sales if the price drops.

Detailed Analysis

1. Geopolitical tariffs $114K Short-term negative(

Overview:

President Trump’s threat to impose 10% tariffs on

BTC-0,6%

- Reward

- like

- Comment

- Repost

- Share

Brief

Discussions around Ethereum resemble a tug-of-war between hopes for growth and fears of decline. Here's what's trending now:

Optimistic technical analysis (TA) targets the $3,500 level by February

Pessimistic signals warn of decreasing momentum

BitMine's stake of $279 million in ETH indicates confidence

Analysts are divided due to mixed signals

Details

1. $3,500 target — optimistic

"Ethereum price forecast: aiming for the $3,500 range by February 2026. Technical analysis indicates movement toward resistance at $3,500 within 4-6 weeks based on momentum patterns."

What this means: This is

Discussions around Ethereum resemble a tug-of-war between hopes for growth and fears of decline. Here's what's trending now:

Optimistic technical analysis (TA) targets the $3,500 level by February

Pessimistic signals warn of decreasing momentum

BitMine's stake of $279 million in ETH indicates confidence

Analysts are divided due to mixed signals

Details

1. $3,500 target — optimistic

"Ethereum price forecast: aiming for the $3,500 range by February 2026. Technical analysis indicates movement toward resistance at $3,500 within 4-6 weeks based on momentum patterns."

What this means: This is

ETH-1,31%

- Reward

- 2

- 3

- Repost

- Share

Discovery :

:

Watching Closely 🔍️View More

Discussions around #Bitcoin fluctuate between excitement over the possible achievement of $100K and concerns about consolidation. Here are the main # trends:

Target $110K by March – technical analysis indicates a possible bullish breakout

Contradictory forecasts – bets on $60K and more than $1 million in the long term

Whales versus retail investors – growth in large players' holdings faces panicked selling by small investors

Details

1. Growth until $110K by March 2026 – optimistic scenario

"$BTC consolidates above key support… a rise to $110,000 is possible within 6-8 weeks"

What it mea

Target $110K by March – technical analysis indicates a possible bullish breakout

Contradictory forecasts – bets on $60K and more than $1 million in the long term

Whales versus retail investors – growth in large players' holdings faces panicked selling by small investors

Details

1. Growth until $110K by March 2026 – optimistic scenario

"$BTC consolidates above key support… a rise to $110,000 is possible within 6-8 weeks"

What it mea

BTC-0,6%

- Reward

- 1

- 1

- Repost

- Share

ASSA :

:

Observing...#GateSquareCreatorNewYearIncentives

#BTC 🎯 Positive Outlook (利好📈)

#Институции Strengthening demand: Over the past week, Bitcoin (≈95,200 USDT) demonstrates resilience despite fluctuations. Positive flows into ETFs (up to 1.46 billion USD per day) and the interest of major players lay the foundation for a breakout from consolidation. Increased participation of financial institutions in BTC supports the entire market, and related altcoins — primarily ETH and SOL — may gain momentum following the main cryptocurrency.

News Background (利好📈):

Topic: Institutional accumulation of BTC: The backg

View Original#BTC 🎯 Positive Outlook (利好📈)

#Институции Strengthening demand: Over the past week, Bitcoin (≈95,200 USDT) demonstrates resilience despite fluctuations. Positive flows into ETFs (up to 1.46 billion USD per day) and the interest of major players lay the foundation for a breakout from consolidation. Increased participation of financial institutions in BTC supports the entire market, and related altcoins — primarily ETH and SOL — may gain momentum following the main cryptocurrency.

News Background (利好📈):

Topic: Institutional accumulation of BTC: The backg

- Reward

- 4

- 2

- Repost

- Share

Discovery :

:

Thank you for the information and sharing.View More

#Doge #прогноз for a week

Action

Bullish

Buy from support

🎯 Opportunity (Bullish 📈)

Correction completed, a surge upwards possible: DOGE has formed an inverted "head and shoulders" pattern, holding around 0.137 USDT. Breaking through the resistance zone at 0.152 USDT could lead to a rise to 0.19 USDT. Supported by positive momentum in BTC and ETH, as well as a neutral-optimistic market background for altcoins (fear and greed index = 49).

News (Bullish 📈)

Technical reversal: The "head and shoulders" pattern on the daily chart indicates increasing momentum, with analysts noting a weakening of

View OriginalAction

Bullish

Buy from support

🎯 Opportunity (Bullish 📈)

Correction completed, a surge upwards possible: DOGE has formed an inverted "head and shoulders" pattern, holding around 0.137 USDT. Breaking through the resistance zone at 0.152 USDT could lead to a rise to 0.19 USDT. Supported by positive momentum in BTC and ETH, as well as a neutral-optimistic market background for altcoins (fear and greed index = 49).

News (Bullish 📈)

Technical reversal: The "head and shoulders" pattern on the daily chart indicates increasing momentum, with analysts noting a weakening of

- Reward

- 2

- 1

- Repost

- Share

ASSA :

:

Jump in 🚀Brief

News about #Bitcoin is filled with reports of institutional adoption and technological achievements. Here are the latest updates:

U.S. Bitcoin Strategic Reserve (January 17, 2026) – Trump signed an order to create a reserve from confiscated BTC, indicating an unprecedented level of government involvement.

ETF inflows reached $1.42 billion (January 17, 2026) – Spot Bitcoin ETFs recorded the largest weekly inflow since October, signaling renewed institutional investor interest.

BTC closed a CME gap at $94 800 (January 17, 2026) – Technical gap closure is seen as a positive signal toward re

News about #Bitcoin is filled with reports of institutional adoption and technological achievements. Here are the latest updates:

U.S. Bitcoin Strategic Reserve (January 17, 2026) – Trump signed an order to create a reserve from confiscated BTC, indicating an unprecedented level of government involvement.

ETF inflows reached $1.42 billion (January 17, 2026) – Spot Bitcoin ETFs recorded the largest weekly inflow since October, signaling renewed institutional investor interest.

BTC closed a CME gap at $94 800 (January 17, 2026) – Technical gap closure is seen as a positive signal toward re

BTC-0,6%

- Reward

- 2

- 1

- Repost

- Share

ASSA :

:

Follow 🔍 closelyDiscussions #Dogecoin — is a constant struggle between sharp growth and decline. Here's what's trending now:

1. **#Dogecoin Targets** – analysts forecast a breakthrough to $0.21–$0.30 by February

2. **#Оптимистичные Signals** – strong candles and large purchases indicate growth

3. **Pessimistic Warnings** – charts hint at a possible drop to $0.08

Short-term optimistic targets are $0.21

"Price forecast for $DOGE: targets of $0.165–$0.21 by February amid improving technical picture"

**What does this mean:** This is a positive signal for DOGE, as analysts expect consolidation around $

1. **#Dogecoin Targets** – analysts forecast a breakthrough to $0.21–$0.30 by February

2. **#Оптимистичные Signals** – strong candles and large purchases indicate growth

3. **Pessimistic Warnings** – charts hint at a possible drop to $0.08

Short-term optimistic targets are $0.21

"Price forecast for $DOGE: targets of $0.165–$0.21 by February amid improving technical picture"

**What does this mean:** This is a positive signal for DOGE, as analysts expect consolidation around $

DOGE0,31%

Your opinion on the price trend

DOGE up

5

5

DOGE down

4

4

9 ParticipantsVoting Finished

- Reward

- 11

- 1

- Repost

- Share

ASSA :

:

Dogecoin is on the verge of a significant breakthrough driven by an inverted "head and shoulders" pattern, with the key level to break through being $0.152. 📉 Over the past 24 hours, the price of Dogecoin has changed by -1.9%, to $0.13, and the trading volume has increased by +2.17%, to $1.31b.Brief😟🙁🤒😴🥳🤤😇😂🤠🤗

#Dogecoin overcomes technical levels and expands international partnerships, while major holders (whales) show caution. Here are the latest news:

A bullish pattern is forming (January 15, 2026) – DOGE has broken out of a key descending wedge but faces resistance at the $0.17 level to continue its rise.

Expansion launch in Japan (January 9, 2026) – House of Doge is partnering with Japanese companies on real asset tokenization and payment integrations.

Large holder activity slows down (January 9, 2026) – Major investors did not participate in the January rally, raising

#Dogecoin overcomes technical levels and expands international partnerships, while major holders (whales) show caution. Here are the latest news:

A bullish pattern is forming (January 15, 2026) – DOGE has broken out of a key descending wedge but faces resistance at the $0.17 level to continue its rise.

Expansion launch in Japan (January 9, 2026) – House of Doge is partnering with Japanese companies on real asset tokenization and payment integrations.

Large holder activity slows down (January 9, 2026) – Major investors did not participate in the January rally, raising

DOGE0,31%

- Reward

- 10

- 8

- Repost

- Share

Plastikkid :

:

Jump in 🚀View More

Brief

Over the past 24 hours, the crypto market decreased by 1.49%, despite a weekly growth of 4.04%. This was due to weak performance of altcoins compared to Bitcoin amid regulatory uncertainty.

Regulatory concerns: Disagreements surrounding the US CLARITY Act increased policy uncertainty, negatively impacting investor sentiment.

Altcoin weakness: Tokens such as UNI and FOGO fell by 5–12% due to issues related to specific projects, affecting the overall market.

Rotation towards Bitcoin: Bitcoin’s dominance increased by 0.10% to 59.07%, indicating a capital shift from altcoins to Bitcoin and p

View OriginalOver the past 24 hours, the crypto market decreased by 1.49%, despite a weekly growth of 4.04%. This was due to weak performance of altcoins compared to Bitcoin amid regulatory uncertainty.

Regulatory concerns: Disagreements surrounding the US CLARITY Act increased policy uncertainty, negatively impacting investor sentiment.

Altcoin weakness: Tokens such as UNI and FOGO fell by 5–12% due to issues related to specific projects, affecting the overall market.

Rotation towards Bitcoin: Bitcoin’s dominance increased by 0.10% to 59.07%, indicating a capital shift from altcoins to Bitcoin and p

- Reward

- 6

- 5

- Repost

- Share

GateUser-40388b14 :

:

Jump in 🚀View More

🐕 #Dogecoin is gaining momentum again — but the next step matters.

After failing to break above $0.152, $DOGE experienced a healthy pullback, a drop below $0.15 and $0.145. Nothing dramatic — the bulls stepped in exactly where it was important.

📉 The price respected the support at $0.142, coinciding with the bullish trend line and key Fibonacci levels.

As long as DOGE remains above $0.142–0.143 and the 100H MA, the structure remains bullish.🔑 Key levels to watch:

- Resistance: $0.145 → $0.150 → $0.151- Break and close above $0.151 → targets open towards $0.155, then $0.176–0.185

- Loss of $

After failing to break above $0.152, $DOGE experienced a healthy pullback, a drop below $0.15 and $0.145. Nothing dramatic — the bulls stepped in exactly where it was important.

📉 The price respected the support at $0.142, coinciding with the bullish trend line and key Fibonacci levels.

As long as DOGE remains above $0.142–0.143 and the 100H MA, the structure remains bullish.🔑 Key levels to watch:

- Resistance: $0.145 → $0.150 → $0.151- Break and close above $0.151 → targets open towards $0.155, then $0.176–0.185

- Loss of $

DOGE0,31%

- Reward

- 3

- 1

- Repost

- Share

GateUser-d9c25102 :

:

Very interesting information, thank you ♥️#CryptoMarketWatch

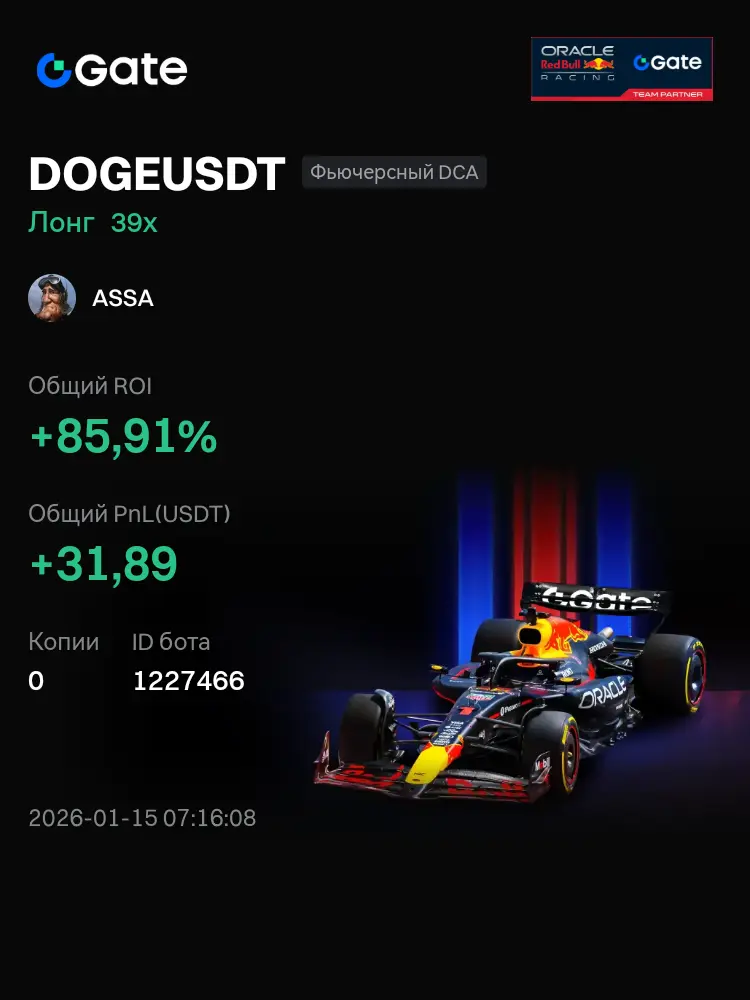

#DOGEUSDT Futures DCA on Gate. ROI since the bot was created has reached +85.91%

View Original#DOGEUSDT Futures DCA on Gate. ROI since the bot was created has reached +85.91%

- Reward

- 7

- Comment

- Repost

- Share

#Dogecoin It is adapting to regulatory changes and expanding its presence in the real world, while traders are closely watching key price levels. Here are the latest updates:

Regulatory vote could free DOGE from SEC oversight (January 15, 2026) – The Senate Committee will decide the legal status of DOGE.

Dogecoin ETFs are ignored in favor of Bitcoin and Solana (January 15, 2026) – Institutional investors prefer more regulated and useful assets.

House of Doge expands in Japan with a focus on real assets (January 9, 2026) – The partnership aims at asset tokenization and stablecoins.

Details

1. R

View OriginalRegulatory vote could free DOGE from SEC oversight (January 15, 2026) – The Senate Committee will decide the legal status of DOGE.

Dogecoin ETFs are ignored in favor of Bitcoin and Solana (January 15, 2026) – Institutional investors prefer more regulated and useful assets.

House of Doge expands in Japan with a focus on real assets (January 9, 2026) – The partnership aims at asset tokenization and stablecoins.

Details

1. R

- Reward

- 6

- 7

- Repost

- Share

Topinvest :

:

Hold tight 💪View More

#MyFavouriteChineseMemecoin

Around #Dogecoin (DOGE), interest is growing due to expansion in Japan, regulatory clarity, and a 9% price increase, with traders targeting the $0.15 mark. Here are the latest updates:

1. **Expansion in Japan (January 9, 2026)** – House of Doge is partnering with Japanese companies to launch projects with real assets (RWA) to use DOGE not just as a meme.

2. **Regulatory support (January 13, 2026)** – The US Senate proposes a bill classifying DOGE as a commodity, reducing risks for institutional investors.

3. **Price increase (January 14, 2026)** – DOGE rose b

View OriginalAround #Dogecoin (DOGE), interest is growing due to expansion in Japan, regulatory clarity, and a 9% price increase, with traders targeting the $0.15 mark. Here are the latest updates:

1. **Expansion in Japan (January 9, 2026)** – House of Doge is partnering with Japanese companies to launch projects with real assets (RWA) to use DOGE not just as a meme.

2. **Regulatory support (January 13, 2026)** – The US Senate proposes a bill classifying DOGE as a commodity, reducing risks for institutional investors.

3. **Price increase (January 14, 2026)** – DOGE rose b

- Reward

- like

- Comment

- Repost

- Share