51QuantitativeStrategy

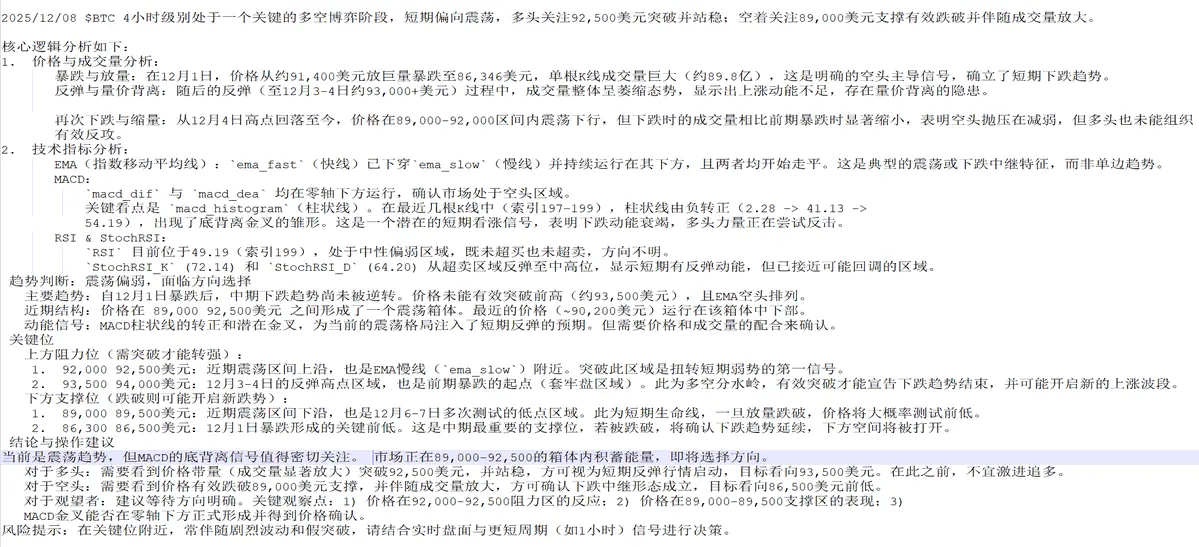

December 16, 2025 $BTC is in a clear 4-hour downtrend. All major technical indicators (EMA bearish alignment, MACD weakening below zero, RSI entering oversold territory) support this assessment. Although short-term indicators show oversold conditions that may trigger a technical rebound, the trend remains bearish until the price effectively breaks above key resistance levels (such as 89,500).

Operational advice: Trend traders should mainly consider shorting on rallies or staying on the sidelines. If aiming for a rebound, closely monitor resistance levels above and set strict stop-loss orders.

Operational advice: Trend traders should mainly consider shorting on rallies or staying on the sidelines. If aiming for a rebound, closely monitor resistance levels above and set strict stop-loss orders.

BTC0.35%