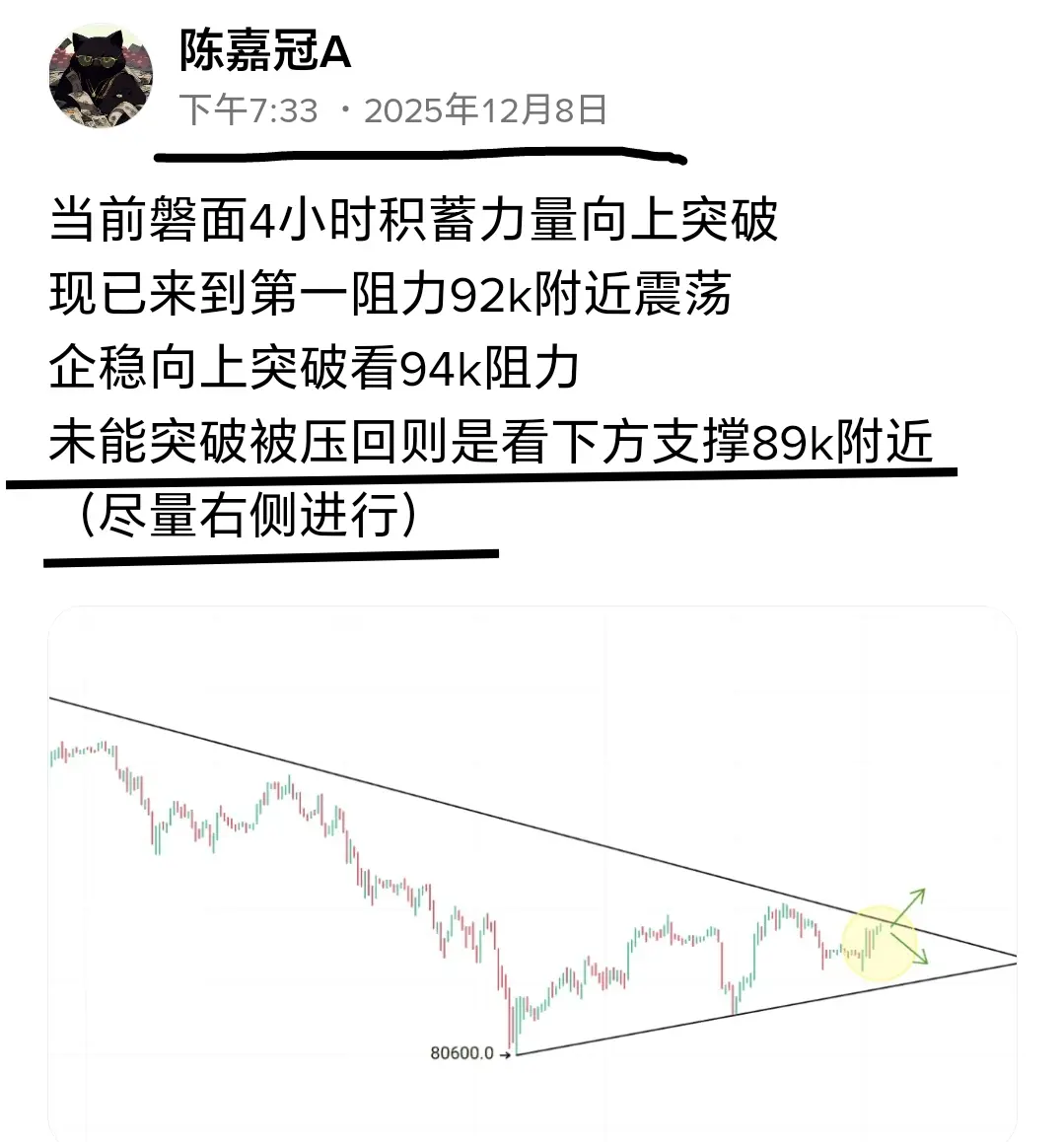

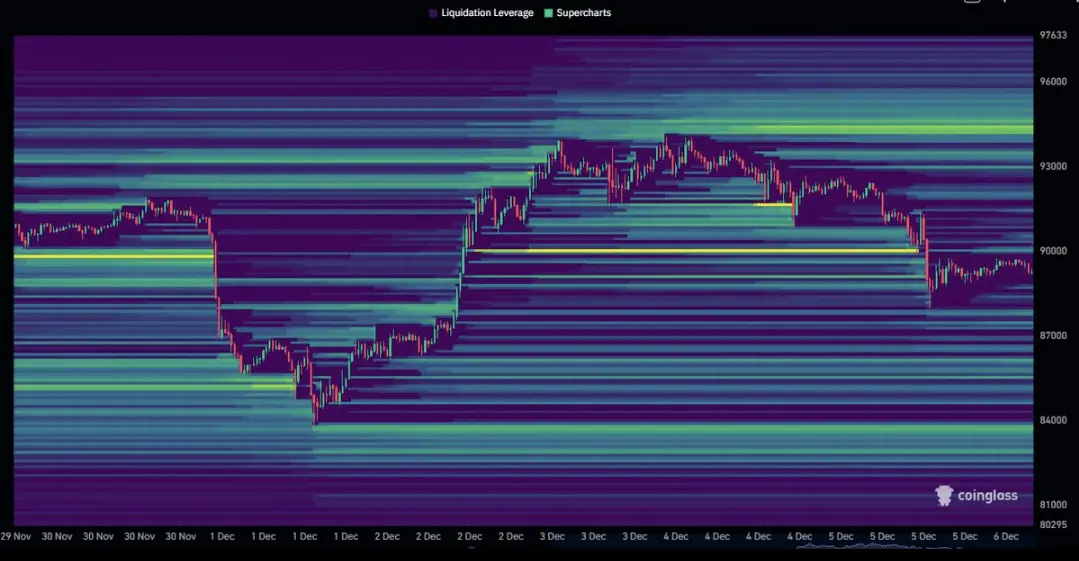

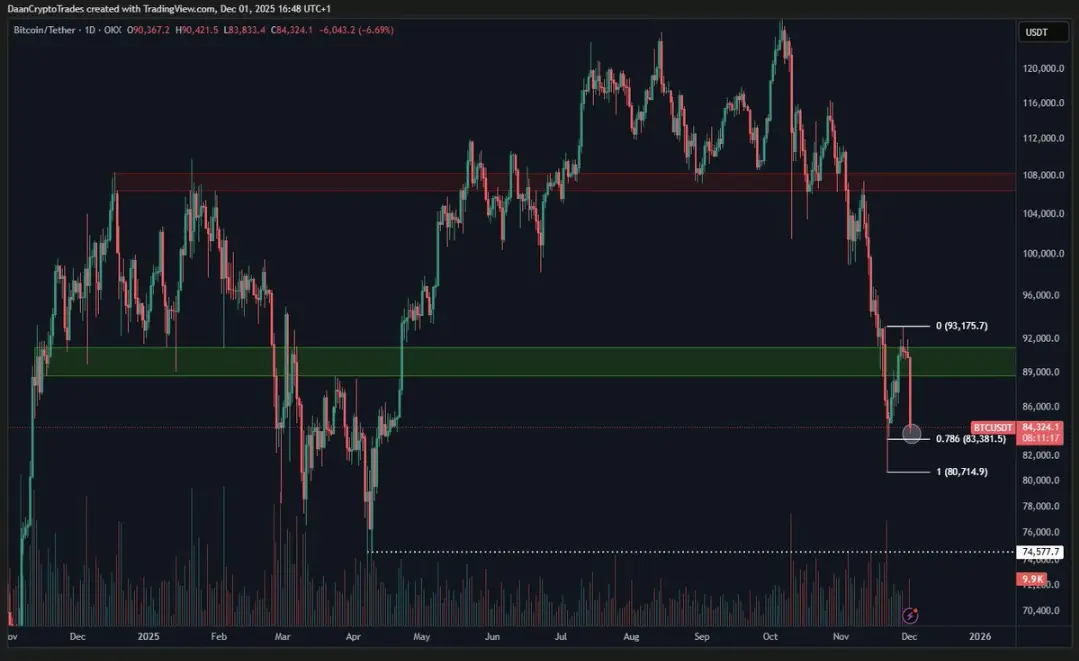

BTC has been consolidating in this relatively narrow range of 91.3k-92.4k.

After the futures market reopened today, it broke through the high point and reached 93k, but now it has returned to the 91k range.

If it breaks below, I think 88k-89k is worth paying attention to or can maintain above 91K, it may try to break through 93K again.

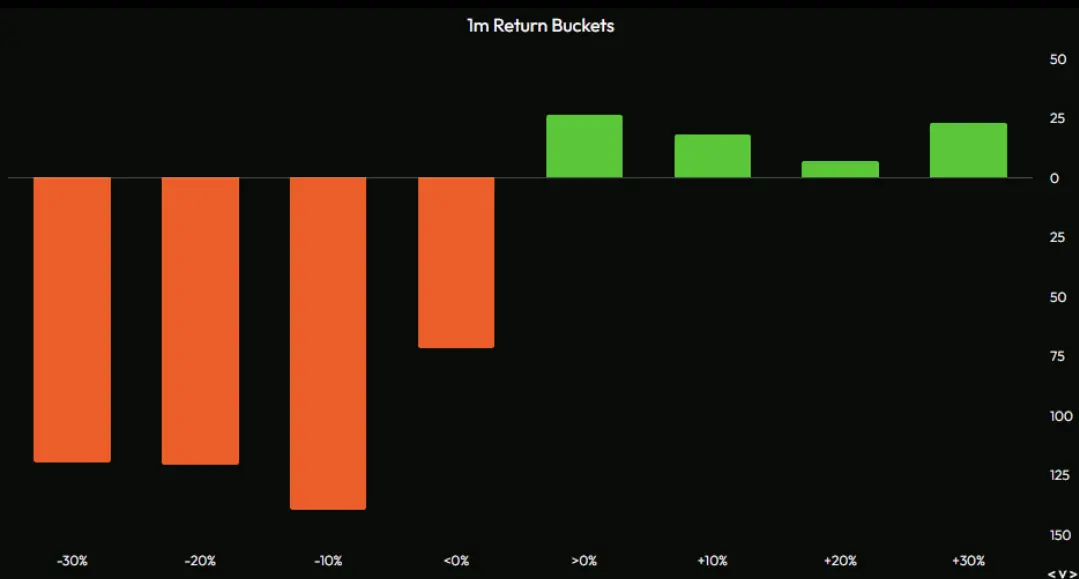

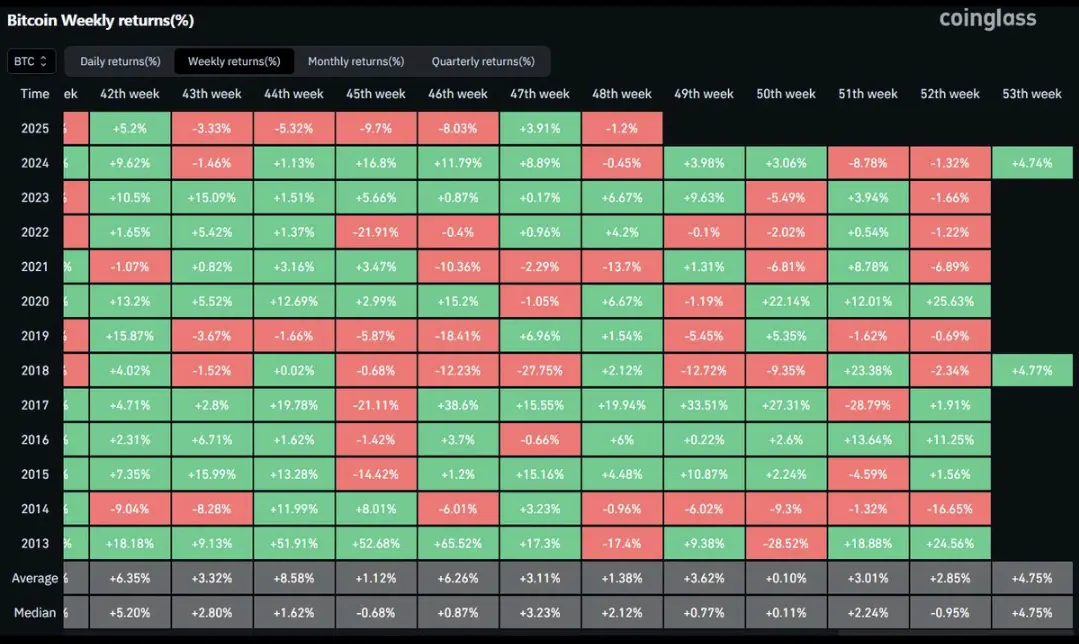

The market environment around Thanksgiving is quite volatile in the short term, and the trading volume and liquidity are usually low during the weekend.

After the futures market reopened today, it broke through the high point and reached 93k, but now it has returned to the 91k range.

If it breaks below, I think 88k-89k is worth paying attention to or can maintain above 91K, it may try to break through 93K again.

The market environment around Thanksgiving is quite volatile in the short term, and the trading volume and liquidity are usually low during the weekend.

BTC-1.2%