12.17 Cryptocurrency Morning Trading Tips

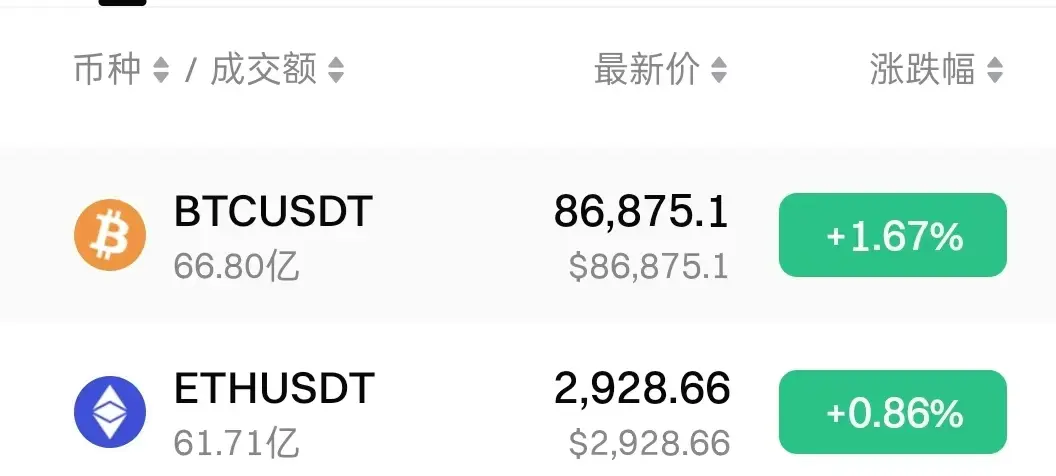

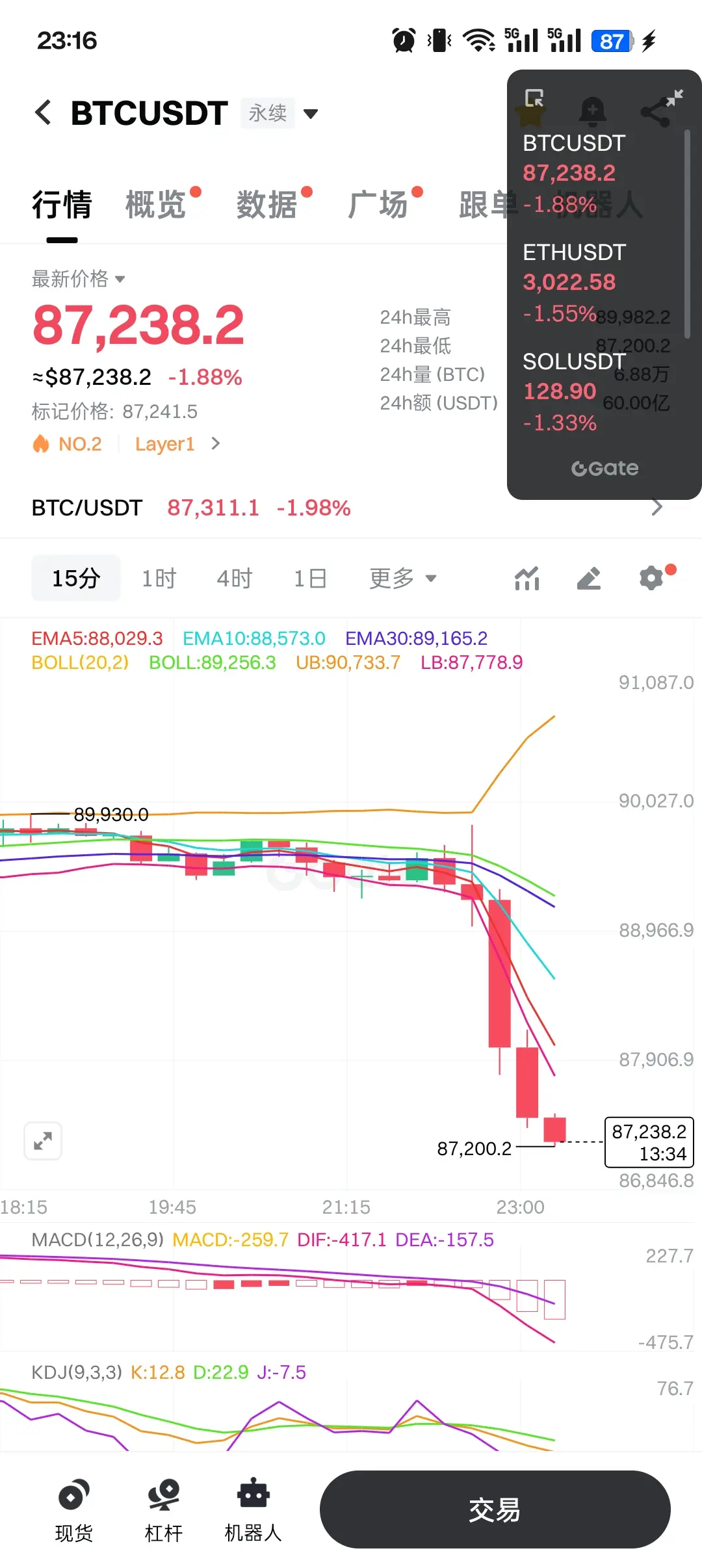

BTC

- Long: 85,000-86,000 Stop Loss: below 84,500

- Target: 88,000-89,000, breakout to 90,500

- Key support at 85,000, if broken, look for 80,000-82,000

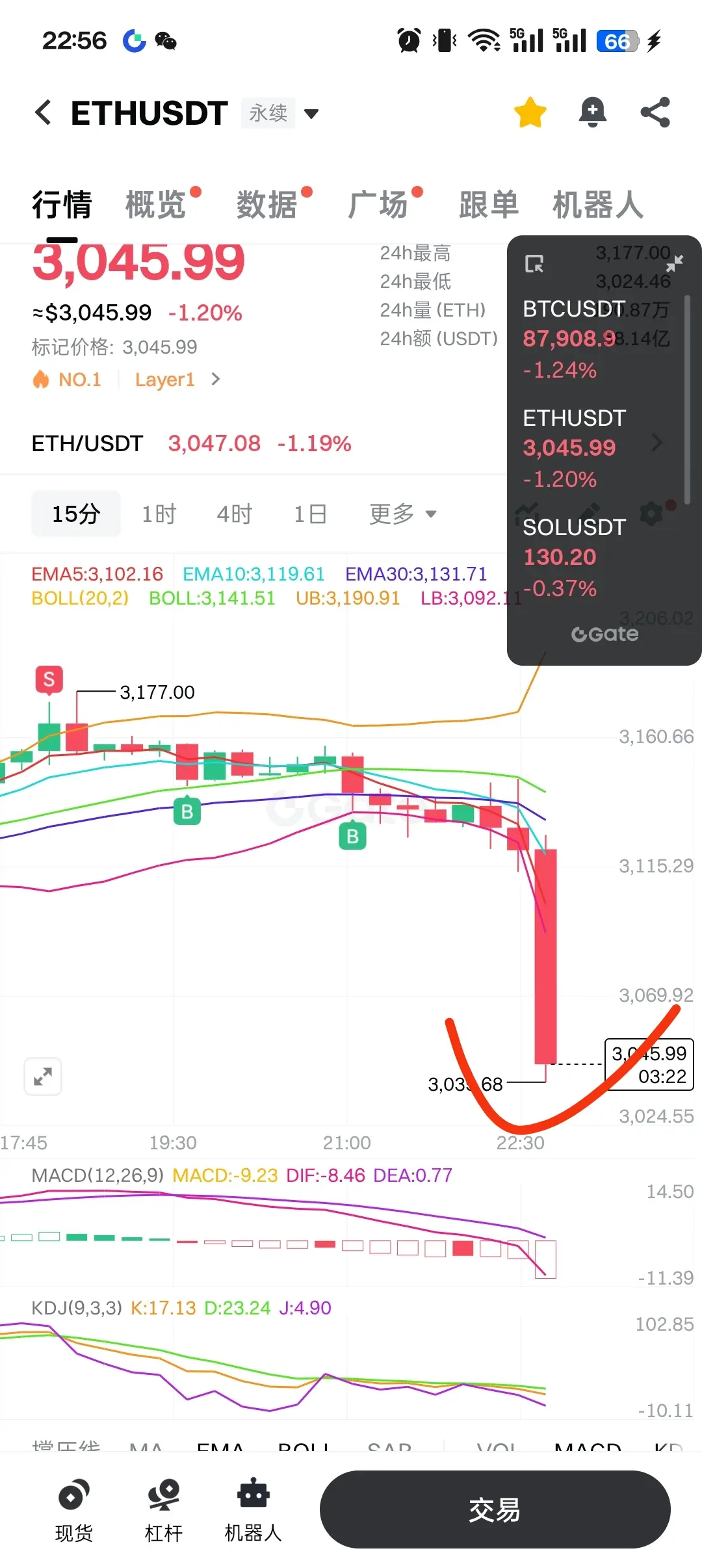

ETH

- Long: 2,860-2,880 Stop Loss: 2,830

- Target: 2,950-3,000, breakout to 3,050-3,130

- The trend is weaker than BTC, need to monitor BTC strength simultaneously

View Original