# WhiteHouseTalksStablecoinYields

1.09K

HighAmbition

#WhiteHouseTalksStablecoinYields

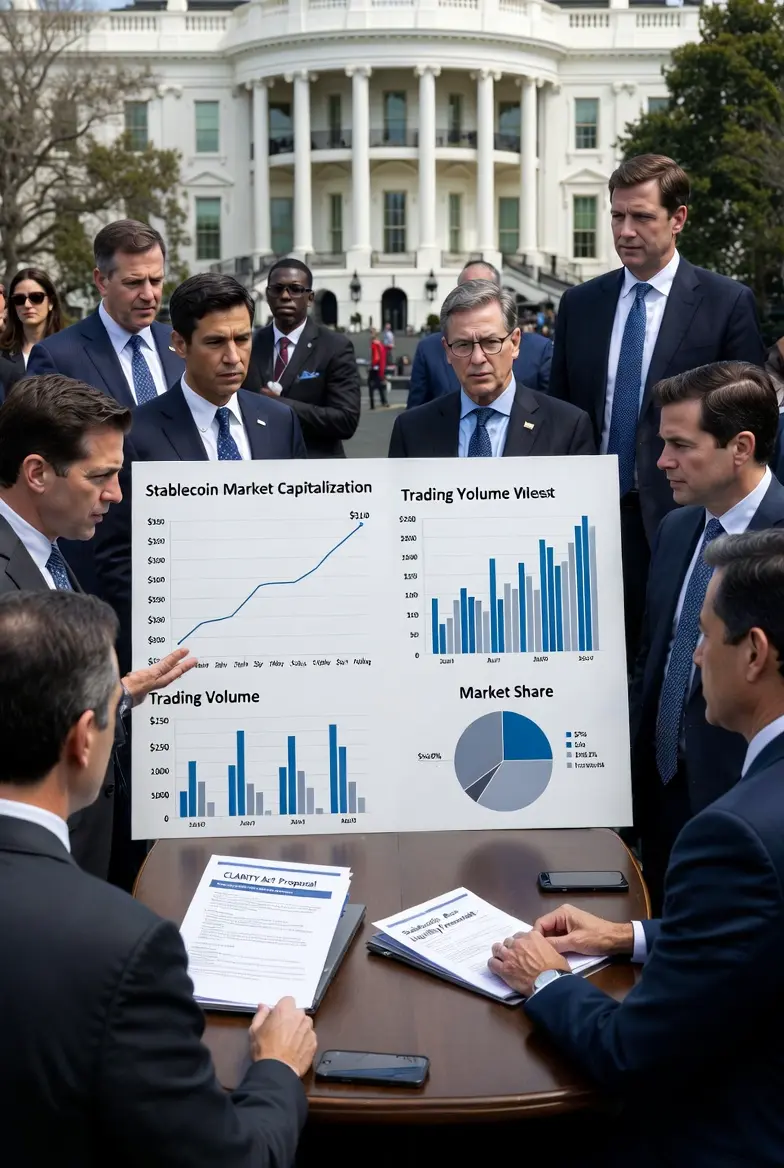

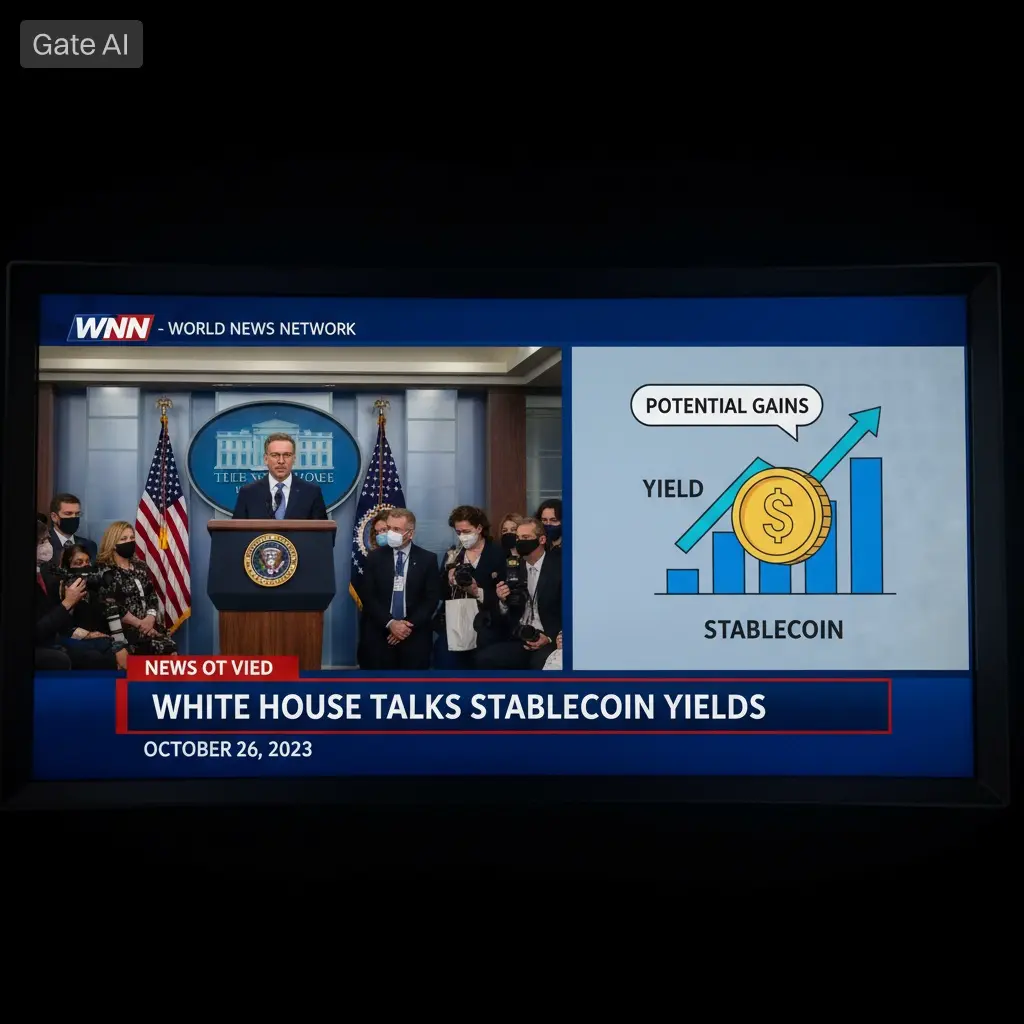

The ongoing White House discussions on stablecoin yields and the CLARITY Act in early February 2026 are highly relevant to the broader crypto market dynamics, including volume, price stability, percentage changes (in market cap, supply, or yields), and liquidity. These elements are interconnected because stablecoins like USDT (Tether) and USDC (Circle) serve as the primary on-ramp/off-ramp for crypto trading, DeFi, and institutional activity. Any regulatory outcome on yields could significantly influence their attractiveness, usage, and overall market health.

The ongoing White House discussions on stablecoin yields and the CLARITY Act in early February 2026 are highly relevant to the broader crypto market dynamics, including volume, price stability, percentage changes (in market cap, supply, or yields), and liquidity. These elements are interconnected because stablecoins like USDT (Tether) and USDC (Circle) serve as the primary on-ramp/off-ramp for crypto trading, DeFi, and institutional activity. Any regulatory outcome on yields could significantly influence their attractiveness, usage, and overall market health.

- Reward

- 4

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#WhiteHouseTalksStablecoinYields

🚀 White House & Stablecoin Yield Talks: What’s Happening?

The White House has become a central forum for intense discussions between banking representatives, cryptocurrency firms, and federal policymakers about stablecoin yields a key and contentious issue in shaping future U.S. digital asset regulation. These talks have quickly become one of the most important debates influencing the progress of broader crypto market structure legislation following efforts to form a comprehensive federal framework.

The Core Issue: Should Stablecoins Offer Yield?

At the heart

🚀 White House & Stablecoin Yield Talks: What’s Happening?

The White House has become a central forum for intense discussions between banking representatives, cryptocurrency firms, and federal policymakers about stablecoin yields a key and contentious issue in shaping future U.S. digital asset regulation. These talks have quickly become one of the most important debates influencing the progress of broader crypto market structure legislation following efforts to form a comprehensive federal framework.

The Core Issue: Should Stablecoins Offer Yield?

At the heart

- Reward

- 1

- 2

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

New Year Wealth Explosion 🤑View More

#WhiteHouseTalksStablecoinYields Why Yield-Bearing Stablecoins Are Under the Spotlight

Recent discussions at the White House surrounding stablecoin yields have drawn significant attention across both crypto and traditional finance. As policymakers and regulators evaluate the implications of yield-generating digital dollars, markets are facing a new layer of complexity: how to balance innovation, risk, and oversight.

These talks reflect a growing recognition that stablecoins are no longer just payment tools. They are increasingly becoming strategic financial instruments capable of reshaping liq

Recent discussions at the White House surrounding stablecoin yields have drawn significant attention across both crypto and traditional finance. As policymakers and regulators evaluate the implications of yield-generating digital dollars, markets are facing a new layer of complexity: how to balance innovation, risk, and oversight.

These talks reflect a growing recognition that stablecoins are no longer just payment tools. They are increasingly becoming strategic financial instruments capable of reshaping liq

- Reward

- 6

- 14

- Repost

- Share

CryptoSocietyOfRhinoBrotherIn :

:

New Year Wealth Explosion 🤑View More

#WhiteHouseTalksStablecoinYields

🇺🇸 White House & Stablecoin Yield Talks: What’s Happening?

The White House has become a central forum for intense discussions between banking representatives, cryptocurrency firms, and federal policymakers about stablecoin yields a key and contentious issue in shaping future U.S. digital asset regulation. These talks have quickly become one of the most important debates influencing the progress of broader crypto market structure legislation following efforts to form a comprehensive federal framework.

The Core Issue: Should Stablecoins Offer Yield?

At the hea

🇺🇸 White House & Stablecoin Yield Talks: What’s Happening?

The White House has become a central forum for intense discussions between banking representatives, cryptocurrency firms, and federal policymakers about stablecoin yields a key and contentious issue in shaping future U.S. digital asset regulation. These talks have quickly become one of the most important debates influencing the progress of broader crypto market structure legislation following efforts to form a comprehensive federal framework.

The Core Issue: Should Stablecoins Offer Yield?

At the hea

- Reward

- 2

- 7

- Repost

- Share

Luna_Star :

:

Buy To Earn 💎View More

#WhiteHouseTalksStablecoinYields

Recent discussions at the White House regarding stablecoin yields are turning heads across the crypto and traditional finance landscape. As regulators and policymakers debate the implications of yield-generating stablecoins, markets are grappling with a new layer of complexity: how to balance innovation, risk, and oversight. These talks highlight the growing recognition that stablecoins are not just transactional tools, but increasingly strategic financial instruments that could reshape liquidity and capital flow in digital markets.

From a macro perspective, t

Recent discussions at the White House regarding stablecoin yields are turning heads across the crypto and traditional finance landscape. As regulators and policymakers debate the implications of yield-generating stablecoins, markets are grappling with a new layer of complexity: how to balance innovation, risk, and oversight. These talks highlight the growing recognition that stablecoins are not just transactional tools, but increasingly strategic financial instruments that could reshape liquidity and capital flow in digital markets.

From a macro perspective, t

DEFI-2,76%

- Reward

- 3

- 3

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

181.01K Popularity

41.09K Popularity

1.62K Popularity

2.86K Popularity

3.71K Popularity

2.16K Popularity

2.14K Popularity

269 Popularity

13.43K Popularity

2.08K Popularity

1.52K Popularity

1.09K Popularity

70.71K Popularity

17.51K Popularity

37.28K Popularity

News

View More"Maqi" panic selling, nearly half an hour reducing 1125 ETH long positions

3 m

Gate Plaza launches the Year of the Horse Spring Festival event, posting to share a $50,000 red envelope rain

7 m

Data: If ETH breaks through $2,126, the total liquidation strength of long positions on mainstream CEXs will reach $599 million.

9 m

On-chain bot sniping keywords from He Yi's tweet, creating and monopolizing meme coins, earning $27,000 in 1.5 minutes

13 m

Market downturn combined with overvaluation, MetaDAO faces its first ICO failure project

18 m

Pin