# StocksatAllTimeHigh

26.46K

S&P 500 is close to 7,000 and could mark 8 straight months of gains. If the Fed starts easing, will money keep rotating into traditional sectors or flow back to tech? And more importantly — will crypto follow equities higher, or decouple? What’s your prediction?

MrFlower_XingChen

#StocksatAllTimeHigh S&P 500 Near 7,000: Liquidity Cycles, Sector Rotation, and Crypto’s Role in a Potential Fed Easing Era

As the S&P 500 approaches the 7,000 level, markets are witnessing one of the most persistent rallies in modern history, potentially marking eight consecutive months of gains. Such extended upside momentum is rare and signals not just optimism, but a market increasingly driven by liquidity expectations, policy anticipation, and positioning rather than fundamentals alone. The next phase now depends heavily on Federal Reserve direction and how global liquidity reallocates on

As the S&P 500 approaches the 7,000 level, markets are witnessing one of the most persistent rallies in modern history, potentially marking eight consecutive months of gains. Such extended upside momentum is rare and signals not just optimism, but a market increasingly driven by liquidity expectations, policy anticipation, and positioning rather than fundamentals alone. The next phase now depends heavily on Federal Reserve direction and how global liquidity reallocates on

- Reward

- 11

- 5

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

#StocksatAllTimeHigh

The Summit is Now a Starting Point: A New Dawn in the Financial Sky!

#StocksatAllTimeHigh

In the past, the term "all-time high" (ATH) evoked fears of a pause or pullback. However, the picture we see when we wake up on the first morning of 2026 is completely different: The summit is no longer a destination, but merely a launchpad. While the S&P 500 and Nasdaq are breaking records on Wall Street, technology stocks are no longer just "stocks"; they have become the new raw material of global growth. As Gateio frequently emphasizes in its global analyses, "The future is the s

The Summit is Now a Starting Point: A New Dawn in the Financial Sky!

#StocksatAllTimeHigh

In the past, the term "all-time high" (ATH) evoked fears of a pause or pullback. However, the picture we see when we wake up on the first morning of 2026 is completely different: The summit is no longer a destination, but merely a launchpad. While the S&P 500 and Nasdaq are breaking records on Wall Street, technology stocks are no longer just "stocks"; they have become the new raw material of global growth. As Gateio frequently emphasizes in its global analyses, "The future is the s

- Reward

- 77

- 123

- Repost

- Share

SULEMANFARSI :

:

2026 GOGOGO 👊View More

#StocksatAllTimeHigh

The Summit is Now a Starting Point: A New Dawn in the Financial Sky!

#StocksatAllTimeHigh

In the past, the term "all-time high" (ATH) evoked fears of a pause or pullback. However, the picture we see when we wake up on the first morning of 2026 is completely different: The summit is no longer a destination, but merely a launchpad. While the S&P 500 and Nasdaq are breaking records on Wall Street, technology stocks are no longer just "stocks"; they have become the new raw material of global growth. As Gateio frequently emphasizes in its global analyses, "The future is the s

The Summit is Now a Starting Point: A New Dawn in the Financial Sky!

#StocksatAllTimeHigh

In the past, the term "all-time high" (ATH) evoked fears of a pause or pullback. However, the picture we see when we wake up on the first morning of 2026 is completely different: The summit is no longer a destination, but merely a launchpad. While the S&P 500 and Nasdaq are breaking records on Wall Street, technology stocks are no longer just "stocks"; they have become the new raw material of global growth. As Gateio frequently emphasizes in its global analyses, "The future is the s

- Reward

- 3

- 2

- Repost

- Share

SujonFF :

:

happy happy new year all peopleView More

#StocksatAllTimeHigh

📈 Markets at a Crossroads: Equities, Tech, and Crypto

The S&P 500 is hovering near the 7,000 level, potentially marking eight consecutive months of gains. This kind of momentum is rare and raises important questions about what comes next for global markets. With inflation gradually cooling and expectations building around possible Fed easing, investors are closely watching where capital will flow next.

One key debate is sector rotation. Over recent months, money has steadily moved into more traditional and defensive sectors, while tech has shown mixed performance. If the

📈 Markets at a Crossroads: Equities, Tech, and Crypto

The S&P 500 is hovering near the 7,000 level, potentially marking eight consecutive months of gains. This kind of momentum is rare and raises important questions about what comes next for global markets. With inflation gradually cooling and expectations building around possible Fed easing, investors are closely watching where capital will flow next.

One key debate is sector rotation. Over recent months, money has steadily moved into more traditional and defensive sectors, while tech has shown mixed performance. If the

- Reward

- 3

- 2

- Repost

- Share

🔥 TONCOIN 2026 FORECAST – A LONG PAUSE, NOT A MOONSHOT 🔥

TON is one of the most watched coins in the Russian crypto space, mostly because of its roots linked to Pavel Durov. But hype alone does not move markets forever.

📉 Price Reality

From $8 to around $1.5 in one year. Nearly minus 80%. This was not a correction, this was a crash. Even while the broader market moved up, TON stayed weak. Why? No organic demand. Airdrops, taps, mini games hype faded fast.

👉 2026 forecast is simple and cold: sideways between $1.5 to $2.5. Unlocks of 37M TON every month will keep pressure on price until 2028

TON is one of the most watched coins in the Russian crypto space, mostly because of its roots linked to Pavel Durov. But hype alone does not move markets forever.

📉 Price Reality

From $8 to around $1.5 in one year. Nearly minus 80%. This was not a correction, this was a crash. Even while the broader market moved up, TON stayed weak. Why? No organic demand. Airdrops, taps, mini games hype faded fast.

👉 2026 forecast is simple and cold: sideways between $1.5 to $2.5. Unlocks of 37M TON every month will keep pressure on price until 2028

NOT-0,98%

- Reward

- 2

- 1

- Repost

- Share

ComeOnEveryDay :

:

#StocksatAllTimeHigh

We are witnessing a period where the heart of the markets beats, giants take the stage, and records are flying. As we enter 2026, everywhere from Wall Street to global markets is echoing with the sounds of "All-Time High" (ATH). A Historic Threshold in the Financial World: The Summit is Now a Starting Point! #StocksatAllTimeHigh

Markets are not just rising, they are being rewritten! The S&P 500 and Nasdaq, which bid farewell to 2025 with records, said "hello" to 2026 by surpassing the 6,800 and 25,000 point barriers, respectively. We are in an era where Nvidia has reached

We are witnessing a period where the heart of the markets beats, giants take the stage, and records are flying. As we enter 2026, everywhere from Wall Street to global markets is echoing with the sounds of "All-Time High" (ATH). A Historic Threshold in the Financial World: The Summit is Now a Starting Point! #StocksatAllTimeHigh

Markets are not just rising, they are being rewritten! The S&P 500 and Nasdaq, which bid farewell to 2025 with records, said "hello" to 2026 by surpassing the 6,800 and 25,000 point barriers, respectively. We are in an era where Nvidia has reached

- Reward

- 103

- 195

- Repost

- Share

User_any :

:

2026 GOGOGO 👊View More

🌅 #My2026FirstPost | A Calm Start, A Clear Direction

2026 doesn’t begin with noise or hype —

it begins with clarity.

This year, my focus is simple: • Trade with patience

• Learn before acting

• Value consistency over excitement

• Build, not rush

Crypto has taught me that the strongest growth happens quietly — when discipline meets time.

I’m stepping into 2026 with a calm mind, clear goals, and long-term vision.

No shortcuts. No emotional trades. Just steady progress.

💬 My 2026 rule:

Protect capital first, profits will follow.

Here’s to a smarter, stronger year ahead 🚀

#My2026FirstPost #2026

2026 doesn’t begin with noise or hype —

it begins with clarity.

This year, my focus is simple: • Trade with patience

• Learn before acting

• Value consistency over excitement

• Build, not rush

Crypto has taught me that the strongest growth happens quietly — when discipline meets time.

I’m stepping into 2026 with a calm mind, clear goals, and long-term vision.

No shortcuts. No emotional trades. Just steady progress.

💬 My 2026 rule:

Protect capital first, profits will follow.

Here’s to a smarter, stronger year ahead 🚀

#My2026FirstPost #2026

- Reward

- 2

- 6

- Repost

- Share

AylaShinex :

:

1000x VIbes 🤑View More

#StocksatAllTimeHigh

Market Pivot: S&P 500 at 7,000 & The Crypto Connection 💹

The S&P 500 is nearing the historic 7,000 mark, potentially closing its 8th straight month of gains. This is a massive milestone for traditional finance, but for us in Web3, it raises a critical question as the Fed considers easing: Where will the capital flow next?

The Great Rotation or The Tech Surge?

If the Fed starts easing, we might see two scenarios:

Traditional Rotation: Capital moves into value and traditional sectors.

Tech Rebound: Low rates reignite the fire in high-growth tech stocks.

The Crypto Factor:

Market Pivot: S&P 500 at 7,000 & The Crypto Connection 💹

The S&P 500 is nearing the historic 7,000 mark, potentially closing its 8th straight month of gains. This is a massive milestone for traditional finance, but for us in Web3, it raises a critical question as the Fed considers easing: Where will the capital flow next?

The Great Rotation or The Tech Surge?

If the Fed starts easing, we might see two scenarios:

Traditional Rotation: Capital moves into value and traditional sectors.

Tech Rebound: Low rates reignite the fire in high-growth tech stocks.

The Crypto Factor:

BTC-0,02%

- Reward

- 19

- 12

- Repost

- Share

Flower89 :

:

2026 GOGOGO 👊View More

#StocksatAllTimeHigh

#StocksAtAllTimeHigh 📊

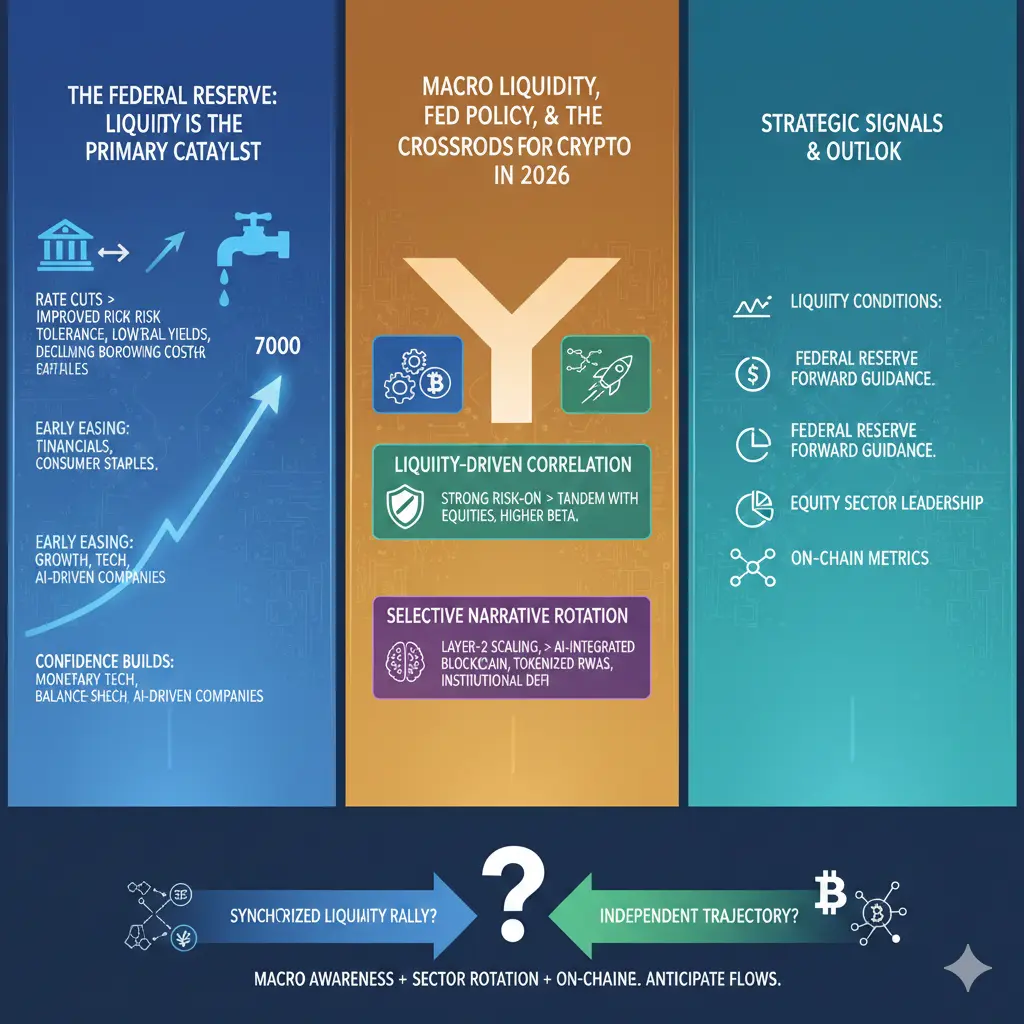

Macro Liquidity, Fed Policy, and the Crossroads for Crypto in 2026

With the S&P 500 rapidly approaching the 7,000 level and on track for eight consecutive months of gains, U.S. equities are experiencing one of the most persistent bullish phases in recent history. Such extended rallies are rare and often mark critical inflection points, where market participants reassess valuation sustainability, sector leadership, and the durability of underlying liquidity.

Historically, prolonged all-time-high environments tend to precede rotation rather than immed

#StocksAtAllTimeHigh 📊

Macro Liquidity, Fed Policy, and the Crossroads for Crypto in 2026

With the S&P 500 rapidly approaching the 7,000 level and on track for eight consecutive months of gains, U.S. equities are experiencing one of the most persistent bullish phases in recent history. Such extended rallies are rare and often mark critical inflection points, where market participants reassess valuation sustainability, sector leadership, and the durability of underlying liquidity.

Historically, prolonged all-time-high environments tend to precede rotation rather than immed

- Reward

- 7

- 2

- Repost

- Share

🔥 TONCOIN 2026 FORECAST – A LONG PAUSE, NOT A MOONSHOT 🔥

TON is one of the most watched coins in the Russian crypto space, mostly because of its roots linked to Pavel Durov. But hype alone does not move markets forever.

📉 Price Reality

From $8 to around $1.5 in one year. Nearly minus 80%. This was not a correction, this was a crash. Even while the broader market moved up, TON stayed weak. Why? No organic demand. Airdrops, taps, mini games hype faded fast.

👉 2026 forecast is simple and cold: sideways between $1.5 to $2.5. Unlocks of 37M TON every month will keep pressure on price until 2028

TON is one of the most watched coins in the Russian crypto space, mostly because of its roots linked to Pavel Durov. But hype alone does not move markets forever.

📉 Price Reality

From $8 to around $1.5 in one year. Nearly minus 80%. This was not a correction, this was a crash. Even while the broader market moved up, TON stayed weak. Why? No organic demand. Airdrops, taps, mini games hype faded fast.

👉 2026 forecast is simple and cold: sideways between $1.5 to $2.5. Unlocks of 37M TON every month will keep pressure on price until 2028

- Reward

- 7

- 2

- Repost

- Share

Zake :

:

This is great, well done. Keep up the good work, may your efforts be blessed.View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

167.79K Popularity

33.76K Popularity

30.64K Popularity

75.93K Popularity

14.52K Popularity

280.23K Popularity

371.59K Popularity

26.82K Popularity

16.15K Popularity

14.72K Popularity

14.6K Popularity

13.53K Popularity

13.53K Popularity

40.9K Popularity

News

View MoreSoftBank and Ampere Computing jointly test running small AI models using CPUs

25 m

Insider: Dark Side of the Moon seeks to reach a $10 billion valuation in the new funding round

51 m

A certain whale liquidates ETH and BTC short positions, earning a profit of $1,575,000

56 m

ZeroLend will cease operations. Users are advised to withdraw their remaining funds from the platform.

1 h

AC launches the Flying Tulip public offering, emphasizing "Principal Protection" ftPUT mechanism

1 h

Pin