#OvernightV-ShapedMoveinCrypto The recent overnight V-shaped move in crypto once again demonstrates how quickly sentiment, liquidity, and positioning can collide in digital asset markets. These rapid collapses and equally fast recoveries are not random anomalies. They are structural events that reflect how crypto’s 24/7, leverage-heavy ecosystem responds when imbalances reach critical levels.

During low-liquidity hours, markets become more fragile. Order books thin, bid depth weakens, and even moderate selling pressure can cascade into sharp declines. When combined with high leverage, this environment becomes especially dangerous. A small break in support can trigger forced liquidations, stop-loss clusters, and algorithmic selling, accelerating downside far beyond what organic spot selling would produce.

In this case, the initial drop was driven less by fundamental news and more by positioning stress. Long-heavy derivatives markets became vulnerable, and once key intraday levels failed, liquidation engines took control. Price moved not because investors changed their long-term outlook, but because leverage needed to be flushed. This distinction is critical for interpreting what followed.

The rebound was equally telling. As price entered historically significant demand zones, experienced buyers stepped in. Long-term holders, institutional desks, and opportunistic traders recognized forced selling and liquidity gaps. At the same time, late-entry shorts were caught off guard, triggering short squeezes that reinforced upside momentum. The recovery was mechanical as much as it was emotional.

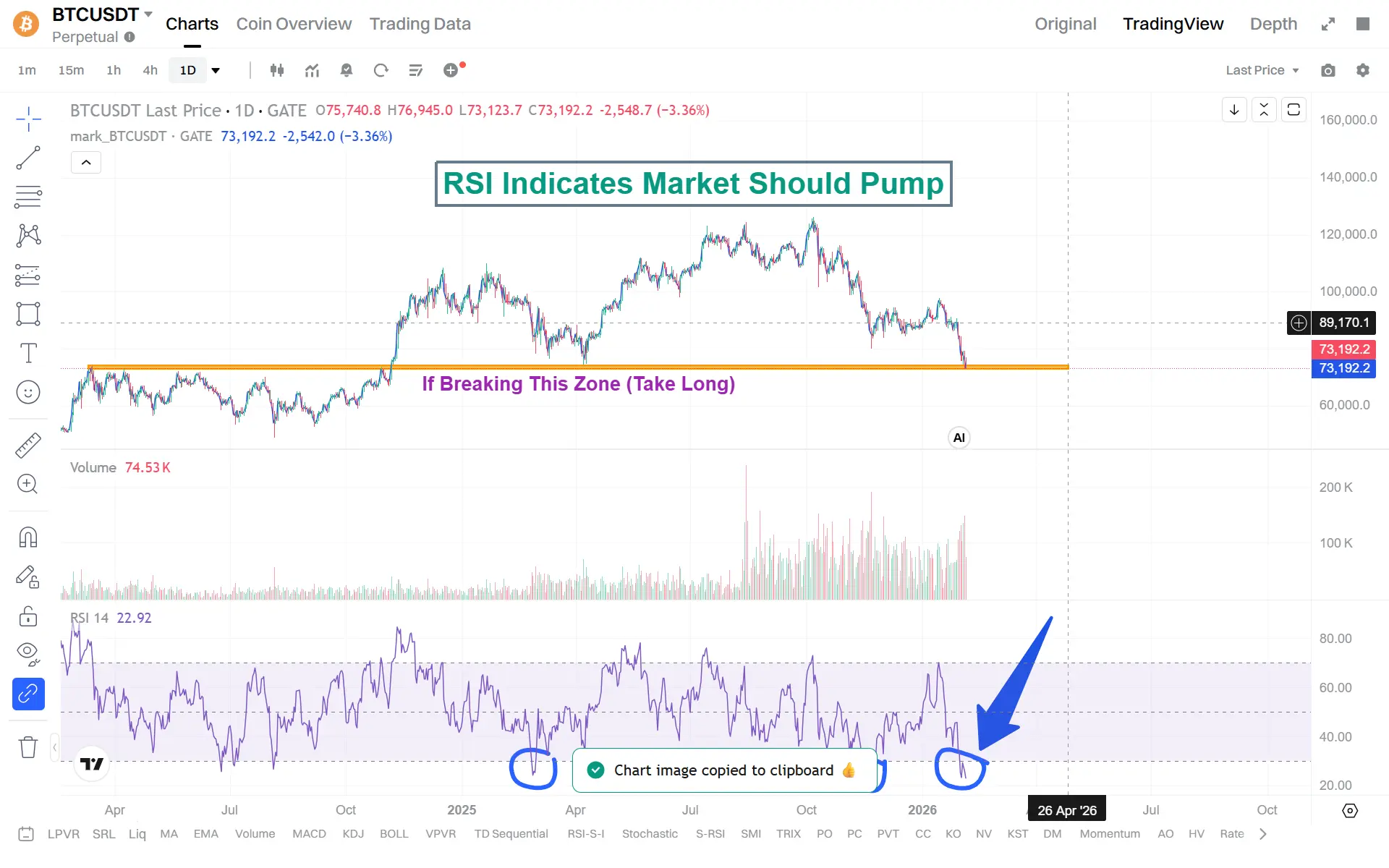

From a technical standpoint, V-shaped moves reflect extreme short-term disequilibrium. Indicators often show deep oversold conditions, stretched deviations from moving averages, and abnormal liquidation volume. While the bounce can look impressive, it does not automatically indicate trend reversal. Many V-shaped recoveries simply restore price to fair value after temporary distortion.

Market structure explains why these patterns are so common in crypto. Derivatives markets dominate price discovery, and when positioning becomes overcrowded, the system seeks balance through volatility. These violent resets act as pressure valves, clearing excessive risk before new trends can form. In that sense, V-shaped moves are part of the market’s self-correction mechanism.

Psychologically, these events are designed to test discipline. Panic selling near the lows and emotional chasing near the highs are natural human responses—but they are consistently punished in this environment. Experienced participants focus on preparation, predefined risk limits, and liquidity awareness rather than reacting to every sharp move.

These overnight swings also reveal crypto’s role as a real-time sentiment barometer. Because the market never closes, it absorbs global risk shifts immediately. Changes in equity futures, currency markets, or macro headlines are often reflected in crypto first. This makes digital assets both more volatile and more informative than traditional markets.

The broader lesson is that volatility is structural, not accidental. It arises from continuous trading, high leverage, fragmented liquidity, and global participation. Trying to eliminate volatility in crypto is unrealistic. Learning to operate within it is what separates consistent participants from emotional ones.

Ultimately, the #OvernightV-ShapedMoveinCrypto reinforces a timeless principle: fast recoveries do not equal lasting strength. Sustainable trends require time, volume support, and structural confirmation. Sharp rebounds may offer tactical opportunities, but long-term success comes from understanding when a move represents true accumulation—and when it is simply the market resetting itself before the next phase.

During low-liquidity hours, markets become more fragile. Order books thin, bid depth weakens, and even moderate selling pressure can cascade into sharp declines. When combined with high leverage, this environment becomes especially dangerous. A small break in support can trigger forced liquidations, stop-loss clusters, and algorithmic selling, accelerating downside far beyond what organic spot selling would produce.

In this case, the initial drop was driven less by fundamental news and more by positioning stress. Long-heavy derivatives markets became vulnerable, and once key intraday levels failed, liquidation engines took control. Price moved not because investors changed their long-term outlook, but because leverage needed to be flushed. This distinction is critical for interpreting what followed.

The rebound was equally telling. As price entered historically significant demand zones, experienced buyers stepped in. Long-term holders, institutional desks, and opportunistic traders recognized forced selling and liquidity gaps. At the same time, late-entry shorts were caught off guard, triggering short squeezes that reinforced upside momentum. The recovery was mechanical as much as it was emotional.

From a technical standpoint, V-shaped moves reflect extreme short-term disequilibrium. Indicators often show deep oversold conditions, stretched deviations from moving averages, and abnormal liquidation volume. While the bounce can look impressive, it does not automatically indicate trend reversal. Many V-shaped recoveries simply restore price to fair value after temporary distortion.

Market structure explains why these patterns are so common in crypto. Derivatives markets dominate price discovery, and when positioning becomes overcrowded, the system seeks balance through volatility. These violent resets act as pressure valves, clearing excessive risk before new trends can form. In that sense, V-shaped moves are part of the market’s self-correction mechanism.

Psychologically, these events are designed to test discipline. Panic selling near the lows and emotional chasing near the highs are natural human responses—but they are consistently punished in this environment. Experienced participants focus on preparation, predefined risk limits, and liquidity awareness rather than reacting to every sharp move.

These overnight swings also reveal crypto’s role as a real-time sentiment barometer. Because the market never closes, it absorbs global risk shifts immediately. Changes in equity futures, currency markets, or macro headlines are often reflected in crypto first. This makes digital assets both more volatile and more informative than traditional markets.

The broader lesson is that volatility is structural, not accidental. It arises from continuous trading, high leverage, fragmented liquidity, and global participation. Trying to eliminate volatility in crypto is unrealistic. Learning to operate within it is what separates consistent participants from emotional ones.

Ultimately, the #OvernightV-ShapedMoveinCrypto reinforces a timeless principle: fast recoveries do not equal lasting strength. Sustainable trends require time, volume support, and structural confirmation. Sharp rebounds may offer tactical opportunities, but long-term success comes from understanding when a move represents true accumulation—and when it is simply the market resetting itself before the next phase.