#BlackRockToBuyUNI

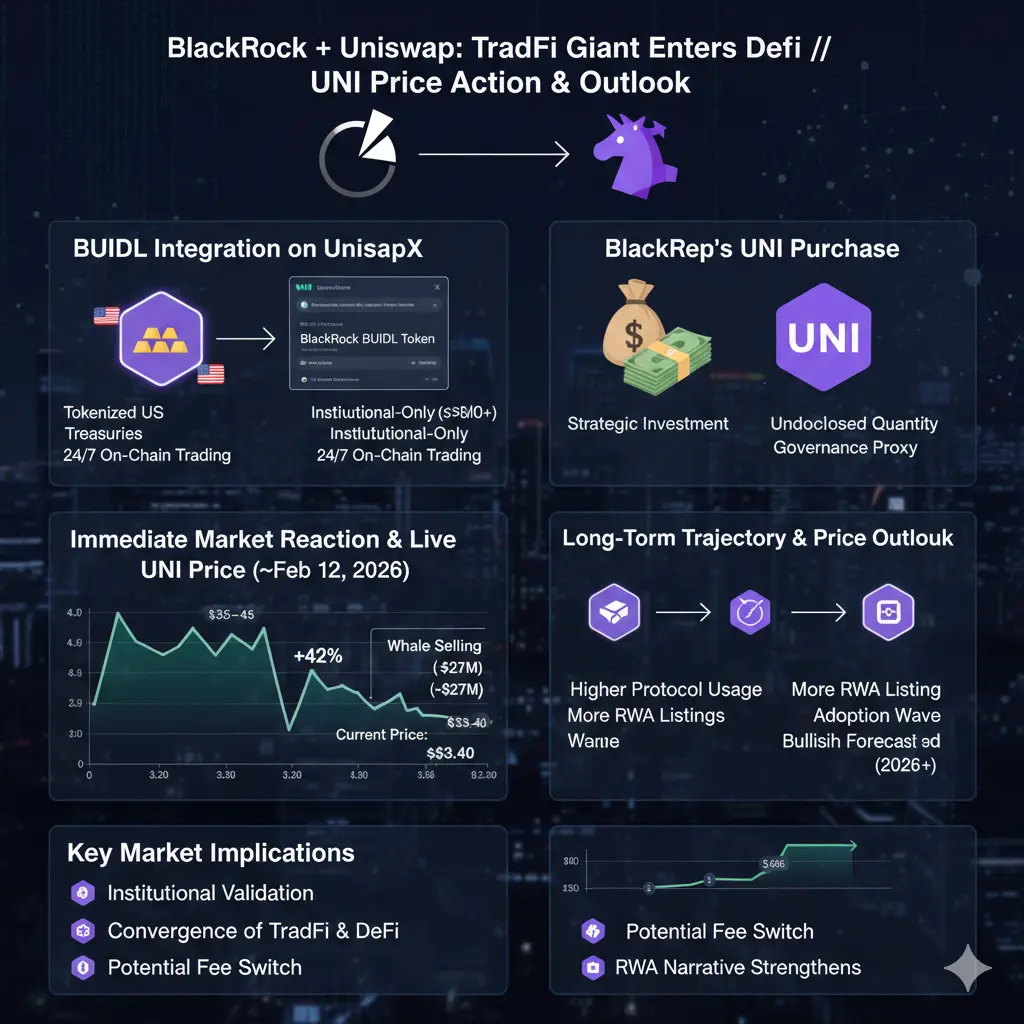

BlackRock, the world's largest asset manager (with trillions in AUM), has made a major move into decentralized finance (DeFi) by integrating its tokenized U.S. Treasury-backed fund BUIDL (currently ~$1.8–$2.2 billion in value) with Uniswap via UniswapX (in partnership with Securitize). As part of this strategic step — announced on February 11, 2026 — BlackRock is purchasing an undisclosed amount of UNI tokens (Uniswap's governance token). This marks BlackRock's first direct entry into DeFi infrastructure and the first time a major TradFi giant holds UNI on its balance sheet.

This signals strong institutional validation for DeFi protocols, especially leading DEXs like Uniswap, and highlights the growing convergence of tokenized real-world assets (RWAs) with decentralized trading rails.

Key Details of the Development

BUIDL Integration on UniswapX

BUIDL shares (tokenized short-term U.S. Treasuries/yield-bearing) are now tradable on UniswapX (an intents-based RFQ system for efficient swaps).

Access is whitelisted and institutional-only (minimum thresholds like $5M+ for qualified investors).

Enables 24/7 on-chain trading with stablecoins, self-custody, and compliance via Securitize.

This unlocks new liquidity for BUIDL holders while bridging TradFi yield to DeFi ecosystems.

BlackRock's UNI Purchase

BlackRock bought an undisclosed quantity of UNI as a "strategic investment in the Uniswap ecosystem."

UNI serves as governance proxy for Uniswap — holding it gives voting rights on protocol upgrades, fees, etc.

This is seen as a vote of confidence in Uniswap's long-term infrastructure role for tokenized assets.

Immediate Market Reaction

UNI surged 15–42% intraday on the news (peaking near $4.50–$4.57 from pre-news levels around $3.20–$3.50).

It later corrected ~26% due to whale selling (~5.95M UNI offloaded, ~$27M value), settling lower amid profit-taking.

Current UNI Price (as of February 12, 2026)

Live Price: ~$3.35–$3.45 USD (up ~3% in recent hours but down from intraday highs).

24h Trading Volume: ~$900M–$1B+ (spiked on news).

Market Cap: ~$2–$2.1B+.

Circulating Supply: ~753M UNI (total supply 1B, with vesting/unlocks ongoing).

UNI Price Impact & Where It Could Go Next

This news is hugely bullish for UNI long-term as it legitimizes Uniswap as DeFi's core liquidity layer for institutional RWAs (e.g., tokenized Treasuries/MMFs). BlackRock's involvement could drive:

Higher protocol usage → more fees (if fee switch activates).

Governance influence → potential pro-institutional upgrades.

Broader DeFi adoption → more TVL and volume on Uniswap.

Short-Term (Next Weeks–Months):

Expect volatility: Profit-taking from retail/whales could push UNI back to $3.00–$3.20 support (recent lows).

If momentum holds and more institutions follow (e.g., via similar integrations), rebound to $3.80–$4.20 resistance is likely.

Oversold signals (RSI ~26 earlier) suggest a bounce possible if volume sustains.

Medium-Term Forecast (Rest of 2026):

Bullish catalysts: More RWA listings on Uniswap, DeFi revival with lower rates, UNI governance proposals (fee switch).

Conservative forecasts: $4–$6 range (some analysts see $7–$9 if adoption accelerates).

Optimistic: $8–$10+ if BlackRock/others increase exposure and tokenized assets hit $100B+ TVL.

Risks: Macro downturns, regulatory scrutiny on DeFi, or whale dumps could cap gains at $3–$4.

Long-Term (2027+):

UNI could benefit massively from hybrid TradFi-DeFi growth (e.g., trillions in tokenized assets).

Projections range $5–$15+ by 2030 in bullish scenarios, driven by Uniswap's dominance in DEX volume.

Trading Strategy (Brief & Practical)

Bullish Bias (Long-Term Hold): Accumulate on dips below $3.30–$3.40 (strong support). Target $4–$5 retest in coming months.

Short-Term Swing: Buy pullbacks to $3.20–$3.30, sell partials at $3.80–$4.00 resistance. Use tight stops below $3.00 to manage volatility.

Risk Management: Position size small (1–5% portfolio) — news-driven pumps often correct hard. Watch whale wallets and Uniswap TVL for confirmation.

Avoid: FOMO buying at highs; wait for consolidation.

Watch: Upcoming Uniswap governance votes, more RWA integrations, or BlackRock follow-ups.

In summary, BlackRock's UNI purchase and BUIDL integration is a game-changer — validating DeFi for institutions and positioning UNI as a key beneficiary. While short-term price action remains choppy (~$3.35–$3.45 now), the structural tailwinds point to higher levels ahead ($4+ near-term, $6–$10+ longer-term possible). !

BlackRock, the world's largest asset manager (with trillions in AUM), has made a major move into decentralized finance (DeFi) by integrating its tokenized U.S. Treasury-backed fund BUIDL (currently ~$1.8–$2.2 billion in value) with Uniswap via UniswapX (in partnership with Securitize). As part of this strategic step — announced on February 11, 2026 — BlackRock is purchasing an undisclosed amount of UNI tokens (Uniswap's governance token). This marks BlackRock's first direct entry into DeFi infrastructure and the first time a major TradFi giant holds UNI on its balance sheet.

This signals strong institutional validation for DeFi protocols, especially leading DEXs like Uniswap, and highlights the growing convergence of tokenized real-world assets (RWAs) with decentralized trading rails.

Key Details of the Development

BUIDL Integration on UniswapX

BUIDL shares (tokenized short-term U.S. Treasuries/yield-bearing) are now tradable on UniswapX (an intents-based RFQ system for efficient swaps).

Access is whitelisted and institutional-only (minimum thresholds like $5M+ for qualified investors).

Enables 24/7 on-chain trading with stablecoins, self-custody, and compliance via Securitize.

This unlocks new liquidity for BUIDL holders while bridging TradFi yield to DeFi ecosystems.

BlackRock's UNI Purchase

BlackRock bought an undisclosed quantity of UNI as a "strategic investment in the Uniswap ecosystem."

UNI serves as governance proxy for Uniswap — holding it gives voting rights on protocol upgrades, fees, etc.

This is seen as a vote of confidence in Uniswap's long-term infrastructure role for tokenized assets.

Immediate Market Reaction

UNI surged 15–42% intraday on the news (peaking near $4.50–$4.57 from pre-news levels around $3.20–$3.50).

It later corrected ~26% due to whale selling (~5.95M UNI offloaded, ~$27M value), settling lower amid profit-taking.

Current UNI Price (as of February 12, 2026)

Live Price: ~$3.35–$3.45 USD (up ~3% in recent hours but down from intraday highs).

24h Trading Volume: ~$900M–$1B+ (spiked on news).

Market Cap: ~$2–$2.1B+.

Circulating Supply: ~753M UNI (total supply 1B, with vesting/unlocks ongoing).

UNI Price Impact & Where It Could Go Next

This news is hugely bullish for UNI long-term as it legitimizes Uniswap as DeFi's core liquidity layer for institutional RWAs (e.g., tokenized Treasuries/MMFs). BlackRock's involvement could drive:

Higher protocol usage → more fees (if fee switch activates).

Governance influence → potential pro-institutional upgrades.

Broader DeFi adoption → more TVL and volume on Uniswap.

Short-Term (Next Weeks–Months):

Expect volatility: Profit-taking from retail/whales could push UNI back to $3.00–$3.20 support (recent lows).

If momentum holds and more institutions follow (e.g., via similar integrations), rebound to $3.80–$4.20 resistance is likely.

Oversold signals (RSI ~26 earlier) suggest a bounce possible if volume sustains.

Medium-Term Forecast (Rest of 2026):

Bullish catalysts: More RWA listings on Uniswap, DeFi revival with lower rates, UNI governance proposals (fee switch).

Conservative forecasts: $4–$6 range (some analysts see $7–$9 if adoption accelerates).

Optimistic: $8–$10+ if BlackRock/others increase exposure and tokenized assets hit $100B+ TVL.

Risks: Macro downturns, regulatory scrutiny on DeFi, or whale dumps could cap gains at $3–$4.

Long-Term (2027+):

UNI could benefit massively from hybrid TradFi-DeFi growth (e.g., trillions in tokenized assets).

Projections range $5–$15+ by 2030 in bullish scenarios, driven by Uniswap's dominance in DEX volume.

Trading Strategy (Brief & Practical)

Bullish Bias (Long-Term Hold): Accumulate on dips below $3.30–$3.40 (strong support). Target $4–$5 retest in coming months.

Short-Term Swing: Buy pullbacks to $3.20–$3.30, sell partials at $3.80–$4.00 resistance. Use tight stops below $3.00 to manage volatility.

Risk Management: Position size small (1–5% portfolio) — news-driven pumps often correct hard. Watch whale wallets and Uniswap TVL for confirmation.

Avoid: FOMO buying at highs; wait for consolidation.

Watch: Upcoming Uniswap governance votes, more RWA integrations, or BlackRock follow-ups.

In summary, BlackRock's UNI purchase and BUIDL integration is a game-changer — validating DeFi for institutions and positioning UNI as a key beneficiary. While short-term price action remains choppy (~$3.35–$3.45 now), the structural tailwinds point to higher levels ahead ($4+ near-term, $6–$10+ longer-term possible). !