# BTC

37.7M

Crypto_iqra

📊 #What’sNextForBitcoin? 🤔

Bitcoin is moving inside a tight range between support and resistance ⚖️

Momentum is slightly negative 📉

RSI is neutral 🟡

EMA acting as a decision zone 🔄

So what’s next? 👇

🟢 Break above resistance with strong volume → Bullish continuation 🚀

🔴 Break below support with strong selling → Bearish extension 📉

🟡 Stay inside range → More consolidation before big move ⏳

Right now, the market is preparing…

A breakout or breakdown is loading. 🔥

Smart traders are not predicting —

They are waiting for confirmation. 🎯

Are you bullish or bearish for the next move? Drop

Bitcoin is moving inside a tight range between support and resistance ⚖️

Momentum is slightly negative 📉

RSI is neutral 🟡

EMA acting as a decision zone 🔄

So what’s next? 👇

🟢 Break above resistance with strong volume → Bullish continuation 🚀

🔴 Break below support with strong selling → Bearish extension 📉

🟡 Stay inside range → More consolidation before big move ⏳

Right now, the market is preparing…

A breakout or breakdown is loading. 🔥

Smart traders are not predicting —

They are waiting for confirmation. 🎯

Are you bullish or bearish for the next move? Drop

BTC-1,44%

- Reward

- 1

- Comment

- Repost

- Share

# ApollotoBuy90MMORPHOin4Years

Apollo Goes Big on DeFi: Up to 90M MORPHO Tokens

Incoming! 🏦💎

Apollo Global Management just signed a game-changing deal with

Morpho Association to scoop up to 90 million MORPHO tokens over the next 4

years (48 months).

·

Full stake: ~9% of Morpho's governance supply,

valued at $107M–$115M at current prices (~$1.25/token).

·

Via open-market buys, OTC trades; includes

governance rights for on-chain lending boost.

·

Builds on Morpho's institutional wins like

Bitwise USDC vaults (6% yields).

DeFi meets TradFi—watch MORPHO surge! Who's bu

Apollo Goes Big on DeFi: Up to 90M MORPHO Tokens

Incoming! 🏦💎

Apollo Global Management just signed a game-changing deal with

Morpho Association to scoop up to 90 million MORPHO tokens over the next 4

years (48 months).

·

Full stake: ~9% of Morpho's governance supply,

valued at $107M–$115M at current prices (~$1.25/token).

·

Via open-market buys, OTC trades; includes

governance rights for on-chain lending boost.

·

Builds on Morpho's institutional wins like

Bitwise USDC vaults (6% yields).

DeFi meets TradFi—watch MORPHO surge! Who's bu

- Reward

- 2

- Comment

- Repost

- Share

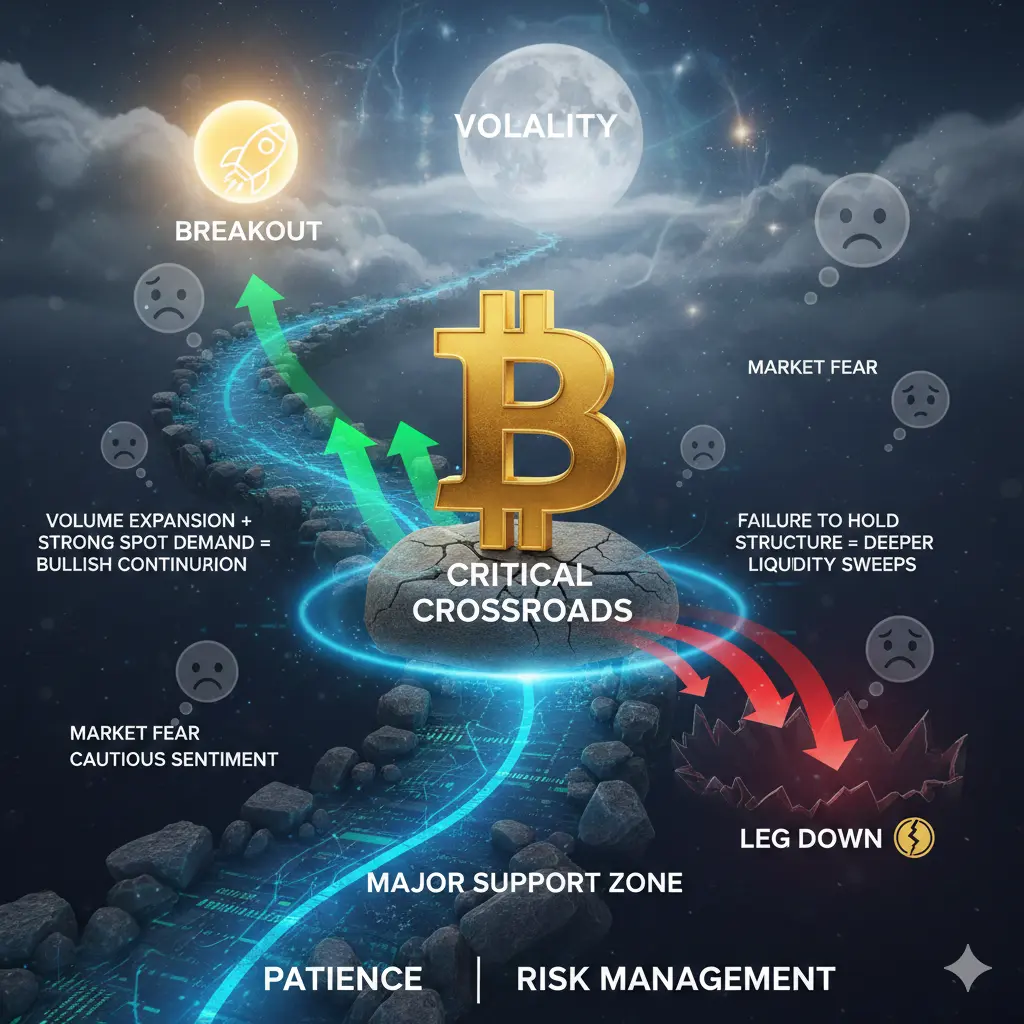

#What’sNextforBitcoin?

Bitcoin is currently standing at a critical crossroads. After recent volatility and rising market fear, the key question is whether this is consolidation before the next breakout — or preparation for another leg down.

Technically, price is reacting near major support zones while sentiment remains cautious. Historically, periods of extreme fear often appear near macro bottoms, but confirmation comes from volume expansion and strong spot demand.

If buyers defend support and reclaim key resistance levels, we could see momentum shift back to bullish continuation. However, fa

Bitcoin is currently standing at a critical crossroads. After recent volatility and rising market fear, the key question is whether this is consolidation before the next breakout — or preparation for another leg down.

Technically, price is reacting near major support zones while sentiment remains cautious. Historically, periods of extreme fear often appear near macro bottoms, but confirmation comes from volume expansion and strong spot demand.

If buyers defend support and reclaim key resistance levels, we could see momentum shift back to bullish continuation. However, fa

BTC-1,44%

- Reward

- 3

- 4

- Repost

- Share

Crypto_Teacher :

:

“Top-tier stream — can’t wait for the next one!”View More

#BitcoinPlungeNearsHistoricLows

📉 #BitcoinPlungeNearsHistoricLows — Market Reality Check

Bitcoin has been sliding deeper into oversold territory and nearing multi-month lows as risk sentiment weakens across digital assets.

🔶 Extreme sentiment drops: The fear/greed index for crypto is hitting record lows, reflecting deep market pessimism and a prolonged correction phase.

🔶 Broader weakness persists: Strategists are warning that the slide could signal broader market stress, with some suggesting that deeper downside risks remain.

🔶 Market sentiment still fragile: Extreme fear readings refu

📉 #BitcoinPlungeNearsHistoricLows — Market Reality Check

Bitcoin has been sliding deeper into oversold territory and nearing multi-month lows as risk sentiment weakens across digital assets.

🔶 Extreme sentiment drops: The fear/greed index for crypto is hitting record lows, reflecting deep market pessimism and a prolonged correction phase.

🔶 Broader weakness persists: Strategists are warning that the slide could signal broader market stress, with some suggesting that deeper downside risks remain.

🔶 Market sentiment still fragile: Extreme fear readings refu

BTC-1,44%

- Reward

- 6

- 6

- Repost

- Share

repanzal :

:

thanks for the outstanding information sharing with us its realy informative.View More

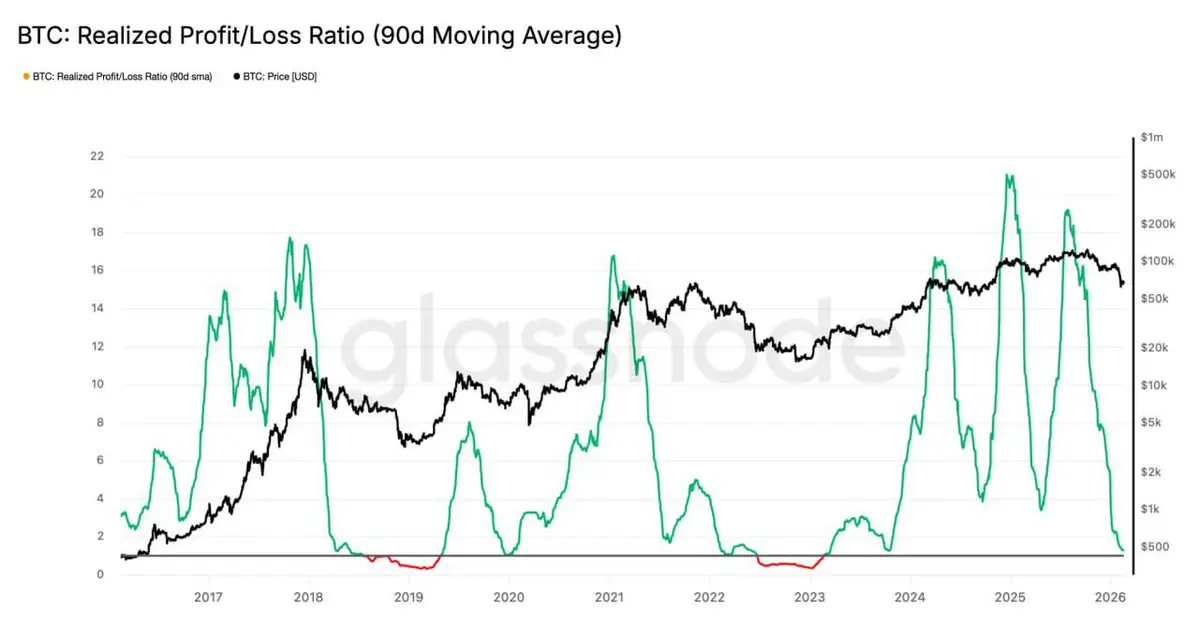

💸 #BTC Glassnode:

- In the absence of an unexpected macroeconomic catalyst, the true market price at $79,000 and the realized price at $54,900 will likely define the main resistance and support corridor for the medium-term market structure. - The defense of the $60,000,$69,000 range indicates that medium-term stock holders remain stable, allowing the market to #transition from impulsive declines to absorption within a #limited range. - As long as the realized profit/loss ratio does not return to a level above 2, signaling a resumption of profitability and an increase in liquidity inflow, the

- In the absence of an unexpected macroeconomic catalyst, the true market price at $79,000 and the realized price at $54,900 will likely define the main resistance and support corridor for the medium-term market structure. - The defense of the $60,000,$69,000 range indicates that medium-term stock holders remain stable, allowing the market to #transition from impulsive declines to absorption within a #limited range. - As long as the realized profit/loss ratio does not return to a level above 2, signaling a resumption of profitability and an increase in liquidity inflow, the

BTC-1,44%

- Reward

- 3

- 1

- Repost

- Share

LittleQueen :

:

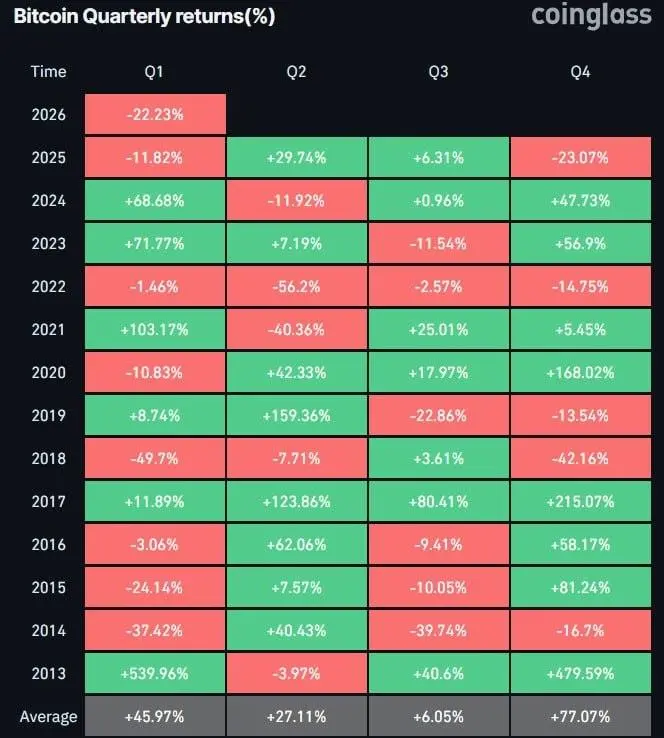

To The Moon 🌕#BTC on Track for Its Worst Q1 Since 2018

Bitcoin is closing in on its weakest first quarter performance since 2018 a period that followed the euphoric 2017 blow-off top and led into prolonged bear market pressure.

The signal isn’t just price. Liquidity is tighter, capital rotation has slowed, and risk appetite is clearly fragile.

Historically, extreme Q1 weakness has marked either: • Deep continuation of macro stress

• Or late-stage capitulation before structural recovery

The key question now:

Is this distribution… or quiet accumulation?

Volatility compresses before expansion. Stay positione

Bitcoin is closing in on its weakest first quarter performance since 2018 a period that followed the euphoric 2017 blow-off top and led into prolonged bear market pressure.

The signal isn’t just price. Liquidity is tighter, capital rotation has slowed, and risk appetite is clearly fragile.

Historically, extreme Q1 weakness has marked either: • Deep continuation of macro stress

• Or late-stage capitulation before structural recovery

The key question now:

Is this distribution… or quiet accumulation?

Volatility compresses before expansion. Stay positione

BTC-1,44%

- Reward

- 2

- Comment

- Repost

- Share

#What’sNextforBitcoin? 🚨 DAY 1 RECAP: The $70K Wall vs The 2.5% CPI Floor

It’s Wednesday, Feb 18, 2026 — and Bitcoin is NOT crashing… it’s compressing.

After reclaiming $70K yesterday, heavy resistance pushed BTC back into consolidation around $68K–$68.5K.

This isn’t weakness.

This is pressure building. ⚡

🔮 What’s Next for Bitcoin?

📊 Technical Structure

Bitcoin is forming a Symmetrical Triangle on the 4H chart — higher lows from $60K, but repeated rejection at $70K.

That means one thing:

A breakout is coming.

The trigger?

📰 FOMC Minutes today.

🏦 Macro Advantage

US Core CPI is at 2.5% (4-y

It’s Wednesday, Feb 18, 2026 — and Bitcoin is NOT crashing… it’s compressing.

After reclaiming $70K yesterday, heavy resistance pushed BTC back into consolidation around $68K–$68.5K.

This isn’t weakness.

This is pressure building. ⚡

🔮 What’s Next for Bitcoin?

📊 Technical Structure

Bitcoin is forming a Symmetrical Triangle on the 4H chart — higher lows from $60K, but repeated rejection at $70K.

That means one thing:

A breakout is coming.

The trigger?

📰 FOMC Minutes today.

🏦 Macro Advantage

US Core CPI is at 2.5% (4-y

BTC-1,44%

- Reward

- 5

- 7

- Repost

- Share

ShainingMoon :

:

To The Moon 🌕View More

#BitcoinPlungeNearsHistoricLows

📉 #BitcoinPlungeNearsHistoricLows — Market Reality Check

Bitcoin has been sliding deeper into oversold territory and nearing multi-month lows as risk sentiment weakens across digital assets.

🔶 Extreme sentiment drops: The fear/greed index for crypto is hitting record lows, reflecting deep market pessimism and a prolonged correction phase.

🔶 Broader weakness persists: Strategists are warning that the slide could signal broader market stress, with some suggesting that deeper downside risks remain.

🔶 Market sentiment still fragile: Extreme fear readings refu

📉 #BitcoinPlungeNearsHistoricLows — Market Reality Check

Bitcoin has been sliding deeper into oversold territory and nearing multi-month lows as risk sentiment weakens across digital assets.

🔶 Extreme sentiment drops: The fear/greed index for crypto is hitting record lows, reflecting deep market pessimism and a prolonged correction phase.

🔶 Broader weakness persists: Strategists are warning that the slide could signal broader market stress, with some suggesting that deeper downside risks remain.

🔶 Market sentiment still fragile: Extreme fear readings refu

BTC-1,44%

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊🇦🇪 Abu Dhabi wealth funds bitcoin ETF holdings topped $1 billion at end of 2025

Two of Abu Dhabi’s major investment firms increased their exposure to bitcoin BTC $67,661.84 in the fourth quarter of 2025, buying into BlackRock’s spot bitcoin ETF as the market fell, according to recent regulatory filings.

Mubadala Investment Company, a sovereign wealth fund backed by the Abu Dhabi government, added nearly four million shares of BlackRock’s iShares Bitcoin Trust (IBIT) between October and December, bringing its total holdings to 12.7 million shares. The move came as bitcoin fell roughly 23% dur

Two of Abu Dhabi’s major investment firms increased their exposure to bitcoin BTC $67,661.84 in the fourth quarter of 2025, buying into BlackRock’s spot bitcoin ETF as the market fell, according to recent regulatory filings.

Mubadala Investment Company, a sovereign wealth fund backed by the Abu Dhabi government, added nearly four million shares of BlackRock’s iShares Bitcoin Trust (IBIT) between October and December, bringing its total holdings to 12.7 million shares. The move came as bitcoin fell roughly 23% dur

BTC-1,44%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? After years in this market, one pattern never changes:

Retail buys dips emotionally.

Professionals buy structure strategically.

Not every dip is opportunity.

Some are healthy pullbacks within strong trends.

Some are distribution phases where smart money offloads into optimism.

Some are the early stages of deeper corrections that punish impatience.

Price being red does not equal value.

Structure determines value.

Before I deploy capital, I look at three things — no exceptions:

1️⃣ Higher Timeframe Structure

Are key supports holding on daily and weekly levels?

Are higher hig

Retail buys dips emotionally.

Professionals buy structure strategically.

Not every dip is opportunity.

Some are healthy pullbacks within strong trends.

Some are distribution phases where smart money offloads into optimism.

Some are the early stages of deeper corrections that punish impatience.

Price being red does not equal value.

Structure determines value.

Before I deploy capital, I look at three things — no exceptions:

1️⃣ Higher Timeframe Structure

Are key supports holding on daily and weekly levels?

Are higher hig

- Reward

- 8

- 10

- Repost

- Share

ybaser :

:

Wishing you great wealth in the Year of the Horse 🐴To The Moon 🌕2026 Go Go Go 👊Good luck and prosperity 🧧View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

210.7K Popularity

13.28K Popularity

45.88K Popularity

86.41K Popularity

850.81K Popularity

291.12K Popularity

445.55K Popularity

33.81K Popularity

22.44K Popularity

20.58K Popularity

21.03K Popularity

18.66K Popularity

20.31K Popularity

47.99K Popularity

News

View MoreData: US XRP spot ETF experienced a total net outflow of $220,620 in one day

4 m

Hanwha Invests $13 Million in Kresus Labs to Drive Seedless Wallets and RWA Tokenization

15 m

Data: If BTC breaks through $69,657, the total liquidation strength of long positions on mainstream CEXs will reach $1.426 billion.

18 m

The probability that the Federal Reserve will keep interest rates unchanged in March is 93.6%.

35 m

The New York Stock Exchange plans to launch a 24/7 blockchain trading platform

46 m

Pin