# What’sNextforBitcoin?

23.7K

Luna_Star

#What’sNextforBitcoin?

February 16, 2026 ,The question dominating the market right now is simple: #What’sNextforBitcoin? After recent volatility, strong rebounds, and macro-driven sentiment shifts, investors are trying to determine whether the next move is continuation… or correction.

Let’s break this down step by step.

First, we assess the current structure.

Bitcoin has recently shown resilience during macro uncertainty. Each dip has attracted buyers, suggesting strong underlying demand. That’s typically a bullish characteristic in mid-to-late cycle environments.

However, price action alone

February 16, 2026 ,The question dominating the market right now is simple: #What’sNextforBitcoin? After recent volatility, strong rebounds, and macro-driven sentiment shifts, investors are trying to determine whether the next move is continuation… or correction.

Let’s break this down step by step.

First, we assess the current structure.

Bitcoin has recently shown resilience during macro uncertainty. Each dip has attracted buyers, suggesting strong underlying demand. That’s typically a bullish characteristic in mid-to-late cycle environments.

However, price action alone

BTC-1,82%

- Reward

- 4

- 5

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Strong development for the space 👏 Real progress like this keeps the ecosystem moving forward. 🚀View More

🇺🇸 ETF FLOWS: SOL and XRP spot ETFs saw net inflows last week, while BTC and ETH spot ETFs saw net outflows.

BTC: - $359.91M

ETH: - $161.15M

SOL: $13.17M

XRP: $7.65M

#GateSquare$50KRedPacketGiveaway #What’sNextforBitcoin?

BTC: - $359.91M

ETH: - $161.15M

SOL: $13.17M

XRP: $7.65M

#GateSquare$50KRedPacketGiveaway #What’sNextforBitcoin?

- Reward

- like

- Comment

- Repost

- Share

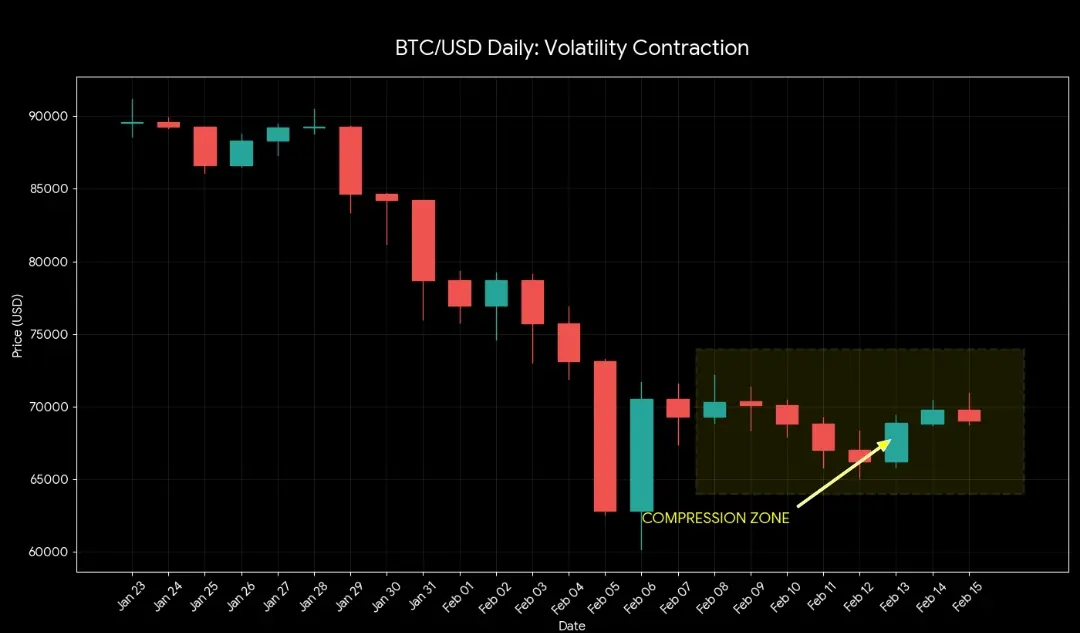

Is a Crypto Correction Brewing? Leverage Is Quietly Climbing Again

Crypto markets look calm on the surface.

But beneath the surface, leverage is creeping higher again.

And historically, that hasn’t ended gently.

As Bitcoin and major altcoins trade in tight ranges, derivatives positioning is starting to build. Open interest across major exchanges has ticked upward, while volatility remains compressed.

That combination can be combustible.

---

Why Leverage Matters Right Now

When leverage rises during sideways price action, it signals:

• Traders positioning early

• Increasing conviction without co

Crypto markets look calm on the surface.

But beneath the surface, leverage is creeping higher again.

And historically, that hasn’t ended gently.

As Bitcoin and major altcoins trade in tight ranges, derivatives positioning is starting to build. Open interest across major exchanges has ticked upward, while volatility remains compressed.

That combination can be combustible.

---

Why Leverage Matters Right Now

When leverage rises during sideways price action, it signals:

• Traders positioning early

• Increasing conviction without co

BTC-1,82%

- Reward

- like

- Comment

- Repost

- Share

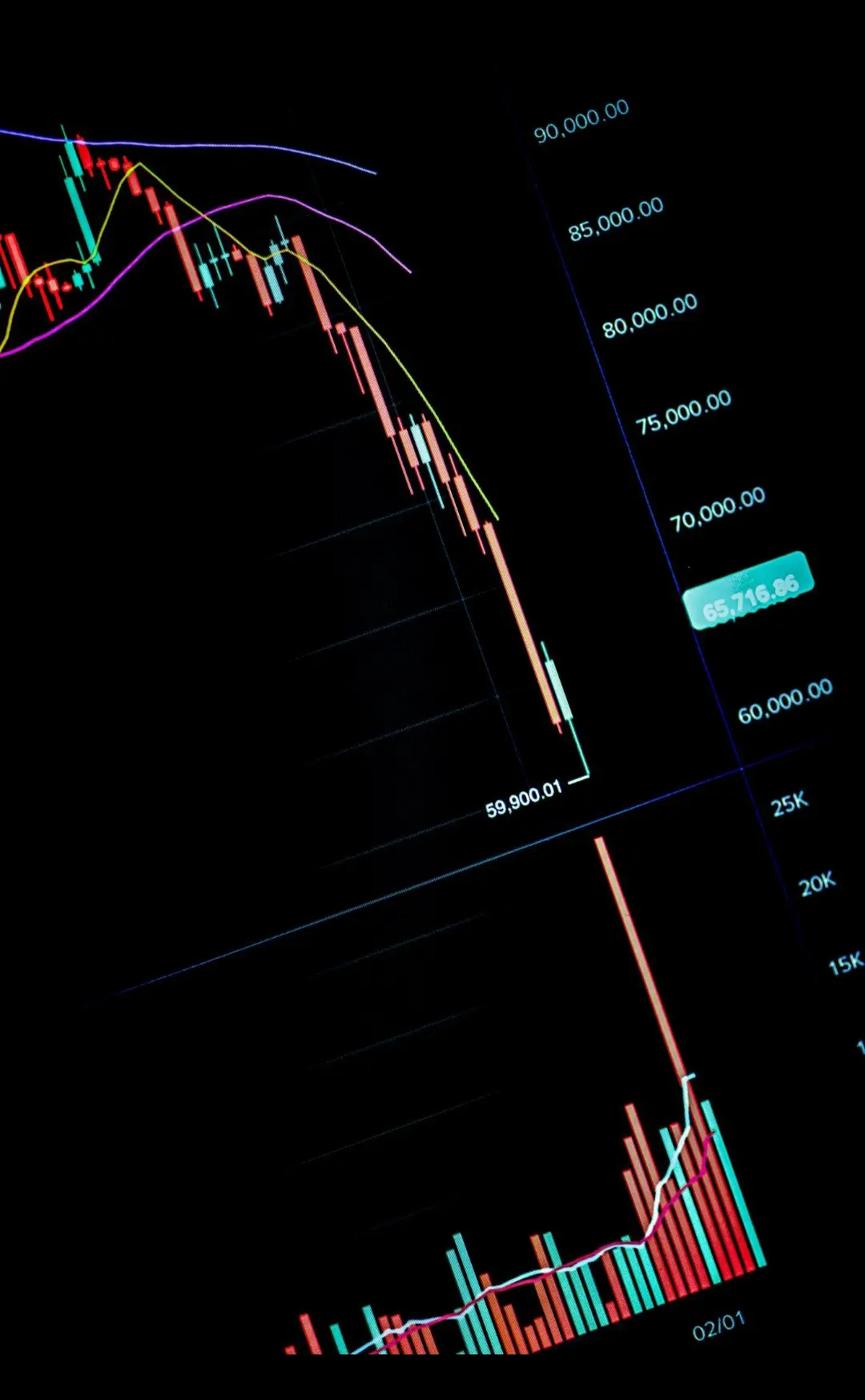

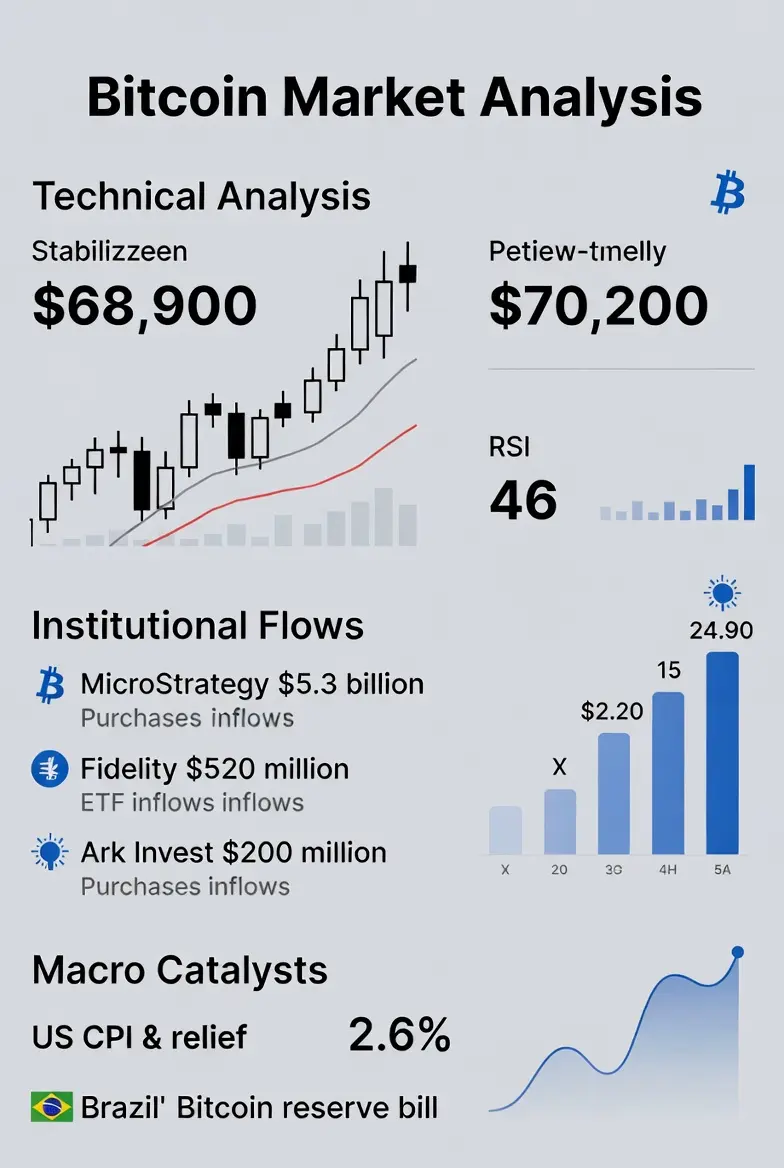

#What’sNextforBitcoin? As of today, Bitcoin (BTC) is hovering around $68,700, sitting at a crucial range where short-term swings intersect with medium-term structural support. This level, spanning roughly $65,000 to $70,000, has emerged as a decisive zone for traders weighing whether BTC is preparing for renewed upward momentum or bracing for a deeper pullback.

Macro and Institutional Factors

BTC continues to move under the influence of macro trends and institutional flows. Recent inflation data, showing moderation in core CPI, has reduced some pressure on central bank tightening, offering bro

Macro and Institutional Factors

BTC continues to move under the influence of macro trends and institutional flows. Recent inflation data, showing moderation in core CPI, has reduced some pressure on central bank tightening, offering bro

BTC-1,82%

- Reward

- 5

- 5

- Repost

- Share

ybaser :

:

To The Moon 🌕View More

#What’sNextforBitcoin?

The crypto market never sleeps, and once again the big question echoing across trading desks and social platforms is simple: What’s next for Bitcoin? As the world’s leading digital asset, Bitcoin continues to set the tone for the entire market. Whether you’re a long-term holder, a short-term trader, or just a curious observer, understanding Bitcoin’s next potential moves is essential.

1️⃣ Market Momentum and Price Structure

Bitcoin has shown remarkable resilience despite global economic uncertainty. From inflation concerns to interest rate decisions, macroeconomic factor

The crypto market never sleeps, and once again the big question echoing across trading desks and social platforms is simple: What’s next for Bitcoin? As the world’s leading digital asset, Bitcoin continues to set the tone for the entire market. Whether you’re a long-term holder, a short-term trader, or just a curious observer, understanding Bitcoin’s next potential moves is essential.

1️⃣ Market Momentum and Price Structure

Bitcoin has shown remarkable resilience despite global economic uncertainty. From inflation concerns to interest rate decisions, macroeconomic factor

- Reward

- 2

- 2

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#What’sNextforBitcoin?

Bitcoin is once again at a critical crossroads, where short-term price movements matter far less than the broader structural forces shaping its next phase. After years of extreme volatility, cycles of hype and fear, and constant macro pressure, Bitcoin has matured into an asset that now reacts not only to crypto-specific narratives but also to global liquidity, monetary policy, and institutional behavior. The question “What’s next for Bitcoin?” is no longer about a single breakout or crash it’s about understanding where Bitcoin fits in a changing financial system and ho

Bitcoin is once again at a critical crossroads, where short-term price movements matter far less than the broader structural forces shaping its next phase. After years of extreme volatility, cycles of hype and fear, and constant macro pressure, Bitcoin has matured into an asset that now reacts not only to crypto-specific narratives but also to global liquidity, monetary policy, and institutional behavior. The question “What’s next for Bitcoin?” is no longer about a single breakout or crash it’s about understanding where Bitcoin fits in a changing financial system and ho

- Reward

- like

- Comment

- Repost

- Share

🚀 #What’sNextforBitcoin?

Bitcoin is navigating a pivotal moment as the crypto market evolves. With institutional interest rising, macroeconomic factors like inflation and interest rates stabilizing, and the growing adoption of blockchain technology, Bitcoin’s trajectory could see both volatility and opportunity.

Key points to watch:

1️⃣ Institutional Adoption – More funds and corporations are showing interest in BTC, potentially driving demand.

2️⃣ Regulatory Landscape – Governments worldwide, including the U.S. and Hong Kong, are shaping crypto regulations that could impact market behavior.

Bitcoin is navigating a pivotal moment as the crypto market evolves. With institutional interest rising, macroeconomic factors like inflation and interest rates stabilizing, and the growing adoption of blockchain technology, Bitcoin’s trajectory could see both volatility and opportunity.

Key points to watch:

1️⃣ Institutional Adoption – More funds and corporations are showing interest in BTC, potentially driving demand.

2️⃣ Regulatory Landscape – Governments worldwide, including the U.S. and Hong Kong, are shaping crypto regulations that could impact market behavior.

BTC-1,82%

- Reward

- 2

- Comment

- Repost

- Share

$STORJ /USDT Trade Setup 🔥

Long — 10x Leverage

Entry Zone: 0.1150 – 0.1100

Stop Loss: 0.1000

Targets: 0.1220 → 0.1300 → 0.1400

📌 Plan:

After the first target is hit, move stop loss to entry to protect capital.

⚠️ Not financial advice. Do your own research.

#GateSquare$50KRedPacketGiveaway #USCoreCPIHitsFour-YearLow #What’sNextforBitcoin? #GateSpringFestivalHorseRacingEvent #AIAgentProjectsI’mWatching

Long — 10x Leverage

Entry Zone: 0.1150 – 0.1100

Stop Loss: 0.1000

Targets: 0.1220 → 0.1300 → 0.1400

📌 Plan:

After the first target is hit, move stop loss to entry to protect capital.

⚠️ Not financial advice. Do your own research.

#GateSquare$50KRedPacketGiveaway #USCoreCPIHitsFour-YearLow #What’sNextforBitcoin? #GateSpringFestivalHorseRacingEvent #AIAgentProjectsI’mWatching

STORJ3,9%

- Reward

- like

- Comment

- Repost

- Share

#What’sNextforBitcoin?

Bitcoin is once again at a

crossroads. After extreme volatility over the past year, analysts are split

between a powerful breakout and another corrective phase. Here’s what the

latest data suggests about where BTC could be heading next.

📊 The Current Market Reality

Bitcoin has fallen roughly 50% from its October 2025

peak near $126,000, shifting sentiment from euphoria to caution.

Forecasts vary dramatically — some expect $75K,

while bullish models see a path toward $225K depending on key

market signals.

👉 Translation: uncertainty is high, but so i

Bitcoin is once again at a

crossroads. After extreme volatility over the past year, analysts are split

between a powerful breakout and another corrective phase. Here’s what the

latest data suggests about where BTC could be heading next.

📊 The Current Market Reality

Bitcoin has fallen roughly 50% from its October 2025

peak near $126,000, shifting sentiment from euphoria to caution.

Forecasts vary dramatically — some expect $75K,

while bullish models see a path toward $225K depending on key

market signals.

👉 Translation: uncertainty is high, but so i

BTC-1,82%

- Reward

- 1

- Comment

- Repost

- Share

#What’sNextforBitcoin?

Bitcoin currently stands at a critical juncture where macroeconomic forces, institutional flows, and on-chain fundamentals are converging to shape its next move. Unlike previous cycles driven primarily by retail sentiment, the current phase reflects a maturing market increasingly tied to global liquidity, central bank policy, and structural adoption trends. For traders and investors, the question is no longer whether Bitcoin will rise or fall in the short term—it’s how broader financial conditions, regulatory clarity, and structural supply dynamics will influence medium

Bitcoin currently stands at a critical juncture where macroeconomic forces, institutional flows, and on-chain fundamentals are converging to shape its next move. Unlike previous cycles driven primarily by retail sentiment, the current phase reflects a maturing market increasingly tied to global liquidity, central bank policy, and structural adoption trends. For traders and investors, the question is no longer whether Bitcoin will rise or fall in the short term—it’s how broader financial conditions, regulatory clarity, and structural supply dynamics will influence medium

BTC-1,82%

- Reward

- 9

- 8

- Repost

- Share

Luna_Star :

:

Ape In 🚀View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

142.85K Popularity

26.8K Popularity

23.7K Popularity

69.31K Popularity

11K Popularity

271.39K Popularity

332.75K Popularity

24.35K Popularity

13.39K Popularity

11.26K Popularity

11.41K Popularity

11.15K Popularity

9.85K Popularity

38.72K Popularity

News

View MoreAIX.FUN leading token Horse's market capitalization surpasses $10 million and launches a New Year airdrop event

41 m

A whale deposited 3.16 million USDC into HyperLiquid and placed a limit buy order for XMR.

50 m

Data: 164.59 BTC transferred from an anonymous address, then routed through a relay and sent to another anonymous address

51 m

Logan Paul's rare Pokémon card sold for a record-breaking $16,492,000, setting the world's most expensive trading card record

1 h

Vice President of HKU: Hong Kong's digital asset market has already experimented with digital RMB for settlement

1 h

Pin