Post content & earn content mining yield

placeholder

reads

🔹 Silent for 13 years! Ancient Bitcoin whale moves 909 BTC, with unrealized gains reaching 13,900×

- Reward

- like

- Comment

- Repost

- Share

Everyone involved in financial markets often hears a term: “smart money.”

Let’s not talk about it as something mysterious, but in its simplest form.

What we call smart money is

investors who are not in a hurry,

who do not act impulsively,

and who have time and capital.

In other words, large funds, banks, and long-term thinkers.

The most fundamental characteristic of this money is:

it doesn’t rush when news breaks.

It usually stays silent while everyone else is talking.

Because for smart money, what matters is not

“what is happening right now,”

but rather, “at what stage is this market?”

The c

View OriginalLet’s not talk about it as something mysterious, but in its simplest form.

What we call smart money is

investors who are not in a hurry,

who do not act impulsively,

and who have time and capital.

In other words, large funds, banks, and long-term thinkers.

The most fundamental characteristic of this money is:

it doesn’t rush when news breaks.

It usually stays silent while everyone else is talking.

Because for smart money, what matters is not

“what is happening right now,”

but rather, “at what stage is this market?”

The c

- Reward

- like

- Comment

- Repost

- Share

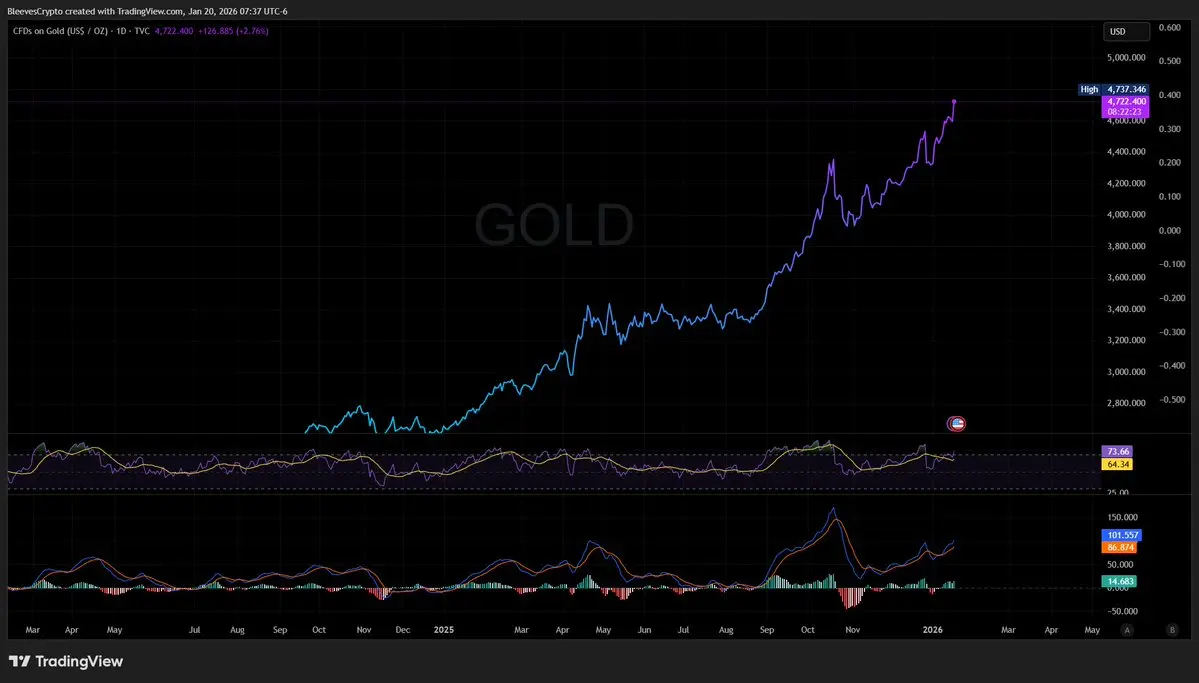

#GateTradFi1gGoldGiveaway, Tether Gold (XAUT) is currently trading near the upper range of its recent movement, reflecting steady demand for gold-backed digital assets. The market structure remains supported by global uncertainty, inflation concerns, and a gradual shift of capital from high-risk crypto assets into safer stores of value. XAUT mirrors the price of physical gold, so its direction is strongly influenced by the U.S. dollar index, interest-rate expectations, and geopolitical sentiment.

From a technical perspective, the short-term trend is slightly mixed. On lower time frames, price

From a technical perspective, the short-term trend is slightly mixed. On lower time frames, price

XAUT1,46%

- Reward

- like

- Comment

- Repost

- Share

RE

新能源币

Created By@TheLittleBeggarInThe

Listing Progress

0.00%

MC:

$3.4K

Create My Token

Gate Live · Refresh Season | Revamped App, Ignited Excitement https://www.gate.com/campaigns/3873?ref=VVBDU19YCQ&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

Hit like if you want it ...

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Only win battles! In this era, strength is the only language that matters. Those who watch from the sidelines will always stay in the same place. Only those willing to take action can see hope. Whether the train is fast or not depends on the engine!

#Gate每10分钟送1克黄金 #欧美关税风波冲击市场

View Original#Gate每10分钟送1克黄金 #欧美关税风波冲击市场

- Reward

- like

- 2

- Repost

- Share

Challenge10UWith10,000U :

:

You're so impressive, you must have become a billionaire. Making money so easily, you should call all your aunts and uncles.View More

Betting small to win big, the principal did not exceed 300

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

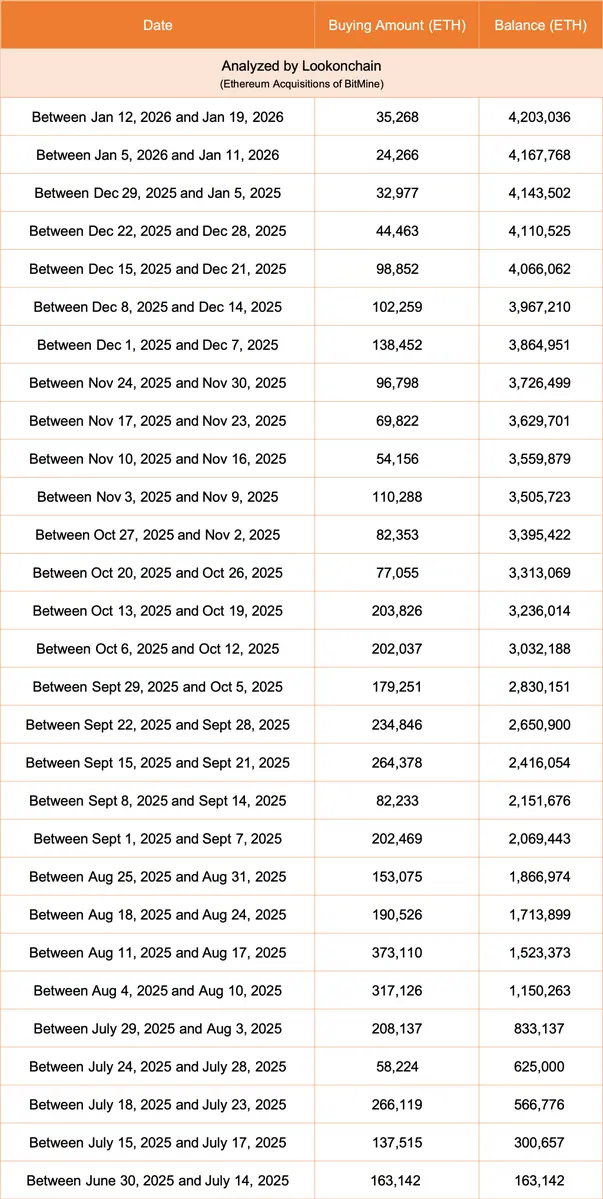

Tom Lee(@fundstrat)'s #Bitmine bought 35,268 $ETH($108.17M) last week and currently holds 4,203,036 $ETH($12.89B).

ETH-5,85%

- Reward

- like

- Comment

- Repost

- Share

Can we take profits on this short-term move?

View Original

- Reward

- like

- Comment

- Repost

- Share

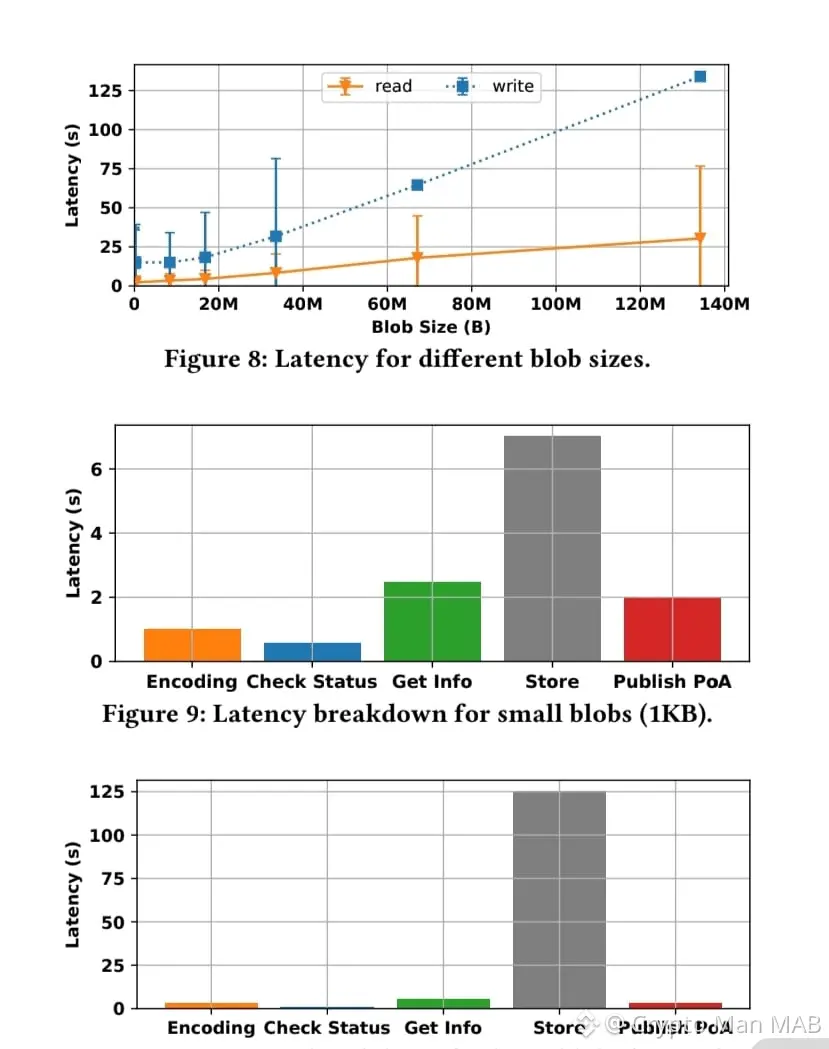

Walrus Latency. Figure 8 illustrated the end-to-end latency experienced by the client. We start measuring before the client encodesthe blob and finish when it observes a proof-of-availability confirmation on the blockchain. Each point represents the p50 over 5

minutes of runs; error bars indicate p90.

The graph shows that read latency remains low, even for large

blobs. For small blobs (less than 20 MB), the latency stays below 15

seconds. For large blobs (130 MB), the latency increases to around

30 seconds

{future}(WALUSDT)

minutes of runs; error bars indicate p90.

The graph shows that read latency remains low, even for large

blobs. For small blobs (less than 20 MB), the latency stays below 15

seconds. For large blobs (130 MB), the latency increases to around

30 seconds

{future}(WALUSDT)

- Reward

- like

- Comment

- Repost

- Share

Are there friends who are currently chasing longs at high levels or temporarily trapped? Don’t panic, the situation is not hopeless. There are various strategies here to help you gradually resolve the dilemma.

Remember these core principles:

First, cut losses decisively if the direction is wrong

When the market clearly weakens and the downward space has not been fully released, exiting in time is often more rational than stubbornly holding on. Preserving the rhythm allows you to wait for the next opportunity.

Second, timing is crucial when adding positions

Only consider scaling in when the pri

View OriginalRemember these core principles:

First, cut losses decisively if the direction is wrong

When the market clearly weakens and the downward space has not been fully released, exiting in time is often more rational than stubbornly holding on. Preserving the rhythm allows you to wait for the next opportunity.

Second, timing is crucial when adding positions

Only consider scaling in when the pri

- Reward

- like

- Comment

- Repost

- Share

ETHA

ETHA

Created By@Gate.io

Subscription Progress

0.00%

MC:

$0

Create My Token

Market Structure: Higher Highs & Lower Lows

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

ok hear me out!

it is not shitcoin

it is a novelty

it is not shitcoin

it is a novelty

- Reward

- like

- Comment

- Repost

- Share

U can't fake good liquidity

$buttcoin

$buttcoin

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More6.87K Popularity

35.51K Popularity

49.63K Popularity

11.67K Popularity

8.91K Popularity

News

View MoreSolana Labs Co-Founder: SKR at low prices benefits early builders; ecosystem maturity takes 10 years

11 m

The Dogecoin Foundation-supported House of Doge project launches DOGE payment app "Such"

12 m

After launching on NPM, Alpha increased by 4218.95%, current price 0.0024421 USDT

16 m

In the past 4 hours, the entire network has been liquidated for $236 million, mainly long positions.

20 m

Chainlink launches 24/5 US stock data stream to bring US stocks on-chain

28 m

Pin