MrFlower_

No content yet

MrFlower_

#FedLeadershipImpact The leadership of the US Federal Reserve continues to act as a central gravitational force for global financial markets, influencing capital flows, risk sentiment, and long-term investment behavior. As markets move deeper into a data-driven and expectation-sensitive environment, Fed leadership is no longer judged solely by interest rate decisions, but by credibility, consistency, and strategic foresight. In the current cycle, even subtle shifts in tone can reshape narratives across equities, bonds, commodities, and digital assets.

At the foundation of this influence lies t

At the foundation of this influence lies t

BTC1,08%

- Reward

- 11

- 13

- 1

- Share

Peacefulheart :

:

Happy New Year! 🤑View More

#Web3FebruaryFocus February is emerging as a decisive inflection point for Web3, marking a transition from reactionary market behavior toward intentional ecosystem building. After January’s volatility reset expectations, the industry is now entering a phase where capital discipline, developer commitment, and product-market alignment matter more than speculative momentum. This shift reflects a broader realization that the next wave of Web3 growth will not be driven by hype cycles, but by resilient infrastructure capable of supporting millions of real users across diverse use cases.

A major them

A major them

- Reward

- 9

- 17

- 1

- Share

Peacefulheart :

:

Happy New Year! 🤑View More

#CryptoMarketWatch Market Under Stress: Leverage Flush, Smart Money Control & the Rise of Tokenized Assets

The cryptocurrency market has entered a high-stress, high-volatility phase, driven by aggressive deleveraging, shifting institutional behavior, and evolving capital narratives. Recent price action reflects more than emotional selling—it marks a technically significant breakdown in Bitcoin’s market structure.

🔻 Bitcoin Price Action & Technical Overview

Current Status: Technically fragile after losing multiple critical support levels

Trend Structure:

Short-term: Bearish

Medium-term: Weaken

The cryptocurrency market has entered a high-stress, high-volatility phase, driven by aggressive deleveraging, shifting institutional behavior, and evolving capital narratives. Recent price action reflects more than emotional selling—it marks a technically significant breakdown in Bitcoin’s market structure.

🔻 Bitcoin Price Action & Technical Overview

Current Status: Technically fragile after losing multiple critical support levels

Trend Structure:

Short-term: Bearish

Medium-term: Weaken

BTC1,08%

- Reward

- 12

- 18

- 1

- Share

Nazdej :

:

2026 GOGOGO 👊View More

#VanEckLaunchesAVAXSpotETF A New Era for Altcoins: VanEck Launches AVAX Spot ETF

The crypto investment landscape has taken a major leap forward as VanEck officially launches the first U.S.-listed Spot Avalanche (AVAX) ETF. This development signals that institutional finance is expanding beyond Bitcoin and Ethereum, embracing next-generation blockchain networks.

About the VanEck Avalanche Spot ETF (VAVX)

Unlike futures-based products, the ETF holds actual AVAX tokens, providing direct exposure without requiring wallets, private keys, or on-chain custody. Investors can track real market price mo

The crypto investment landscape has taken a major leap forward as VanEck officially launches the first U.S.-listed Spot Avalanche (AVAX) ETF. This development signals that institutional finance is expanding beyond Bitcoin and Ethereum, embracing next-generation blockchain networks.

About the VanEck Avalanche Spot ETF (VAVX)

Unlike futures-based products, the ETF holds actual AVAX tokens, providing direct exposure without requiring wallets, private keys, or on-chain custody. Investors can track real market price mo

- Reward

- 13

- 20

- 1

- Share

Nazdej :

:

2026 GOGOGO 👊View More

#SEConTokenizedSecurities Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional instruments like stocks, bonds, or funds—fall under existing securities laws. Whether native on-chain or digital representations, all legal obligations apply, including registration, disclosures, investor protections, and anti-fraud rules. Brokers, issuers, and trading platforms must comply to ensure legal a

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional instruments like stocks, bonds, or funds—fall under existing securities laws. Whether native on-chain or digital representations, all legal obligations apply, including registration, disclosures, investor protections, and anti-fraud rules. Brokers, issuers, and trading platforms must comply to ensure legal a

- Reward

- 12

- 19

- 1

- Share

Nazdej :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold “Digital Gold” Is Losing Ground to Traditional Trust

For years, Bitcoin has been positioned as a challenger to gold — a modern store of value for the digital age. Yet early 2026 tells a different story. Spot gold has surged beyond $5,200/oz, strengthening amid rising global uncertainty, while Bitcoin remains range-bound between $86,000–$89,000, struggling to regain decisive momentum. In stormy markets, capital favors assets backed by physical certainty and centuries of trust.

At the core of this divergence is a renewed global preference for pure safe havens. Investors a

For years, Bitcoin has been positioned as a challenger to gold — a modern store of value for the digital age. Yet early 2026 tells a different story. Spot gold has surged beyond $5,200/oz, strengthening amid rising global uncertainty, while Bitcoin remains range-bound between $86,000–$89,000, struggling to regain decisive momentum. In stormy markets, capital favors assets backed by physical certainty and centuries of trust.

At the core of this divergence is a renewed global preference for pure safe havens. Investors a

BTC1,08%

- Reward

- 12

- 16

- 1

- Share

Nazdej :

:

2026 GOGOGO 👊View More

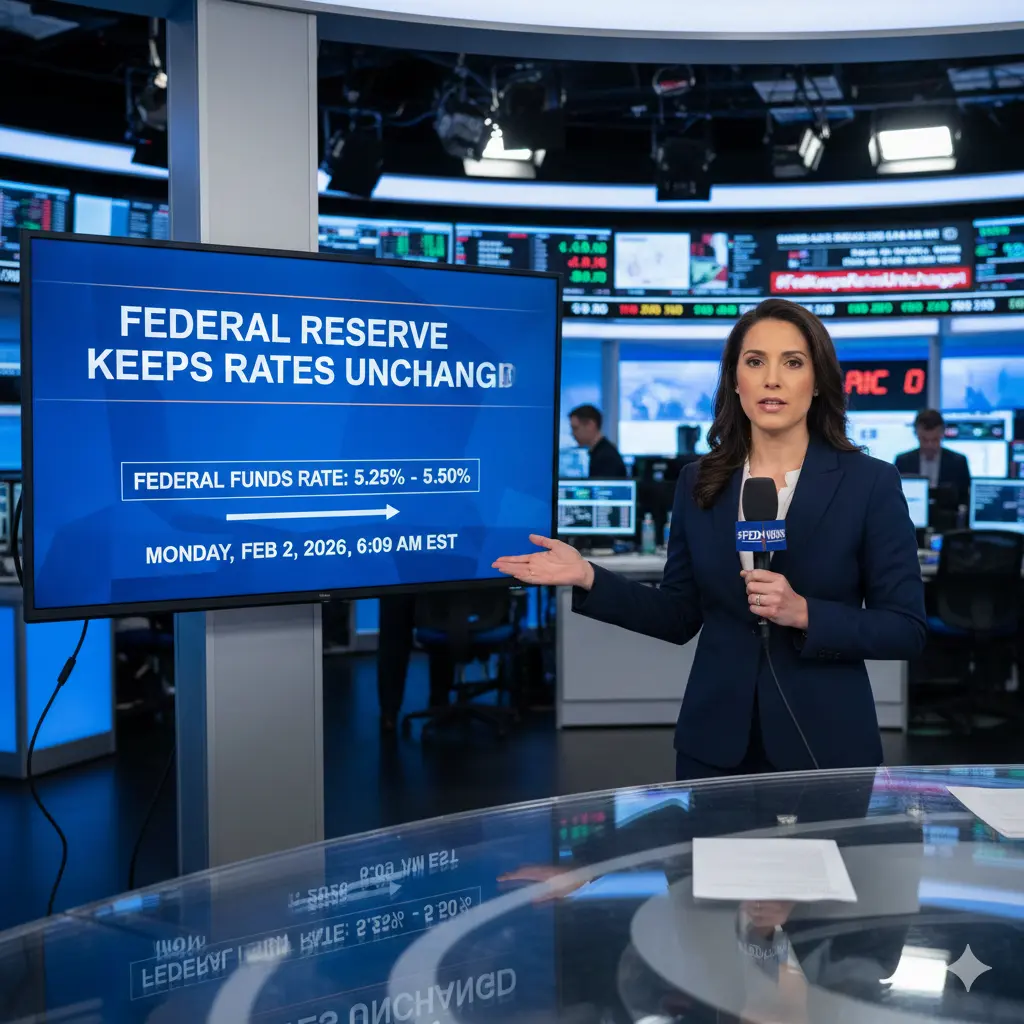

#FedKeepsRatesUnchanged The Federal Reserve has decided to hold interest rates steady, maintaining the “higher for longer” environment that markets have been pricing in for months. This pause signals stability but not easing, creating a cautious landscape for macro-sensitive assets, including crypto. Careful positioning between defensive allocations and tactical risk-on moves is essential.

Macro Context:

Interest rates remain elevated, affecting borrowing costs, corporate financing, and consumer spending. Risk assets often underperform in this climate, but disciplined investors can still find

Macro Context:

Interest rates remain elevated, affecting borrowing costs, corporate financing, and consumer spending. Risk assets often underperform in this climate, but disciplined investors can still find

BTC1,08%

- Reward

- 13

- 28

- 1

- Share

Nazdej :

:

2026 GOGOGO 👊View More

#CryptoRegulationNewProgress Growth Value New Year Lottery Vol.16: How Discipline Turns Into Rewards

The 16th edition of the Growth Value New Year Lottery isn’t just a seasonal giveaway—it’s a smart incentive engine designed to reward consistent user engagement while strengthening the Gate ecosystem. Unlike traditional lotteries based purely on luck, this campaign blends strategy, persistence, and community activity, giving proactive users a meaningful advantage.

At its core, this lottery converts routine engagement into tangible benefits. Every post, comment, and like on Gate’s Plaza earns gr

The 16th edition of the Growth Value New Year Lottery isn’t just a seasonal giveaway—it’s a smart incentive engine designed to reward consistent user engagement while strengthening the Gate ecosystem. Unlike traditional lotteries based purely on luck, this campaign blends strategy, persistence, and community activity, giving proactive users a meaningful advantage.

At its core, this lottery converts routine engagement into tangible benefits. Every post, comment, and like on Gate’s Plaza earns gr

- Reward

- 14

- 21

- 1

- Share

Nazdej :

:

2026 GOGOGO 👊View More

#GrowthPointsDrawRound16 Growth Value New Year Lottery Vol.16: How Discipline Turns Into Rewards

The 16th edition of the Growth Value New Year Lottery isn’t just a seasonal giveaway—it’s a smart incentive engine designed to reward consistent user engagement while strengthening the Gate ecosystem. Unlike traditional lotteries based purely on luck, this campaign blends strategy, persistence, and community activity, giving proactive users a meaningful advantage.

At its core, this lottery converts routine engagement into tangible benefits. Every post, comment, and like on Gate’s Plaza earns growth

The 16th edition of the Growth Value New Year Lottery isn’t just a seasonal giveaway—it’s a smart incentive engine designed to reward consistent user engagement while strengthening the Gate ecosystem. Unlike traditional lotteries based purely on luck, this campaign blends strategy, persistence, and community activity, giving proactive users a meaningful advantage.

At its core, this lottery converts routine engagement into tangible benefits. Every post, comment, and like on Gate’s Plaza earns growth

- Reward

- 14

- 14

- 1

- Share

Nazdej :

:

2026 GOGOGO 👊View More

#TokenizedSilverTrend 🪙⚡

Silver is no longer just a metal — it’s becoming programmable. The rise of tokenized silver is quietly gaining momentum, merging real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassles

⚡ Faster settlement compared to traditional markets

While gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative. In 2026, capit

Silver is no longer just a metal — it’s becoming programmable. The rise of tokenized silver is quietly gaining momentum, merging real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassles

⚡ Faster settlement compared to traditional markets

While gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative. In 2026, capit

- Reward

- 13

- 12

- 1

- Share

Nazdej :

:

2026 GOGOGO 👊View More

#AIBotClawdbotGoesViral The local AI tool Clawdbot has gone viral, driving significant attention and sparking a surge in related meme coins such as CLAWD. This sudden FOMO illustrates a growing trend in crypto: where technology adoption, community engagement, and meme-driven narratives intersect to create rapid, sometimes explosive market movements. CLAWD’s rapid price appreciation mirrors patterns seen in earlier viral rallies like GOAT and ACT, showing how sentiment, hype, and retail participation can temporarily dominate fundamentals.

Clawdbot’s virality goes beyond social media buzz. As an

Clawdbot’s virality goes beyond social media buzz. As an

- Reward

- 13

- 17

- 1

- Share

YingYue :

:

2026 GOGOGO 👊View More

#USGovernmentShutdownRisk A U.S. government shutdown occurs when Congress fails to pass—or the President does not sign—funding legislation such as appropriations bills or continuing resolutions before existing funding expires. This creates a funding gap, and under interpretations of the Antideficiency Act shaped by landmark 1980–1981 legal opinions, non-essential federal operations must largely cease. The result is widespread furloughs of federal employees, closure of national parks, delayed public services, and broader economic ripple effects that extend into financial markets.

Historically,

Historically,

- Reward

- 14

- 19

- 1

- Share

YingYue :

:

2026 GOGOGO 👊View More

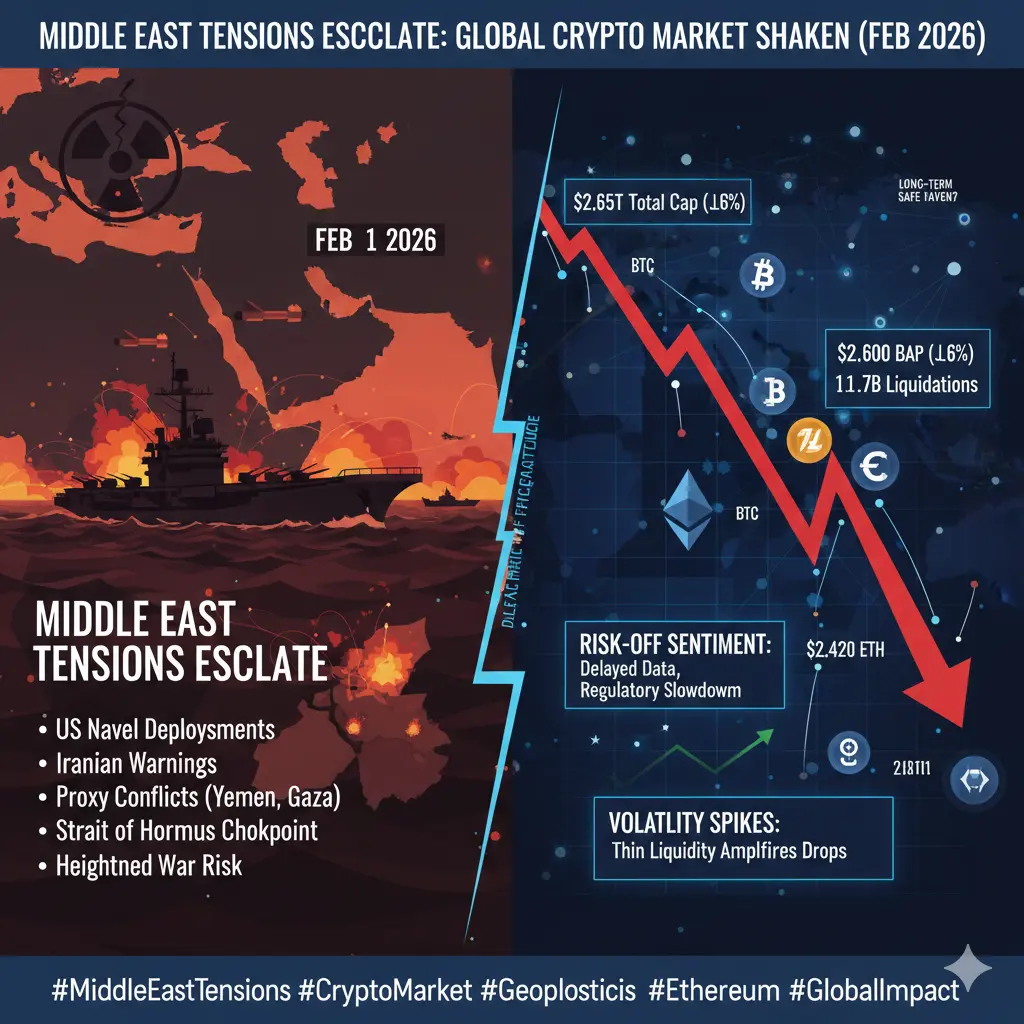

#MiddleEastTensionsEscalate The rapid escalation of geopolitical tensions in the Middle East has materially intensified stress across the cryptocurrency market, transforming what initially looked like a controlled pullback into a full-scale risk-off event. As tensions involving the U.S. and Iran escalated, crypto markets reacted immediately with accelerated price declines, thinning liquidity, and liquidation-driven volume spikes—highlighting just how sensitive digital assets remain to global instability.

Price Impact: Escalation Multiplies the Downside

Before the geopolitical flare-up intensif

Price Impact: Escalation Multiplies the Downside

Before the geopolitical flare-up intensif

- Reward

- 15

- 17

- 1

- Share

YingYue :

:

2026 GOGOGO 👊View More

#PreciousMetalsPullBack Markets are undergoing a sharp and synchronized correction across precious metals and cryptocurrencies following historic rallies in late 2025 and early January 2026. Gold briefly surged to around $5,595/oz, silver spiked near $121/oz, Bitcoin topped close to $90,000, and Ethereum traded above $3,000. As February 2026 begins, both asset classes have pulled back decisively. Importantly, this move reflects profit-taking, technical overextension, and macro repricing, rather than a breakdown of long-term bullish fundamentals.

A pullback is best understood as a temporary ret

A pullback is best understood as a temporary ret

- Reward

- 13

- 17

- 1

- Share

YingYue :

:

2026 GOGOGO 👊View More

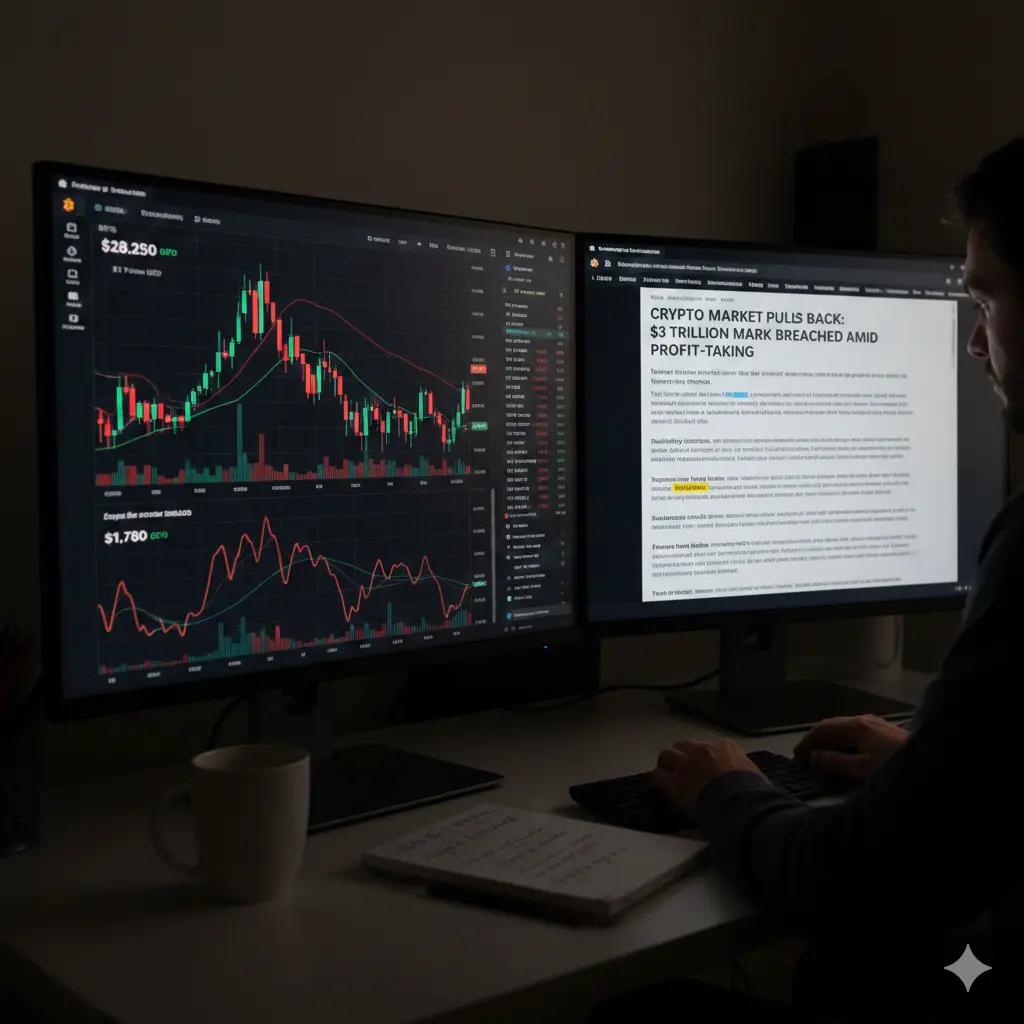

#CryptoMarketPullback The crypto market has experienced a sharp overnight pullback, with both Bitcoin and Ethereum weakening and total market capitalization slipping below the $3 trillion mark. This move appears driven more by profit-taking, tightening liquidity, and macro-led risk-off sentiment than by any fundamental breakdown in market structure. Corrections of this nature are a normal part of bullish market cycles, often serving to reset leverage and test conviction among participants.

Such pullbacks tend to separate long-term holders from short-term speculators, creating heightened volati

Such pullbacks tend to separate long-term holders from short-term speculators, creating heightened volati

- Reward

- 11

- 12

- 1

- Share

YingYue :

:

2026 GOGOGO 👊View More

#GateLiveMiningProgramPublicBeta Gate.io has officially launched its Live Mining Program in public beta, marking a major step forward in crypto engagement, liquidity mining, and decentralized finance innovation. This initiative introduces a real-time, interactive framework where users can actively participate in mining and rewards distribution while gaining hands-on exposure to DeFi mechanics. By blending accessibility, education, and strategic earning, Gate.io is positioning this program as more than just a rewards system — it’s an evolving ecosystem experience.

The public beta phase allows a

The public beta phase allows a

- Reward

- 14

- 13

- 2

- Share

YingYue :

:

2026 GOGOGO 👊View More

#MyWeekendTradingPlan Futures Market Outlook — Defense First, Then Precision Attack

The crypto futures market is heading into the weekend under extreme stress, and the current environment clearly favors caution over aggression. Bitcoin’s sharp drop from the $80,000 region into the $75,000–$77,000 zone triggered more than $2.5 billion in long liquidations, rapidly flushing excessive leverage from the system. While such events often reset market structure, they do not automatically confirm a trend reversal. Sentiment remains fragile, liquidity is thin, and emotions are elevated — classic condit

The crypto futures market is heading into the weekend under extreme stress, and the current environment clearly favors caution over aggression. Bitcoin’s sharp drop from the $80,000 region into the $75,000–$77,000 zone triggered more than $2.5 billion in long liquidations, rapidly flushing excessive leverage from the system. While such events often reset market structure, they do not automatically confirm a trend reversal. Sentiment remains fragile, liquidity is thin, and emotions are elevated — classic condit

- Reward

- 12

- 16

- 1

- Share

YingYue :

:

Buy To Earn 💎View More

GOLD & SILVER JUST COLLIDED! ⚡

Gold plunged 16% and silver tumbled 39% in just 2 days, wiping out trillions in value. This isn’t just a dip it’s a shockwave through the metals market.

Why the crash?

1️⃣ Fed Clarity: Markets were betting on a super-dovish Fed. That guess is gone.

2️⃣ Parabolic Pop: Silver’s meteoric rise is now a steep fall parabolic spikes rarely recover fast.

3️⃣ Mania Ends: Everyone rushed in crypto, traders, speculators. Extreme hype usually ends in a major top.

4️⃣ History Rhymes: Silver’s past shows crashes like this can take months or years to recover.

The takeaway? Meta

Gold plunged 16% and silver tumbled 39% in just 2 days, wiping out trillions in value. This isn’t just a dip it’s a shockwave through the metals market.

Why the crash?

1️⃣ Fed Clarity: Markets were betting on a super-dovish Fed. That guess is gone.

2️⃣ Parabolic Pop: Silver’s meteoric rise is now a steep fall parabolic spikes rarely recover fast.

3️⃣ Mania Ends: Everyone rushed in crypto, traders, speculators. Extreme hype usually ends in a major top.

4️⃣ History Rhymes: Silver’s past shows crashes like this can take months or years to recover.

The takeaway? Meta

- Reward

- 14

- 12

- Repost

- Share

YingYue :

:

Buy To Earn 💎View More

🚨 SYSTEM ALERT: GLOBAL MARKETS AT BREAKING POINT

Tomorrow, the U.S. stock market reopens after the government shutdown.

And what we’re seeing right now is not normal volatility…

It’s a warning signal.

Gold is falling.

Silver is falling.

Stocks are falling.

The U.S. dollar is weakening.

This is not a coincidence.

This is what systemic stress looks like.

History shows one thing clearly:

When multiple asset classes crash together, something big is breaking under the surface.

The last time markets showed similar conditions, global equities crashed nearly 60%.

And this time, the situation is eve

Tomorrow, the U.S. stock market reopens after the government shutdown.

And what we’re seeing right now is not normal volatility…

It’s a warning signal.

Gold is falling.

Silver is falling.

Stocks are falling.

The U.S. dollar is weakening.

This is not a coincidence.

This is what systemic stress looks like.

History shows one thing clearly:

When multiple asset classes crash together, something big is breaking under the surface.

The last time markets showed similar conditions, global equities crashed nearly 60%.

And this time, the situation is eve

- Reward

- 16

- 13

- 1

- Share

YingYue :

:

2026 GOGOGO 👊View More