# PreciousMetalsPullBack

4.98K

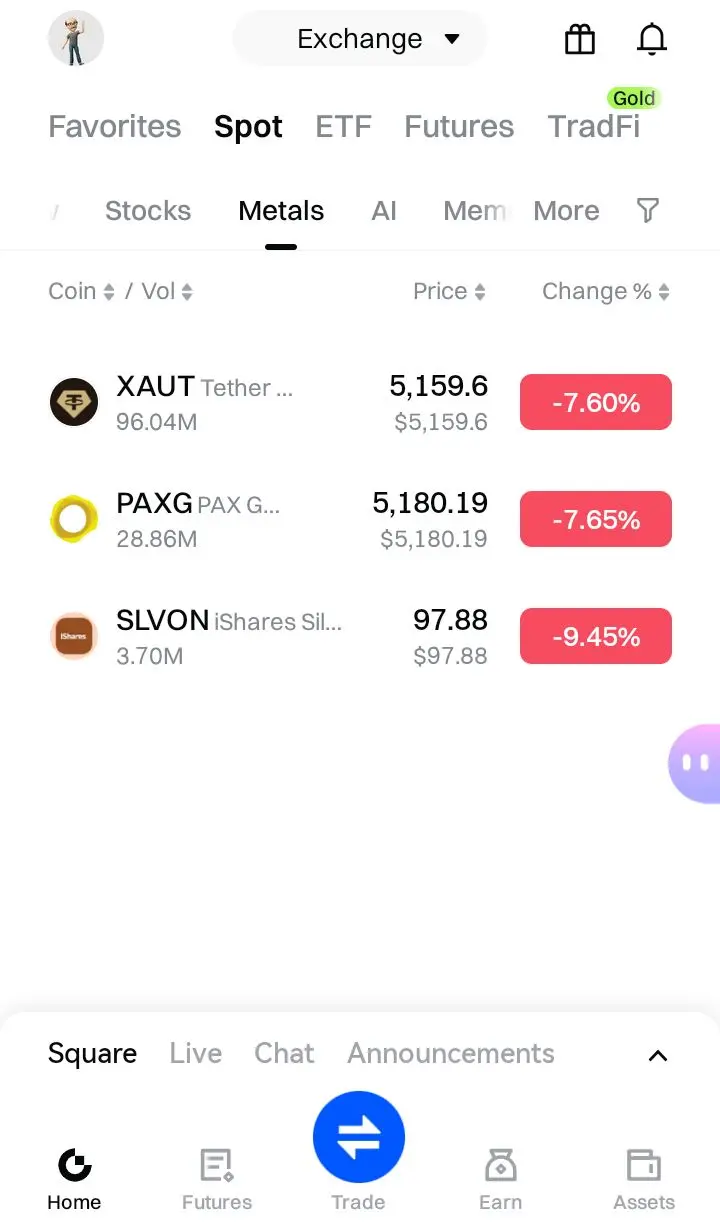

Risk assets fell overnight. Gold slid $300 to $5,155/oz, and silver dropped up to 8% to $108.23/oz. Are you buying the dip or cutting exposure? Share your Gate TradFi metals strategy!

MrFlower_

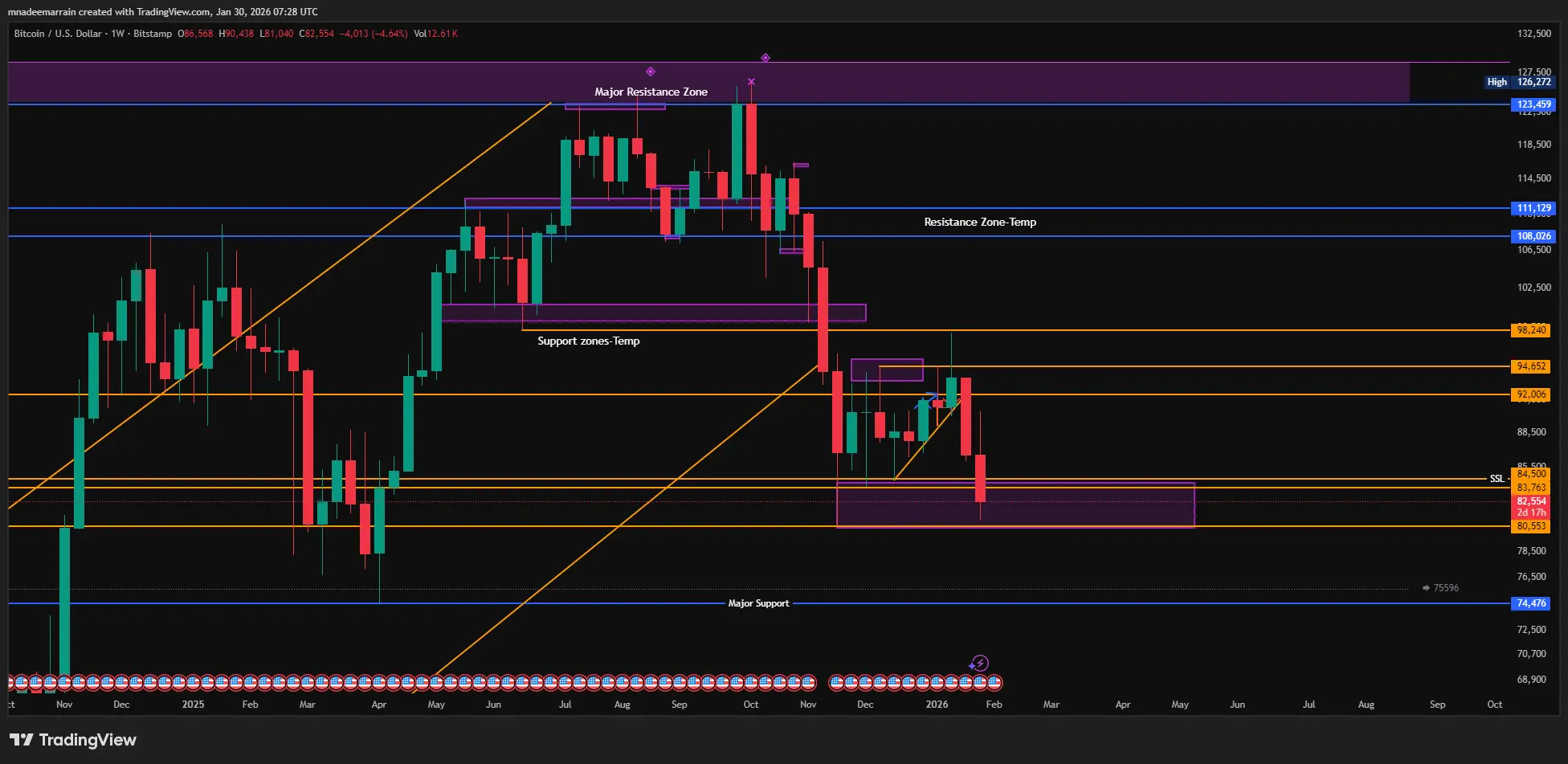

#PreciousMetalsPullBack Bitcoin continues to face heavy pressure as global markets move deeper into a risk-off phase. After dropping sharply on January 29, BTC fell to an intraday low near $83,383, marking its weakest level since November. Although a minor bounce followed, Bitcoin remains trapped in the $84,000–$85,000 range, representing a 33% decline from the October peak near $126,000.

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

BTC-6,46%

- Reward

- 4

- 9

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#PreciousMetalsPullBack #贵金属行情下跌 #贵金属巨震 Markets reminded everyone of a brutal truth today: there is no such thing as a one-way trade.

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

- Reward

- 5

- 2

- Repost

- Share

ybaser :

:

very good information to readView More

#PreciousMetalsPullBack Bitcoin dropped 6.4% to $83,383 on January 29, 2026, due to five consecutive days of ETF outflows totaling $1.137 billion, capital rotation into surging precious metals (gold $5,600, silver $120), US rare earth tariff announcements spiking volatility above 40, and bearish options market positioning with 97% of calls out-of-the-money.

What is the Bitcoin price now?

Bitcoin is trading at $84,233-84,623 as of Thursday, January 29, 2026, after hitting an intraday low of $83,383, the lowest level since November, representing a 33% decline from October's $126,000 peak.

Why is

What is the Bitcoin price now?

Bitcoin is trading at $84,233-84,623 as of Thursday, January 29, 2026, after hitting an intraday low of $83,383, the lowest level since November, representing a 33% decline from October's $126,000 peak.

Why is

BTC-6,46%

- Reward

- like

- Comment

- Repost

- Share

#PreciousMetalsPullBack The January 29-30, 2026 Market Rout: A Sharp Correction Amid Geopolitical Heat and Leverage Unwind

On January 30, 2026, global risk assets endured a violent flush, with an estimated $8 trillion in paper wealth erased across equities, crypto, and commodities in under 24 hours.

This was not a full-blown crash but a high-velocity deleveraging event triggered by escalating U.S.-Iran tensions, aggressive CME margin increases, persistent Fed hawkishness, and looming tariff risks.

Key Price Action (as of late January 30, 2026):

Bitcoin (BTC): Closed around $82,000–$82,350 aft

On January 30, 2026, global risk assets endured a violent flush, with an estimated $8 trillion in paper wealth erased across equities, crypto, and commodities in under 24 hours.

This was not a full-blown crash but a high-velocity deleveraging event triggered by escalating U.S.-Iran tensions, aggressive CME margin increases, persistent Fed hawkishness, and looming tariff risks.

Key Price Action (as of late January 30, 2026):

Bitcoin (BTC): Closed around $82,000–$82,350 aft

- Reward

- 1

- Comment

- Repost

- Share

#PreciousMetalsPullBack

Gate Square Daily | Jan 30

1️⃣ Market Moves: Global risk assets sold off, with U.S. equities, precious metals, and crypto all under pressure

2️⃣ Trade Update: Trump signals a potential 50% tariff on Canadian aircraft

3️⃣ Regulatory Voice: SEC Chair says now is the right time to allow crypto in 401(k) retirement plans

4️⃣ BTC Watch: Bitcoin hits its lowest level since last November; analysts warn of a pullback to $70,000

5️⃣ Central Bank Action: El Salvador’s central bank buys $50M in gold

Gate Square Daily | Jan 30

1️⃣ Market Moves: Global risk assets sold off, with U.S. equities, precious metals, and crypto all under pressure

2️⃣ Trade Update: Trump signals a potential 50% tariff on Canadian aircraft

3️⃣ Regulatory Voice: SEC Chair says now is the right time to allow crypto in 401(k) retirement plans

4️⃣ BTC Watch: Bitcoin hits its lowest level since last November; analysts warn of a pullback to $70,000

5️⃣ Central Bank Action: El Salvador’s central bank buys $50M in gold

BTC-6,46%

- Reward

- 3

- 4

- Repost

- Share

Ryakpanda :

:

New Year Wealth Explosion 🤑View More

Bitcoin is trading around $82,000. As I’ve been saying, the weekly 99 EMA is the strongest support. We’re seeing a clear breakdown attempt, but the weekly candle still has two days left to close. Confirmation only comes with a weekly close below this level.I’m still holding my short position. As I’ve said before, this is a short-side market for me. I added more shorts around the $97,000 area, as I mentioned multiple times. Since then, BTC is down nearly $16,000. I’m staying patient here. $72,000 is loading.As you know, I remain strongly bullish on gold and silver, while staying bearish on cry

- Reward

- 1

- 1

- Repost

- Share

GateUser-aaeb7e62 :

:

Happy New Year! 🤑#PreciousMetalsPullBack XAG / Silver

Sell-the-rally bias as price fails to hold post-bounce, confirms lower high below 116–118 supply, and trades firmly under declining EMAs, signaling continuation of short-term distribution.

Bias: SHORT

Entry: 111.0 – 113.0

Stop-Loss: 116.2

TP1: 107.5

TP2: 105.0

TP3: 102.8

As long as price remains below 116.2, downside follow-through is favored and rebounds lack conviction. Acceptance above that level invalidates the setup and shifts bias neutral.

Sell-the-rally bias as price fails to hold post-bounce, confirms lower high below 116–118 supply, and trades firmly under declining EMAs, signaling continuation of short-term distribution.

Bias: SHORT

Entry: 111.0 – 113.0

Stop-Loss: 116.2

TP1: 107.5

TP2: 105.0

TP3: 102.8

As long as price remains below 116.2, downside follow-through is favored and rebounds lack conviction. Acceptance above that level invalidates the setup and shifts bias neutral.

- Reward

- 1

- 1

- Repost

- Share

mrbui07 :

:

Happy New Year! 🤑Friday ops update — Jan 30, 2026: Risk-off dominates as BTC slides to ~$82K (2-mo low) amid $1.7B+ liquidations & Fed chair speculation. Gold corrects post-rally (spot ~$5,544/oz, MCX volatile), but macro tailwinds intact — geopolitical premia + diversification demand. Tether's 140-ton hoard & XAUT's redeemable backing shine brighter in volatility: efficient safe-haven exposure without crypto beta. Physical gold vs. tokenized? Both stacking in uncertain regimes. Stay positioned.

The target price for BTC is an analysis from @astronacci. Thank you for providing the price range.

don't forget s

The target price for BTC is an analysis from @astronacci. Thank you for providing the price range.

don't forget s

MC:$3.79KHolders:3

0.60%

- Reward

- 2

- Comment

- Repost

- Share

Important market news ‼️

1. Institutional fund withdrawal: Spot Bitcoin and Ethereum have experienced four consecutive days of net outflows, with a weekly outflow of $1.137 billion. Major funds like BlackRock and Grayscale are showing negative returns, indicating significant profit-taking by institutions.

2. Geopolitical and macro risks: Iran's Hormuz Strait exercises and escalating Middle East tensions, combined with weakening US stock risk assets, have shifted funds toward gold and other traditional safe-haven assets, impacting the crypto "safe-haven narrative."

3. Sentiment and liquidity: F

View Original1. Institutional fund withdrawal: Spot Bitcoin and Ethereum have experienced four consecutive days of net outflows, with a weekly outflow of $1.137 billion. Major funds like BlackRock and Grayscale are showing negative returns, indicating significant profit-taking by institutions.

2. Geopolitical and macro risks: Iran's Hormuz Strait exercises and escalating Middle East tensions, combined with weakening US stock risk assets, have shifted funds toward gold and other traditional safe-haven assets, impacting the crypto "safe-haven narrative."

3. Sentiment and liquidity: F

- Reward

- 2

- 1

- Repost

- Share

SlayHeavenZero :

:

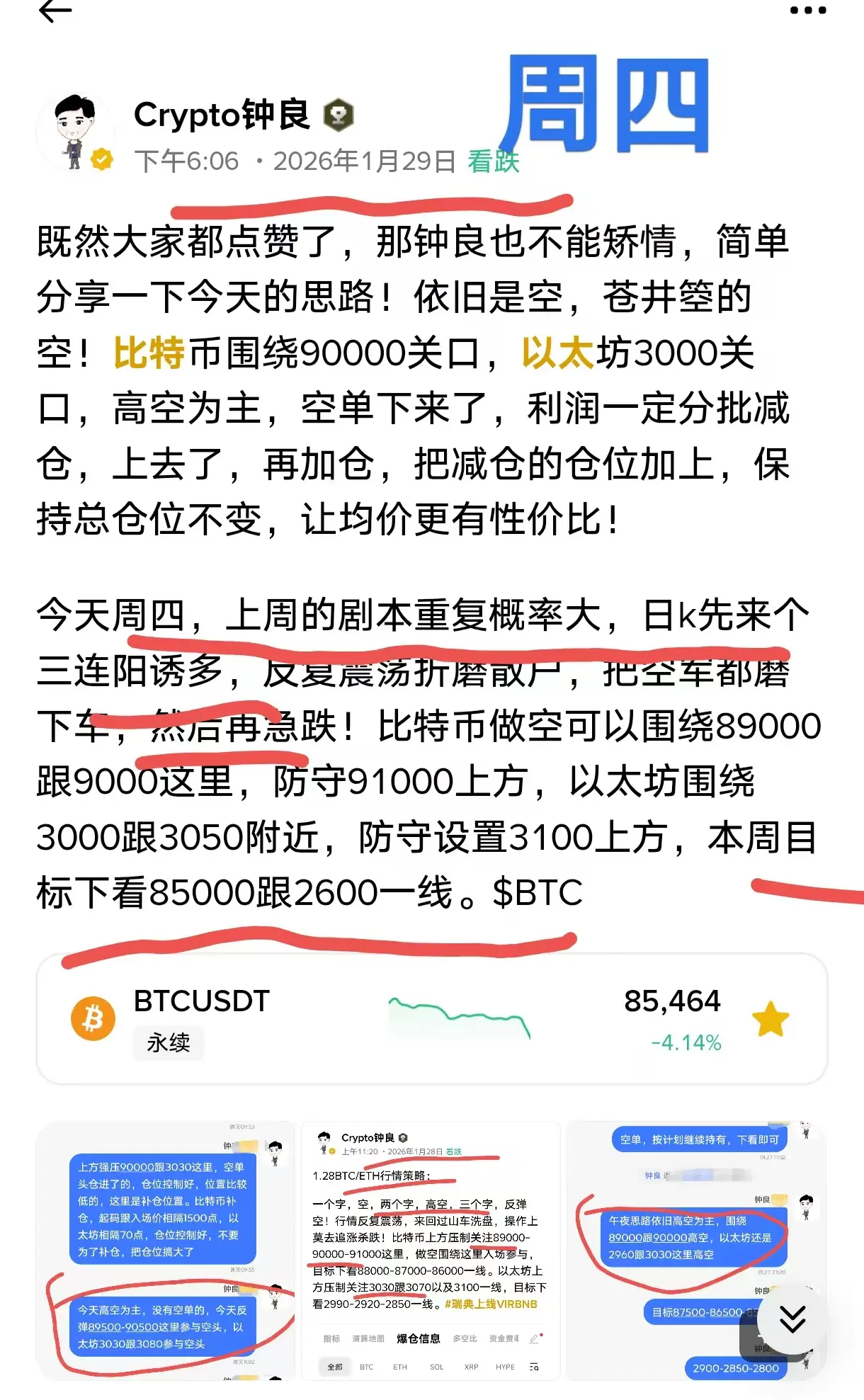

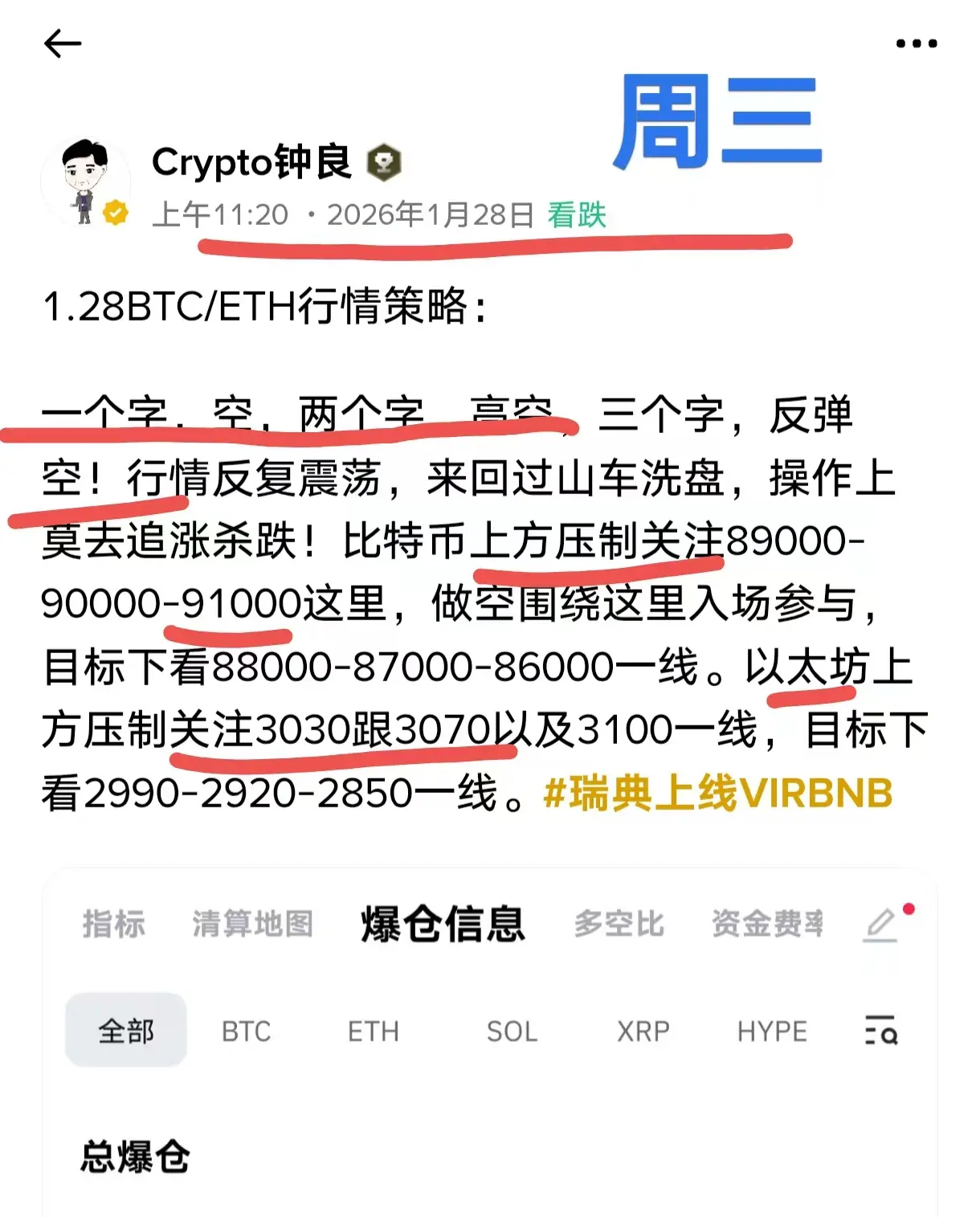

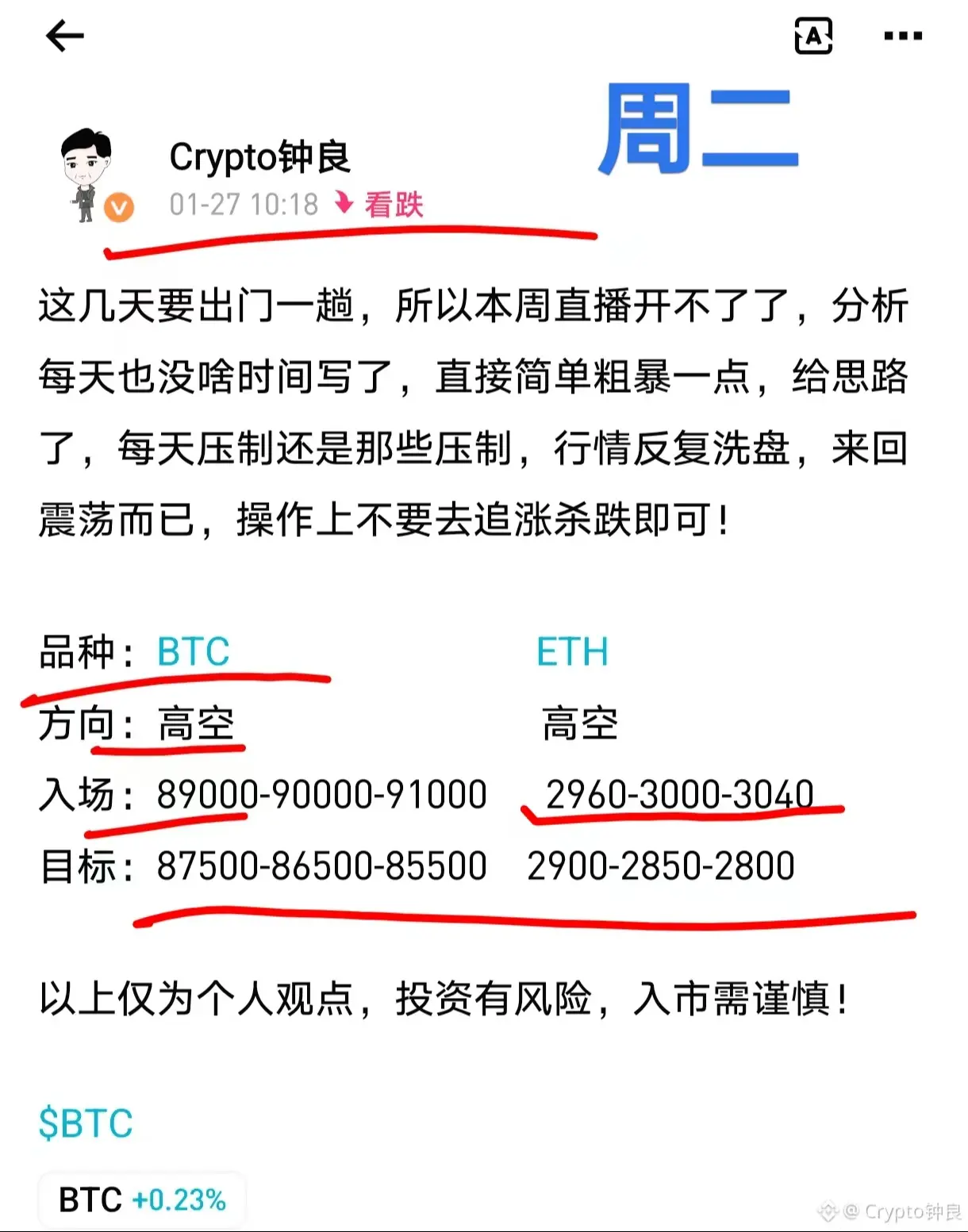

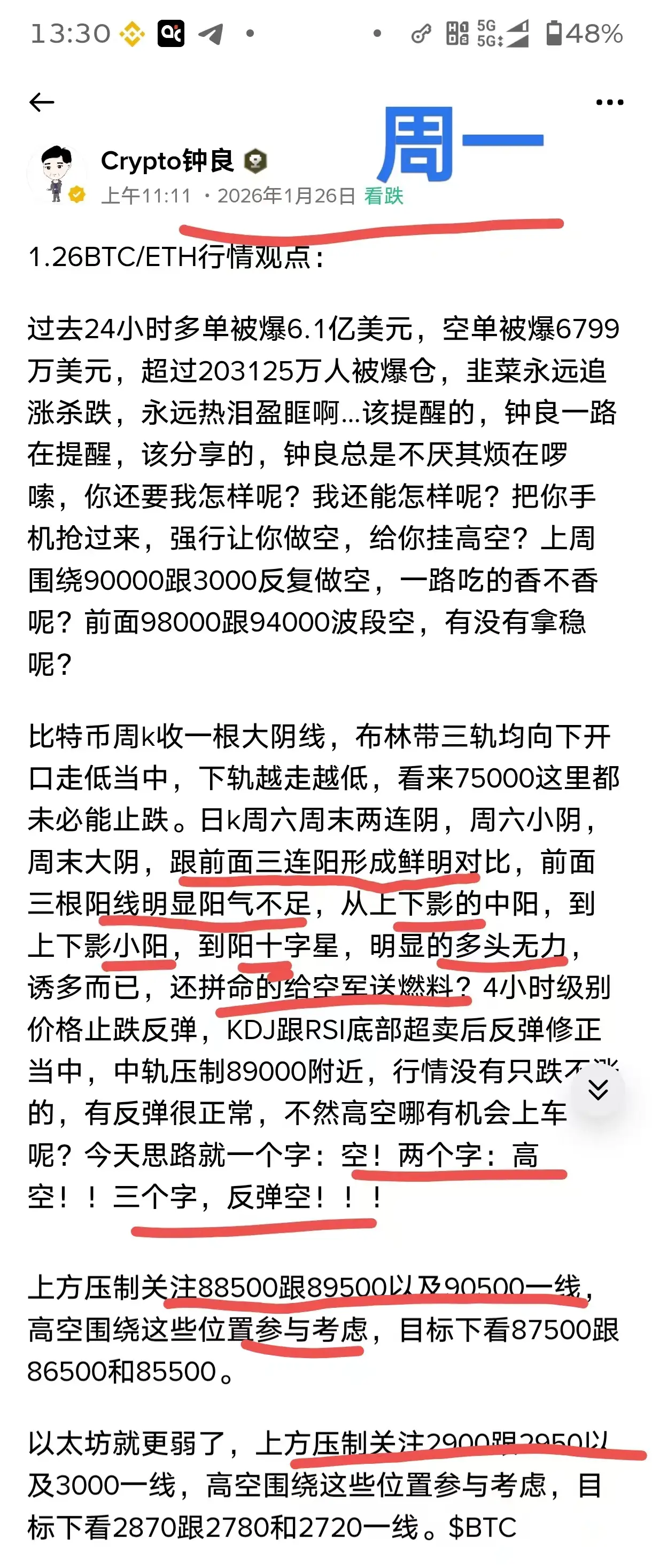

New Year Wealth Explosion 🤑1.30BTC/ETH Market Outlook:

Last night saw a sharp decline, with gold and silver plunging from high levels, and the crypto market also experienced a flood of sell-offs. Since last week, everyone has been repeatedly testing the 90,000 and 3,000 levels, continuously shorting. Yesterday, Thursday afternoon, I explicitly told everyone not to mistake rebounds for reversals, not to be fooled by false signals, and to short towards the 85,000 and 2,600 levels. Those who followed have already made substantial profits!

Bitcoin daily chart from Monday to Wednesday closed with consecutive bullish candles,

Last night saw a sharp decline, with gold and silver plunging from high levels, and the crypto market also experienced a flood of sell-offs. Since last week, everyone has been repeatedly testing the 90,000 and 3,000 levels, continuously shorting. Yesterday, Thursday afternoon, I explicitly told everyone not to mistake rebounds for reversals, not to be fooled by false signals, and to short towards the 85,000 and 2,600 levels. Those who followed have already made substantial profits!

Bitcoin daily chart from Monday to Wednesday closed with consecutive bullish candles,

BTC-6,46%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

4.98K Popularity

21.87K Popularity

19.29K Popularity

7.85K Popularity

50K Popularity

5.06K Popularity

18.61K Popularity

6.91K Popularity

82K Popularity

29.11K Popularity

89.98K Popularity

26.53K Popularity

18.78K Popularity

15.33K Popularity

205.36K Popularity

News

View MoreNYMEX silver and spot silver both suffered heavy declines intraday.

2 m

Analysis: Today is the first monthly settlement day after the annual settlement, with bullish options dominating the market.

4 m

Data: Hyperliquid platform whales currently hold positions worth $5.085 billion, with a long-short position ratio of 0.93.

9 m

A certain whale received 445,000 HYPE from Galaxy Digital OTC or will be staked.

14 m

Whale "0xd4d" Receives Additional 445,000 HYPE from Galaxy Digital OTC

15 m

Pin