MikeBrown

Aún no hay contenido

MikeBrown

¡Nueva fase desbloqueada!! 👊🏻$TIME La Preventa del Universo Ronda 3 ya está oficialmente en marcha. Gran agradecimiento a todos los que apoyaron las dos primeras rondas y ayudaron a sentar las bases. Anuncios de intercambios, asociaciones y actualizaciones de lanzamiento próximamente. Únete y sé parte de ello.

Ver originales

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

¡Nueva fase desbloqueada!! La preventa de 👊🏻Time Universe Ronda 3 ya está oficialmente en marcha. Gran agradecimiento a todos los que apoyaron las dos primeras rondas y ayudaron a sentar las bases. Anuncios de intercambios, asociaciones y actualizaciones de lanzamiento próximamente. Únete y sé parte de ello.

Ver originales

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Terapeuta: “¿Qué tipo de pesadillas te mantienen despierto por la noche?”Yo:

Ver originales

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Primero las prioridades.

Ver originales

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

¡Por qué @SNXS_ae me parece correcto! Me encanta trabajar con plataformas que se sienten organizadas, justas y realmente enfocadas en los creadores. Por eso, #SNXSCreatorsPad destaca para mí. Todo es simple, estructurado y basado en un esfuerzo real. Obtienes misiones claras, clasificaciones visibles y recompensas que provienen de un compromiso significativo, no solo números en una pantalla. También aprecio mucho el programa #SNXSReferral. Puedo invitar a otros creadores, ganar puntos cuando se vuelven activos y ser parte de algo que crece juntos. Se siente bien construir dentro de un ecosiste

Ver originales

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Noticias de última hora del futuro. 🤡Markets acaba de reescribir la historia.• BTC rompe un nuevo máximo histórico en $156,000• ETH supera los $12,500 con convicción• BNB cotiza cómodamente en $2,000• SOL se mantiene fuerte alrededor de $550• LINK todavía luchando contra la resistencia cerca de $150• Y sí, EE. UU. añadió $10B en BTC a su tesoreríaResulta que la estrategia a largo plazo sí importaba.

Ver originales- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

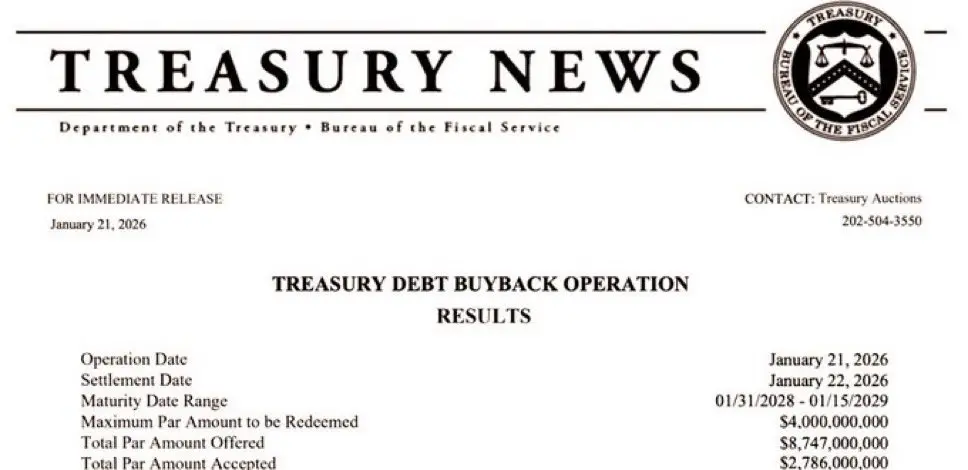

GRAN MOVIMIENTO 🫵🏻

El Tesoro de EE. UU. acaba de recomprar deuda por valor de 2.8 MIL MILLONES de dólares.

Eso es gestión de liquidez en acción.

Señala confianza, estabiliza los mercados y reduce la oferta.

Movimiento silencioso, implicaciones fuertes.

Ver originalesEl Tesoro de EE. UU. acaba de recomprar deuda por valor de 2.8 MIL MILLONES de dólares.

Eso es gestión de liquidez en acción.

Señala confianza, estabiliza los mercados y reduce la oferta.

Movimiento silencioso, implicaciones fuertes.

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$VANRY está construyendo algo muy diferente a la narrativa habitual de L1.

En lugar de perseguir el hype genérico de DeFi, @Vanarchain está diseñado para una adopción real por parte de los consumidores, especialmente en juegos, entretenimiento y marcas globales.

La misión es simple pero audaz: incorporar a los próximos miles de millones de usuarios a través de experiencias que la gente ya ama.

Por qué parece legítimo:

→ El equipo proviene del mundo de los juegos y los medios, no solo de cripto.

→ Enfoque real en IA, mundos virtuales y experiencias de marca.

→ Productos en funcionamiento ya en

En lugar de perseguir el hype genérico de DeFi, @Vanarchain está diseñado para una adopción real por parte de los consumidores, especialmente en juegos, entretenimiento y marcas globales.

La misión es simple pero audaz: incorporar a los próximos miles de millones de usuarios a través de experiencias que la gente ya ama.

Por qué parece legítimo:

→ El equipo proviene del mundo de los juegos y los medios, no solo de cripto.

→ Enfoque real en IA, mundos virtuales y experiencias de marca.

→ Productos en funcionamiento ya en

VANRY1,62%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Walrus Protocol es el tipo de adopción que realmente importa.

Unchained no solo "probó" Walrus. Lo reemplazaron en su pila de almacenamiento centralizado. Que una verdadera empresa de medios confíe en el almacenamiento descentralizado para sus operaciones diarias dice mucho. Sin entorno de prueba. Sin prueba de concepto. Archivos reales, tráfico real, responsabilidad real.

Para mí, este es el punto de inflexión. Cuando los equipos dejan de hablar de descentralización y realmente construyen sobre ella, es cuando la tecnología se demuestra a sí misma. Mover una biblioteca de medios de producción

Unchained no solo "probó" Walrus. Lo reemplazaron en su pila de almacenamiento centralizado. Que una verdadera empresa de medios confíe en el almacenamiento descentralizado para sus operaciones diarias dice mucho. Sin entorno de prueba. Sin prueba de concepto. Archivos reales, tráfico real, responsabilidad real.

Para mí, este es el punto de inflexión. Cuando los equipos dejan de hablar de descentralización y realmente construyen sobre ella, es cuando la tecnología se demuestra a sí misma. Mover una biblioteca de medios de producción

WAL-1,58%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Ver esta llegada de datos es honestamente increíble.

Ambos rastreadores independientes de inflación están ahora por debajo del objetivo del 2%:

US CPI: 1.56%

US PCE: 1.78%

Lo que realmente me llama la atención es cómo se recopilan estos datos.

El BLS todavía depende de decenas de miles de encuestas que deben ser procesadas manualmente por el personal del gobierno.

Mientras tanto, Truflation obtiene más de 35 millones de precios en tiempo real todos los días y calcula la inflación automáticamente.

Sistema antiguo: lento, muestras limitadas, burocracia pesada.

Nuevo sistema: datos en vivo, escal

Ver originalesAmbos rastreadores independientes de inflación están ahora por debajo del objetivo del 2%:

US CPI: 1.56%

US PCE: 1.78%

Lo que realmente me llama la atención es cómo se recopilan estos datos.

El BLS todavía depende de decenas de miles de encuestas que deben ser procesadas manualmente por el personal del gobierno.

Mientras tanto, Truflation obtiene más de 35 millones de precios en tiempo real todos los días y calcula la inflación automáticamente.

Sistema antiguo: lento, muestras limitadas, burocracia pesada.

Nuevo sistema: datos en vivo, escal

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir