Marty043

Chưa có nội dung

Marty043

Bitcoin rơi vào vùng thường báo hiệu sự đau đớn sâu sắc.

$BTC hiện đang giao dịch dưới mức giá thực tế của cá mập nắm giữ từ 100-1K BTC nằm quanh mức $69K .

Nói một cách đơn giản:

Ngay cả những nhà nắm giữ lớn trong phạm vi này cũng đang thua lỗ hiện tại.

Lần cuối cùng điều này xảy ra sau đỉnh cao nhất (ATH) là vào tháng 6 năm 2022 và BTC duy trì dưới mức đó gần 7 tháng trước khi phục hồi bắt đầu.

Khi giá giảm xuống dưới cơ sở chi phí của cá mập, thường có nghĩa là thị trường đang trong giai đoạn đặt lại nặng nề, không phải là một cú giảm nhanh.

Tiền thông minh không có lợi nhuận ở đây, và đi

$BTC hiện đang giao dịch dưới mức giá thực tế của cá mập nắm giữ từ 100-1K BTC nằm quanh mức $69K .

Nói một cách đơn giản:

Ngay cả những nhà nắm giữ lớn trong phạm vi này cũng đang thua lỗ hiện tại.

Lần cuối cùng điều này xảy ra sau đỉnh cao nhất (ATH) là vào tháng 6 năm 2022 và BTC duy trì dưới mức đó gần 7 tháng trước khi phục hồi bắt đầu.

Khi giá giảm xuống dưới cơ sở chi phí của cá mập, thường có nghĩa là thị trường đang trong giai đoạn đặt lại nặng nề, không phải là một cú giảm nhanh.

Tiền thông minh không có lợi nhuận ở đây, và đi

BTC-3,03%

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

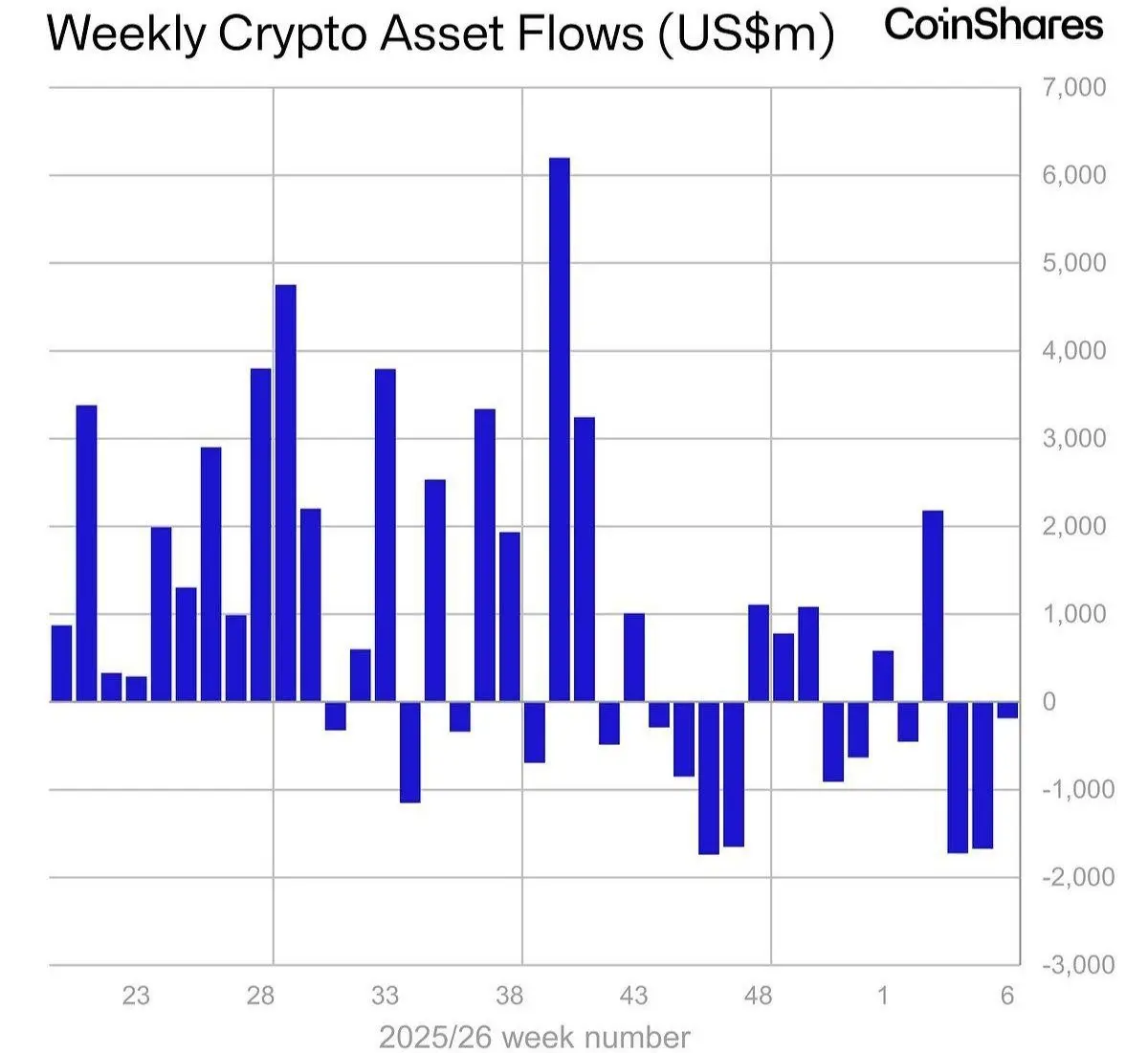

Tài sản kỹ thuật số vừa ghi nhận tuần thứ ba liên tiếp rút khỏi thị trường.

Chỉ riêng tuần trước đã có $187M rút khỏi thị trường, đẩy tổng giá trị tài sản quản lý (AuM) xuống còn 129,8 tỷ USD, mức thấp nhất kể từ cú sốc thuế quan của Mỹ vào tháng 3 năm 2025.

Nhưng đây mới là phần thú vị…

Mặc dù giá giảm mạnh, lượng rút khỏi thị trường thực tế đã chậm lại.

Áp lực bán vẫn còn đó nhưng không tăng tốc như nhiều người đã dự đoán.

Xem bản gốcChỉ riêng tuần trước đã có $187M rút khỏi thị trường, đẩy tổng giá trị tài sản quản lý (AuM) xuống còn 129,8 tỷ USD, mức thấp nhất kể từ cú sốc thuế quan của Mỹ vào tháng 3 năm 2025.

Nhưng đây mới là phần thú vị…

Mặc dù giá giảm mạnh, lượng rút khỏi thị trường thực tế đã chậm lại.

Áp lực bán vẫn còn đó nhưng không tăng tốc như nhiều người đã dự đoán.

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Làn sóng thanh khoản bắt đầu từ hôm nay, và thị trường sắp cảm nhận được điều đó.

Trong $55B , dòng tiền ngắn hạn sẽ chảy vào hệ thống trong suốt tháng 1 và đầu tháng 2.

Loại thanh khoản này không đứng yên.

Nó tìm kiếm các tài sản. Và $BTC và tiền điện tử thường là những người đầu tiên.

Nhiều tiền hơn, điều kiện dễ dàng hơn, khả năng chấp nhận rủi ro cao hơn.

Đây là kiểu thiết lập mà Bitcoin và tiền điện tử bắt đầu thở lại.

Trong $55B , dòng tiền ngắn hạn sẽ chảy vào hệ thống trong suốt tháng 1 và đầu tháng 2.

Loại thanh khoản này không đứng yên.

Nó tìm kiếm các tài sản. Và $BTC và tiền điện tử thường là những người đầu tiên.

Nhiều tiền hơn, điều kiện dễ dàng hơn, khả năng chấp nhận rủi ro cao hơn.

Đây là kiểu thiết lập mà Bitcoin và tiền điện tử bắt đầu thở lại.

BTC-3,03%

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

$BTC đã vào vùng nguy hiểm.

Những người nắm giữ ngắn hạn đang trở lại có lợi nhuận, và đây thường là thời điểm cảm xúc bắt đầu chi phối thị trường.

Mọi người cảm thấy tự tin hơn, việc mua bán trở nên quyết đoán hơn, và rủi ro dần tích tụ dưới bề mặt.

Khi tiền nhanh bắt đầu thắng thế, áp lực bán thường không xa.

Những người nắm giữ ngắn hạn đang trở lại có lợi nhuận, và đây thường là thời điểm cảm xúc bắt đầu chi phối thị trường.

Mọi người cảm thấy tự tin hơn, việc mua bán trở nên quyết đoán hơn, và rủi ro dần tích tụ dưới bề mặt.

Khi tiền nhanh bắt đầu thắng thế, áp lực bán thường không xa.

BTC-3,03%

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Thị trường token hóa đã tăng gần 10 lần chỉ trong 2 năm, từ dưới $2B đến gần 20 tỷ đô la.

Phần lớn sự tăng trưởng này đến từ các tài sản thực như trái phiếu Chính phủ Mỹ, tín dụng tư nhân và quỹ tổ chức, chứ không phải từ đầu cơ bán lẻ.

Điều này có nghĩa là tài chính truyền thống đang tích cực chuyển sang chuỗi, không chỉ thử nghiệm.

Nếu token hóa tiếp tục mở rộng, hạ tầng đằng sau nó sẽ trở nên quan trọng không kém gì các tài sản chính nó.

Xem bản gốcPhần lớn sự tăng trưởng này đến từ các tài sản thực như trái phiếu Chính phủ Mỹ, tín dụng tư nhân và quỹ tổ chức, chứ không phải từ đầu cơ bán lẻ.

Điều này có nghĩa là tài chính truyền thống đang tích cực chuyển sang chuỗi, không chỉ thử nghiệm.

Nếu token hóa tiếp tục mở rộng, hạ tầng đằng sau nó sẽ trở nên quan trọng không kém gì các tài sản chính nó.

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Vấn đề với AI ngày nay không phải là sức mạnh. Đó là quyền sở hữu.

Một số ít công ty quyết định ai được truy cập, giá cả ra sao, và dữ liệu của bạn sẽ đi về đâu. Đó không phải là một nền kinh tế mở, đó là một hệ thống đóng. Và chính xác đây là nơi @nesaorg bắt đầu trở nên quan trọng.

Nesa đang xây dựng một mạng lưới AI không thuộc về bất kỳ công ty nào. Không có người quản lý trung tâm, không có quy tắc ẩn, không tin tưởng mù quáng. AI hoạt động theo cách phi tập trung, nơi kết quả có thể xác minh, quyền riêng tư được bảo vệ bằng mật mã, và quyền kiểm soát được chia sẻ rộng rãi trong mạng lưới

Xem bản gốcMột số ít công ty quyết định ai được truy cập, giá cả ra sao, và dữ liệu của bạn sẽ đi về đâu. Đó không phải là một nền kinh tế mở, đó là một hệ thống đóng. Và chính xác đây là nơi @nesaorg bắt đầu trở nên quan trọng.

Nesa đang xây dựng một mạng lưới AI không thuộc về bất kỳ công ty nào. Không có người quản lý trung tâm, không có quy tắc ẩn, không tin tưởng mù quáng. AI hoạt động theo cách phi tập trung, nơi kết quả có thể xác minh, quyền riêng tư được bảo vệ bằng mật mã, và quyền kiểm soát được chia sẻ rộng rãi trong mạng lưới

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Thị trường dự đoán đang nhanh chóng trở thành một trong những trường hợp sử dụng mạnh mẽ nhất trong lĩnh vực crypto, và các nền tảng đơn giản hóa trải nghiệm chính là những nền tảng sẽ chiếm ưu thế.

Điều này không còn về việc đầu cơ nữa. Đó là về việc xây dựng các sản phẩm cảm giác tự nhiên, nhanh chóng và mượt mà cho người dùng hàng ngày.

Đó là nơi @rainbowdotme đang phân biệt chính mình. Các thị trường dự đoán được hỗ trợ bởi @Polymarket đã hoạt động trên iOS và Android, và chúng không cảm giác giống như một sản phẩm crypto điển hình.

Bạn giao dịch trực tiếp từ ví của mình, bạn luôn đăng nhậ

Xem bản gốcĐiều này không còn về việc đầu cơ nữa. Đó là về việc xây dựng các sản phẩm cảm giác tự nhiên, nhanh chóng và mượt mà cho người dùng hàng ngày.

Đó là nơi @rainbowdotme đang phân biệt chính mình. Các thị trường dự đoán được hỗ trợ bởi @Polymarket đã hoạt động trên iOS và Android, và chúng không cảm giác giống như một sản phẩm crypto điển hình.

Bạn giao dịch trực tiếp từ ví của mình, bạn luôn đăng nhậ

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

$KAIO cảm giác như một trong những trường hợp hiếm hoi mà token thực sự phản ánh cách hoạt động của doanh nghiệp.

Giải thích của COO Olivier của @KAIO_xyz đã làm rõ điều gì đó rất rõ ràng đối với tôi: KAIO không cố gắng trở thành một ứng dụng giao dịch kèm theo token. Nó đang được xây dựng như một quản lý tài sản trên chuỗi.

Giao thức kiếm phí quản lý dựa trên tài sản dưới quản lý, giống như các quỹ truyền thống. Và những khoản phí đó được thiết kế để tích lũy vào $KAIO.

Điều đó thay đổi cách tôi nhìn nhận về nó.

Tăng trưởng không phải là về hype hay đột biến khối lượng. Nó là về số vốn thực

Xem bản gốcGiải thích của COO Olivier của @KAIO_xyz đã làm rõ điều gì đó rất rõ ràng đối với tôi: KAIO không cố gắng trở thành một ứng dụng giao dịch kèm theo token. Nó đang được xây dựng như một quản lý tài sản trên chuỗi.

Giao thức kiếm phí quản lý dựa trên tài sản dưới quản lý, giống như các quỹ truyền thống. Và những khoản phí đó được thiết kế để tích lũy vào $KAIO.

Điều đó thay đổi cách tôi nhìn nhận về nó.

Tăng trưởng không phải là về hype hay đột biến khối lượng. Nó là về số vốn thực

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Hầu hết các mối quan hệ hợp tác với vận động viên trong Web3 đều cảm thấy giống nhau khi bạn nhìn kỹ và đó chính xác là điều @SIXR_cricket đang nhấn mạnh trong bài viết mới nhất của mình.

Một tên tuổi lớn xuất hiện khi ra mắt, có một đợt chú ý bùng nổ, vài bài đăng được đăng tải rồi mọi thứ lặng lẽ phai nhạt.

Vận động viên chuyển sang hoạt động khác, nền tảng tiếp tục xây dựng, và người hâm mộ chẳng còn gì thực sự tồn tại lâu dài.

Thay vì xem các huyền thoại như những biển quảng cáo thuê, SIXR đang xây dựng dựa trên ý tưởng rằng nếu vận động viên là nền tảng của văn hóa, họ cũng nên là một phầ

Xem bản gốcMột tên tuổi lớn xuất hiện khi ra mắt, có một đợt chú ý bùng nổ, vài bài đăng được đăng tải rồi mọi thứ lặng lẽ phai nhạt.

Vận động viên chuyển sang hoạt động khác, nền tảng tiếp tục xây dựng, và người hâm mộ chẳng còn gì thực sự tồn tại lâu dài.

Thay vì xem các huyền thoại như những biển quảng cáo thuê, SIXR đang xây dựng dựa trên ý tưởng rằng nếu vận động viên là nền tảng của văn hóa, họ cũng nên là một phầ

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Nesa là mạng lưới blockchain toàn cầu được xây dựng dựa trên một thực tế đơn giản: AI đang tiến vào các hệ thống nhạy cảm, thế giới thực, và cách vận hành cũ không còn an toàn nữa.

@nesaorg tồn tại vì các hệ thống AI tập trung bị phá vỡ ngay khi dữ liệu thực sự quan trọng.

Trong nhiều năm, AI đã sống trong các máy chủ tập trung, cơ sở dữ liệu có thể đọc được và các quản trị viên đáng tin cậy. Mô hình đó thất bại trong các hệ thống y tế, tài chính và pháp lý, nơi một vi phạm bảo mật có thể lộ toàn bộ dữ liệu mãi mãi.

Nesa đảo ngược mô hình này bằng cách đưa AI trực tiếp lên chuỗi, nơi thực thi

Xem bản gốc@nesaorg tồn tại vì các hệ thống AI tập trung bị phá vỡ ngay khi dữ liệu thực sự quan trọng.

Trong nhiều năm, AI đã sống trong các máy chủ tập trung, cơ sở dữ liệu có thể đọc được và các quản trị viên đáng tin cậy. Mô hình đó thất bại trong các hệ thống y tế, tài chính và pháp lý, nơi một vi phạm bảo mật có thể lộ toàn bộ dữ liệu mãi mãi.

Nesa đảo ngược mô hình này bằng cách đưa AI trực tiếp lên chuỗi, nơi thực thi

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Hầu hết các token đều cố gắng tạo ra nhu cầu. @rainbowdotme đang làm điều ngược lại; nó đang chuyển hướng nhu cầu đã tồn tại.

Mọi người đã và đang hoán đổi, giao dịch hợp đồng vĩnh viễn, và đặt cược dự đoán trong Rainbow mỗi ngày.

Sự kiện ra mắt $RNBW ngày 5 tháng 2 đơn giản hóa hoạt động đó thành quyền sở hữu. Thay vì người dùng cung cấp dữ liệu cho nền tảng, nền tảng sẽ phản hồi lại người dùng.

Mọi tương tác, như sử dụng ví, giao dịch hợp đồng vĩnh viễn và tham gia thị trường dự đoán đều trở thành hoạt động kinh tế.

Những hành động đó giờ đây tạo ra RNBW, một quyền yêu cầu trực tiếp vào hệ

Xem bản gốcMọi người đã và đang hoán đổi, giao dịch hợp đồng vĩnh viễn, và đặt cược dự đoán trong Rainbow mỗi ngày.

Sự kiện ra mắt $RNBW ngày 5 tháng 2 đơn giản hóa hoạt động đó thành quyền sở hữu. Thay vì người dùng cung cấp dữ liệu cho nền tảng, nền tảng sẽ phản hồi lại người dùng.

Mọi tương tác, như sử dụng ví, giao dịch hợp đồng vĩnh viễn và tham gia thị trường dự đoán đều trở thành hoạt động kinh tế.

Những hành động đó giờ đây tạo ra RNBW, một quyền yêu cầu trực tiếp vào hệ

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Chủ đề thịnh hành

Xem thêm222.52K Phổ biến

31.17K Phổ biến

16.96K Phổ biến

14.51K Phổ biến

7.63K Phổ biến

Ghim