# BitcoinBouncesBack

22.24K

Pin

Gate广场_Official

Gate Plaza|2/9 Today's Hot Topics: #比特币反弹

🎁【Fan Appreciation Giveaway】Post with a hashtag or #BTC trading pair, 5 lucky winners * each receive an $200 position experience voucher!

Bitcoin (BTC), influenced by macro capital flows, rebounded to $71,000, with a 24-hour increase of 2.25%. The market is currently at a critical point of bullish and bearish competition.

💬 This week's hot discussion topics:

1️⃣ Trend Analysis: After reclaiming the $71,000 level, do you think this rebound will continue, or is a second pullback likely?

2️⃣ Position Strategy: Are you currently committed to HODLing f

🎁【Fan Appreciation Giveaway】Post with a hashtag or #BTC trading pair, 5 lucky winners * each receive an $200 position experience voucher!

Bitcoin (BTC), influenced by macro capital flows, rebounded to $71,000, with a 24-hour increase of 2.25%. The market is currently at a critical point of bullish and bearish competition.

💬 This week's hot discussion topics:

1️⃣ Trend Analysis: After reclaiming the $71,000 level, do you think this rebound will continue, or is a second pullback likely?

2️⃣ Position Strategy: Are you currently committed to HODLing f

BTC0,33%

- Reward

- 10

- 12

- Repost

- Share

ybaser :

:

Hold on tight, we're about to take off 🛫View More

#比特币反弹 #BTC

Bitcoin Rebounds to $71,000 Assessing Sustainability Amid Macro and Market Dynamics

Bitcoin (BTC) has recently reclaimed the $71,000 level, marking a notable rebound after a period of consolidation and volatility. On the surface, the move appears bullish, but the underlying dynamics reveal a more nuanced story. The market is currently at a critical juncture, where technical support, investor psychology, macroeconomic developments, and liquidity flows converge to shape the trajectory of the world’s largest cryptocurrency. Understanding whether this rebound can sustain itself re

Bitcoin Rebounds to $71,000 Assessing Sustainability Amid Macro and Market Dynamics

Bitcoin (BTC) has recently reclaimed the $71,000 level, marking a notable rebound after a period of consolidation and volatility. On the surface, the move appears bullish, but the underlying dynamics reveal a more nuanced story. The market is currently at a critical juncture, where technical support, investor psychology, macroeconomic developments, and liquidity flows converge to shape the trajectory of the world’s largest cryptocurrency. Understanding whether this rebound can sustain itself re

BTC0,33%

- Reward

- 5

- 7

- Repost

- Share

Yusfirah :

:

Ape In 🚀View More

#BitcoinBouncesBack

#BRC #GT

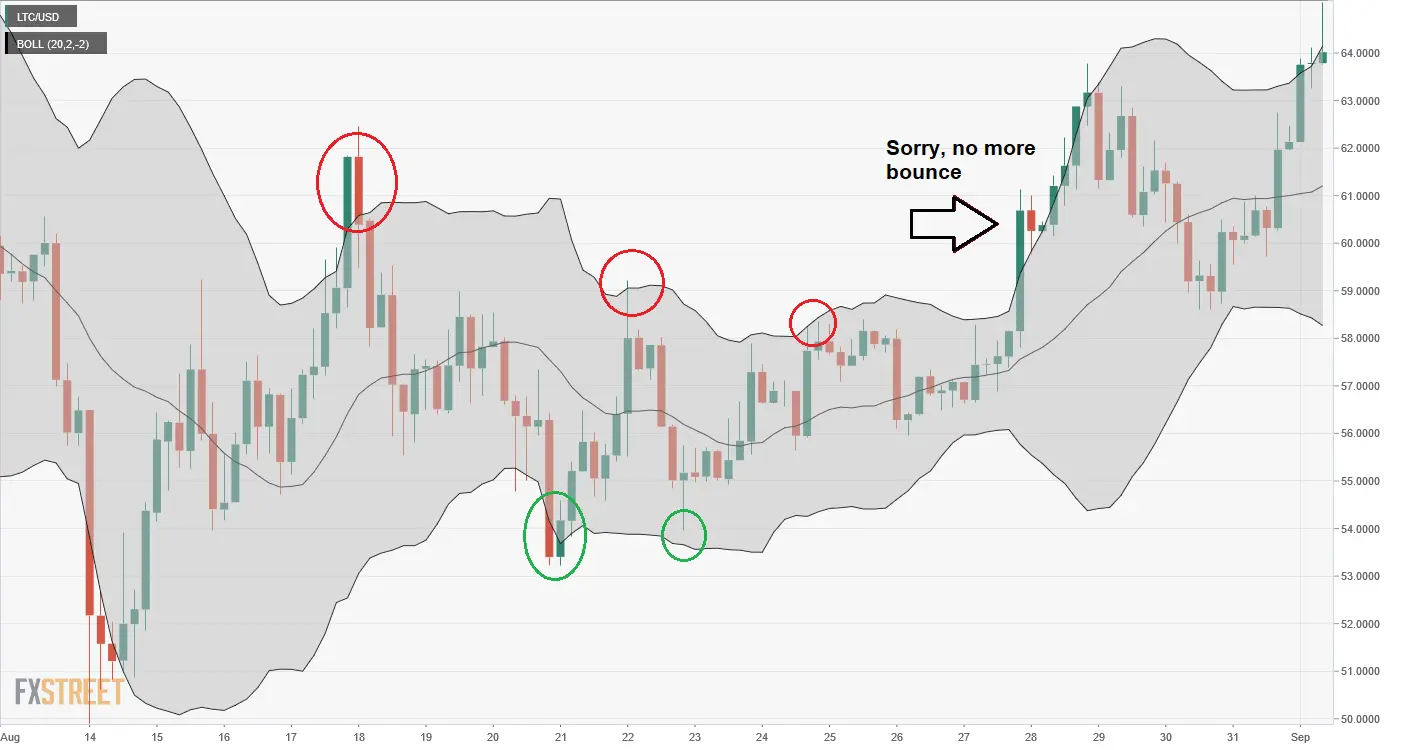

The phrase "Bitcoin bounces back" has echoed through market cycles for over a decade. Yet, each resurgence tells a unique story, emerging from a specific confluence of technical damage, on-chain stress, and shifting macro tides. The current rally off the ~$53,500 lows is not merely a "dead cat bounce." It is a complex, multi-factor signal demanding a forensic examination of its structure, sustainability, and the precise battlegrounds that will define its next major move. This analysis dissects the bounce through the lens of the BTC/GT trading pair and universal U

#BRC #GT

The phrase "Bitcoin bounces back" has echoed through market cycles for over a decade. Yet, each resurgence tells a unique story, emerging from a specific confluence of technical damage, on-chain stress, and shifting macro tides. The current rally off the ~$53,500 lows is not merely a "dead cat bounce." It is a complex, multi-factor signal demanding a forensic examination of its structure, sustainability, and the precise battlegrounds that will define its next major move. This analysis dissects the bounce through the lens of the BTC/GT trading pair and universal U

- Reward

- 4

- 5

- Repost

- Share

Luna_Star :

:

Buy To Earn 💎View More

#BitcoinBouncesBack

As of today, Bitcoin’s bounce feels more like a calculated response than an emotional relief rally. After a period of pressure and uncertainty, price action is showing signs of stabilization, suggesting that buyers are stepping in selectively rather than chasing momentum. This kind of rebound often reflects improving confidence, but not blind optimism.

What stands out is how the bounce is forming. Volume remains controlled, volatility is cooling, and panic selling appears to have faded. Historically, these conditions tend to favor short-term consolidation before the market

As of today, Bitcoin’s bounce feels more like a calculated response than an emotional relief rally. After a period of pressure and uncertainty, price action is showing signs of stabilization, suggesting that buyers are stepping in selectively rather than chasing momentum. This kind of rebound often reflects improving confidence, but not blind optimism.

What stands out is how the bounce is forming. Volume remains controlled, volatility is cooling, and panic selling appears to have faded. Historically, these conditions tend to favor short-term consolidation before the market

- Reward

- 1

- 1

- Repost

- Share

xxx40xxx :

:

Thank you for the information🙏🙏🙏#BitcoinBouncesBack $BTC SHOCKING: “Satoshi Wallet” Activity Sparks Bitcoin Frenzy 🚨

Crypto Twitter just exploded — a wallet labeled as Satoshi Nakamoto suddenly showed activity after 15 YEARS of silence. A transfer of 2,565 BTC appeared out of nowhere, instantly igniting speculation across the market.

Is this really Satoshi? Maybe. Maybe not. But that’s not the point.

What matters is the reaction. Old coins moving always hit a nerve. When ultra-early Bitcoin wakes up, traders assume something is changing — and emotion floods in fast. Fear, hype, conspiracy theories, all at once.

Here’s the r

Crypto Twitter just exploded — a wallet labeled as Satoshi Nakamoto suddenly showed activity after 15 YEARS of silence. A transfer of 2,565 BTC appeared out of nowhere, instantly igniting speculation across the market.

Is this really Satoshi? Maybe. Maybe not. But that’s not the point.

What matters is the reaction. Old coins moving always hit a nerve. When ultra-early Bitcoin wakes up, traders assume something is changing — and emotion floods in fast. Fear, hype, conspiracy theories, all at once.

Here’s the r

BTC0,33%

- Reward

- 3

- 3

- Repost

- Share

映月 :

:

2026 GOGOGO 👊View More

#我在Gate广场过新年

#BitcoinBouncesBack

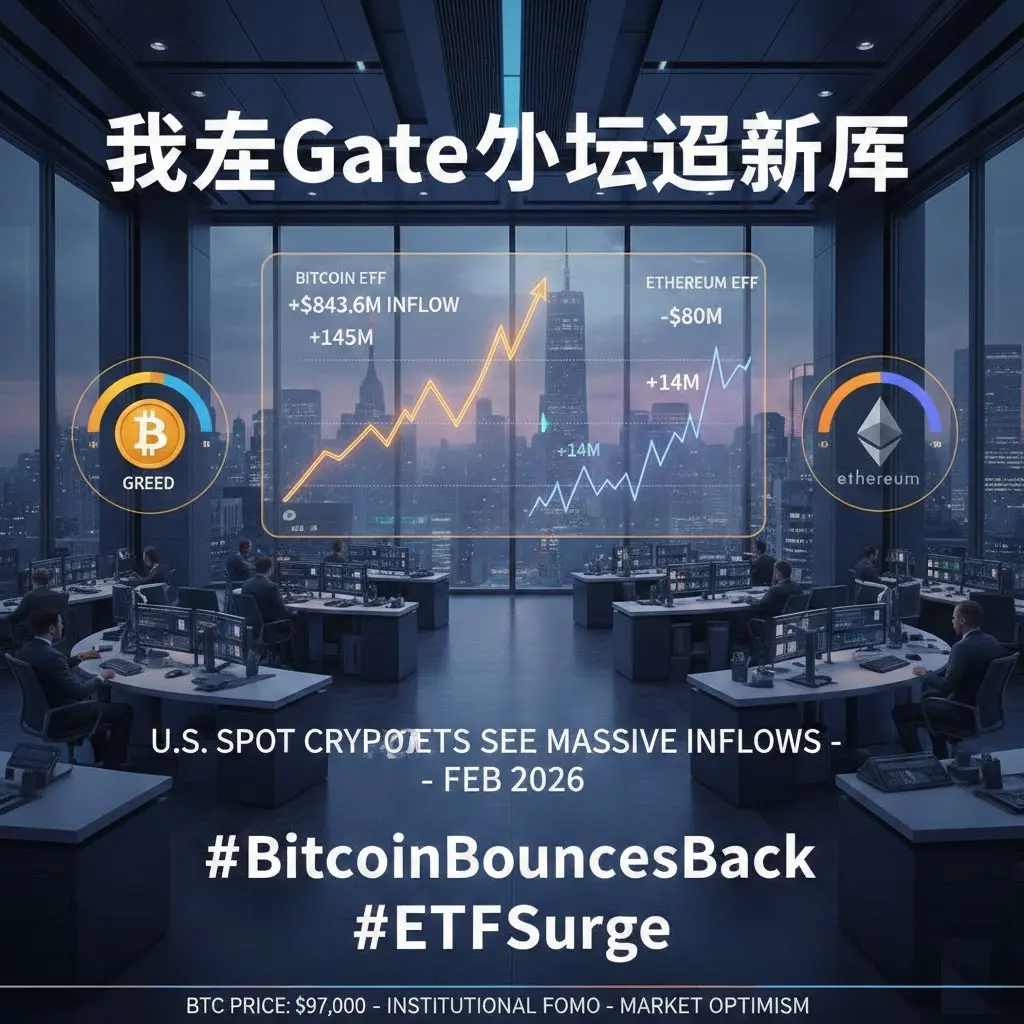

There was a strong inflow into spot Bitcoin and Ethereum ETFs in the US.

We are seeing a clear "buy the dip" trend in February. Following a turbulent start to 2026, institutional interest has returned to US spot ETFs, especially for Bitcoin.

Bitcoin ETFs: Leading the Way

Bitcoin's trend has shifted from heavy selling in early January to a strong recovery.

Bitcoin ETFs saw a massive net inflow of $843.6 million last Wednesday—the strongest single-day performance so far in 2026.

Following low volatility over the weekend, an additional $145 million flowed in

#BitcoinBouncesBack

There was a strong inflow into spot Bitcoin and Ethereum ETFs in the US.

We are seeing a clear "buy the dip" trend in February. Following a turbulent start to 2026, institutional interest has returned to US spot ETFs, especially for Bitcoin.

Bitcoin ETFs: Leading the Way

Bitcoin's trend has shifted from heavy selling in early January to a strong recovery.

Bitcoin ETFs saw a massive net inflow of $843.6 million last Wednesday—the strongest single-day performance so far in 2026.

Following low volatility over the weekend, an additional $145 million flowed in

- Reward

- 4

- 3

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

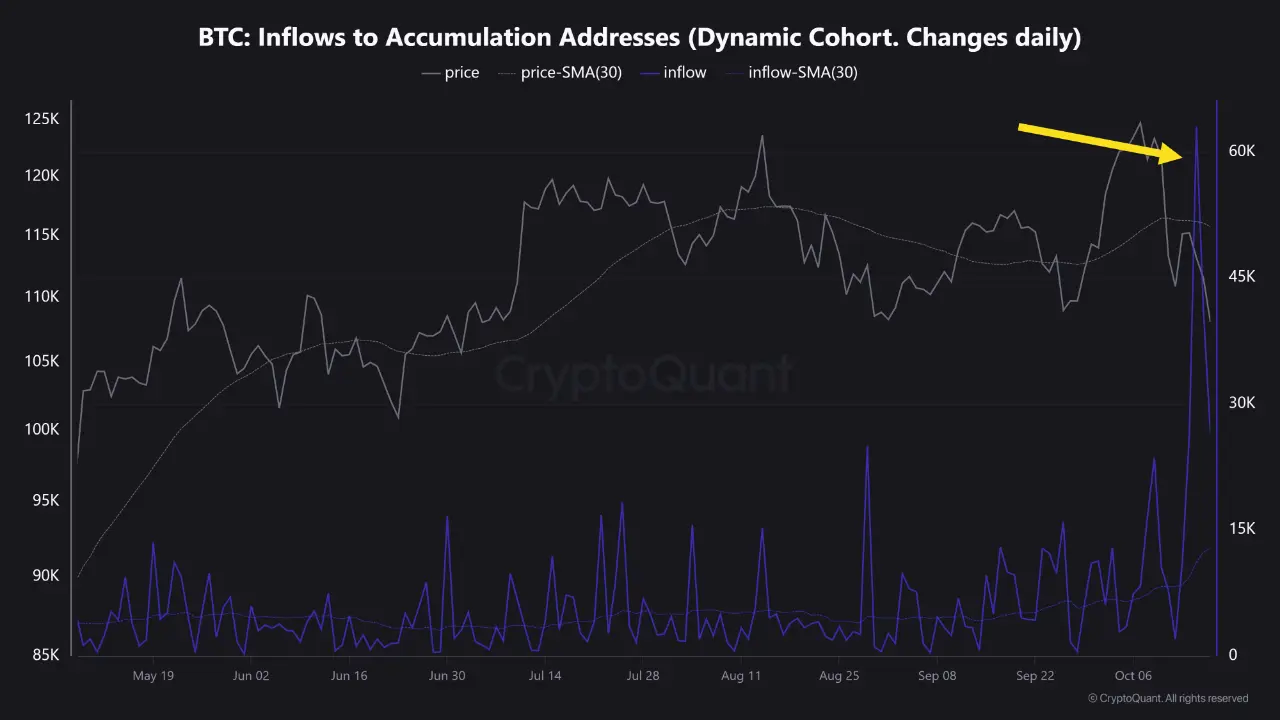

#BitcoinBouncesBack: A Resilient Recovery in a Volatile Market

Bitcoin has once again demonstrated why it remains the backbone of the cryptocurrency market. After facing weeks of uncertainty, sharp corrections, and widespread fear across global risk assets, Bitcoin is bouncing back with renewed strength. This recovery is not just a price movement—it reflects deeper market confidence, improving sentiment, and Bitcoin’s growing role as a long-term digital asset.

Recent volatility was driven by a mix of macroeconomic pressure, including tighter monetary expectations, fluctuations in equity market

Bitcoin has once again demonstrated why it remains the backbone of the cryptocurrency market. After facing weeks of uncertainty, sharp corrections, and widespread fear across global risk assets, Bitcoin is bouncing back with renewed strength. This recovery is not just a price movement—it reflects deeper market confidence, improving sentiment, and Bitcoin’s growing role as a long-term digital asset.

Recent volatility was driven by a mix of macroeconomic pressure, including tighter monetary expectations, fluctuations in equity market

BTC0,33%

- Reward

- 2

- 4

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#BitcoinBouncesBack

📊 Key Takeaways — Bitcoin “Bounce Back” Amid Heavy Volatility

Bitcoin’s recent rebound attempt has intensified debate across the market. While price action shows signs of short-term stabilization, broader data suggests the market is still navigating high volatility, liquidity reshuffling, and confidence rebuilding. Below is a comprehensive breakdown covering price action, percentage damage, liquidity behavior, volume dynamics, and sentiment to understand what this bounce really means.

📈 Expanded Core Market Data

Current price: $69,926.90 USDT (BTC/USDT)

24-hour change: -

📊 Key Takeaways — Bitcoin “Bounce Back” Amid Heavy Volatility

Bitcoin’s recent rebound attempt has intensified debate across the market. While price action shows signs of short-term stabilization, broader data suggests the market is still navigating high volatility, liquidity reshuffling, and confidence rebuilding. Below is a comprehensive breakdown covering price action, percentage damage, liquidity behavior, volume dynamics, and sentiment to understand what this bounce really means.

📈 Expanded Core Market Data

Current price: $69,926.90 USDT (BTC/USDT)

24-hour change: -

BTC0,33%

- Reward

- 14

- 18

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

#BitcoinBouncesBack 💡 Why This is a "Game Changer" (and not just hype)

The move toward a CME Token isn't about creating a new speculative asset for retail; it's about operational velocity. Here is a quick look at the friction points this solves:🚀 The "Hidden" Impact: Capital Efficiency

For a hedge fund trading Bitcoin futures on CME, "capital efficiency" is king. Currently, if a massive price swing happens on a Sunday, that fund might struggle to move collateral to meet a margin call because the traditional banking rails are closed.

A CME Coin would allow for:

Programmable Margin: Automated

The move toward a CME Token isn't about creating a new speculative asset for retail; it's about operational velocity. Here is a quick look at the friction points this solves:🚀 The "Hidden" Impact: Capital Efficiency

For a hedge fund trading Bitcoin futures on CME, "capital efficiency" is king. Currently, if a massive price swing happens on a Sunday, that fund might struggle to move collateral to meet a margin call because the traditional banking rails are closed.

A CME Coin would allow for:

Programmable Margin: Automated

BTC0,33%

- Reward

- 11

- 17

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#BitcoinBouncesBack 💡 Why This is a "Game Changer" (and not just hype)

The move toward a CME Token isn't about creating a new speculative asset for retail; it's about operational velocity. Here is a quick look at the friction points this solves:🚀 The "Hidden" Impact: Capital Efficiency

For a hedge fund trading Bitcoin futures on CME, "capital efficiency" is king. Currently, if a massive price swing happens on a Sunday, that fund might struggle to move collateral to meet a margin call because the traditional banking rails are closed.

A CME Coin would allow for:

Programmable Margin: Automated

The move toward a CME Token isn't about creating a new speculative asset for retail; it's about operational velocity. Here is a quick look at the friction points this solves:🚀 The "Hidden" Impact: Capital Efficiency

For a hedge fund trading Bitcoin futures on CME, "capital efficiency" is king. Currently, if a massive price swing happens on a Sunday, that fund might struggle to move collateral to meet a margin call because the traditional banking rails are closed.

A CME Coin would allow for:

Programmable Margin: Automated

BTC0,33%

- Reward

- 2

- 2

- Repost

- Share

AylaShinex :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

204.08K Popularity

3.65K Popularity

5.03K Popularity

7.84K Popularity

2.74K Popularity

44.2K Popularity

1.16K Popularity

2.05K Popularity

22.24K Popularity

1.03K Popularity

1.73K Popularity

10.91K Popularity

1.57K Popularity

18.38K Popularity

10.52K Popularity

News

View MoreGate will delist the perpetual contracts of 13 tokens including QUBIC, YALA, RVV, ALEO, etc., on February 12. Users must close their positions before 16:00.

2 m

Bitcoin OG Withdraws $77.47M USDT from CEX for Loan Repayment

2 m

Defiance Capital investor Kyle adjusts investment portfolio, 75% allocated to non-US markets

3 m

The US dollar against the Japanese yen fell more than 0.5% intraday, currently at 155.06

34 m

SBF account claims FTX has never gone bankrupt: Lawyer filed a false bankruptcy claim after takeover for profit

38 m

Pin