2025 WOD Price Prediction: Analyzing Market Trends and Expert Forecasts for World of Demons Tokens

Introduction: WOD's Market Position and Investment Value

World of Dypians (WOD), as a revolutionary MMORPG in the blockchain gaming sector, has made significant strides since its inception. As of 2025, WOD's market capitalization has reached $652,642.75, with a circulating supply of approximately 15,103,975 tokens, and a price hovering around $0.04321. This asset, often referred to as a "DeFi-NFT-Gaming hybrid," is playing an increasingly crucial role in the convergence of decentralized finance, non-fungible tokens, and immersive gaming experiences.

This article will comprehensively analyze WOD's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. WOD Price History Review and Current Market Status

WOD Historical Price Evolution Trajectory

- 2024: WOD launched, price reached all-time high of $0.31842 on November 27

- 2025: Market downturn, price dropped to all-time low of $0.02914 on October 20

WOD Current Market Situation

As of October 30, 2025, WOD is trading at $0.04321, with a 24-hour trading volume of $365,416.82. The token has experienced a 6.08% increase in the last 24 hours. WOD's market cap currently stands at $652,642.76, ranking it at 3218 in the cryptocurrency market.

The token has shown significant volatility in recent periods. Over the past week, WOD has seen a substantial gain of 34.11%. However, looking at the 30-day performance, there's a notable decline of 43.41%. The yearly performance shows a slight decrease of 4.45%.

WOD's circulating supply is 15,103,975 tokens, which is 1.51% of its total supply of 1,000,000,000. The fully diluted market cap is $43,210,000.

Click to view the current WOD market price

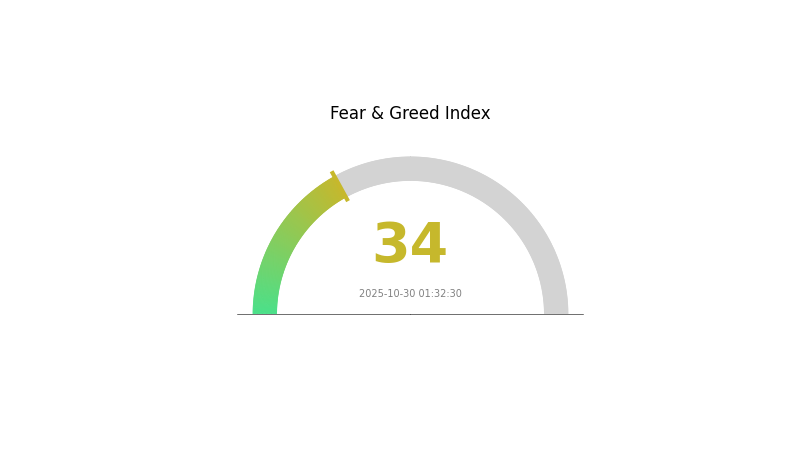

WOD Market Sentiment Indicator

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index registering at 34. This indicates a cautious sentiment among investors, who may be hesitant to make bold moves. During such times, it's crucial to remain vigilant and conduct thorough research before making any investment decisions. While fear can present potential buying opportunities for long-term investors, it's essential to assess your risk tolerance and investment goals carefully. Remember, market sentiment can shift quickly, so stay informed and adapt your strategy accordingly.

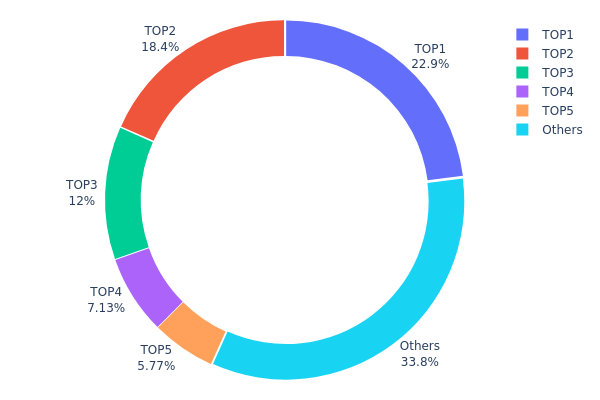

WOD Holdings Distribution

The address holdings distribution chart for WOD reveals a significant concentration of tokens among a few top addresses. The top holder possesses 22.94% of the total supply, while the top five addresses collectively control 66.21% of all WOD tokens. This high level of concentration raises concerns about potential market manipulation and price volatility.

Such a concentrated distribution suggests that WOD's market structure is currently vulnerable to the actions of these large holders. Any significant movement of tokens by these addresses could have a substantial impact on the token's price and liquidity. Furthermore, this concentration indicates a relatively low level of decentralization, which may be at odds with the principles of many blockchain projects.

The presence of 33.79% of tokens held by other addresses provides some balance, but the overall distribution still reflects a market where a small number of entities have considerable influence. This structure could lead to increased price volatility and potential challenges in achieving a stable, widely distributed token ecosystem.

Click to view the current WOD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb80e...ec3fe9 | 229432.31K | 22.94% |

| 2 | 0x2827...a602ee | 183738.45K | 18.37% |

| 3 | 0x218b...85c9f2 | 120000.00K | 12.00% |

| 4 | 0x3589...2d3890 | 71300.00K | 7.13% |

| 5 | 0xd62f...e0204c | 57733.22K | 5.77% |

| - | Others | 337796.03K | 33.79% |

II. Key Factors Influencing WOD's Future Price

Supply Mechanism

- Historical patterns: Past supply changes have significantly impacted price movements

- Current impact: Expected supply changes are likely to influence price trends

Macroeconomic Environment

- Monetary policy impact: Central bank policies are expected to play a crucial role

- Inflation hedging properties: Performance in inflationary environments may affect demand

- Geopolitical factors: International situations could influence market sentiment

Technical Development and Ecosystem Building

- Ecosystem applications: Major DApps and ecosystem projects may drive adoption and value

III. WOD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02809 - $0.03500

- Neutral prediction: $0.03500 - $0.05000

- Optimistic prediction: $0.05000 - $0.05662 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.05287 - $0.07307

- 2028: $0.04968 - $0.07948

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.06000 - $0.08000 (assuming steady market growth)

- Optimistic scenario: $0.08000 - $0.10007 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $0.10000+ (assuming breakthrough use cases and mainstream integration)

- 2030-12-31: WOD $0.07468 (average price projection, indicating potential for significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05662 | 0.04322 | 0.02809 | 0 |

| 2026 | 0.06889 | 0.04992 | 0.04792 | 15 |

| 2027 | 0.07307 | 0.0594 | 0.05287 | 37 |

| 2028 | 0.07948 | 0.06624 | 0.04968 | 53 |

| 2029 | 0.0765 | 0.07286 | 0.04954 | 68 |

| 2030 | 0.10007 | 0.07468 | 0.0478 | 72 |

IV. Professional Investment Strategies and Risk Management for WOD

WOD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate WOD tokens during market dips

- Set price targets and regularly reassess based on project developments

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps in identifying overbought/oversold conditions

- Key points for swing trading:

- Monitor WOD's correlation with the broader crypto market

- Pay attention to project announcements and updates that may affect price

WOD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance WOD with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for WOD

WOD Market Risks

- High volatility: WOD price may experience significant fluctuations

- Limited liquidity: May impact ability to enter or exit positions quickly

- Correlation risk: WOD may be affected by overall crypto market sentiment

WOD Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting gaming tokens

- Cross-border compliance: Varying regulations in different jurisdictions

- Tax implications: Evolving tax laws for crypto gaming assets

WOD Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Scalability challenges: Possible network congestion on the BSC chain

- Interoperability issues: Potential difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

WOD Investment Value Assessment

WOD presents a unique opportunity in the blockchain gaming sector, with potential for long-term growth. However, it carries significant short-term risks due to market volatility and the nascent state of the gaming ecosystem.

WOD Investment Recommendations

✅ Beginners: Start with small, affordable positions and focus on learning about the project ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Conduct thorough due diligence and consider WOD as part of a diversified crypto gaming portfolio

WOD Trading Participation Methods

- Spot trading: Buy and sell WOD tokens on Gate.com

- Staking: Participate in staking programs if offered by the project

- In-game purchases: Use WOD tokens within the World of Dypians game ecosystem

Cryptocurrency investments are extremely risky. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Worldcoin expected to rise?

Yes, Worldcoin is expected to rise. Predictions indicate significant growth potential through 2030, supported by positive correlations with major cryptocurrencies.

Will Wlfi reach $10?

Reaching $10 is unlikely for WLFI. It would require massive market cap growth, competing with established cryptocurrencies. Currently, it's not feasible.

Can compound reach $1000?

While COMP reached $911 in 2021, hitting $1000 depends on DeFi growth, market demand, and crypto conditions. It's possible but uncertain, requiring significant adoption and favorable market trends.

Could VeChain hit $1?

Yes, VeChain could potentially hit $1 with strong market conditions and continued project growth. While ambitious, it's not impossible given VeChain's past performance and future potential in the blockchain space.

2025 BIGTIME Price Prediction: Analysis of Growth Potential and Market Factors Influencing the Gaming Token's Future Value

2025 GAME2Price Prediction: Analyzing Market Trends and Future Valuation Potential for the Gaming Token

2025 MAVIA Price Prediction: Future Growth Analysis and Potential ROI for Investors

2025 FORESTPrice Prediction: Analyzing Market Trends and Environmental Factors Shaping the Future of Sustainable Forestry

2025 LOE Price Prediction: Navigating the Future of Cryptocurrency Investments

Is Ember Sword (EMBER) a good investment?: Analyzing the potential and risks of this blockchain-based MMORPG token

What is KARRAT: A Comprehensive Guide to the Revolutionary Autonomous Robot Platform

What is OCTA: A Comprehensive Guide to Optical Coherence Tomography Angiography in Modern Retinal Imaging

What is TITN: A Comprehensive Guide to Understanding This Revolutionary Technology Platform

What is ATM: A Comprehensive Guide to Automated Teller Machines and Their Role in Modern Banking

What is CEUR: A Comprehensive Guide to the Conference and Workshop Proceedings Series