Predicción del precio de CATI en 2025: análisis de tendencias de mercado y potencial de crecimiento futuro en el ecosistema de activos descentralizados

Introducción: Posición de mercado y valor de inversión de CATI

Catizen (CATI), pionero en el modelo Play-to-Airdrop dentro del ecosistema GameFi, ha logrado avances notables desde su origen. En 2025, la capitalización de mercado de CATI alcanza los 16 807 540 $, con una circulación aproximada de 206 000 000 tokens y un precio en torno a 0,08159 $. Este activo, conocido como el "innovador del Universo Meow", está adquiriendo creciente relevancia en el segmento de gaming casual y la integración blockchain.

Este artículo ofrece un análisis completo de la evolución del precio de CATI entre 2025 y 2030, considerando patrones históricos, oferta y demanda, desarrollo del ecosistema y factores macroeconómicos, para presentar predicciones profesionales y estrategias de inversión prácticas para inversores.

I. Revisión histórica del precio de CATI y estado actual del mercado

Evolución histórica del precio de CATI

- 2024: Lanzamiento del proyecto, precio máximo de 1,1274 $ el 20 de septiembre

- 2025: Bajada del mercado, precio mínimo histórico de 0,06783 $ el 21 de junio

- 2025: Recuperación gradual, precio actual estabilizado en torno a 0,08159 $

Situación actual del mercado de CATI

El 6 de octubre de 2025, CATI cotiza a 0,08159 $, con un volumen de negociación en 24 horas de 742 564,54 $. El token ha caído un 1 % en las últimas 24 horas. La capitalización de mercado de CATI es de 16 807 540 $, situándose en la posición 1 184 del mercado global de criptomonedas.

La oferta en circulación es de 206 000 000 CATI, lo que corresponde al 20,6 % del suministro máximo de 1 000 000 000 CATI. La capitalización de mercado totalmente diluida es de 81 590 000 $.

En cuanto a las tendencias recientes, CATI ha registrado un rendimiento dispar en distintos plazos:

- 1 hora: +0,97 %

- 24 horas: -1 %

- 7 días: -2,76 %

- 30 días: -4,3 %

- 1 año: -84,42 %

El precio actual está muy por debajo de su máximo histórico de 1,1274 $, alcanzado el 20 de septiembre de 2024, lo que refleja una corrección importante desde ese pico.

Haz clic para consultar el precio de mercado actual de CATI

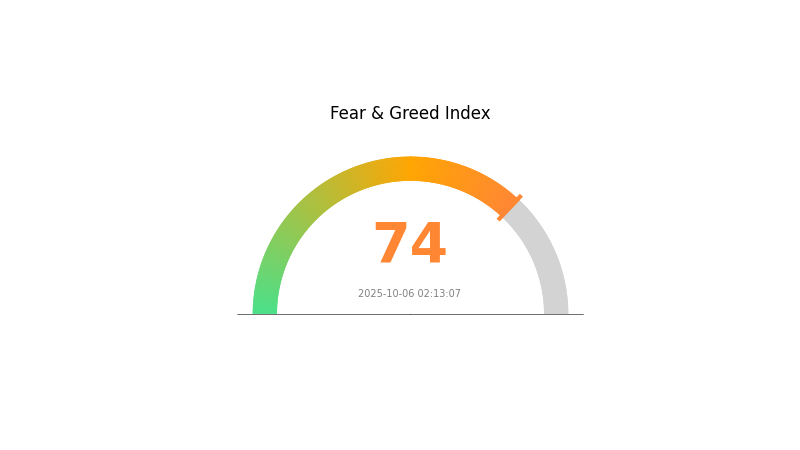

Indicador de sentimiento de mercado de CATI

06-10-2025 Índice de Miedo y Codicia: 74 (Codicia)

Haz clic para consultar el Índice de Miedo y Codicia

El mercado cripto vive actualmente una fase de codicia, con el Índice de Miedo y Codicia en 74. Este alto grado de optimismo muestra que los inversores están cada vez más confiados, lo que potencialmente puede impulsar los precios. Sin embargo, los operadores veteranos saben que la codicia extrema suele anticipar correcciones de mercado. Es fundamental actuar con prudencia y evitar decisiones impulsivas por FOMO. Diversifica tu cartera y establece órdenes stop-loss para proteger tus beneficios. Siempre investiga a fondo y gestiona el riesgo con sensatez en este entorno volátil.

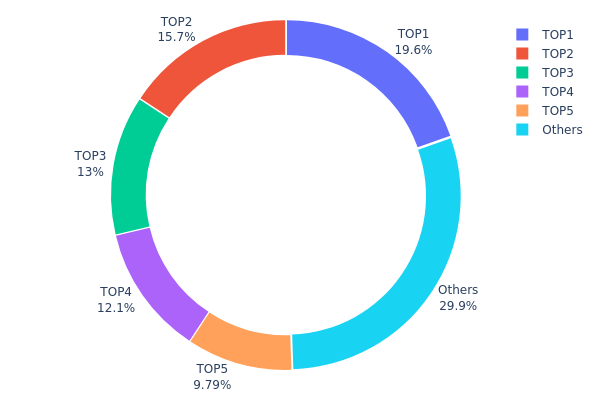

Distribución de tenencia de CATI

El gráfico de distribución de tenencia de CATI muestra una notable concentración de tokens en pocas direcciones principales. Las cinco direcciones principales acumulan el 70,1 % del suministro total de CATI, con la mayor ostentando el 19,58 %. Esta concentración apunta a una distribución relativamente centralizada, con posibles efectos en la dinámica y estabilidad del precio.

Esta concentración incrementa el riesgo de manipulación de mercado y volatilidad. Los grandes titulares, conocidos como "ballenas", pueden mover sensiblemente el mercado con sus operaciones. No obstante, el 29,9 % de los CATI está repartido entre otras direcciones, lo que refleja una cierta participación más amplia en el ecosistema.

Desde el punto de vista de la estructura de mercado, este patrón indica que la estabilidad on-chain y la descentralización de CATI pueden mejorar. Aunque cierta concentración es común en proyectos cripto en fases iniciales, una asignación más repartida suele considerarse más saludable para la sostenibilidad y la reducción de riesgos de manipulación a largo plazo.

Haz clic para consultar la distribución de tenencia de CATI actual

| Top | Dirección | Cantidad | Tenencia (%) |

|---|---|---|---|

| 1 | EQAQqB...vAdZox | 195 833,33K | 19,58 % |

| 2 | EQCWfR...Rddbp4 | 157 333,65K | 15,73 % |

| 3 | EQAnbL...iMDdME | 129 586,89K | 12,95 % |

| 4 | UQD4uG...tTYCQx | 120 586,77K | 12,05 % |

| 5 | EQCEFQ...Ovcin- | 97 916,67K | 9,79 % |

| - | Otros | 298 742,69K | 29,9 % |

II. Factores clave que afectan al precio futuro de CATI

Mecanismo de suministro

- Suministro total: El suministro total y el ratio de distribución de CATI influyen directamente en su escasez y volatilidad de precio.

- Patrón histórico: Es importante vigilar el suministro total y el ratio de distribución, ya que históricamente han afectado la escasez y las fluctuaciones del precio.

- Impacto actual: El mecanismo de suministro vigente seguirá impactando el precio según evolucione el proyecto.

Dinámica institucional y de ballenas

- Adopción empresarial: Si la base de jugadores de Catizen crece y se lanzan nuevas funciones, podría aumentar el interés institucional.

Entorno macroeconómico

- Función de cobertura frente a la inflación: Como activo digital, CATI puede verse como protección frente a la inflación, como ocurre con otras criptomonedas.

Desarrollo técnico y del ecosistema

- Aplicaciones del ecosistema: La expansión de Catizen y la llegada de nuevas funciones probablemente incidirán en el valor de CATI.

- Participación de usuarios: CATI debe mantener el compromiso de sus usuarios y diferenciarse para seguir compitiendo en un mercado en constante evolución.

III. Predicción del precio de CATI para 2025-2030

Perspectivas 2025

- Previsión conservadora: 0,06695 $ - 0,08165 $

- Previsión neutral: 0,08165 $ - 0,09635 $

- Previsión optimista: 0,09635 $ - 0,11303 $ (requiere fuerte recuperación de mercado)

Perspectivas 2027-2028

- Fase esperada: Potencial crecimiento

- Rango de precios:

- 2027: 0,06667 $ - 0,1293 $

- 2028: 0,07831 $ - 0,14394 $

- Catalizadores: Mayor adopción y avances tecnológicos

Perspectivas largo plazo 2030

- Escenario base: 0,12955 $ - 0,15093 $ (crecimiento sostenido)

- Escenario optimista: 0,15093 $ - 0,22337 $ (condiciones favorables)

- Escenario transformador: 0,22337 $ - 0,25000 $ (innovaciones disruptivas)

- 31-12-2030: CATI 0,15093 $ (aumento del 84 % respecto a 2025)

| Año | Precio máximo previsto | Precio medio previsto | Precio mínimo previsto | Variación (%) |

|---|---|---|---|---|

| 2025 | 0,09635 | 0,08165 | 0,06695 | 0 |

| 2026 | 0,11303 | 0,089 | 0,08455 | 9 |

| 2027 | 0,1293 | 0,10101 | 0,06667 | 23 |

| 2028 | 0,14394 | 0,11516 | 0,07831 | 41 |

| 2029 | 0,1723 | 0,12955 | 0,12437 | 58 |

| 2030 | 0,22337 | 0,15093 | 0,08301 | 84 |

IV. Estrategias de inversión y gestión de riesgos profesional para CATI

Metodología de inversión en CATI

(1) Estrategia de tenencia a largo plazo

- Para: Inversores con alta tolerancia al riesgo y visión de largo plazo

- Recomendaciones:

- Acumula CATI en correcciones de mercado

- Fija objetivos de precio para realizar ventas parciales

- Almacena los tokens en monederos seguros bajo control de claves privadas

(2) Estrategia de trading activo

- Herramientas de análisis técnico:

- Medias móviles: Identificar tendencias y posibles giros

- RSI (Relative Strength Index): Vigilar condiciones de sobrecompra/sobreventa

- Aspectos clave para swing trading:

- Configura stop-loss para limitar pérdidas

- Realiza ventas en niveles de resistencia predeterminados

Marco de gestión de riesgos para CATI

(1) Principios de asignación de activos

- Inversores conservadores: 1-3 % de la cartera cripto

- Inversores agresivos: 5-10 % de la cartera cripto

- Inversores profesionales: hasta el 15 % de la cartera cripto

(2) Soluciones de cobertura de riesgos

- Diversificación: Distribuye la inversión entre varios criptoactivos

- Stop-loss: Utilízalos para limitar pérdidas

(3) Soluciones de almacenamiento seguro

- Monedero caliente recomendado: Gate Web3 Wallet

- Almacenamiento en frío: Monedero hardware para tenencia a largo plazo

- Medidas de seguridad: Activa la autenticación en dos factores y usa contraseñas robustas

V. Riesgos y desafíos potenciales de CATI

Riesgos de mercado de CATI

- Alta volatilidad: Fluctuaciones extremas de precio

- Liquidez limitada: Puede dificultar operaciones de gran volumen

- Competencia: Otros proyectos GameFi pueden afectar la cuota de mercado

Riesgos regulatorios de CATI

- Regulación incierta: Posibilidad de normas más restrictivas

- Cumplimiento transfronterizo: Reglamentaciones variables entre jurisdicciones

- Implicaciones fiscales: Legislación tributaria en evolución para criptoactivos

Riesgos técnicos de CATI

- Vulnerabilidad de contratos inteligentes: Riesgo de exploits o fallos

- Congestión de red: Puede afectar velocidad y costes de transacción

- Obsolescencia tecnológica: Avances acelerados en tecnología blockchain

VI. Conclusión y recomendaciones de acción

Valoración del potencial de inversión de CATI

CATI introduce un modelo innovador en GameFi con PLAY-TO-AIRDROP. Aunque ofrece potencial de crecimiento en el mercado de juegos casuales, los inversores deben considerar la alta volatilidad y la incertidumbre regulatoria presentes en el sector cripto.

Recomendaciones de inversión en CATI

✅ Principiantes: Empieza con posiciones pequeñas y dedica tiempo a aprender la tecnología y el mercado ✅ Inversores experimentados: Incluye CATI en una cartera cripto diversificada y aplica gestión de riesgos ✅ Institucionales: Realiza análisis exhaustivos y considera acceder mediante productos estructurados o mercados OTC

Formas de participar en CATI

- Trading spot: Compra y vende CATI en Gate.com

- Staking: Participa en programas de staking si están disponibles

- Participación GameFi: Interactúa con el ecosistema Catizen y consigue recompensas

Invertir en criptomonedas implica riesgos muy elevados y este artículo no constituye asesoramiento financiero. Decide con cautela según tu tolerancia al riesgo y consulta profesionales. Nunca inviertas más de lo que puedas permitirte perder.

FAQ

¿CATI volverá a subir?

Sí, se espera que CATI vuelva a subir. Las proyecciones apuntan a que podría alcanzar 6,55 $ en 2029 y entre 1,69 $ y 4 $ en 2030, impulsado por su utilidad y el crecimiento de GameFi.

¿Cuál es la previsión para CATI coin?

Se estima que CATI cotice entre 0,05844 $ y 0,083708 $ el próximo año, con una posible subida del 1,21 %.

¿Cuál es el precio futuro de CATI coin?

Según el análisis de mercado actual, CATI coin podría alcanzar 0,06237 $ en octubre de 2025, reflejando una tendencia bajista en el mercado de criptomonedas.

¿Cuánto vale 1 CATI token en dólares?

El 6 de octubre de 2025, 1 CATI token vale aproximadamente 0,082909 $. Este precio refleja el valor de mercado actual de CATI en dólares estadounidenses.

¿Es GameFi (GAFI) una buena inversión?: Análisis del potencial y los riesgos de los tokens de juegos blockchain en 2023

Predicción del precio de HMSTR en 2025: Análisis de los factores de crecimiento y el potencial de mercado para Hamster Token

Predicción del precio de GMT en 2025: análisis de las tendencias del mercado y factores de crecimiento potencial para el token nativo de STEPN

Predicción del precio de BIGTIME en 2025: análisis del potencial de crecimiento y de los factores de mercado que afectan al valor futuro del token de gaming

Predicción del precio de GAME2 en 2025: análisis de tendencias de mercado y potencial de valoración futura para el token de gaming

Predicción del precio de MAVIA en 2025: análisis del crecimiento futuro y potencial retorno de la inversión para inversores

2025 Bull Run: Previsiones de expertos sobre el precio de los altcoins líderes

Los 5 proyectos de criptomonedas más prometedores para observar en 2025

Guía para principiantes para elegir las mejores billeteras digitales en 2025

¿Qué es TEXITcoin (TXC): lógica del whitepaper, casos de uso y análisis de la hoja de ruta para 2025

¿Cuáles son los principales riesgos de seguridad y vulnerabilidades que afectan a Dash crypto en 2025?