Previsão do preço do AXS para 2025: análise do potencial de crescimento no ecossistema GameFi em transformação

Introdução: Posição de Mercado e Valor de Investimento da AXS

Axie Infinity (AXS), reconhecida como uma das principais plataformas de gaming com base em blockchain, conquistou posições de destaque desde que foi lançada em 2018. Em 2025, a sua capitalização de mercado cifra-se nos 370 926 464 $, com uma quantidade em circulação a rondar 166 484 050 tokens e um preço atual em torno dos 2,228 $. Este ativo, frequentemente apelidado de “Pokémon do blockchain”, assume uma influência crescente tanto no segmento play-to-earn como no ecossistema mais amplo dos NFT.

Este artigo propõe-se a analisar de forma exaustiva a evolução do preço da Axie Infinity entre 2025 e 2030, avaliando padrões históricos, dinâmicas de oferta e procura, desenvolvimento do ecossistema e fatores macroeconómicos, fornecendo aos investidores previsões profissionais e estratégias práticas de investimento.

I. Análise Histórica do Preço da AXS e Estado Atual do Mercado

Evolução Histórica do Preço da AXS

- 2020: Lançamento da AXS, preço inicial em 0,123718 $ (mínimo absoluto)

- 2021: Máximo do mercado em alta, preço atinge recorde histórico de 164,9 $ a 7 de novembro

- 2022-2025: Correção e consolidação de mercado, com o preço a regressar aos valores atuais

Situação Atual de Mercado da AXS

Em 23 de setembro de 2025, a AXS negocia-se a 2,228 $. O token registou uma valorização de 1,13 % nas últimas 24 horas, com volume transacionado de 93 065,59033 $. Atualmente, a AXS ocupa a 209.ª posição no ranking do mercado cripto, com uma capitalização de mercado de 370 926 464,61 $. Estão em circulação 166 484 050,54 AXS, representando 61,66 % do fornecimento total de 270 000 000 AXS.

No curto prazo, a AXS mostra resultados heterogéneos em diferentes horizontes temporais. Valoriza 0,36 % na última hora e 1,13 % nas últimas 24 horas, mas apresenta perdas de 8,21 % na última semana e de 7,56 % nos últimos 30 dias. A tendência de longo prazo permanece negativa, com uma queda acentuada de 54,6 % ao longo do último ano.

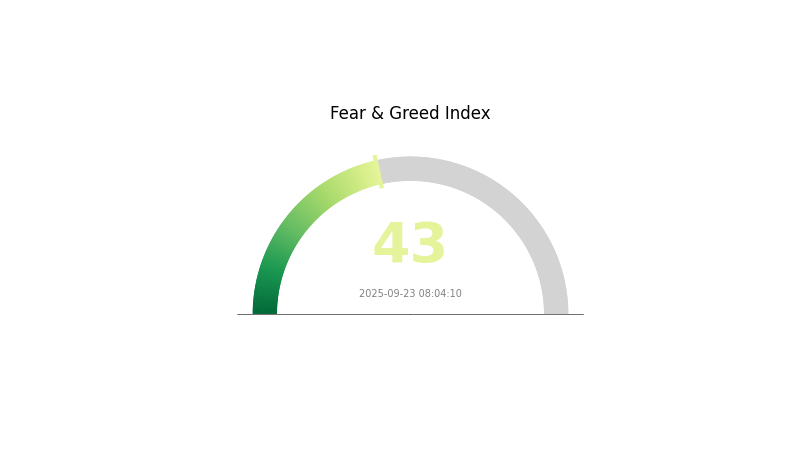

O sentimento atual do mercado de criptoativos é de cautela, refletido por um Índice de Medo e Ganância de 43 pontos, traduzindo uma abordagem reservada dos investidores.

Clique para ver o preço de mercado atual de AXS

Indicador de Sentimento de Mercado da AXS

2025-09-23 Índice de Medo e Ganância: 43 (Medo)

Clique para consultar o Índice de Medo & Ganância de AXS

Neste momento, o sentimento do mercado para AXS posiciona-se na zona de “Medo”, com uma leitura de 43 no Índice de Medo e Ganância. Este ambiente de prudência entre os investidores pode gerar oportunidades de compra para quem tem maior tolerância ao risco. No entanto, é essencial realizar uma análise rigorosa e considerar o seu perfil de risco antes de investir. O sentimento de mercado poderá mudar abruptamente, dada a natureza volátil do setor cripto.

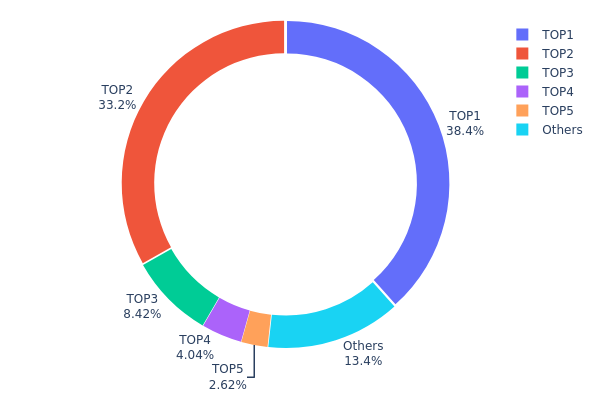

Distribuição dos Detentores de AXS

A análise das posses em AXS revela uma forte concentração de tokens. Os cinco principais endereços controlam 86,59 % da oferta total de AXS, sendo que os dois maiores somam 71,54 %. Esta concentração extrema levanta preocupações sobre a descentralização do token e a estabilidade de mercado.

Uma distribuição tão concentrada pode amplificar a volatilidade do mercado, já que os principais detentores exercem influência notória sobre as oscilações do preço e aumentam o potencial de manipulação. Grandes vendas provenientes destes endereços podem desestabilizar drasticamente o valor de mercado da AXS, expondo o ecossistema a riscos substanciais.

Do ponto de vista estrutural, esta elevada concentração sugere que a economia do token da AXS permanece numa fase pouco madura. Uma distribuição mais ampla é necessária para reforçar a descentralização e reduzir riscos sistémicos. Este padrão de posse deve ser cuidadosamente ponderado por investidores, pois mostra vulnerabilidades na estabilidade on-chain e na sustentabilidade de longo prazo da AXS.

Clique para consultar a distribuição de participações de AXS atual

| Posição | Endereço | Quantidade Detida | Percentagem (%) |

|---|---|---|---|

| 1 | 0xf333...50440a | 103 569,61 K | 38,35 % |

| 2 | 0x73b1...9a1162 | 89 622,90 K | 33,19 % |

| 3 | 0x24b0...3b77e5 | 22 723,82 K | 8,41 % |

| 4 | 0xea8b...70779c | 10 894,51 K | 4,03 % |

| 5 | 0xd631...5bd641 | 7 068,65 K | 2,61 % |

| - | Outros | 36 120,51 K | 13,41 % |

II. Fatores Essenciais para o Futuro Preço da AXS

Desenvolvimento Técnico e Expansão do Ecossistema

- Upgrade da Ronin Chain: Aperfeiçoamentos na sidechain Ronin para reforço da escalabilidade e rapidez das transações do Axie Infinity.

- Land Gameplay: Lançamento de funcionalidades de jogabilidade relacionadas com terrenos virtuais, potenciando a utilidade dos tokens AXS no ecossistema Axie.

- Aplicações do Ecossistema: Criação de novos jogos e aplicações no universo Axie Infinity, com reflexo expectável na procura de tokens AXS.

III. Projeções de Preço da AXS para 2025-2030

Projeção para 2025

- Cenário conservador: 1,86 $ - 2,22 $

- Cenário neutro: 2,22 $ - 2,61 $

- Cenário otimista: 2,61 $ - 3,00 $ (dependendo da evolução sustentada do ecossistema Axie Infinity)

Projeção para 2027-2028

- Estágio de mercado previsto: Consolidação, seguida de crescimento gradual

- Intervalos de preço estimados:

- 2027: 1,85 $ - 3,50 $

- 2028: 1,68 $ - 3,76 $

- Principais catalisadores: Desenvolvimento do segmento play-to-earn e adoção generalizada do blockchain

Projeção de Longo Prazo 2029-2030

- Cenário base: 3,52 $ - 4,34 $ (assumindo crescimento estável do mercado)

- Cenário otimista: 4,34 $ - 5,15 $ (com aceleração na adoção de gaming em blockchain)

- Cenário transformador: 5,15 $ - 6,42 $ (apoiado por inovações disruptivas no ecossistema Axie)

- 2030-12-31: AXS 6,42 $ (potencial máximo caso as condições de mercado sejam particularmente favoráveis)

| Ano | Preço Máximo Previsto | Preço Médio Previsto | Preço Mínimo Previsto | Variação (%) |

|---|---|---|---|---|

| 2025 | 3,0024 | 2,224 | 1,86816 | 0 |

| 2026 | 3,58008 | 2,6132 | 2,19509 | 17 |

| 2027 | 3,49921 | 3,09664 | 1,85799 | 39 |

| 2028 | 3,75963 | 3,29792 | 1,68194 | 48 |

| 2029 | 5,15202 | 3,52878 | 2,0114 | 58 |

| 2030 | 6,42379 | 4,3404 | 3,34211 | 95 |

IV. Estratégias de Investimento e Gestão de Risco Profissional para AXS

Metodologia de Investimento em AXS

(1) Estratégia de Detenção de Longo Prazo

- Indicada para: Investidores com convicção no potencial dos jogos blockchain e NFT

- Recomendações:

- Reforçar posições em AXS durante correções de mercado

- Efetuar staking de AXS para obtenção de recompensas

- Guardar tokens em carteiras de hardware de elevada segurança

(2) Estratégia de Negociação Ativa

- Ferramentas técnicas:

- Médias móveis: Identificação clara de tendências e sinais de reversão

- RSI (Índice de Força Relativa): Monitorização precisa de níveis de sobrecompra/sobrevenda

- Pontos essenciais para swing trading:

- Definir sempre stop-loss para limitar perdas

- Realizar lucros em níveis pré-definidos

Estrutura de Gestão de Risco para AXS

(1) Princípios de Alocação de Ativos

- Investidores conservadores: 1-3 % do portefólio cripto

- Investidores agressivos: 5-10 % do portefólio cripto

- Profissionais: Até 15 % do portefólio cripto

(2) Soluções de Cobertura de Risco

- Diversificação: Distribuir capital por múltiplos tokens de gaming

- Contratos de opções: Proteção face a potenciais quedas de valor

(3) Soluções de Armazenamento Seguro

- Carteira quente recomendada: carteira Gate Web3 carteira

- Armazenamento a frio: carteiras de hardware para detenção prolongada

- Práticas de segurança: Ativar autenticação de dois fatores, adotar palavras-passe fortes

V. Riscos e Desafios Potenciais para AXS

Riscos de Mercado

- Volatilidade intensa: O preço da AXS pode variar acentuadamente

- Pressão concorrencial: Proliferação de projetos de gaming em blockchain

- Influência do sentimento global: Movimentos do mercado cripto afetam de forma decisiva

Riscos Regulatórios

- Contexto legal incerto para NFT e tokens de gaming

- Possível reclassificação como valor mobiliário em certos países

- Implicações fiscais para ganhos in-game e negociação de tokens

Riscos Técnicos

- Vulnerabilidades em smart contracts: Suscetibilidade a exploits ou ataques

- Limitações de escalabilidade: Desafios na resposta a maiores volumes de utilizadores

- Dependência da rede Ethereum: Sujeita a congestionamentos e custos elevados

VI. Conclusão e Recomendações para Ação

Avaliação do Valor de Investimento em AXS

A AXS oferece uma oportunidade de elevado risco e elevado retorno no universo dos jogos blockchain. O potencial de longo prazo depende da capacidade de Axie Infinity em manter a sua base de utilizadores e inovar, enquanto a volatilidade de curto prazo e as incertezas regulatórias representam ameaças tangíveis.

Recomendações de Investimento em AXS

✅ Investidores iniciantes: Optar por exposições reduzidas e de carácter exploratório

✅ Investidores experientes: Aplicar métodos de investimento recorrente e definir estratégias de saída

✅ Institucionais: Realizar due diligence aprofundada e considerar a AXS como elemento de diversificação em portefólios cripto

Modalidades de Participação na Negociação de AXS

- Negociação à vista: Compra e venda de AXS na Gate.com

- Staking: Participação em programas de staking para rentabilidade passiva

- Participação in-game: Interação direta no ecossistema Axie Infinity

O investimento em criptoativos envolve riscos muito elevados. Este artigo não constitui aconselhamento financeiro. Os investidores devem tomar decisões em função do seu perfil de risco e consultar sempre consultores financeiros qualificados. Nunca invista mais do que está disposto a perder.

Perguntas Frequentes

A AXS pode chegar aos 100 $?

Sim, a AXS poderá atingir os 100 $ em 2025 caso mantenha o forte crescimento nos segmentos de gaming e NFT. No entanto, a evolução do mercado e do projeto será determinante para este cenário.

Qual o potencial máximo da Axie Infinity?

A Axie Infinity pode alcançar 100 $ em 2026, impulsionada pela adoção generalizada, melhorias contínuas e pelo crescimento do mercado cripto.

Qual a previsão para o token AXS?

As projeções apontam para um valor de 50-60 $ em 2025, suportado pelo crescimento da base de utilizadores e pela expansão do ecossistema Axie Infinity.

Qual foi o valor máximo da AXS até hoje?

O preço recorde da AXS foi de 165,37 $ em 6 de novembro de 2021.

Previsão do Preço ORO em 2025: Análise das Tendências de Mercado e dos Fatores Potenciais de Crescimento

Previsão do preço ILV em 2025: análise das tendências do mercado e dos potenciais fatores de crescimento para Illuvium

Estratégia Web3 Gigachad: Dominando Ativos de criptografia em 2025

Previsão de preço CHEEL para 2025: análise e projeção de mercado do ativo emergente da Blockchain

Previsão do Preço do AXS para 2025: Perspetiva Positiva para o Token da Axie Infinity no Crescente Ecossistema GameFi

RON vs FLOW: Comparação entre Duas Abordagens para Serialização Eficiente de Dados

Compreensão dos Forks em Blockchain: Práticas Fundamentais de Segurança

Guia para Aquisição Segura de Tether USDT na Índia

Otimização de transações na rede através da tecnologia BlockDAG

Descubra a nova aplicação de mineração BlockDAG—X1 Miner já se encontra disponível.

Principais Atributos das Funções de Hash Criptográficas Explicados