Dự báo giá ALPA năm 2025: Xu hướng tích cực khi mức độ ứng dụng DeFi tăng mạnh

Giới thiệu: Vị thế thị trường và giá trị đầu tư của ALPA

Alpaca City (ALPA), một dự án thành phố ảo trên nền tảng Ethereum, đã ghi dấu ấn mạnh mẽ kể từ khi ra mắt năm 2020. Đến năm 2025, vốn hóa thị trường của ALPA đạt 86.526 USD, tổng nguồn cung lưu hành khoảng 10.922.261 token, giá giao dịch quanh mức 0,007922 USD. Loại tài sản này, thường gọi là “Alpaca NFT Token”, ngày càng đóng vai trò chiến lược trong lĩnh vực quản lý tài sản ảo và game NFT.

Bài viết này cung cấp phân tích toàn diện về xu hướng giá ALPA từ năm 2025 đến 2030, dựa trên dữ liệu lịch sử, cung cầu thị trường, phát triển hệ sinh thái và các yếu tố kinh tế vĩ mô, nhằm mang đến cho nhà đầu tư dự báo giá chuyên sâu và chiến lược đầu tư thực tiễn.

I. Đánh giá lịch sử giá ALPA và thực trạng thị trường

Biến động giá ALPA qua các năm

- 2021: Thiết lập đỉnh lịch sử, giá đạt 2,02771554 USD vào 15 tháng 04

- 2025: Đáy chu kỳ, giá giảm xuống 0,000118906610776371 USD vào 13 tháng 01

- 2025: Phục hồi gần đây, giá tăng 64,7% trong vòng một năm qua

Thực trạng thị trường ALPA hiện nay

Tính đến ngày 02 tháng 11 năm 2025, ALPA giao dịch ở mức 0,007922 USD. Token này giảm nhẹ trong ngắn hạn, mất 1,11% trong 24 giờ gần nhất và giảm 5,89% trong tuần qua. Tuy nhiên, mức tăng trưởng 64,7% trong năm cho thấy tiềm năng xu hướng tăng dài hạn.

Vốn hóa thị trường của ALPA hiện đạt 86.526 USD, đứng thứ 5.236 trên thị trường tiền mã hóa. Nguồn cung lưu hành đạt 10.922.261 ALPA, chiếm 43,82% tổng nguồn cung là 24.927.132 token.

Mốc giá cao nhất mọi thời đại là 2,02771554 USD vào ngày 15 tháng 04 năm 2021, trong khi giá thấp nhất lịch sử là 0,000118906610776371 USD vào ngày 13 tháng 01 năm 2025. Điều này phản ánh mức độ biến động giá lớn của ALPA kể từ khi phát hành.

Nhấn để xem giá ALPA hiện tại

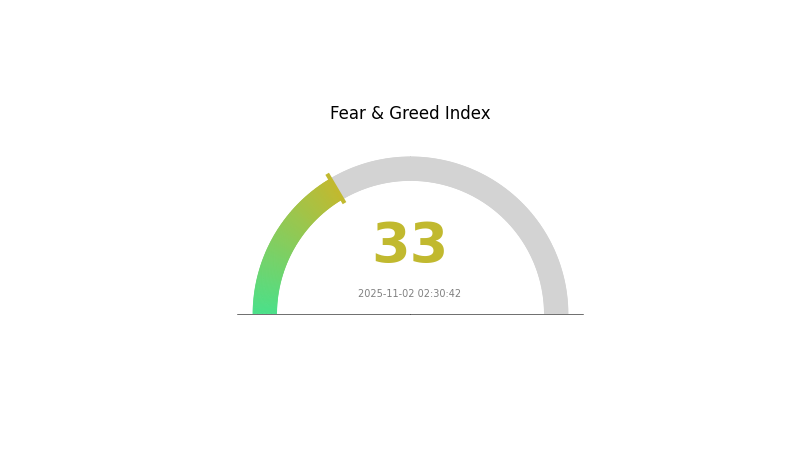

Chỉ báo tâm lý thị trường ALPA

02 tháng 11 năm 2025, Chỉ số Sợ hãi và Tham lam: 33 (Sợ hãi)

Nhấn để xem Chỉ số Sợ hãi & Tham lam hiện tại

Thị trường tiền mã hóa đang trong giai đoạn sợ hãi với chỉ số tâm lý ở mức 33. Nhà đầu tư hiện rất thận trọng và có thể tìm kiếm cơ hội mua vào. Trong giai đoạn này, cần cập nhật thông tin liên tục và tránh quyết định vội vàng. Chu kỳ thị trường là điều bình thường; đây có thể là thời điểm để tích lũy tài sản giá thấp. Tuy nhiên, hãy luôn nghiên cứu kỹ lưỡng và xác định mức chịu rủi ro phù hợp trước khi đầu tư.

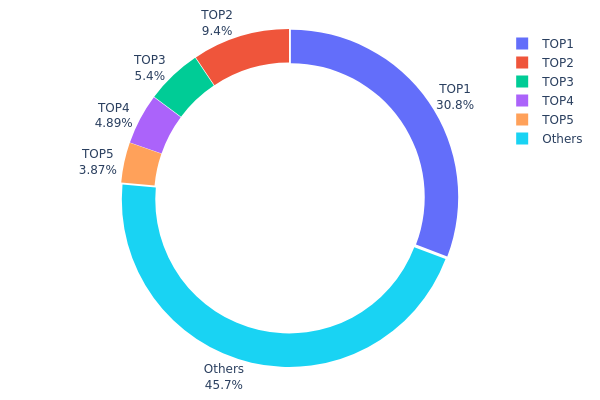

Phân bổ sở hữu ALPA

Dữ liệu phân bổ địa chỉ sở hữu cho thấy sự tập trung đáng kể token ALPA ở một số ví lớn. Địa chỉ nắm giữ lớn nhất chiếm 30,77% tổng nguồn cung; năm địa chỉ lớn nhất sở hữu tổng cộng 54,3% lượng ALPA lưu hành.

Mức tập trung này tiềm ẩn rủi ro tập trung hóa cho hệ sinh thái ALPA. Khi hơn một nửa lượng token nằm trong tay năm ví lớn, nguy cơ thao túng thị trường hoặc biến động giá mạnh tăng lên nếu các holder này bán hoặc chuyển tài sản. Chủ sở hữu lớn nhất có thể ảnh hưởng lớn đến diễn biến giá token.

Dù vậy, 45,7% ALPA vẫn được phân bổ cho các địa chỉ khác, thể hiện sự phân tán nhất định. Sự cân bằng giữa tập trung và phân bổ rộng tạo ra cấu trúc thị trường hỗn hợp, nơi các nhà đầu tư lớn chi phối nhưng nhà đầu tư nhỏ vẫn còn cơ hội tham gia. Theo dõi diễn biến phân bổ sẽ giúp đánh giá độ ổn định và mức độ phi tập trung của hệ sinh thái ALPA về lâu dài.

Nhấn để xem Phân bổ sở hữu ALPA hiện tại

| Top | Địa chỉ | Số lượng nắm giữ | Tỷ lệ nắm giữ (%) |

|---|---|---|---|

| 1 | 0x741c...33344a | 7.850,31K | 30,77% |

| 2 | 0x1109...671417 | 2.397,10K | 9,39% |

| 3 | 0xd93d...3c055e | 1.378,40K | 5,40% |

| 4 | 0x441f...f91eca | 1.246,78K | 4,88% |

| 5 | 0xe23a...81605f | 987,00K | 3,86% |

| - | Khác | 11.647,11K | 45,7% |

II. Các yếu tố ảnh hưởng chính đến giá ALPA trong tương lai

Môi trường kinh tế vĩ mô

- Tác động của chính sách tiền tệ: Các quyết định của ngân hàng trung ương lớn ảnh hưởng trực tiếp đến diễn biến giá ALPA.

- Tính phòng ngừa lạm phát: Hiệu suất của ALPA trong môi trường lạm phát được nhà đầu tư chú ý sát sao.

- Yếu tố địa chính trị: Biến động chính trị và xung đột quốc tế có thể làm thay đổi giá trị và tâm lý thị trường ALPA.

Phát triển công nghệ và hệ sinh thái

- Tích hợp AI: Việc ứng dụng công nghệ AI liên tục và tích hợp vào hệ sinh thái ALPA sẽ thúc đẩy mức độ chấp nhận và tăng giá trị token.

- Ứng dụng hệ sinh thái: Việc xây dựng các DApp lớn cùng dự án hệ sinh thái trên mạng ALPA giữ vai trò quyết định đến tốc độ tăng trưởng và định giá token.

III. Dự báo giá ALPA giai đoạn 2025-2030

Triển vọng năm 2025

- Dự báo thận trọng: 0,00616 - 0,0079 USD

- Dự báo trung lập: 0,0079 - 0,0094 USD

- Dự báo lạc quan: 0,0094 USD (nếu thị trường thuận lợi)

Triển vọng 2026-2028

- Giai đoạn thị trường: Tăng trưởng từ từ

- Dự báo biên độ giá:

- 2026: 0,00476 - 0,01245 USD

- 2027: 0,00612 - 0,01298 USD

- 2028: 0,00917 - 0,014 USD

- Động lực chính: Gia tăng mức độ ứng dụng, cải tiến công nghệ, môi trường tâm lý thị trường tích cực

Triển vọng dài hạn 2029-2030

- Kịch bản cơ bản: 0,01224 - 0,01533 USD (tăng trưởng thị trường ổn định)

- Kịch bản lạc quan: 0,01777 - 0,02161 USD (thị trường tăng trưởng mạnh)

- Kịch bản đột phá: Trên 0,02161 USD (thị trường cực kỳ thuận lợi)

- 31 tháng 12 năm 2030: ALPA đạt 0,01533 USD (tăng 93% so với năm 2025)

| Năm | Giá dự báo cao nhất | Giá dự báo trung bình | Giá dự báo thấp nhất | Biến động (%) |

|---|---|---|---|---|

| 2025 | 0,0094 | 0,0079 | 0,00616 | 0 |

| 2026 | 0,01245 | 0,00865 | 0,00476 | 9 |

| 2027 | 0,01298 | 0,01055 | 0,00612 | 33 |

| 2028 | 0,014 | 0,01176 | 0,00917 | 48 |

| 2029 | 0,01777 | 0,01288 | 0,01224 | 62 |

| 2030 | 0,02161 | 0,01533 | 0,01425 | 93 |

IV. Chiến lược đầu tư chuyên nghiệp và quản lý rủi ro ALPA

Phương pháp đầu tư ALPA

(1) Chiến lược nắm giữ dài hạn

- Phù hợp với: Nhà đầu tư quan tâm lĩnh vực thế giới ảo và game NFT

- Khuyến nghị vận hành:

- Tích lũy ALPA khi thị trường điều chỉnh giảm

- Tham gia hệ sinh thái Alpaca City để hiểu rõ dự án

- Bảo quản token tại ví phi tập trung an toàn

(2) Chiến lược giao dịch chủ động

- Công cụ phân tích kỹ thuật:

- Đường trung bình động: Nhận diện xu hướng, tín hiệu đảo chiều

- Chỉ số RSI: Theo dõi trạng thái quá mua/quá bán

- Điểm quan trọng khi giao dịch ngắn hạn:

- Theo sát diễn biến thị trường NFT và tác động lên ALPA

- Cập nhật tiến độ phát triển Alpaca City cùng tăng trưởng cộng đồng

Khung quản trị rủi ro ALPA

(1) Nguyên tắc phân bổ tài sản

- Nhà đầu tư thận trọng: 1-3% tổng danh mục tiền mã hóa

- Nhà đầu tư chấp nhận rủi ro: 5-10% tổng danh mục tiền mã hóa

- Nhà đầu tư chuyên nghiệp: Tối đa 15% tổng danh mục tiền mã hóa

(2) Kế hoạch phòng ngừa rủi ro

- Đa dạng hóa: Đầu tư vào nhiều token NFT và gaming khác

- Lệnh cắt lỗ: Đặt mức cắt lỗ hợp lý để hạn chế rủi ro thua lỗ

(3) Giải pháp lưu trữ an toàn

- Khuyến nghị ví Web3: Gate Web3 Wallet

- Lưu trữ lạnh: Chuyển token về ví ngoại tuyến khi nắm giữ dài hạn

- Bảo mật: Sử dụng xác thực hai lớp, tuyệt đối không chia sẻ khóa riêng tư

V. Rủi ro và thách thức tiềm tàng với ALPA

Rủi ro thị trường ALPA

- Biến động lớn: Token NFT và gaming thường biến động giá mạnh

- Cạnh tranh: Nhiều dự án mới trong thế giới ảo có thể làm giảm vị thế của ALPA

- Tâm lý thị trường: Biến động tâm lý toàn thị trường ảnh hưởng trực tiếp đến hiệu suất ALPA

Rủi ro pháp lý ALPA

- Quy định NFT: Các quy định mới về NFT có thể ảnh hưởng hoạt động của Alpaca City

- Luật tiền mã hóa: Thay đổi pháp lý toàn cầu có thể hạn chế khả năng tiếp cận của ALPA

- Thuế: Luật thuế tài sản ảo thay đổi ảnh hưởng đến người nắm giữ ALPA

Rủi ro kỹ thuật ALPA

- Lỗ hổng hợp đồng thông minh: Có thể tồn tại lỗi trong hợp đồng thông minh Alpaca City

- Vấn đề mở rộng: Tắc nghẽn mạng Ethereum ảnh hưởng trải nghiệm người dùng

- Bảo mật: Nguy cơ bị hack hoặc truy cập trái phép vào nền tảng

VI. Kết luận và khuyến nghị hành động

Đánh giá giá trị đầu tư ALPA

ALPA mang tới cơ hội nổi bật trong lĩnh vực thế giới ảo và game NFT. Tuy nhiên, tiềm năng tăng trưởng đi kèm với biến động giá lớn và rủi ro pháp lý cao, nhà đầu tư cần cân nhắc kỹ lưỡng.

Khuyến nghị đầu tư ALPA

✅ Người mới tham gia: Nên đầu tư nhỏ để hiểu hệ sinh thái Alpaca City ✅ Nhà đầu tư giàu kinh nghiệm: Nên áp dụng chiến lược cân bằng, kết hợp ALPA với các tài sản tiền mã hóa lớn ✅ Nhà đầu tư tổ chức: Cần thẩm định kỹ lộ trình phát triển Alpaca City và chỉ số chấp nhận người dùng

Hình thức tham gia giao dịch ALPA

- Giao dịch giao ngay: Mua bán ALPA trên Gate.com

- Staking: Tham gia chương trình staking ALPA nếu có

- Giao dịch NFT: Tham gia sàn NFT Alpaca City để hiểu rõ hệ sinh thái

Đầu tư tiền mã hóa tiềm ẩn rủi ro rất cao, bài viết này không phải là khuyến nghị đầu tư. Nhà đầu tư nên cân nhắc kỹ mức độ chịu rủi ro và tham khảo ý kiến chuyên gia tài chính. Không nên đầu tư quá số tiền có thể mất.

FAQ

Alpa Labs có phải là khoản đầu tư tốt?

Đúng, Alpa Labs hiện được đánh giá là khoản đầu tư tốt. Xu hướng thị trường và tính toán giá trị hợp lý cho thấy triển vọng tích cực cho doanh nghiệp tính đến ngày 02 tháng 11 năm 2025.

API3 có tiềm năng phát triển không?

API3 được dự báo có triển vọng tăng trưởng tốt. Các chuyên gia nhận định token này có thể đạt 8-15 USD vào năm 2030 tùy thuộc vào mức độ ứng dụng và xu hướng thị trường. Nhà đầu tư dài hạn có thể cân nhắc.

Aleph IM có phải là lựa chọn tốt?

Theo phân tích thị trường hiện tại, Aleph IM chưa phải là lựa chọn mua vào tốt. Các chỉ báo kỹ thuật cho thấy triển vọng giảm giá trong năm 2025.

1000 Alpha coin trị giá bao nhiêu?

Tính đến ngày 02 tháng 11 năm 2025, 1.000 Alpha coin có giá khoảng 1,16 USD theo tỷ giá quốc tế mới nhất.

Dự báo giá RACA năm 2025: Phân tích động lực tăng trưởng và tiềm năng thị trường trong hệ sinh thái game NFT đang chuyển mình

Dự báo giá MBOX năm 2025: Đánh giá tiềm năng tăng trưởng trong nền kinh tế trò chơi Metaverse đang đổi mới

GOZ vs SAND: Cuộc đối đầu của hai ông lớn trong lĩnh vực game blockchain

Dự báo giá DXCT năm 2025: Phân tích xu hướng thị trường và những yếu tố thúc đẩy tăng trưởng

PYR vs ENJ: Cuộc Đọ Sức Giữa Hai "Ông Lớn" Trong Đấu Trường Game Blockchain

Bitcoin dẫn đầu so với Ethereum khi vốn hóa thị trường vượt trên 1 nghìn tỷ USD, giá BTC đạt 68.000 USD

Các nền tảng hàng đầu để mua Bitcoin và tiền mã hóa: lựa chọn nổi bật cho năm 2025

PAPARAZZI và KAVA: Phân tích toàn diện về hai xu hướng phổ biến trong lĩnh vực nhiếp ảnh và đồ uống

Câu trả lời Quiz hàng ngày của Marina Protocol ngày 22 tháng 12 năm 2025

Sự phổ biến của token DEGEN đã tăng trưởng mạnh mẽ, đạt mốc 500.000 người sở hữu chỉ sau sáu tháng