龙贸易商

Post content & earn content mining yield

placeholder

- Reward

- 1

- Comment

- Repost

- Share

#比特币技术分析 Looking back on more than ten years of Bitcoin development, I can't help but feel that the market is always cyclical. Tom Lee predicts that Bitcoin could surge to $250,000 within a few months, which reminds me of the frenzy among analysts during the 2017 bull market. At that time, some also predicted Bitcoin would break through $100,000, but it ended up topping out near $20,000 and then falling back.

However, this time might truly be different. Institutional funds are entering on a large scale, and the regulatory environment is gradually becoming clearer. The approval of Bitcoin ETFs

However, this time might truly be different. Institutional funds are entering on a large scale, and the regulatory environment is gradually becoming clearer. The approval of Bitcoin ETFs

BTC-4%

- Reward

- like

- Comment

- Repost

- Share

#加密资产交易策略 These ICO rules are really confusing! First, it was said that the whitelist accounts for 6%, then it was changed to 4%. The proportion of JUP stakers to public sale also increased from 2% to 3%. It seems the project team is adapting and constantly adjusting their strategy. However, this kind of unpredictable approach feels a bit unreliable. Everyone participating should stay alert and not get confused by these constantly changing numbers. By the way, a $69 million valuation is not low, but I wonder what makes this dark pool DEX so special to justify such a high price. In summary, be

JUP-3.68%

- Reward

- like

- Comment

- Repost

- Share

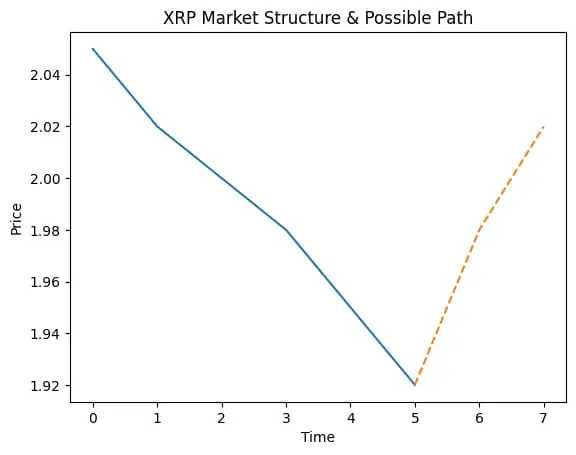

$XRP XRP saw a strong drop after failing to hold the recent highs. The move down was fast and emotional, and now price is sitting near a short-term demand zone.

What stands out

Short-term trend is bearish, but momentum looks stretched

RSI on lower timeframes is deeply oversold → selling pressure is slowing

Volume spiked on the drop, often seen near temporary bottoms

Possible outlook

Short term (hours): A pause or small bounce is likely as sellers cool off

Near term (1–3 days): If this level holds, price may try to recover toward the previous breakdown area

Risk side: If support fails, one mo

What stands out

Short-term trend is bearish, but momentum looks stretched

RSI on lower timeframes is deeply oversold → selling pressure is slowing

Volume spiked on the drop, often seen near temporary bottoms

Possible outlook

Short term (hours): A pause or small bounce is likely as sellers cool off

Near term (1–3 days): If this level holds, price may try to recover toward the previous breakdown area

Risk side: If support fails, one mo

XRP-5.75%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 7

- 6

- Repost

- Share

Gm_Gn_Merchant :

:

ASTER's move this time is really a bit weak, it feels like those who chased the high are all trapped.View More

Looking at the recent K-line chart, I noticed an interesting phenomenon—the current downward trend closely resembles the pattern from the 2021 market cycle. It started with a waterfall-like plunge, followed by a rebound, and then continued to decline. Could history really be repeating itself?

My observation approach is as follows: when BTC drops back to the 80,000+ range, we should carefully analyze what on-chain funds are doing, compare the volume of bulls and bears, and use this to judge whether the subsequent movement will follow the same pattern of decline, consolidation, and accumulation

My observation approach is as follows: when BTC drops back to the 80,000+ range, we should carefully analyze what on-chain funds are doing, compare the volume of bulls and bears, and use this to judge whether the subsequent movement will follow the same pattern of decline, consolidation, and accumulation

BTC-4%

- Reward

- 8

- 5

- Repost

- Share

VitalikFanboy42 :

:

I don't really believe in history repeating itself; it's too easy to self-fulfill. The 80,000 level feels like it's been overhyped, and it might not be effective even if we reach it.

Watching whale movements is smart, but the data we common folks can see has already been seen through by institutions.

View More

ETH strategy

View OriginalSubscribers Only

Subscribe now to view exclusive content[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

12.16 ETH Market Analysis

On the 1-hour chart, Ethereum quickly stabilized and rebounded after dropping to around 2890. The bulls and bears have been battling for a while, and it is now clear that the bulls have the upper hand. Technical indicators show signs of a golden cross forming on the MACD, the energy histogram is approaching the zero line, and the KDJ indicator continues to trend upward. The bearish pressure has become very weak.

For trading, it is recommended to operate within 2900—2930.

Target outlook: 3020-3150

On the 1-hour chart, Ethereum quickly stabilized and rebounded after dropping to around 2890. The bulls and bears have been battling for a while, and it is now clear that the bulls have the upper hand. Technical indicators show signs of a golden cross forming on the MACD, the energy histogram is approaching the zero line, and the KDJ indicator continues to trend upward. The bearish pressure has become very weak.

For trading, it is recommended to operate within 2900—2930.

Target outlook: 3020-3150

ETH-6.61%

- Reward

- like

- Comment

- Repost

- Share

#大户持仓变化 The big whales' moves this time are really fierce. Last night, $ETH and $DOGE experienced significant fluctuations one after another, and it seems like someone is behind the scenes stirring the pot. These continuous actions at the whale level have a quite obvious impact on the market — they can quickly influence many retail investors to follow suit. To be honest, this has become a common tactic in recent market trends. Whoever holds a large amount of chips has the pricing power.

View Original- Reward

- 4

- 4

- Repost

- Share

GateUser-40edb63b :

:

Here we go again, the daily routine of whales harvesting retail investors.View More

#美联储降息 From Losses to Profits, I’ve Discovered Several "Iron Laws" of the Crypto World

Having rooted myself in Shenzhen for many years, I’ve seen too many people lose everything in this market. I’ve also taken some wrong turns myself—8 years of trading, and blow-ups and stop-losses are no longer surprises. The real turning point was the 1460 days of accumulation.

Growing from 30,000 U to 58 million U isn’t due to luck, nor is there any dark secret. The core is actually treating trading as a "monster slaying and level-up" game, with a methodical approach. After countless failures, I summarized

View OriginalHaving rooted myself in Shenzhen for many years, I’ve seen too many people lose everything in this market. I’ve also taken some wrong turns myself—8 years of trading, and blow-ups and stop-losses are no longer surprises. The real turning point was the 1460 days of accumulation.

Growing from 30,000 U to 58 million U isn’t due to luck, nor is there any dark secret. The core is actually treating trading as a "monster slaying and level-up" game, with a methodical approach. After countless failures, I summarized

- Reward

- 11

- 5

- Repost

- Share

StableGeniusDegen :

:

30,000 to 58 million? Dude, you better put a question mark on that number.View More

🇬🇧 The UK Will Regulate Crypto Similar to Traditional Assets Starting in 2027

🔸 The UK will regulate crypto like Bitcoin under the same regulatory framework as traditional finance from 2027.

🔸 Crypto companies ( including wallet providers ) will be subject to FCA oversight and must meet clear regulatory standards.

#JapanToRaiseInterestRatesInMid-to-lateDecember

🔸 The UK will regulate crypto like Bitcoin under the same regulatory framework as traditional finance from 2027.

🔸 Crypto companies ( including wallet providers ) will be subject to FCA oversight and must meet clear regulatory standards.

#JapanToRaiseInterestRatesInMid-to-lateDecember

BTC-4%

- Reward

- like

- Comment

- Repost

- Share

#美联储降息 ZEC has recently become a hot topic again. Some are eager to go long, but is this really such an easy trade?

I've seen many self-proclaimed "trading geniuses" shouting in the market, but upon closer inspection of their trading records, nothing seems particularly impressive. Remember, true trading veterans have endured multiple bull and bear cycles to sharpen their skills. Talking is not enough—those on Wall Street, even if they’re not the best, have at least fought through real market battles.

Looking at the current $ZEC trend, honestly, it's a bit pessimistic. Tonight's market movement

I've seen many self-proclaimed "trading geniuses" shouting in the market, but upon closer inspection of their trading records, nothing seems particularly impressive. Remember, true trading veterans have endured multiple bull and bear cycles to sharpen their skills. Talking is not enough—those on Wall Street, even if they’re not the best, have at least fought through real market battles.

Looking at the current $ZEC trend, honestly, it's a bit pessimistic. Tonight's market movement

ZEC-6.5%

- Reward

- 8

- 5

- Repost

- Share

RugResistant :

:

I get annoyed listening to this set of arguments. Those so-called "neuro traders" talk even more beautifully than they sing, but in the end, the K-line is all nonsense. This wave of ZEC is probably going to cut the leeks. Don't be fooled by the hype.

Those who shout "Emperor" every day will eventually get liquidated and kneel down.

Bearish on ZEC, everyone, wake up.

Neither bulls nor bears should get too carried away; this market is best at biting back those who are overconfident.

I really think buying ZEC right now is just gambling, a gamble that won't pay off.

View More

Respect the trend, simplicity is the ultimate sophistication, go with the flow.

View Original

- Reward

- like

- Comment

- Repost

- Share

#美联储降息 Ethereum's recent performance has indeed been impressive. Against the backdrop of the Federal Reserve cutting interest rates, many people accurately timed @ETH@, with order placements for both long and short positions achieving double returns. In this wave of market movements, assets like @PIPPIN@ and @BEAT@ were also tightly controlled. Interestingly, a shift in the Federal Reserve's policies often triggers chain reactions in the crypto market—from Bitcoin to Ethereum to smaller altcoins—all following this big logic. Want to discuss market views? Join the Gate Square for a chat, share

View Original- Reward

- 12

- 3

- Repost

- Share

MrRightClick :

:

The rate cut this time was definitely worth the wait. If you grasp the rhythm of ETH, doubling is easy, but there are also many pitfalls with small coins, so be careful.View More

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

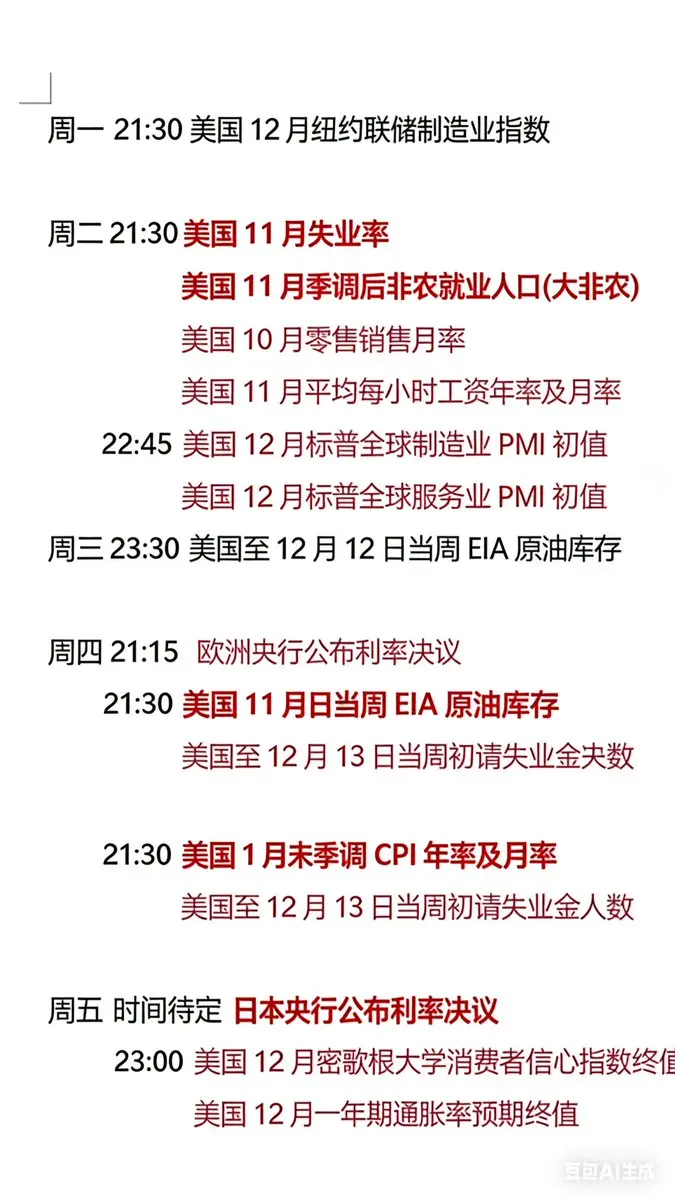

📊 Important Data and Events Preview for Next Week (Must Read)

For stocks, cryptocurrencies, and U.S. Treasuries

Next week will be an extremely critical week. It’s a week that requires full attention

Employment, inflation, and interest rates will all provide answers simultaneously, leaving no room for ambiguity in the market.

This will serve as a concentrated test of “How is the US economy really doing?”

It will also directly determine the Federal Reserve's stance, interest rate expectations, and the direction of risk assets.

📅 Monday

• 🟠 21:30 US December New York Federal Reserve Manufactur

View OriginalFor stocks, cryptocurrencies, and U.S. Treasuries

Next week will be an extremely critical week. It’s a week that requires full attention

Employment, inflation, and interest rates will all provide answers simultaneously, leaving no room for ambiguity in the market.

This will serve as a concentrated test of “How is the US economy really doing?”

It will also directly determine the Federal Reserve's stance, interest rate expectations, and the direction of risk assets.

📅 Monday

• 🟠 21:30 US December New York Federal Reserve Manufactur

- Reward

- like

- Comment

- Repost

- Share

Pyth Network Initiates Monthly Token Buyback Program, Tying Value to Ecosystem Growth 📈

Pyth Network has launched the "PYTH Reserve," a monthly token buyback program that will utilize 33% of its DAO treasury balance to purchase $PYTH tokens on the open market. The initiative is funded by protocol revenue, with the first buyback this month estimated between $100,000 and $200,000.

The program begins as Pyth reports growing traction, noting that its Pyth Pro data product surpassed $1 million in Annual Recurring Revenue (ARR) within its first month. The buyback mechanism is designed to more close

Pyth Network has launched the "PYTH Reserve," a monthly token buyback program that will utilize 33% of its DAO treasury balance to purchase $PYTH tokens on the open market. The initiative is funded by protocol revenue, with the first buyback this month estimated between $100,000 and $200,000.

The program begins as Pyth reports growing traction, noting that its Pyth Pro data product surpassed $1 million in Annual Recurring Revenue (ARR) within its first month. The buyback mechanism is designed to more close

PYTH-6.55%

- Reward

- 2

- Comment

- Repost

- Share

12.15 Morning Session Market Analysis!

View OriginalSubscribers Only

Subscribe now to view exclusive content- Reward

- 4

- 5

- Repost

- Share

SnowyAndProsperousYea :

:

What is the daily resistance level for FIL?View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

- Trending TopicsView More

111 Popularity

104.29K Popularity

62.83K Popularity

184.92K Popularity

5.71K Popularity

- Hot Gate FunView More

- MC:$3.52KHolders:10.00%

- MC:$3.72KHolders:20.00%

- MC:$3.52KHolders:20.00%

- MC:$3.52KHolders:20.00%

- MC:$3.52KHolders:20.01%

- Pin