The project party closed the market right after opening, without even putting on a show.

Just a friendly reminder, withdrawals should be opened in a few days.

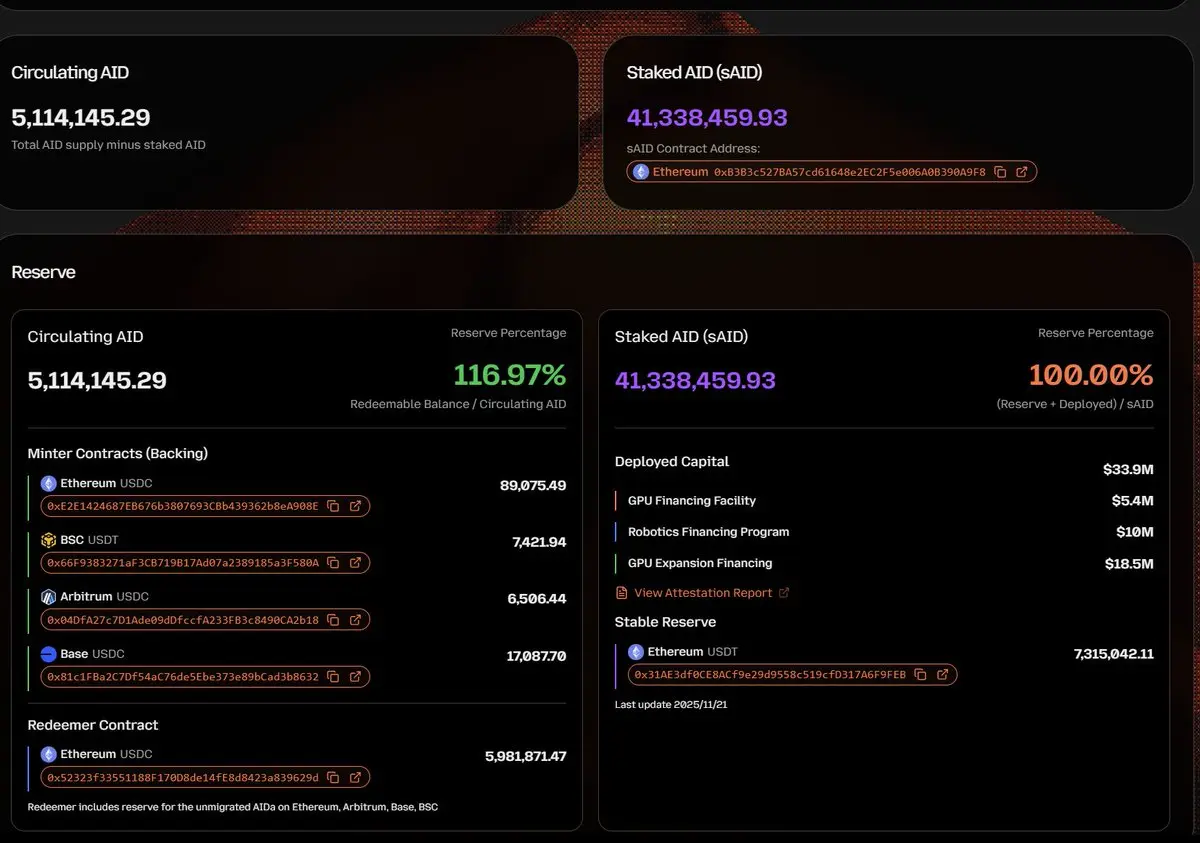

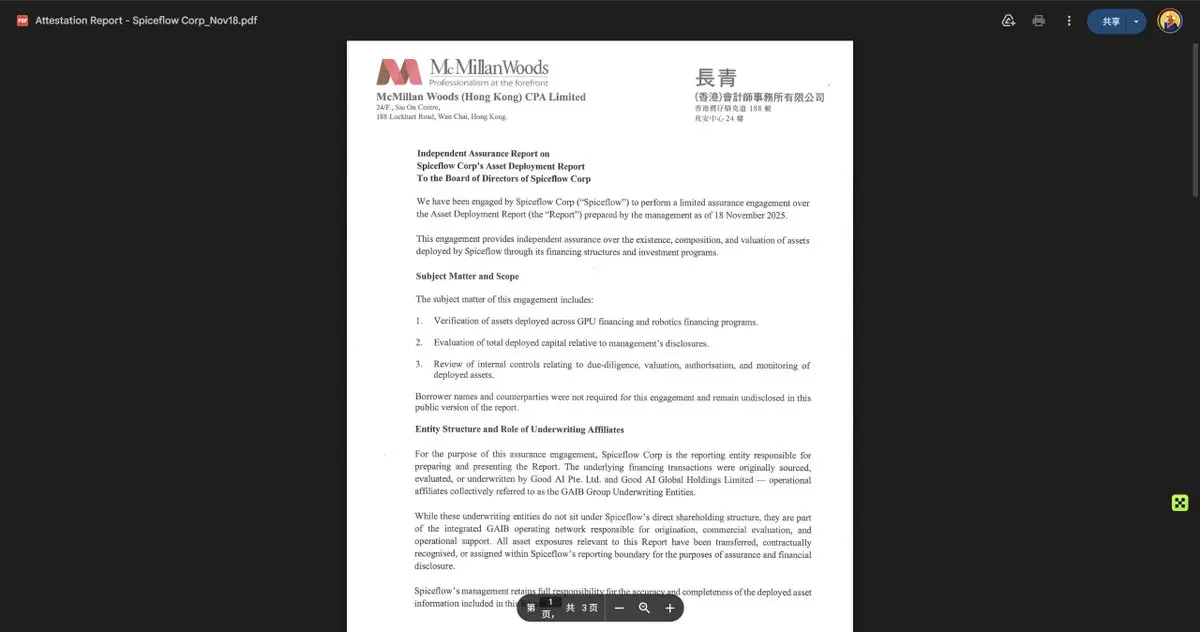

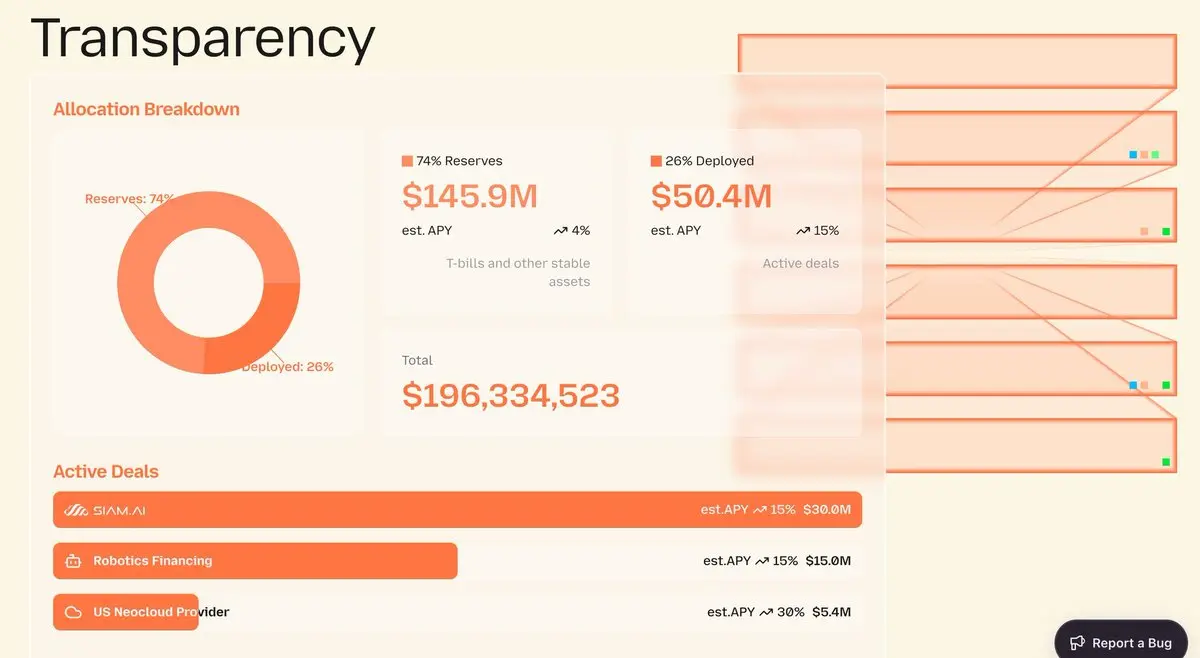

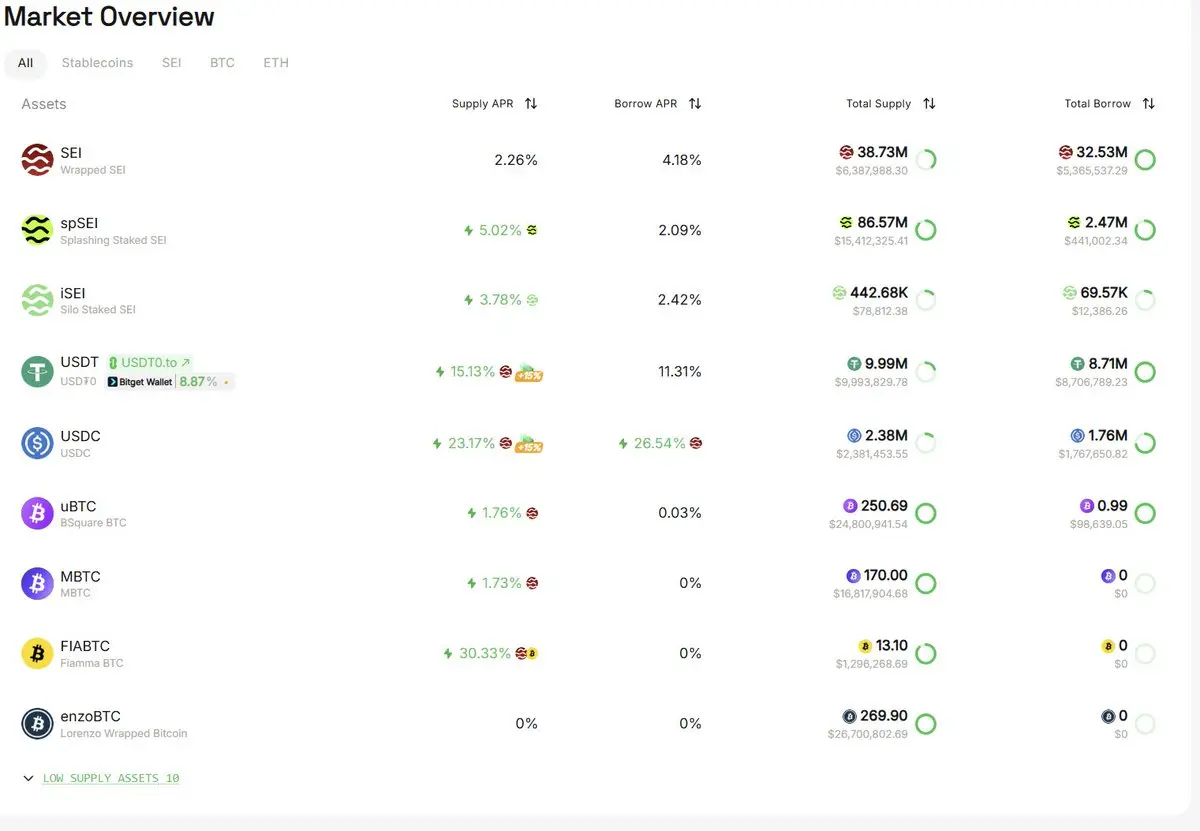

According to previously disclosed information, out of the total deposit of 200 million USD, 50 million is allocated for loans to three companies.

If this part comes entirely from user deposits and is truly given to these enterprises without any drawer agreements,

Need to think about it:

Will these loans be repaid?

Even if it's repaid, will it be repaid immediately, or do we have to wait until the due date? (After all, we don't kn

View Original