CryptoCalling

$ETH $ASTER $DOGE

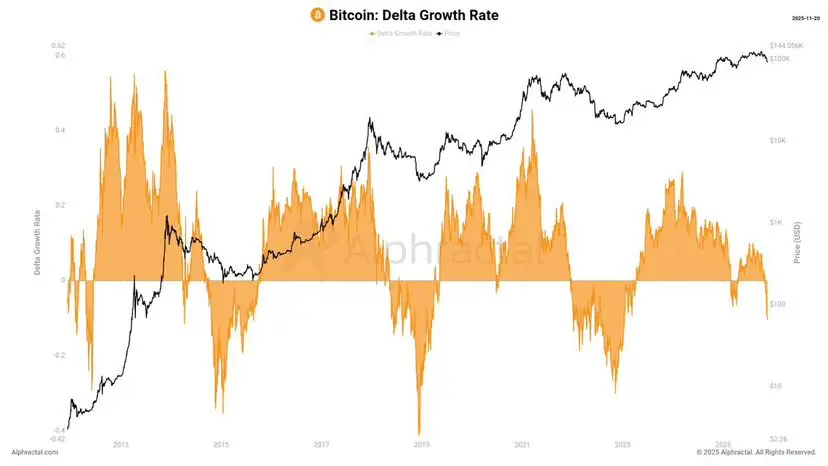

🔥 At 3 AM, the Federal Reserve suddenly injected $25 billion into the market through overnight repurchase agreements. This is the largest scale since 2021.

The timing is very delicate: QT has just wrapped up, and interest rate cuts are on the way, and it just so happens that this move comes at this moment. The liquidity gate is clearly not something that can be opened casually.

Where will this money go? Primary dealers will get cheap dollars and will definitely look for the highest-yielding assets. The entry for cryptocurrency ETFs is more accessible than ever — BlackRock ha

🔥 At 3 AM, the Federal Reserve suddenly injected $25 billion into the market through overnight repurchase agreements. This is the largest scale since 2021.

The timing is very delicate: QT has just wrapped up, and interest rate cuts are on the way, and it just so happens that this move comes at this moment. The liquidity gate is clearly not something that can be opened casually.

Where will this money go? Primary dealers will get cheap dollars and will definitely look for the highest-yielding assets. The entry for cryptocurrency ETFs is more accessible than ever — BlackRock ha