# MarketStructure

3.57K

Mosfick

JUST IN: Bitcoin Challenges $90,000 Resistance as Geopolitical Risk Premium Evaporates.

The market has effectively erased the weekend's panic-driven sell-off. Bitcoin is currently testing the crucial $90,000 psychological level as the narrative shifts away from Greenland tariff fears back to underlying market structure.

This recovery is notable because it is being driven by spot demand, not leverage chasing. Funding rates remain neutral, suggesting a healthy rebuild of positions rather than a speculative frenzy.

Traders should watch the close today. A convincing hold above $90,000 validates th

The market has effectively erased the weekend's panic-driven sell-off. Bitcoin is currently testing the crucial $90,000 psychological level as the narrative shifts away from Greenland tariff fears back to underlying market structure.

This recovery is notable because it is being driven by spot demand, not leverage chasing. Funding rates remain neutral, suggesting a healthy rebuild of positions rather than a speculative frenzy.

Traders should watch the close today. A convincing hold above $90,000 validates th

BTC-0,04%

- Reward

- 1

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

JUST IN: Bitcoin Defends $88,000 Support as Weekend Sell-Off Exhausts Liquidity.

The bleeding has finally stopped. After a relentless slide driven by geopolitical fears, Bitcoin found a hard floor at $87,950 during the Asian Monday open. The aggressive selling pressure that dominated the weekend has evaporated, leaving the market in a state of quiet accumulation.

This is a classic "absorption" phase.

Order book data shows that whales are not chasing price; they are simply parking massive limit buy orders below $88k and letting retail panic-sellers fill them. Funding rates have flipped back to

The bleeding has finally stopped. After a relentless slide driven by geopolitical fears, Bitcoin found a hard floor at $87,950 during the Asian Monday open. The aggressive selling pressure that dominated the weekend has evaporated, leaving the market in a state of quiet accumulation.

This is a classic "absorption" phase.

Order book data shows that whales are not chasing price; they are simply parking massive limit buy orders below $88k and letting retail panic-sellers fill them. Funding rates have flipped back to

BTC-0,04%

- Reward

- like

- Comment

- Repost

- Share

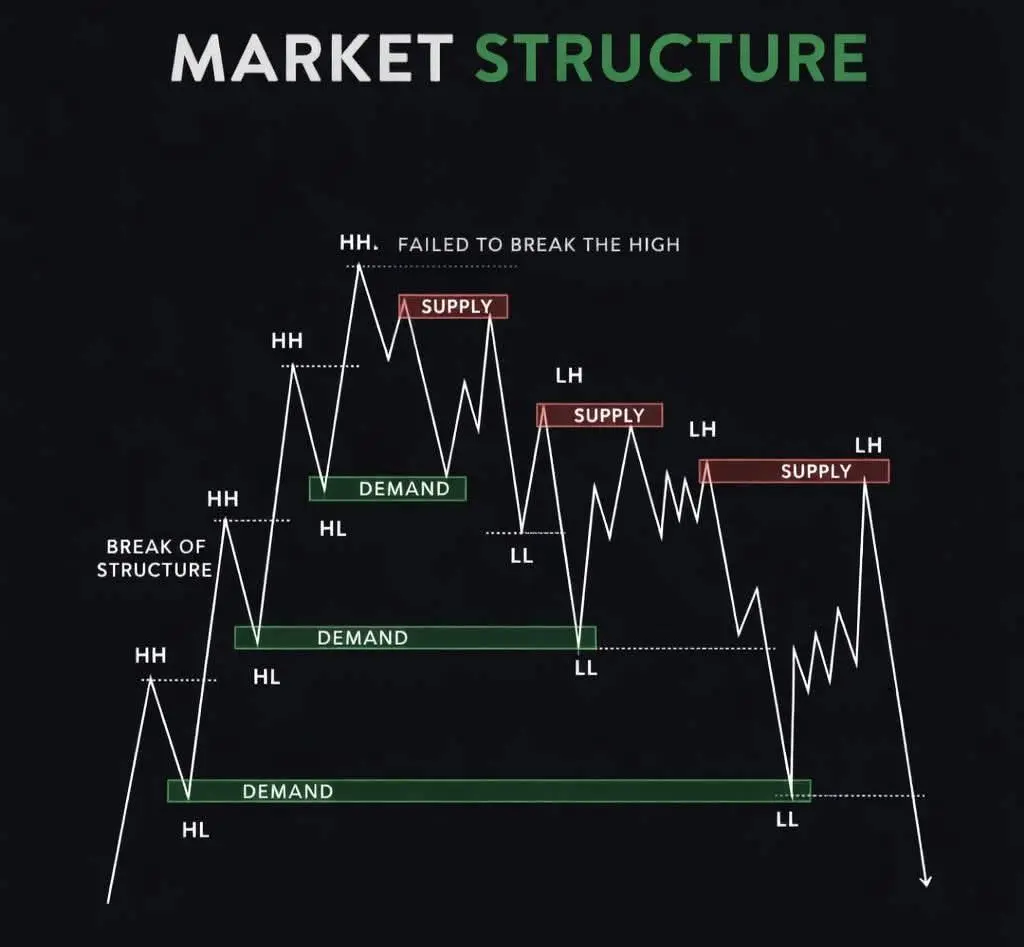

Step 1: Identify the trend

Higher Highs (HH) + Higher Lows (HL) → Uptrend

Lower Highs (LH) + Lower Lows (LL) → Downtrend

Trend is your directional bias, not an entry.

Step 2: Mark demand and supply

Demand forms after strong bullish moves (institutions buy here)

Supply forms after strong bearish moves (institutions sell here) These zones matter more than random support & resistance.

Step 3: Watch for Break of Structure (BOS)

When price breaks a previous HH or LL, it signals trend continuation or shift

No BOS = no confirmation

Step 4: Understand failed highs

When price fails to break the high, i

Higher Highs (HH) + Higher Lows (HL) → Uptrend

Lower Highs (LH) + Lower Lows (LL) → Downtrend

Trend is your directional bias, not an entry.

Step 2: Mark demand and supply

Demand forms after strong bullish moves (institutions buy here)

Supply forms after strong bearish moves (institutions sell here) These zones matter more than random support & resistance.

Step 3: Watch for Break of Structure (BOS)

When price breaks a previous HH or LL, it signals trend continuation or shift

No BOS = no confirmation

Step 4: Understand failed highs

When price fails to break the high, i

- Reward

- like

- Comment

- Repost

- Share

📊 ETHUSDT – Has the Structure Been Broken, or Is This a Healthy Correction?

ETH is maintaining its upward channel structure.

After the recent sharp increase, the price has pulled back to the middle band of the channel and the ascending trend line, consolidating.

📌 The technical setup is clear:

The upward channel is still active

3.10k–3.12k region is a short-term balance zone

Upper band: 3.15k – 3.20k

Lower band / trend support: 3.00k – 3.03k

🧠 What does this mean?

Such pullbacks are usually a pause within the trend.

As long as the price stays above support, the structure is not considered b

View OriginalETH is maintaining its upward channel structure.

After the recent sharp increase, the price has pulled back to the middle band of the channel and the ascending trend line, consolidating.

📌 The technical setup is clear:

The upward channel is still active

3.10k–3.12k region is a short-term balance zone

Upper band: 3.15k – 3.20k

Lower band / trend support: 3.00k – 3.03k

🧠 What does this mean?

Such pullbacks are usually a pause within the trend.

As long as the price stays above support, the structure is not considered b

- Reward

- 17

- 12

- Repost

- Share

Lock_433 :

:

Just Go for it 💪View More

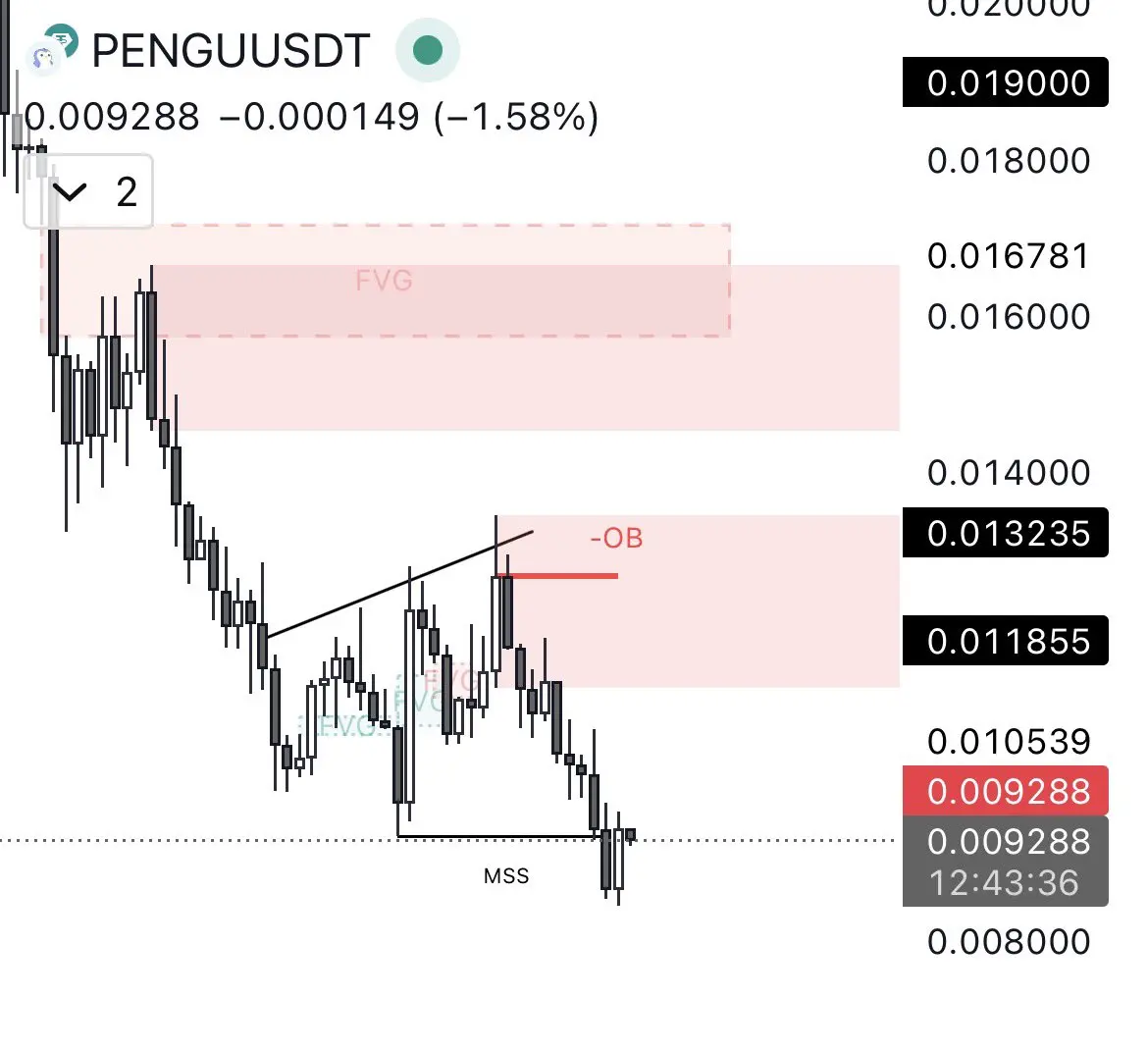

$PENGU is trading at a critical technical zone.

Price rejected cleanly from a major supply area and printed a clear market structure shift on the lower timeframe. This reaction suggests sellers are still defending the level with strength.

As long as price remains below this zone, continuation toward the downside remains the higher-probability scenario.

Bias flips only if supply fails and structure reclaims.

Patience > Prediction.

Let the level decide.

#Crypto #Altcoins #MarketStructure #PriceAction

Price rejected cleanly from a major supply area and printed a clear market structure shift on the lower timeframe. This reaction suggests sellers are still defending the level with strength.

As long as price remains below this zone, continuation toward the downside remains the higher-probability scenario.

Bias flips only if supply fails and structure reclaims.

Patience > Prediction.

Let the level decide.

#Crypto #Altcoins #MarketStructure #PriceAction

PENGU-2,24%

- Reward

- like

- Comment

- Repost

- Share

#IstheMarketBottoming? 📉 A Forward-Looking Deep Dive into Current Market Dynamics

One of the most persistent questions investors are asking right now is whether the market is finally forming a durable bottom—or if recent strength is simply another temporary bounce within a broader corrective phase. History reminds us that true market bottoms are rarely obvious in real time. They are slow, emotionally exhausting processes that test conviction, patience, and discipline long before clarity appears.

Market bottoms are not single moments; they are phases of transition. Price stabilization often co

One of the most persistent questions investors are asking right now is whether the market is finally forming a durable bottom—or if recent strength is simply another temporary bounce within a broader corrective phase. History reminds us that true market bottoms are rarely obvious in real time. They are slow, emotionally exhausting processes that test conviction, patience, and discipline long before clarity appears.

Market bottoms are not single moments; they are phases of transition. Price stabilization often co

XRP-1,36%

- Reward

- 17

- 82

- Repost

- Share

Peacefulheart :

:

Happy New Year! 🤑View More

🧠 Smart Money Signal: ETH vs BTC Rotation Is Brewing

One of the most interesting signals in the market right now isn’t price — it’s positioning.

A well-known BTC OG whale has increased their ETH long exposure to ~$736M. This isn’t a random trade. It’s a rotation.

So what does this tell us?

🔁 From BTC Safety → ETH Opportunity

Historically, capital flows in stages:

1️⃣ BTC leads during fear and uncertainty

2️⃣ ETH outperforms when risk appetite returns

3️⃣ Altcoins follow once confidence spreads

When experienced capital rotates from BTC into ETH, it often signals:

BTC downside risk is stabiliz

One of the most interesting signals in the market right now isn’t price — it’s positioning.

A well-known BTC OG whale has increased their ETH long exposure to ~$736M. This isn’t a random trade. It’s a rotation.

So what does this tell us?

🔁 From BTC Safety → ETH Opportunity

Historically, capital flows in stages:

1️⃣ BTC leads during fear and uncertainty

2️⃣ ETH outperforms when risk appetite returns

3️⃣ Altcoins follow once confidence spreads

When experienced capital rotates from BTC into ETH, it often signals:

BTC downside risk is stabiliz

- Reward

- 11

- 14

- Repost

- Share

MissCrypto :

:

Watching Closely 🔍️View More

#GateSquareCreatorNewYearIncentives 2026 Crypto Reality Check: From Speculation to Structure

The crypto market in 2026 feels very different from previous cycles.

Momentum is no longer driven by noise or hype alone — structure, liquidity, and execution are starting to matter again.

This phase rewards patience, positioning, and understanding where capital is actually moving — not where Twitter says it’s going.

🔍 Key Market Shifts I’m Tracking

Here are the three areas where smart capital seems to be concentrating early this year:

1️⃣ Core Infrastructure & Platform Networks

Projects with real usa

The crypto market in 2026 feels very different from previous cycles.

Momentum is no longer driven by noise or hype alone — structure, liquidity, and execution are starting to matter again.

This phase rewards patience, positioning, and understanding where capital is actually moving — not where Twitter says it’s going.

🔍 Key Market Shifts I’m Tracking

Here are the three areas where smart capital seems to be concentrating early this year:

1️⃣ Core Infrastructure & Platform Networks

Projects with real usa

- Reward

- 10

- 15

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

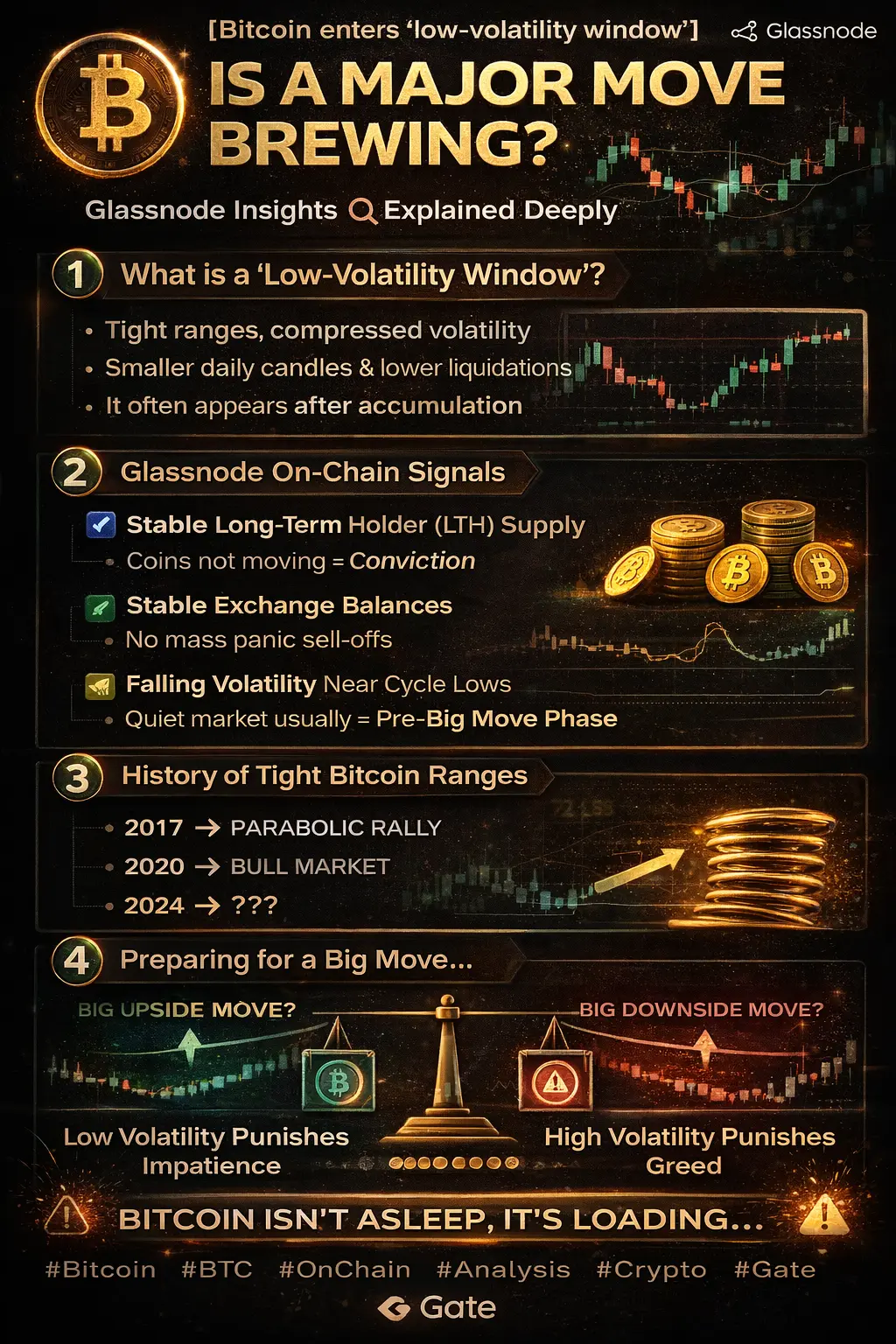

#GateProofOfReservesReport 📊 Bitcoin Market Insight | Glassnode Perspective

Bitcoin is entering what Glassnode calls a low-volatility window — a phase where price action becomes quiet, ranges tighten, and emotions cool down.

Historically, these periods are not signs of weakness. They often represent market balance, where sellers step back and long-term holders stay firm. On-chain data shows declining realized volatility, stable holder supply, and no aggressive exchange inflows — all signs of compression, not distribution.

Bitcoin has a habit of storing energy during these calm phases. When vo

Bitcoin is entering what Glassnode calls a low-volatility window — a phase where price action becomes quiet, ranges tighten, and emotions cool down.

Historically, these periods are not signs of weakness. They often represent market balance, where sellers step back and long-term holders stay firm. On-chain data shows declining realized volatility, stable holder supply, and no aggressive exchange inflows — all signs of compression, not distribution.

Bitcoin has a habit of storing energy during these calm phases. When vo

BTC-0,04%

- Reward

- 8

- 8

- Repost

- Share

CryptoFire :

:

Buy To Earn 💎View More

#FedRateCutComing

Watching price charts alone only scratches the surface the real opportunity lies in structural changes.

The crypto market has been hot lately, but the rise and fall of prices is only part of the story. Smart money is now focusing on policy-level shifts, particularly the US regulatory framework, which is undergoing a significant overhaul. This could become a key catalyst for institutional inflows by 2026.

Three forces are converging:

1️⃣ The Trump administration is refining its regulatory approach. Ambiguity is giving way to clarity, which institutional investors highly valu

Watching price charts alone only scratches the surface the real opportunity lies in structural changes.

The crypto market has been hot lately, but the rise and fall of prices is only part of the story. Smart money is now focusing on policy-level shifts, particularly the US regulatory framework, which is undergoing a significant overhaul. This could become a key catalyst for institutional inflows by 2026.

Three forces are converging:

1️⃣ The Trump administration is refining its regulatory approach. Ambiguity is giving way to clarity, which institutional investors highly valu

DEFI-3,27%

- Reward

- 6

- 8

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

50.22K Popularity

13.54K Popularity

9.86K Popularity

4.5K Popularity

3.84K Popularity

3.9K Popularity

3.37K Popularity

3.22K Popularity

69.52K Popularity

112.06K Popularity

77.98K Popularity

20.06K Popularity

45.56K Popularity

37.53K Popularity

176.23K Popularity

News

View MoreData: 36,400 SOL transferred from an anonymous address, worth approximately $4.5 million

15 m

Data: 130 BTC transferred from multiple anonymous addresses to Wintermute, worth approximately $11.17 million

55 m

Trump hopes the Federal Reserve will lower interest rates

1 h

Moonbirds announces BIRD tokenomics: total supply of 1 billion tokens, with 65% allocated to the community

1 h

Moonbirds launches Birb Game One, unclaimed community tokens will be redistributed through the game

1 h

Pin