# Marketupdate

16.94K

Luna_Star

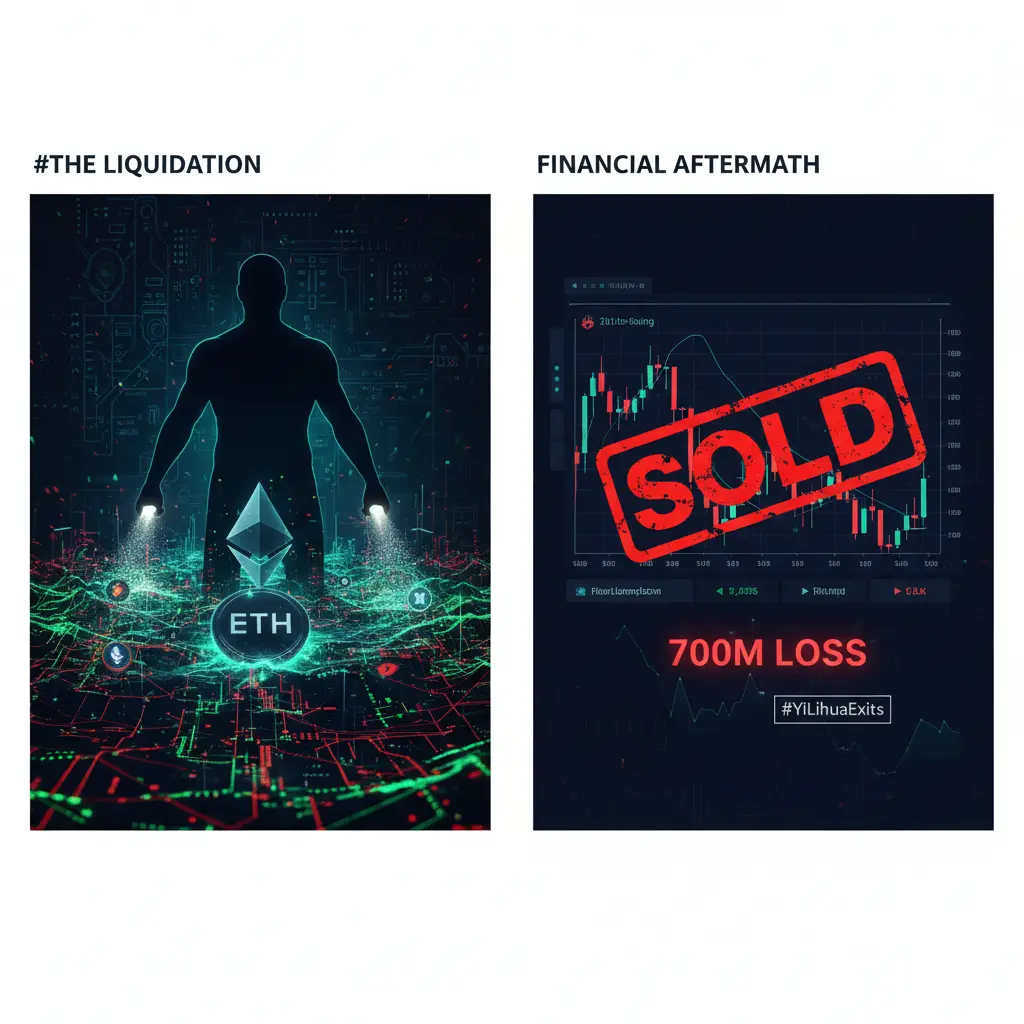

#YiLihuaExitsPositions

Date: 11 February 2026

Crypto markets are reacting to a major sell-off by Yi Lihua, a prominent investor, who has reportedly exited several key positions. Here’s the detailed breakdown

━━━━━━━━━━━━━━━━━━

🔹 1️⃣ Who Is Yi Lihua?

Yi Lihua is a well-known investor in the crypto space, often making moves that influence market sentiment. Their portfolio changes are closely watched by traders and institutions alike.

Exiting positions can signal strategic portfolio adjustments or a reaction to market conditions.

━━━━━━━━━━━━━━━━━━

🔹 2️⃣ Scope of the Exit

• Multiple high-cap

Date: 11 February 2026

Crypto markets are reacting to a major sell-off by Yi Lihua, a prominent investor, who has reportedly exited several key positions. Here’s the detailed breakdown

━━━━━━━━━━━━━━━━━━

🔹 1️⃣ Who Is Yi Lihua?

Yi Lihua is a well-known investor in the crypto space, often making moves that influence market sentiment. Their portfolio changes are closely watched by traders and institutions alike.

Exiting positions can signal strategic portfolio adjustments or a reaction to market conditions.

━━━━━━━━━━━━━━━━━━

🔹 2️⃣ Scope of the Exit

• Multiple high-cap

- Reward

- 5

- 5

- Repost

- Share

HighAmbition :

:

thnxx for sharing information about cryptoView More

Altcoins Rebound as Sentiment Improves

As Bitcoin stabilizes, altcoins are leading the recovery:

• Ethereum ($ETH ) holds near $2,100 following a major whale purchase

• XRP ($XRP ) up over 25% in 72 hours, trading near $1.45

The Fear & Greed Index is moving from Extreme Fear toward Neutral, signaling early risk appetite returning.

📈 Observation:

Rotation into large-cap altcoins typically follows BTC stabilization—not before it.

#ETH #XRP #Altcoins #MarketUpdate

As Bitcoin stabilizes, altcoins are leading the recovery:

• Ethereum ($ETH ) holds near $2,100 following a major whale purchase

• XRP ($XRP ) up over 25% in 72 hours, trading near $1.45

The Fear & Greed Index is moving from Extreme Fear toward Neutral, signaling early risk appetite returning.

📈 Observation:

Rotation into large-cap altcoins typically follows BTC stabilization—not before it.

#ETH #XRP #Altcoins #MarketUpdate

- Reward

- like

- Comment

- Repost

- Share

#GlobalTechSell-OffHitsRiskAssets:

📉 Tech Sell-Off Sends Shockwaves Across Markets 📉

Global technology stocks are facing heavy losses, dragging risk assets down with them. Investors are cautious as volatility spikes.

💡 Key points:

Major tech giants hit by sharp declines

Risk assets including crypto and emerging markets impacted

Traders watching for potential rebound or further downside

#GlobalTechSellOff #MarketUpdate #Investing #CryptoNews

📉 Tech Sell-Off Sends Shockwaves Across Markets 📉

Global technology stocks are facing heavy losses, dragging risk assets down with them. Investors are cautious as volatility spikes.

💡 Key points:

Major tech giants hit by sharp declines

Risk assets including crypto and emerging markets impacted

Traders watching for potential rebound or further downside

#GlobalTechSellOff #MarketUpdate #Investing #CryptoNews

- Reward

- like

- Comment

- Repost

- Share

#BitcoinDropsBelow$65K 🚨📉

Bitcoin has officially broken below the $65,000 level — and that changes short-term structure.

This isn’t just a dip.

This is a key psychological and technical breakdown.

What this means:

🔻 Stop-loss clusters below $66K have been triggered

🔻 Liquidations likely accelerating volatility

🔻 Short-term trend shifting bearish

Now the focus shifts to reaction — not emotion.

📊 Key Zones to Watch: • Immediate support: $60K–$62K

• Deeper demand: $55K–$58K

• Reclaim level for recovery: Back above $67K

If BTC quickly reclaims $65K with strong volume, this could turn into a

Bitcoin has officially broken below the $65,000 level — and that changes short-term structure.

This isn’t just a dip.

This is a key psychological and technical breakdown.

What this means:

🔻 Stop-loss clusters below $66K have been triggered

🔻 Liquidations likely accelerating volatility

🔻 Short-term trend shifting bearish

Now the focus shifts to reaction — not emotion.

📊 Key Zones to Watch: • Immediate support: $60K–$62K

• Deeper demand: $55K–$58K

• Reclaim level for recovery: Back above $67K

If BTC quickly reclaims $65K with strong volume, this could turn into a

BTC-2,51%

- Reward

- 18

- 21

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#FedLeadershipImpact – How Much Did Fed Leadership Change Affect Markets?

When President Trump nominated Kevin Warsh, a known monetary hawk, as Fed Chair, markets reacted immediately—but this was more of a policy repricing than a crash.

📉 Short-Term Market Shock

Crypto: Bitcoin fell from ~$78K → $68K (-12–13%). Total crypto market cap dropped 8–10% ($400–500B wiped out).

US Equities: Nasdaq & high-growth tech: -6–9%, S&P 500: -4–6%, AI & speculative stocks: -10–15%.

Why: Markets feared faster balance sheet reduction, less emergency liquidity, and fewer surprise rate cuts. Risk assets sold fir

When President Trump nominated Kevin Warsh, a known monetary hawk, as Fed Chair, markets reacted immediately—but this was more of a policy repricing than a crash.

📉 Short-Term Market Shock

Crypto: Bitcoin fell from ~$78K → $68K (-12–13%). Total crypto market cap dropped 8–10% ($400–500B wiped out).

US Equities: Nasdaq & high-growth tech: -6–9%, S&P 500: -4–6%, AI & speculative stocks: -10–15%.

Why: Markets feared faster balance sheet reduction, less emergency liquidity, and fewer surprise rate cuts. Risk assets sold fir

BTC-2,51%

- Reward

- 8

- 9

- Repost

- Share

CryptoFiler :

:

2026 GOGOGO 👊View More

📊🌐 #CryptoMarketStructureUpdate – Navigating Market Shifts ⚡

Crypto market structure continuously evolve ho rahi hai, affecting liquidity, trading patterns, and investor behavior. Traders ke liye ye samajhna critical hai. 🪙

✨ Key Insights:

Liquidity & volume changes across major markets 💧

Shift between spot & derivatives trading 📈

Signals for trend continuation or potential reversals 🔄

💡 Gate.io Tip:

Use real-time charts, order-book data, and analytical tools on Gate.io to stay aligned with market structure changes and refine your trading strategy. 🛡️

Stay informed. Trade strategically

Crypto market structure continuously evolve ho rahi hai, affecting liquidity, trading patterns, and investor behavior. Traders ke liye ye samajhna critical hai. 🪙

✨ Key Insights:

Liquidity & volume changes across major markets 💧

Shift between spot & derivatives trading 📈

Signals for trend continuation or potential reversals 🔄

💡 Gate.io Tip:

Use real-time charts, order-book data, and analytical tools on Gate.io to stay aligned with market structure changes and refine your trading strategy. 🛡️

Stay informed. Trade strategically

- Reward

- 3

- Comment

- Repost

- Share

📊🌐 #CryptoMarketStructureUpdate – Navigating Market Shifts ⚡

Crypto market structure continuously evolve ho rahi hai, affecting liquidity, trading patterns, and investor behavior. Traders ke liye ye samajhna critical hai. 🪙

✨ Key Insights:

Liquidity & volume changes across major markets 💧

Shift between spot & derivatives trading 📈

Signals for trend continuation or potential reversals 🔄

💡 Gate.io Tip:

Use real-time charts, order-book data, and analytical tools on Gate.io to stay aligned with market structure changes and refine your trading strategy. 🛡️

Stay informed. Trade strategically

Crypto market structure continuously evolve ho rahi hai, affecting liquidity, trading patterns, and investor behavior. Traders ke liye ye samajhna critical hai. 🪙

✨ Key Insights:

Liquidity & volume changes across major markets 💧

Shift between spot & derivatives trading 📈

Signals for trend continuation or potential reversals 🔄

💡 Gate.io Tip:

Use real-time charts, order-book data, and analytical tools on Gate.io to stay aligned with market structure changes and refine your trading strategy. 🛡️

Stay informed. Trade strategically

- Reward

- 3

- Comment

- Repost

- Share

Here’s a professional post for Gate.io on #CryptoMarketStructureUpdate:📊🔍 #CryptoMarketStructureUpdate – Navigating Market ShiftsThe crypto market structure continues to evolve, reflecting changes in liquidity, trading behavior, and investor sentiment. Understanding these shifts is essential for smarter decision-making. ⚖️✨ What Traders Should Watch:Changes in liquidity and volume distribution 💧Shifts between spot and derivatives markets 📈Market structure signals that may indicate trend continuation or reversal 🔄💡 Gate.io Insight:Use advanced charts, order-book data, and real-time analyt

- Reward

- 3

- Comment

- Repost

- Share

📈 When Will Bitcoin (BTC) Rebound?

Bitcoin rebounds don’t come with a calendar — they come with signals.

🔍 What to watch right now:

Strong support holding after a pullback

Selling pressure fading (lower red volume)

Higher lows forming on the chart

Momentum indicators showing bullish divergence

🕰️ Reality check:

BTC usually rebounds when fear peaks and weak hands exit. Historically, these phases are followed by sharp moves up.

💡 Smart move:

Don’t chase pumps. Accumulate near strong support and wait for confirmation, not hope.

🚀 Patience pays in crypto. The rebound comes to those who wait,

Bitcoin rebounds don’t come with a calendar — they come with signals.

🔍 What to watch right now:

Strong support holding after a pullback

Selling pressure fading (lower red volume)

Higher lows forming on the chart

Momentum indicators showing bullish divergence

🕰️ Reality check:

BTC usually rebounds when fear peaks and weak hands exit. Historically, these phases are followed by sharp moves up.

💡 Smart move:

Don’t chase pumps. Accumulate near strong support and wait for confirmation, not hope.

🚀 Patience pays in crypto. The rebound comes to those who wait,

BTC-2,51%

- Reward

- 5

- 11

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

JUST IN: Bitcoin Opens February Trading with Strong Spot Bid Above $94,500.

The new month has started with immediate buy-side aggression. During the Asian session, Bitcoin decisively reclaimed the $94,500 pivot point, effectively erasing the uncertainty of the weekend consolidation. This move is significant because it is driven by genuine spot volume rather than leveraged speculation.

We are seeing a healthy market reset.

Despite the price increase, funding rates across major derivatives platforms remain near neutral. This divergence indicates that the rally is being fueled by institutional ac

The new month has started with immediate buy-side aggression. During the Asian session, Bitcoin decisively reclaimed the $94,500 pivot point, effectively erasing the uncertainty of the weekend consolidation. This move is significant because it is driven by genuine spot volume rather than leveraged speculation.

We are seeing a healthy market reset.

Despite the price increase, funding rates across major derivatives platforms remain near neutral. This divergence indicates that the rally is being fueled by institutional ac

BTC-2,51%

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

224.5K Popularity

50.56K Popularity

18.35K Popularity

15.21K Popularity

15.78K Popularity

84.61K Popularity

5.5K Popularity

10.58K Popularity

6.77K Popularity

3.54K Popularity

4.9K Popularity

14.39K Popularity

3.6K Popularity

21.2K Popularity

13.28K Popularity

News

View MoreGate releases January Private Wealth Management Report: Market Volatility Intensifies, Quantitative Strategies Demonstrate Steady Return Capabilities

7 m

A major whale in a certain wave re-entered the market after two months, accumulating 3,700 ETH worth $7.31 million.

8 m

The MGBX platform will hold the "AI Agent Trading Carnival" limited-time event from February 12 to 28.

12 m

MGBX will be listed on Aztec (AZTEC) pre-market trading pair on February 11.

14 m

Super short positions betting against ETH starting from $2940 are gradually closing, with a remaining position of $16.45 million.

17 m

Pin