Post content & earn content mining yield

placeholder

GateUser-eb11e30d

- Reward

- 1

- Comment

- Repost

- Share

#TokenizedSilverTrend

The rise of the Tokenized Silver Trend is gaining strong momentum today, reflecting a broader shift in how investors interact with traditional precious metals through blockchain technology. As digital finance continues to mature, tokenized silver is emerging as a bridge between the stability of physical assets and the efficiency of decentralized systems. This trend allows investors to gain exposure to silver without the traditional challenges of storage, transportation, or liquidity constraints, making it especially attractive in a market environment shaped by volatility

The rise of the Tokenized Silver Trend is gaining strong momentum today, reflecting a broader shift in how investors interact with traditional precious metals through blockchain technology. As digital finance continues to mature, tokenized silver is emerging as a bridge between the stability of physical assets and the efficiency of decentralized systems. This trend allows investors to gain exposure to silver without the traditional challenges of storage, transportation, or liquidity constraints, making it especially attractive in a market environment shaped by volatility

- Reward

- like

- Comment

- Repost

- Share

zb

资本家

Created By@ForgottenMemories

Listing Progress

0.00%

MC:

$3.23K

Create My Token

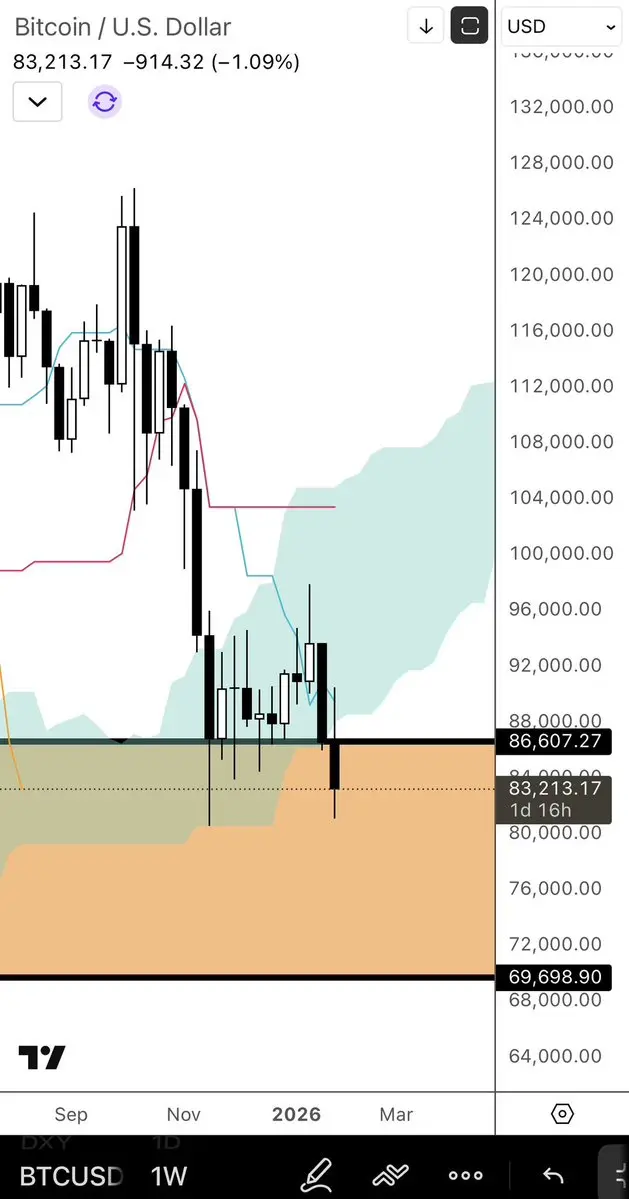

This is a WP Range it belongs to a very HTF - It will be important this year. Of course 86K has been a major level for us since Oct 2024 if you remember. Those are the levels to break for each animal you all love to identify with. Ultimately the TREND and price structure is your friend. Mark those levels, and let things flow without bias or emotions. To those who pay attention I’m extremely sure this year can be a very profitable one if the mindset is in the right place. The next one, 2027, even better! $BTC WP > One step ahead!👺

BTC0,74%

- Reward

- 1

- Comment

- Repost

- Share

RIPPLE AND STELLAR ARE IN THE EPSTEIN EMAILS 😭😭😭😭😭

- Reward

- like

- Comment

- Repost

- Share

Gold and silver market overview last night: The prices of gold and silver experienced fluctuations due to various factors, including international economic data and geopolitical events. Gold prices rose slightly as investors sought safe-haven assets amid market uncertainties, while silver showed mixed movements influenced by industrial demand and currency fluctuations. Overall, the market remained volatile, with traders closely monitoring upcoming economic reports and policy decisions that could impact precious metal prices.

View Original- Reward

- like

- Comment

- Repost

- Share

my two cents as someone who knows how USDe works:the peg was maintained at all times on 10/10 even though 8 BILLION USD was redeemed thereafter they passed a major stress test. it’s actually really bullish on ENA the issue was using a market driven oracle on which liquidated users. it did not reflect the fact that USDe is perfectly collateralised notice how huge loops of the same kind on aave did not get liquidated

- Reward

- 1

- 1

- Repost

- Share

Sanam_Chowdhury :

:

thanks for letting us know thatBTC ETH XRP Markets Analysis

- Reward

- like

- Comment

- Repost

- Share

According to CEIC data, the physical silver supply at the Shanghai Futures Exchange has decreased from 482 tons to 455.06 tons...

- Reward

- 1

- 3

- Repost

- Share

GateUser-562b8b04 :

:

2026 GOGOGO 👊View More

Today's real-time trend orders (1/31/)

Come back to short (suggestion; total position not exceeding 10%, 10x leverage)

ETH

Open position stop-loss range (26) points

Price direction; short around 2659

First take profit level; around 2639

Second take profit level; around 2619

Third take profit level; around 2599

BTC

Open position stop-loss range (470) points

Price direction; short around 83290

First take profit level; around 82928

Second take profit level; around 82566

Third take profit level; around 82204

After the first take profit (reduce position by 30%) / stop-loss cost

After the second tak

View OriginalCome back to short (suggestion; total position not exceeding 10%, 10x leverage)

ETH

Open position stop-loss range (26) points

Price direction; short around 2659

First take profit level; around 2639

Second take profit level; around 2619

Third take profit level; around 2599

BTC

Open position stop-loss range (470) points

Price direction; short around 83290

First take profit level; around 82928

Second take profit level; around 82566

Third take profit level; around 82204

After the first take profit (reduce position by 30%) / stop-loss cost

After the second tak

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Down bad but spiritually bullish.🙂#Crypto #NFTs

- Reward

- like

- Comment

- Repost

- Share

Multi-cycle Trend Forecast: Bottoming Out or Running Away?

Clear Answers by Cycle

Different holding periods require completely different operational logic. Never blindly bottom fish or cut losses; precise responses are the key!

1. Short-term (1-7 days): Decisively wait and see, refuse to bottom fish!

Bitcoin: Slight support around $81,000. If it stabilizes, it could rebound to $83,000-$84,000. If it breaks below, it will test the $80,000 level.

Ethereum: $2,636 is short-term support. If it holds, it can test $2,750-$2,780. If it breaks, it will head straight to $2,600.

Core advice: Bottom fish

View OriginalClear Answers by Cycle

Different holding periods require completely different operational logic. Never blindly bottom fish or cut losses; precise responses are the key!

1. Short-term (1-7 days): Decisively wait and see, refuse to bottom fish!

Bitcoin: Slight support around $81,000. If it stabilizes, it could rebound to $83,000-$84,000. If it breaks below, it will test the $80,000 level.

Ethereum: $2,636 is short-term support. If it holds, it can test $2,750-$2,780. If it breaks, it will head straight to $2,600.

Core advice: Bottom fish

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

SB

神币

Created By@GoodMorning,Tianyou

Listing Progress

0.00%

MC:

$3.29K

Create My Token

But UEFA won\'t stop doing business with football. Why not - PSG v Real Madrid - Inter Milan v Atletico Madrid - Dortmund v Juventus - Newcastle v BenficaAt least let small teams rest small. They will do everything to smuggle the big boys in. We all know who will advance to the next round sha.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

It already killed the desire, it really did... now I'm not just uninterested in trading crypto assets, it actually turns me off from it... this is not fear, it's disgust.

View Original

- Reward

- like

- 1

- Repost

- Share

Bratzdnipra :

:

And I don't know if this will last long.Will gold fill this gap?

View Original

- Reward

- like

- Comment

- Repost

- Share

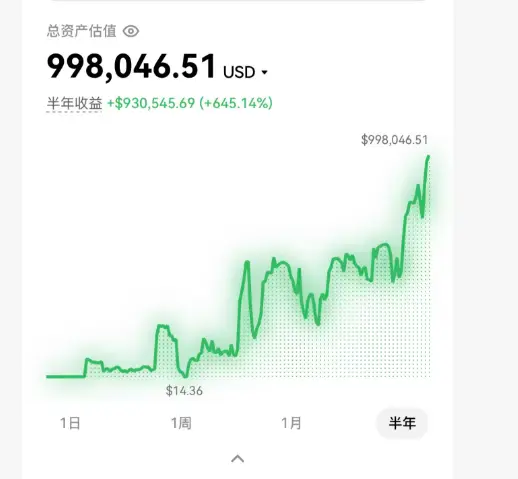

Since October last year, the 90,000-figure goal has officially reached 1M today. Time to enjoy the New Year with peace of mind.

View Original

- Reward

- like

- Comment

- Repost

- Share

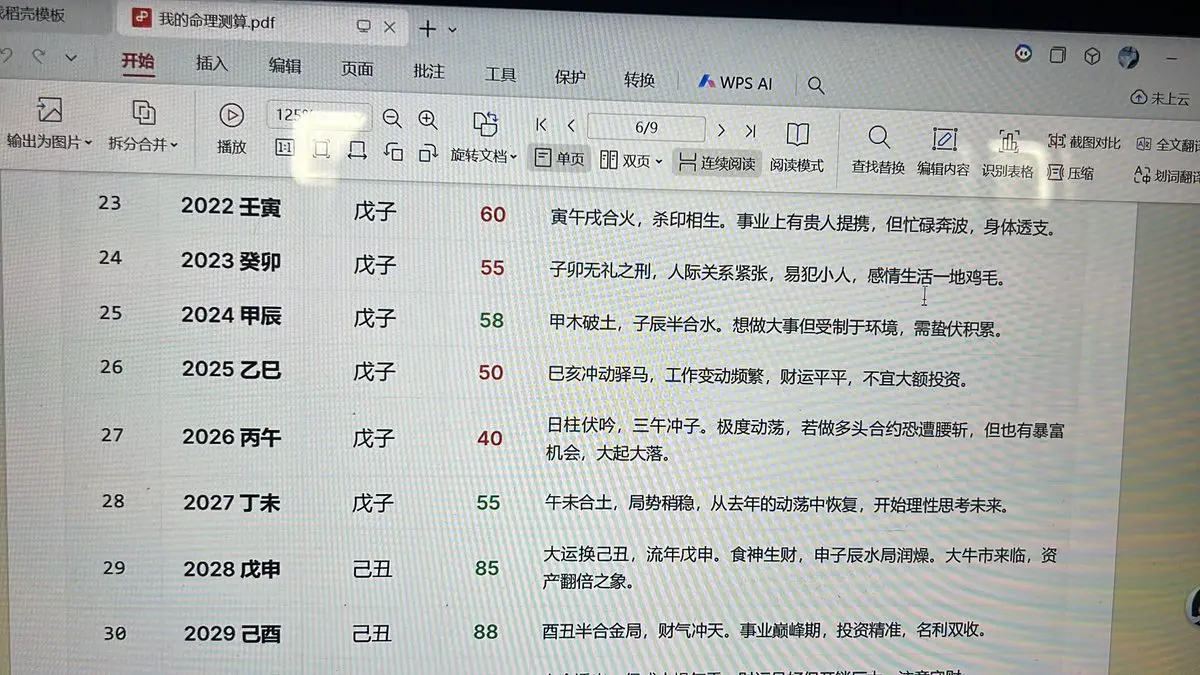

Mistakes should be admitted promptly! I admit that this wave of judgment errors, blindly bottom-fishing $CRCL , led to heavy losses. It has a very strong correlation with the crypto circle! Coupled with the upcoming stock unlock on the 11th of next month and the expected decrease in potential income, it was ruthlessly sold off by the market! I still have a long-term positive outlook on it, but I was too heavily leveraged, and I had to manually cut losses and exit ☹. Looking back, the initial version of my life K-line calculation was quite accurate. This year, my assets were halved in just the

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More33.73K Popularity

44.39K Popularity

360.65K Popularity

37.37K Popularity

55.62K Popularity

News

View MoreData: 492 PAXG transferred out from Bitcoin Suisse, then relayed to another anonymous address

2 m

Cap Co-Founder: CAP will not have an airdrop; the public offering will constitute nearly 100% of the circulating supply at TGE

24 m

"ETH holding for 4 years switches to WBTC" whale swaps $9.06 million worth of WETH for WBTC

36 m

Analysis: Silver correction causes tokenized futures liquidation volume to surpass Bitcoin

40 m

2.3 billion USD in funds, with a whale's ETH long position only $350 away from the liquidation price.

40 m

Pin