Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

TradFi

Gold

Trade global traditional assets with USDT in one place

Options

Hot

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

New

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Affiliate

Enjoy exclusive commissions and earn high returns

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

TradFi

Connect stocks, metals, commodities, forex, and indices

Asset Management

New

One‑stop asset management solution

Institutional

New

Professional digital asset solutions for institutions

OTC Bank Transfer

Deposit and withdraw fiat

Broker Program

Generous API rebate mechanisms

Gate Vault

Keep your assets secure

300364 "One" Character Limit Up! Humanoid Robots to Make a Major Appearance at the Year of the Horse Spring Festival Gala Investors Rush to Buy 7 Performance-Growing Stocks

Humanoid robots are expected to open up a broader market space than automobiles.

AIGC Concept Stocks Hit Limit Up in the Morning

In the morning of February 9, the A-share major indices opened higher and continued to rise, with the ChiNext Index up over 3%. AIGC concept stocks Chinese Online and Haikan Holdings both hit the daily limit up, with Chinese Online (300364) closing with over 330,000 buy orders at the limit. Besides Chinese Online and Haikan Holdings, other AIGC concept stocks that hit the limit in the morning include Jiecheng Holdings, Fengyu Zhu, Zhangyue Technology, Gravity Media, Perfect World, and Huanrui Century.

On the news front, recently, an AI video generation model called Seedance2.0 has once again gone viral across the internet domestically and internationally. According to official information, Seedance2.0, launched by ByteDance, can create cinema-grade videos based on text or images.

Orient Securities pointed out that Seedance2.0 is expected to be widely applied first in short content such as AI web dramas and AI short plays, further promoting significant cost reduction and efficiency improvement in web drama/short drama production and releasing production capacity. Companies with IP reserves and platform traffic advantages are likely to benefit fully.

Products from Multiple Robot Companies

Will Appear on the Year of the Horse Spring Festival Gala

As the China Central Radio and Television Station’s “2026 Spring Festival Gala” (referred to as “2026 Spring Gala”) approaches, a “hard technology” feast has quietly begun. Recently, several robot companies announced they became official strategic partners for smart travel for the 2026 Spring Gala; some companies’ robots have also been designated as embodied large model robots for the event. Industry estimates suggest that more than five embodied intelligent companies will participate in the 2026 Spring Gala, with robots “grouping” onto the stage.

The appearance of multiple brands of embodied intelligent robots at the Spring Gala marks a major “roadshow” for China’s robot industry from laboratory experiments toward commercialization. From an industry development perspective, Zhu Minghao, Executive Director of the China High-End Manufacturing Research Center at Beijing Jiaotong University, believes that embodied intelligence industries represented by humanoid robots are moving from single-point breakthroughs to industry breakthroughs, gradually evolving from technical validation to large-scale commercial expansion, entering the stages of value validation and mass production.

The industry market prospects are equally promising. Guohai Securities pointed out that humanoid robots are expected to open up a broader market space than automobiles, and the industry chain will迎来 an important investment opportunity from “0 to 1.”

IDC data shows that in 2025, China’s embodied intelligent robot user expenditure will exceed $1.4 billion, soaring to $77 billion by 2030, with an annual compound growth rate of 94%. Morgan Stanley expects that in 2026, China will ship 14,000 humanoid robots, with annual doubling in the following years, reaching over one million units by 2034, and potentially 30 million units by 2041, catching up with the passenger car market size.

35 Concept Stocks Expect Good Performance

Based on announced earnings forecasts and performance reports, using the lower limit of net profit forecasts (or the announced figure if no lower limit), there are 35 humanoid robot concept stocks expected to see year-over-year growth in net profit in 2025 (including those turning losses into profits).

Eight stocks are expected to turn losses into profits, including Lierade, Estun, Maidi Technology, Tianqi Shares, Tuosda, and others.

Lierade expects net profit for 2025 to be between 300 million and 380 million yuan, turning profitable year-over-year. During the reporting period, the company entered a new strategic cycle, aiming to “embrace AI, lead visual effects, and achieve a second growth curve,” gradually building an industrial ecosystem of “AI + display + cultural tourism.” The company previously stated on investor interaction platforms that its core Optitrack optical motion capture has been applied in the embodied intelligence industry, including humanoid robots, providing a one-stop solution from data collection and processing to simulation training and real machine training.

Twenty-seven stocks are expected to see performance growth based on last year’s profits, with Xinzhigu Group, Shenghong Technology, Zhenghai Magnetic Materials, Daoshi Technology, and Ningbo Yunsheng among the top performers in profit growth.

Xinzhigu Group expects net profit for 2025 to be between 127 million and 151 million yuan, a year-over-year increase of 502.59% to 616.94%. Currently, the company’s humanoid robot motor-related products are progressing smoothly, with related products already delivered for testing.

Funding Investors Rush to Buy 7 Stocks

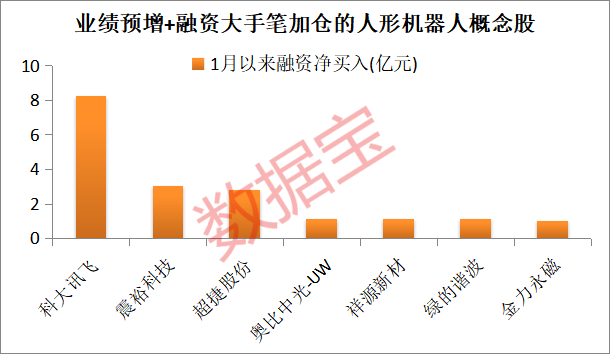

In terms of capital flow, among the 35 humanoid robot concept stocks with expected performance growth, as of the close on February 6, seven stocks had net financing inflows exceeding 100 million yuan since January. These are iFlytek, Zhenyu Technology, Chaojie Shares, Oubo Zhongguang-UW, Xiangyuan New Material, Green Harmonics, and Jinli Permanent Magnet.

iFlytek had the largest net financing inflow in January, totaling 826 million yuan. The company provides AI services centered on multimodal perception interaction and large model brains through the iFlytek Robot Superbrain platform, serving over 500 intelligent robot manufacturers including humanoid robots, quadruped robots, and public service robots.

Zhenyu Technology saw a net financing inflow of 304 million yuan since January. Its products in the robot field, such as linear actuators, reverse planetary roller screws, and dexterous hand precision components, have achieved small batch deliveries to some leading domestic and international robot clients, with smooth progress.

Chaojie Shares experienced a net financing inflow of 280 million yuan since January. It offers various fasteners, PEEK material products, sensor bases, and high-precision machining products for humanoid robots. Some small batch samples and formal orders have already been obtained from clients.

( )

)

(Source: Data Treasure)