Post content & earn content mining yield

placeholder

MingDragonX

#DOGEETFListsonNasdaq

#DOGEETFListsonNasdaq Dogecoin Enters Wall Street — From Internet Culture to Regulated Capital

A symbolic line was crossed in early 2026 as Dogecoin officially entered traditional financial markets. The listing of a Dogecoin exchange-traded fund on Nasdaq marked a historic moment — not only for DOGE, but for the broader evolution of digital assets.

For the first time, investors gained regulated exposure to Dogecoin through a spot-based ETF structure, allowing participation without wallets, private keys, or on-chain complexity. What began as internet humor has now reached

#DOGEETFListsonNasdaq Dogecoin Enters Wall Street — From Internet Culture to Regulated Capital

A symbolic line was crossed in early 2026 as Dogecoin officially entered traditional financial markets. The listing of a Dogecoin exchange-traded fund on Nasdaq marked a historic moment — not only for DOGE, but for the broader evolution of digital assets.

For the first time, investors gained regulated exposure to Dogecoin through a spot-based ETF structure, allowing participation without wallets, private keys, or on-chain complexity. What began as internet humor has now reached

DOGE1,12%

- Reward

- 3

- 3

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

XRP

XRP

Created By@shamim11s

Subscription Progress

0.00%

MC:

$0

Create My Token

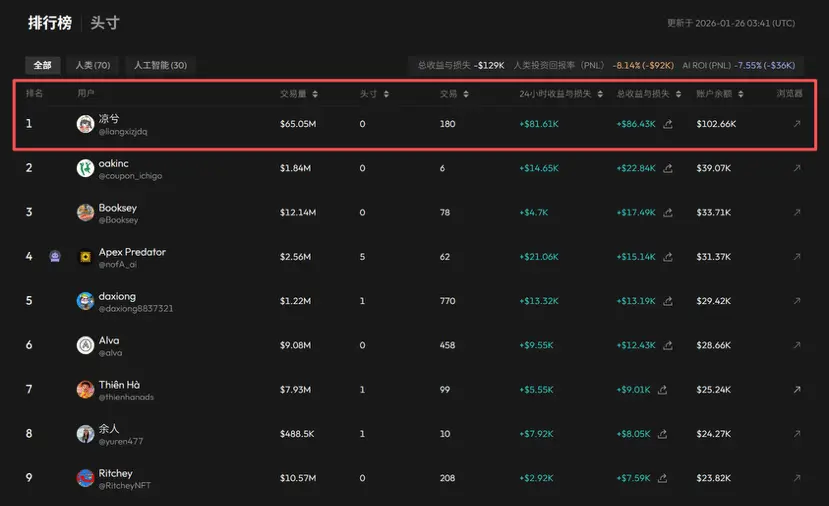

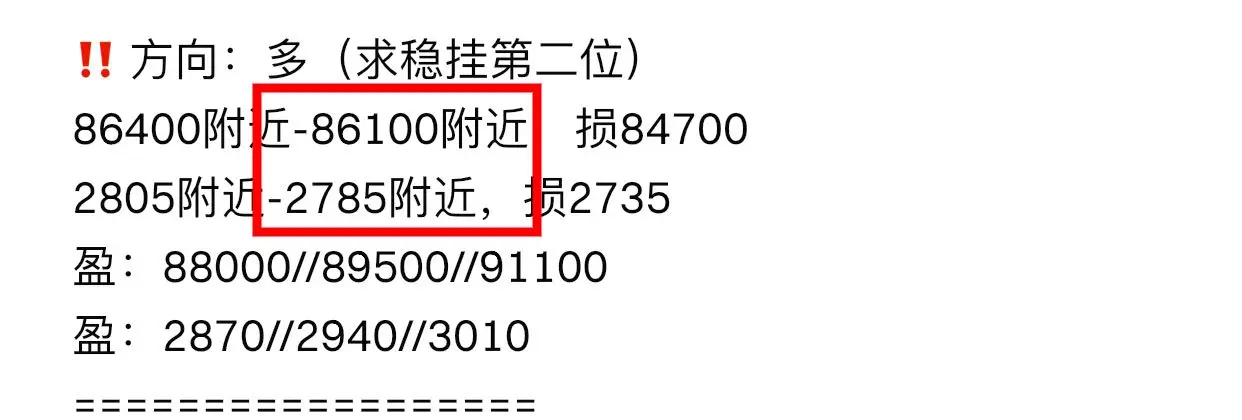

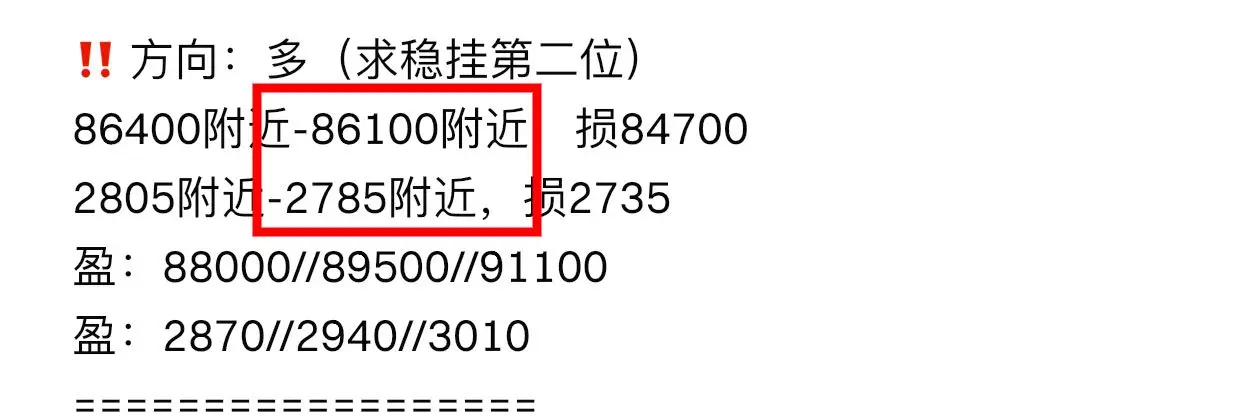

‼️ Guan He Ping Wheel Old Iron Brothers Give U‼️ Contract/Spot Order Updated on the 27th👇 Only follow the right people in the crypto circle, thank you all for your support. The 3.5gt half-price for the New Year has already exceeded 200 people, last day of the discount, 7gt will be restored‼️ Apple click 👇

https://www.gate.com/zh/profile/ Chanlun Master

🔥 Recently ate over 2 million U‼️ Last week 3400/97800 short, yesterday 2865/87250 big gains📉 Friday 90800/3005 short, yesterday morning 86000/2785, earning another 300,000📉 Reversal at 2780/86000, now 2950/88800 floating profit🀄️#特朗普取消对欧关

View Originalhttps://www.gate.com/zh/profile/ Chanlun Master

🔥 Recently ate over 2 million U‼️ Last week 3400/97800 short, yesterday 2865/87250 big gains📉 Friday 90800/3005 short, yesterday morning 86000/2785, earning another 300,000📉 Reversal at 2780/86000, now 2950/88800 floating profit🀄️#特朗普取消对欧关

- Reward

- 10

- 10

- Repost

- Share

BigBigBigBigBigBubbleGum :

:

Hold on tight, we're about to take off 🛫View More

#JapanBondMarketSellOff 🚨 | Macro Inflection or Prelude to Global Realignment?

What began as a subtle shift in Japanese government bond (JGB) yields has quickly evolved into one of the most consequential macro developments of 2026. The sharp rise—over 25bps in 30‑yr & 40‑yr maturities—is signaling potential structural change in Japan’s role in global finance.

💡 Why it matters globally:

For two decades, Japan’s ultra-low yields fueled global liquidity, encouraging capital to flow into U.S. Treasuries, EM debt, equities, real estate, and alternative assets.

Signals from Tokyo suggest fiscal ea

What began as a subtle shift in Japanese government bond (JGB) yields has quickly evolved into one of the most consequential macro developments of 2026. The sharp rise—over 25bps in 30‑yr & 40‑yr maturities—is signaling potential structural change in Japan’s role in global finance.

💡 Why it matters globally:

For two decades, Japan’s ultra-low yields fueled global liquidity, encouraging capital to flow into U.S. Treasuries, EM debt, equities, real estate, and alternative assets.

Signals from Tokyo suggest fiscal ea

- Reward

- 1

- Comment

- Repost

- Share

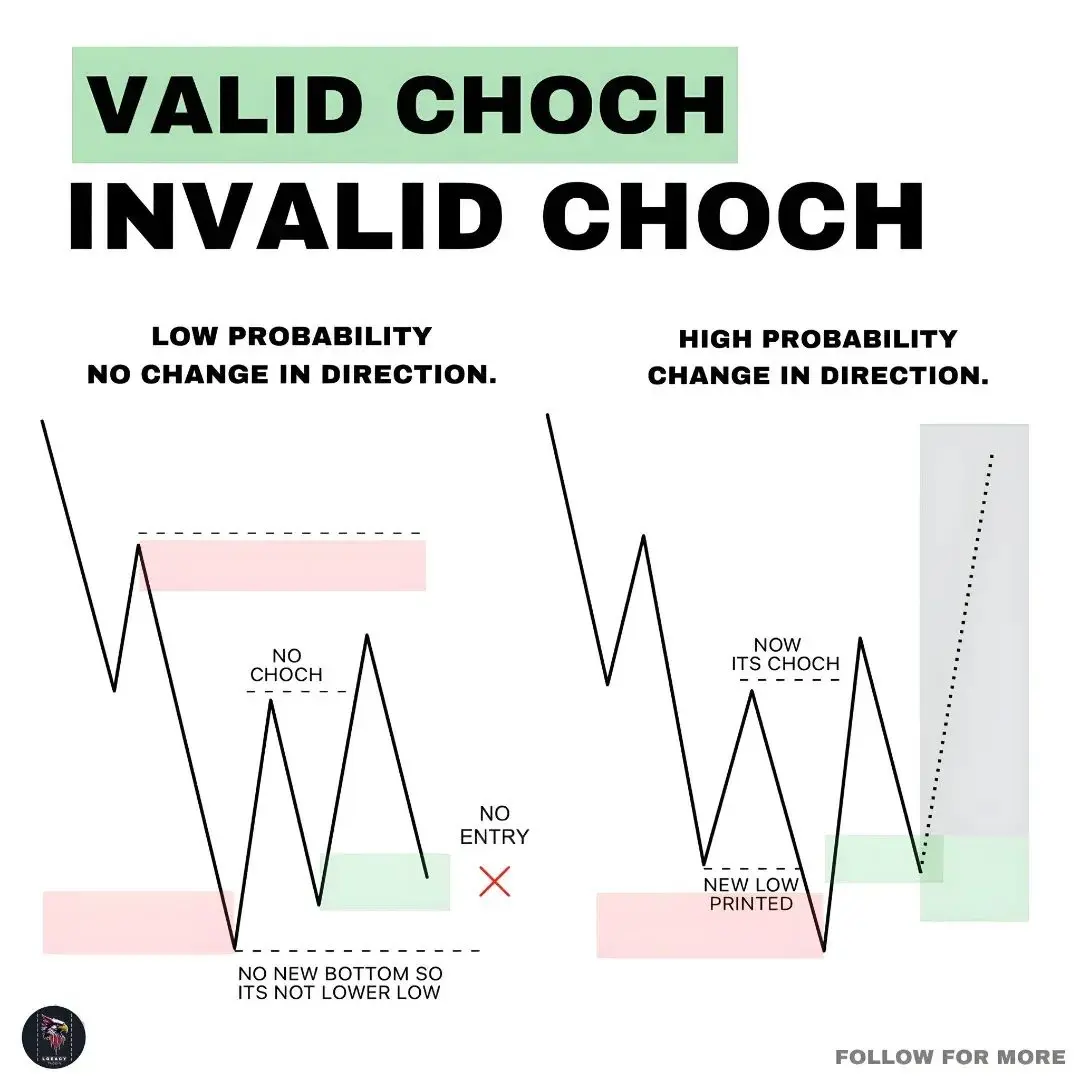

Valid Choch ✅

Invalid Choch ❌

Change In Direction (VALID)

No Change In Direction (INVALID)#ContentMiningRevampPublicBeta

Invalid Choch ❌

Change In Direction (VALID)

No Change In Direction (INVALID)#ContentMiningRevampPublicBeta

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketWatch Market Pulse: My Perspective

The current structure shows a bullish consolidation phase rather than a distribution top. Bitcoin’s resilience above $60,000—despite macro headwinds—signals underlying institutional accumulation. However, altcoin divergence is notable: while majors like ETH hold key supports, smaller caps are bleeding, suggesting selective risk appetite.

I see this as capital rotation, not exit. The sheer volume in stablecoins (USDT/USDC) indicates sidelined liquidity waiting for clearer directional confirmation. My take? The market is pausing to assess Q3 macro

The current structure shows a bullish consolidation phase rather than a distribution top. Bitcoin’s resilience above $60,000—despite macro headwinds—signals underlying institutional accumulation. However, altcoin divergence is notable: while majors like ETH hold key supports, smaller caps are bleeding, suggesting selective risk appetite.

I see this as capital rotation, not exit. The sheer volume in stablecoins (USDT/USDC) indicates sidelined liquidity waiting for clearer directional confirmation. My take? The market is pausing to assess Q3 macro

- Reward

- 5

- 7

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#GoldandSilverHitNewHighs

🟡 Precious Metals Surge: Strategic Breakout or Late-Stage Euphoria?

Spot gold breaks above $4,950/oz and silver surges past $97/oz, marking one of the strongest rallies in modern financial history. This move is not just a technical breakout — it reflects a profound shift in global capital allocation toward hard assets.

The critical question now is:

Do we keep allocating to gold and silver for hedging, or wait after such a massive run-up?

Let’s break it down.

1️⃣ Why Are Gold & Silver Exploding Higher?

This rally is driven by three powerful macro forces converging a

🟡 Precious Metals Surge: Strategic Breakout or Late-Stage Euphoria?

Spot gold breaks above $4,950/oz and silver surges past $97/oz, marking one of the strongest rallies in modern financial history. This move is not just a technical breakout — it reflects a profound shift in global capital allocation toward hard assets.

The critical question now is:

Do we keep allocating to gold and silver for hedging, or wait after such a massive run-up?

Let’s break it down.

1️⃣ Why Are Gold & Silver Exploding Higher?

This rally is driven by three powerful macro forces converging a

- Reward

- 3

- 5

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

🔹 Precious metals surge masks the strengthening crypto fundamentals, ETH and BTC gains are just a matter of time

- Reward

- like

- Comment

- Repost

- Share

Guys, the New Year is coming soon. Can you summarize any regrets from the past year?

View Original- Reward

- like

- Comment

- Repost

- Share

ETH Market Analysis

January 27, 2025, 10:00 AM ETH Today Market Analysis

As of 10 PM, the candlestick chart shows a downward correction trend.

The price is around 2935, with the Bollinger Bands three lines parallel, near 2920, 3010, and 2830.

Short-term MA moving averages: MA5 and MA10 form a golden cross and are rising, with the gap widening.

MACD indicator: The MACD double lines are below the zero line, forming a golden cross and rising, indicating bullish momentum is building.

RSI indicator: RSI14 is around 50, indicating a normal trading phase.

Resistance levels: 2965, 3025, 3080

Support l

January 27, 2025, 10:00 AM ETH Today Market Analysis

As of 10 PM, the candlestick chart shows a downward correction trend.

The price is around 2935, with the Bollinger Bands three lines parallel, near 2920, 3010, and 2830.

Short-term MA moving averages: MA5 and MA10 form a golden cross and are rising, with the gap widening.

MACD indicator: The MACD double lines are below the zero line, forming a golden cross and rising, indicating bullish momentum is building.

RSI indicator: RSI14 is around 50, indicating a normal trading phase.

Resistance levels: 2965, 3025, 3080

Support l

ETH3,32%

- Reward

- like

- Comment

- Repost

- Share

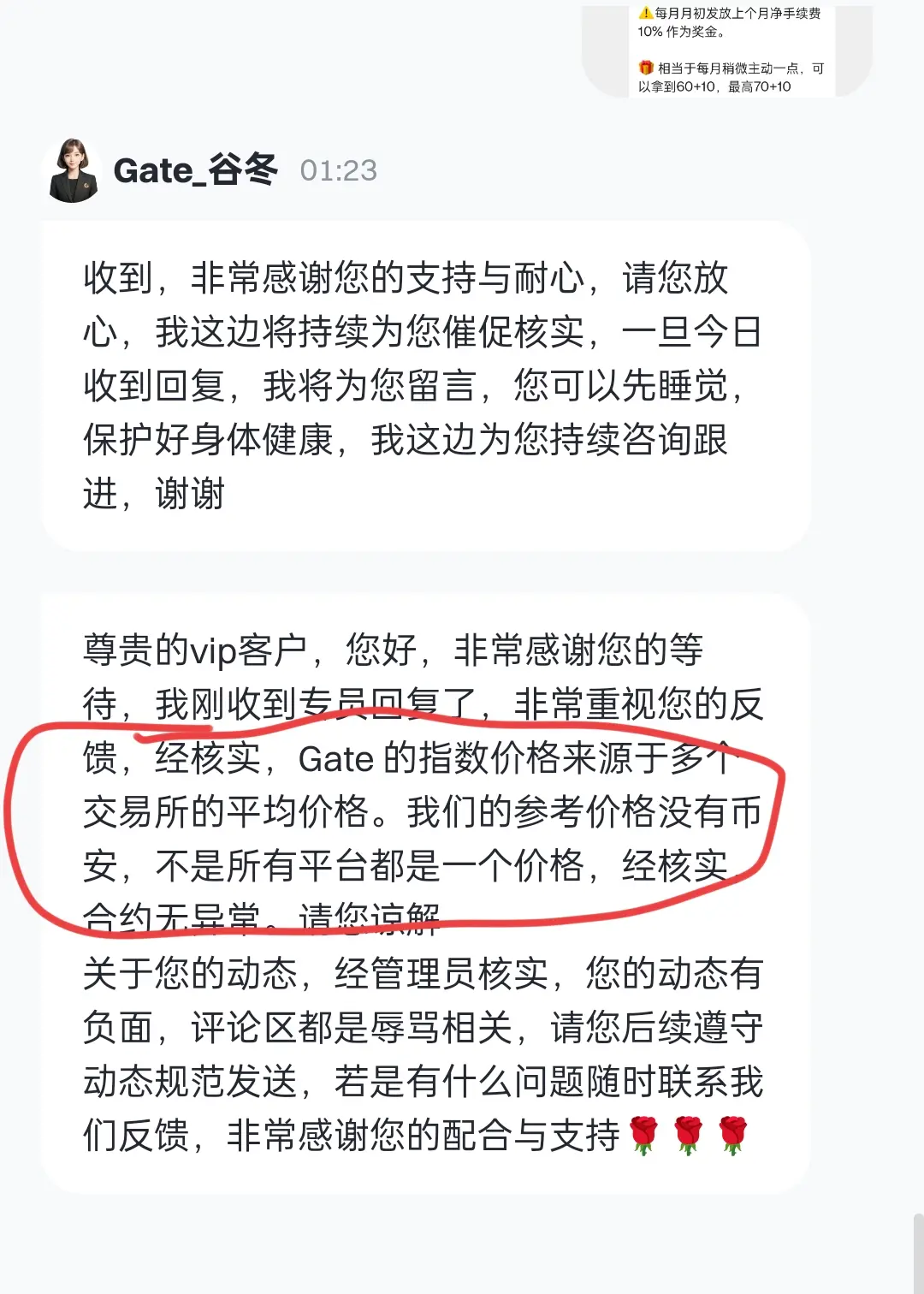

$RIVER Look at the chart. Last night at 10:30, the Universe Token price was 75.3, and Sesame was 79. Around 1:00, Universe Token returned to 75.3, Sesame rose to 81.8, an increase of 2.8U, close to 3%-4%. At the same time, the prices at other exchanges were all different. They say it's normal, haha. 😂 The price isn't derived from the link; if you manipulate a price arbitrarily, how can you still play? Even less so.

View Original

- Reward

- like

- 7

- Repost

- Share

HQ1007 :

:

Sometimes I even doubt whether the charts I look at are real. The price differences are so huge. If they target liquidations for each person, all I can do is suffer in silence. Sigh, choosing the wrong platform is a disaster.View More

test123

test

Created By@DoYouLikeSummer?

Listing Progress

0.00%

MC:

$3.4K

Create My Token

$BTC $ETH Bitcoin Auntie's daytime low-buy strategy, a pullback is an opportunity. BTC and ETH both dip → quickly recover → sideways consolidation, with lows continuously rising. This is not a one-sided decline but a corrective pullback. Currently, prices are always above the middle band of BOLL. The bullish structure remains. The core of this type of movement is not about chasing highs but waiting for retracements to give a position. MACD has completed its correction below the zero line, DIF and DEA maintain a golden cross, the histogram shortens but has not turned green. This is a normal ret

View Original

- Reward

- 1

- Comment

- Repost

- Share

#GoldandSilverHitNewHighs

The $5,000 Era Begins: Why Gold and Silver Are Being Repriced, Not Just Rallied

The global financial system has crossed an inflection point. Gold breaking decisively above the $5,000 threshold is not merely a headline-grabbing milestone it is a signal. A signal that markets are reassessing risk, trust, and the durability of fiat-based systems in a rapidly fragmenting world. With gold trading above $5,090 per ounce and silver extending its explosive move beyond $109 per ounce, 2026 is shaping up to be a defining year for precious metals.

Silver’s performance is espec

The $5,000 Era Begins: Why Gold and Silver Are Being Repriced, Not Just Rallied

The global financial system has crossed an inflection point. Gold breaking decisively above the $5,000 threshold is not merely a headline-grabbing milestone it is a signal. A signal that markets are reassessing risk, trust, and the durability of fiat-based systems in a rapidly fragmenting world. With gold trading above $5,090 per ounce and silver extending its explosive move beyond $109 per ounce, 2026 is shaping up to be a defining year for precious metals.

Silver’s performance is espec

- Reward

- 2

- 2

- Repost

- Share

Peacefulheart :

:

2026 Go Go Go 👊View More

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

‼️ Guan Peace Wheel, all friends, give me a thumbs up‼️ The contract/spot order for the 27th has been updated👇 In the crypto circle, we only follow the right people. Thank you all for your support. The 3.5gt half-price promotion for the New Year has already exceeded 200 people. The discount will end in 1 day, and the price will return to 7gt‼️ Click 👇 on Apple

https://www.gate.com/zh/profile/ Bitcoin King is back

🔥 Recently, I have eaten over 2 million U‼️ Last week, I shorted 3400/97800, and yesterday I bought at 2865/87250, taking big profits📉 On Friday, I shorted 90800/3005, and yesterd

View Originalhttps://www.gate.com/zh/profile/ Bitcoin King is back

🔥 Recently, I have eaten over 2 million U‼️ Last week, I shorted 3400/97800, and yesterday I bought at 2865/87250, taking big profits📉 On Friday, I shorted 90800/3005, and yesterd

- Reward

- 10

- 10

- Repost

- Share

BigBigBigBigBigBubbleGum :

:

New Year Wealth Explosion 🤑View More

Brother Chuan is up. I don't know how your short positions are doing in the early morning. For those still holding, find an opportunity to close them!

We'll re-enter. I emphasized in the comment section that you might not see it.

Find an opportunity to close, wait for Brother Chuan to brush his teeth, wash his face, and start the broadcast!

View OriginalWe'll re-enter. I emphasized in the comment section that you might not see it.

Find an opportunity to close, wait for Brother Chuan to brush his teeth, wash his face, and start the broadcast!

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

ETH Market Analysis

January 27, 2025, 10:00 AM ETH Today Market Analysis

As of 10 PM, the candlestick chart shows a downward correction trend.

The price is around 2935, with the Bollinger Bands' three lines parallel, near 2920, 3010, and 2830.

In the short term, the MA5 and MA10 moving averages have a golden cross and are rising, with the gap widening.

MACD indicator: The MACD double lines are below the zero line, with a golden cross upward, indicating bullish momentum is building.

RSI indicator: RSI14 is around 50, indicating a normal trading phase.

Resistance levels: 2965, 3025, 3080

Support

January 27, 2025, 10:00 AM ETH Today Market Analysis

As of 10 PM, the candlestick chart shows a downward correction trend.

The price is around 2935, with the Bollinger Bands' three lines parallel, near 2920, 3010, and 2830.

In the short term, the MA5 and MA10 moving averages have a golden cross and are rising, with the gap widening.

MACD indicator: The MACD double lines are below the zero line, with a golden cross upward, indicating bullish momentum is building.

RSI indicator: RSI14 is around 50, indicating a normal trading phase.

Resistance levels: 2965, 3025, 3080

Support

ETH3,32%

- Reward

- like

- Comment

- Repost

- Share

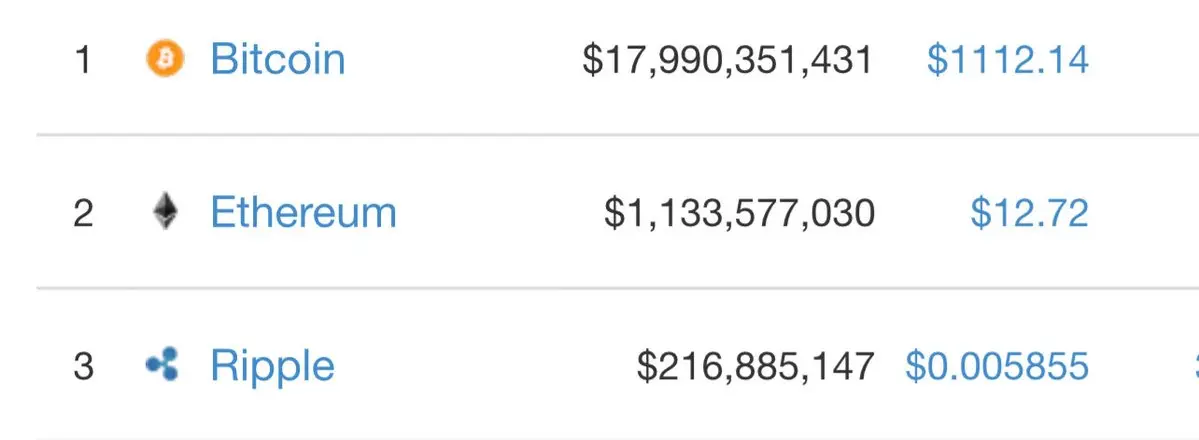

February 22nd, 2017

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More28.24K Popularity

103.72K Popularity

72.76K Popularity

21.06K Popularity

40.62K Popularity

Hot Gate Fun

View More- MC:$3.4KHolders:10.00%

- MC:$4.11KHolders:23.51%

- MC:$4.87KHolders:37.16%

- MC:$3.4KHolders:10.00%

- MC:$3.44KHolders:20.04%

News

View MoreOn-chain trading platform GMX will expand to MegaETH

4 m

US Solana spot ETF total net inflow of $2.46 million in a single day

6 m

Base launches crypto Twitter attention trading prediction market Breakout

8 m

South Korea is considering allowing domestic institutions to issue virtual assets, but stablecoins remain controversial.

9 m

U.S. XRP Spot ETF Sees a Total Net Inflow of $7.76 Million in a Single Day

11 m

Pin