Post content & earn content mining yield

placeholder

MotherHo

#现实世界资产RWA代币化 Seeing the 17 trend predictions from a16z, I have to be honest — RWA tokenization excites me but also makes me cautious.

What excites me is that this truly represents a shift in direction. Moving from purely transaction-driven to infrastructure-driven indicates that the market is finally becoming more rational. Stablecoins are becoming the key for fiat on/off ramps, which means on-chain assets now have a real value anchor, no longer just castles in the air.

But there are more reasons to be wary. I've been in this space for many years and have seen too many "innovative concepts"

View OriginalWhat excites me is that this truly represents a shift in direction. Moving from purely transaction-driven to infrastructure-driven indicates that the market is finally becoming more rational. Stablecoins are becoming the key for fiat on/off ramps, which means on-chain assets now have a real value anchor, no longer just castles in the air.

But there are more reasons to be wary. I've been in this space for many years and have seen too many "innovative concepts"

- Reward

- 3

- 3

- Repost

- Share

MamaWang :

:

Tokenized gold, silver, stocks, and real estate will become trends.View More

U.S. crypto mining stocks strengthened, with IREN up over 8, signaling a rebound in sector sentiment?

- Reward

- 1

- Comment

- Repost

- Share

#中文MEME In the rapidly changing digital age, true wealth is no longer just opportunity, but the convergence of direction and consensus. Tesma, meaning stability, strength, and journey, symbolizes a solid, powerful, and far-reaching choice in the blockchain wave. It does not chase fleeting hype, but instead carries the expectations of every holder for the future through clear mechanisms, long-term development plans, and an ever-expanding ecological application. Choosing Tesma is not just choosing a token, but choosing a visible, steady, and long-term financial path. In the compound interest of

MEME-2,71%

- Reward

- like

- Comment

- Repost

- Share

请叫我麦总

请叫我麦总

Created By@GateUser-e3e793f2

Listing Progress

0.00%

MC:

$3.44K

Create My Token

RIVER Up ~50× in One Month: Reality Check, Opportunities, and Risks

Over the past month, the RIVER token the native asset of a *chain‑abstracted DeFi infrastructure protocol has delivered an eye‑watering performance, rallying from single‑digit levels to well above previous highs, with market observers noting moves from around $4 to stratospheric levels and market capitalizations swelling into the billion‑dollar range.

At its core, River is not just another meme token; it represents a next‑generation DeFi infrastructure project built around chain abstraction and cross‑chain stablecoin mechanics

Over the past month, the RIVER token the native asset of a *chain‑abstracted DeFi infrastructure protocol has delivered an eye‑watering performance, rallying from single‑digit levels to well above previous highs, with market observers noting moves from around $4 to stratospheric levels and market capitalizations swelling into the billion‑dollar range.

At its core, River is not just another meme token; it represents a next‑generation DeFi infrastructure project built around chain abstraction and cross‑chain stablecoin mechanics

- Reward

- like

- Comment

- Repost

- Share

SEC Approves 2026 PCAOB Budget, Highlights Oversight Efforts - - #cryptocurrency #bitcoin #altcoins

BTC-0,08%

- Reward

- like

- Comment

- Repost

- Share

#ETHTrendWatch Navigates Consolidation & Volatility

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently in a phase of consolidation, with traders weighing technical signals against broader macroeconomic conditions. ETH is trading in the $2,970–$3,200 range, following a retracement from recent highs and a period of choppy, indecisive price action.

Over the past month, Ethereum has largely oscillated between $2,950 and $3,260, highlighting a market caught between accumulation and hesitation. Immediate demand repeatedly appears near $3,100–$3,200, supported by short-term movin

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently in a phase of consolidation, with traders weighing technical signals against broader macroeconomic conditions. ETH is trading in the $2,970–$3,200 range, following a retracement from recent highs and a period of choppy, indecisive price action.

Over the past month, Ethereum has largely oscillated between $2,950 and $3,260, highlighting a market caught between accumulation and hesitation. Immediate demand repeatedly appears near $3,100–$3,200, supported by short-term movin

- Reward

- 3

- 9

- Repost

- Share

GateUser-95b130c3 :

:

greatView More

$ETH $BTC Ethereum and Bitcoin Weekly Review! Pure personal insights.

Offering some speculative possibilities about institutions and market makers! Hope this helps everyone capture swings, signals, and thus improve effective market control and risk management!

Crypto insights will provide a daily update during the first half of the night on intra-swing movements, where institutions do not make high-frequency moves in a short period, and market makers do not engage in tricks, maintaining stable prices! Please stay tuned and engage in discussions.

View OriginalOffering some speculative possibilities about institutions and market makers! Hope this helps everyone capture swings, signals, and thus improve effective market control and risk management!

Crypto insights will provide a daily update during the first half of the night on intra-swing movements, where institutions do not make high-frequency moves in a short period, and market makers do not engage in tricks, maintaining stable prices! Please stay tuned and engage in discussions.

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

On Friday, the three major US stock indices showed mixed performance, with the Dow Jones Industrial Average closing down nearly 0.6%. The Consumer Discretionary ETF rose about 0.8%, leading the US stock sector ETFs. Apple dipped slightly by 0.12%, marking a nearly 4% decline for the week and the eighth consecutive week of decline, the longest losing streak since May 2022.

Following a sharp decline in the US dollar, precious metal prices continued to soar. Gold prices briefly surpassed $4,990, hitting a new all-time high, up over 8% this week. Silver and platinum reached historic highs, with we

View OriginalFollowing a sharp decline in the US dollar, precious metal prices continued to soar. Gold prices briefly surpassed $4,990, hitting a new all-time high, up over 8% this week. Silver and platinum reached historic highs, with we

- Reward

- like

- Comment

- Repost

- Share

【$SKR Signal】Short | Volume Breakout Downtrend

$SKR is experiencing a volume surge and a crash, with a daily decline of over 26%. Combined with high open interest, this is a typical forced liquidation sell-off rather than a healthy correction.

🎯 Direction: Short (Short)

🎯 Entry: 0.0305 - 0.0315

🛑 Stop Loss: 0.0335 ( Rigid stop loss, breaking this level invalidates the downward structure )

🚀 Target 1: 0.0270

🚀 Target 2: 0.0240

Price action indicates market sentiment has shifted to panic. Massive sell-offs accompanied by high open interest suggest that long leverage is being systematicall

$SKR is experiencing a volume surge and a crash, with a daily decline of over 26%. Combined with high open interest, this is a typical forced liquidation sell-off rather than a healthy correction.

🎯 Direction: Short (Short)

🎯 Entry: 0.0305 - 0.0315

🛑 Stop Loss: 0.0335 ( Rigid stop loss, breaking this level invalidates the downward structure )

🚀 Target 1: 0.0270

🚀 Target 2: 0.0240

Price action indicates market sentiment has shifted to panic. Massive sell-offs accompanied by high open interest suggest that long leverage is being systematicall

SKR-28,18%

- Reward

- 1

- Comment

- Repost

- Share

【$ETH Signal】Bullish — Pre-breakout after health reset

$ETH Is cooling down after the rally, with price declining and open interest remaining stable, this looks more like a healthy reset rather than large-scale distribution by the main players.

🎯Direction: Long

🎯Entry: 2950 - 2965

🛑Stop Loss: 2880 (Rigid Stop Loss)

🚀Target 1: 3050

🚀Target 2: 3150

$ETH Maintaining tight consolidation above the key support zone, with no significant drop in open interest during the decline, indicating that bulls have not exited in large numbers. Buying pressure on the lower time frame continues to absorb sel

$ETH Is cooling down after the rally, with price declining and open interest remaining stable, this looks more like a healthy reset rather than large-scale distribution by the main players.

🎯Direction: Long

🎯Entry: 2950 - 2965

🛑Stop Loss: 2880 (Rigid Stop Loss)

🚀Target 1: 3050

🚀Target 2: 3150

$ETH Maintaining tight consolidation above the key support zone, with no significant drop in open interest during the decline, indicating that bulls have not exited in large numbers. Buying pressure on the lower time frame continues to absorb sel

ETH-0,41%

- Reward

- 1

- Comment

- Repost

- Share

【$SOL Signal】Long - Healthy Reset After Liquidation and Shakeout

$SOL Price decline accompanied by high open interest shows typical bullish liquidation shakeout characteristics, rather than main force distribution. The price is undergoing a healthy reset above the key support zone.

🎯 Direction: Long

🎯 Entry: 126.50 - 127.80

🛑 Stop Loss: 124.00 ( Rigid Stop Loss )

🚀 Target 1: 132.00

🚀 Target 2: 136.50

$SOL During the decline with record high trading volume at 2049M, open interest (OI) remains high, which is a clear signal of bullish leverage being cleaned out. The price stabilizes above

$SOL Price decline accompanied by high open interest shows typical bullish liquidation shakeout characteristics, rather than main force distribution. The price is undergoing a healthy reset above the key support zone.

🎯 Direction: Long

🎯 Entry: 126.50 - 127.80

🛑 Stop Loss: 124.00 ( Rigid Stop Loss )

🚀 Target 1: 132.00

🚀 Target 2: 136.50

$SOL During the decline with record high trading volume at 2049M, open interest (OI) remains high, which is a clear signal of bullish leverage being cleaned out. The price stabilizes above

SOL-0,87%

- Reward

- 1

- Comment

- Repost

- Share

#MyFirstPostOnSquare

🔥 Gate Square Creator Economy — Just Getting Started 🔥

The next phase of crypto isn’t just about charts, trades, and tokens —

it’s about voices, ideas, and influence.

Gate Square is emerging as a true creator-first ecosystem, where:

✔ Knowledge is rewarded

✔ Consistency matters

✔ Engagement turns into real value

This isn’t a temporary campaign.

This is a long-term shift toward rewarding thinkers — not just traders.

🚀 Why Gate Square Matters

Gate Square is building a platform where:

• New creators can grow without massive followings

• Returning creators can restart witho

🔥 Gate Square Creator Economy — Just Getting Started 🔥

The next phase of crypto isn’t just about charts, trades, and tokens —

it’s about voices, ideas, and influence.

Gate Square is emerging as a true creator-first ecosystem, where:

✔ Knowledge is rewarded

✔ Consistency matters

✔ Engagement turns into real value

This isn’t a temporary campaign.

This is a long-term shift toward rewarding thinkers — not just traders.

🚀 Why Gate Square Matters

Gate Square is building a platform where:

• New creators can grow without massive followings

• Returning creators can restart witho

- Reward

- 3

- 3

- Repost

- Share

Vortex_King :

:

2026 GOGOGO 👊View More

V我50

V我50

Created By@GateUser-e3e793f2

Listing Progress

0.00%

MC:

$3.49K

Create My Token

【$KAIA Signal】Long + Volume Breakout

$KAIA Strong breakout driven by massive volume, price action indicates this is main capital entering the market, rather than just short covering.

🎯 Direction: Long

🎯 Entry: 0.0800 - 0.0830

🛑 Stop Loss: 0.0740 ( Rigid Stop Loss )

🚀 Target 1: 0.0950

🚀 Target 2: 0.1100

The price remains solid after a more than 40% increase, and a volume of 145M is strong evidence of genuine buying. Open interest is rising in tandem, confirming that new long positions are being established. There is no panic selling on the chart; pullbacks are quickly absorbed, indicatin

$KAIA Strong breakout driven by massive volume, price action indicates this is main capital entering the market, rather than just short covering.

🎯 Direction: Long

🎯 Entry: 0.0800 - 0.0830

🛑 Stop Loss: 0.0740 ( Rigid Stop Loss )

🚀 Target 1: 0.0950

🚀 Target 2: 0.1100

The price remains solid after a more than 40% increase, and a volume of 145M is strong evidence of genuine buying. Open interest is rising in tandem, confirming that new long positions are being established. There is no panic selling on the chart; pullbacks are quickly absorbed, indicatin

KAIA39,67%

- Reward

- 1

- Comment

- Repost

- Share

【$ELSA Signal】Short | Volume Breakout Downward

$ELSA is experiencing a volume surge and a crash, with a daily decline of over 24%. Combined with high open interest, this is a typical scenario of long liquidation stampede and main force distribution resonance.

🎯 Direction: Short (Short)

🎯 Entry: 0.155 - 0.160

🛑 Stop Loss: 0.170 ( Rigid stop loss, breaking this level invalidates the downward structure )

🚀 Target 1: 0.140

🚀 Target 2: 0.120

$ELSA Price action indicates a resistance-free decline, with massive volume and high open interest confirming persistent selling pressure. Market logic

$ELSA is experiencing a volume surge and a crash, with a daily decline of over 24%. Combined with high open interest, this is a typical scenario of long liquidation stampede and main force distribution resonance.

🎯 Direction: Short (Short)

🎯 Entry: 0.155 - 0.160

🛑 Stop Loss: 0.170 ( Rigid stop loss, breaking this level invalidates the downward structure )

🚀 Target 1: 0.140

🚀 Target 2: 0.120

$ELSA Price action indicates a resistance-free decline, with massive volume and high open interest confirming persistent selling pressure. Market logic

ELSA-14,31%

- Reward

- like

- Comment

- Repost

- Share

#GoldAndSilverHitRecordHighs continues to push prices to their all-time highs, creating a new legend about silver and gold that are breaking new records each time and are currently being witnessed $BTC

BTC-0,08%

- Reward

- 1

- 1

- Repost

- Share

CryptoMabuS :

:

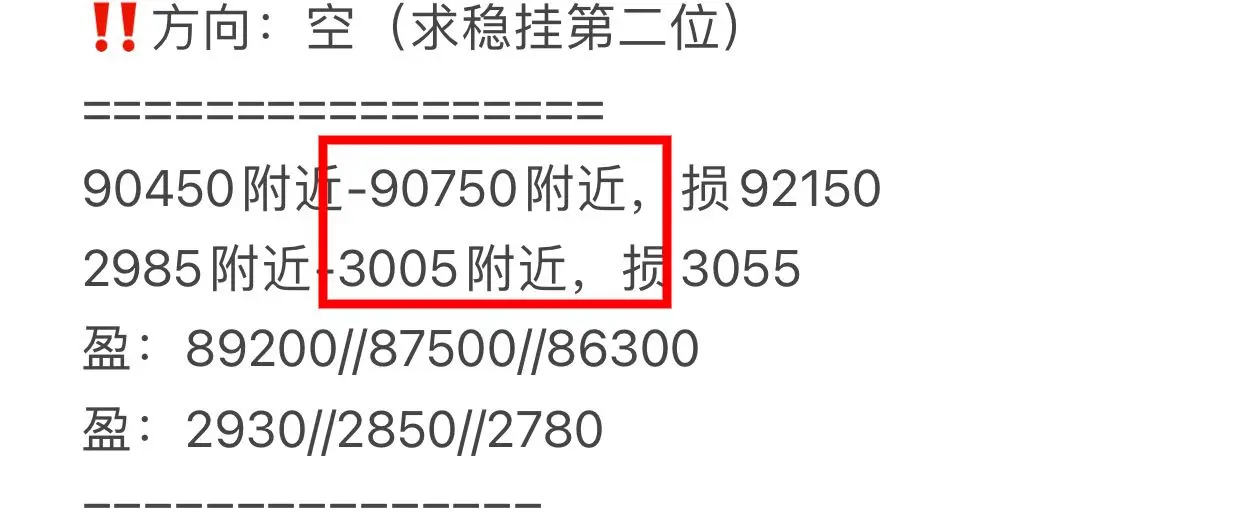

Follow me and I follow back, thank you‼️ Guan Peace Wheel Brothers, give U‼️ The 24th contract/spot order has been updated👇 In the crypto world, only follow the right people. Thank you all for your support. The 3.5gt half-price for the New Year has already exceeded 200 people. The discount will end in 1 day, restoring to 7gt‼️ Apple click 👇

https://www.gate.com/zh/profile/ Little Ghost Daily Contract

🔥 Recently ate over 2 million U‼️ Last week 3400/97800 short, yesterday 2865/87250 took big profits📉 The day before yesterday 2900/87900 reversed to long at 3065/91100, took more profits📈 Overnight reversed to short at 90800/3005

View Originalhttps://www.gate.com/zh/profile/ Little Ghost Daily Contract

🔥 Recently ate over 2 million U‼️ Last week 3400/97800 short, yesterday 2865/87250 took big profits📉 The day before yesterday 2900/87900 reversed to long at 3065/91100, took more profits📈 Overnight reversed to short at 90800/3005

- Reward

- 10

- 10

- Repost

- Share

BigBigBigBigBigBubbleGum :

:

Hold on tight, we're about to take off 🛫View More

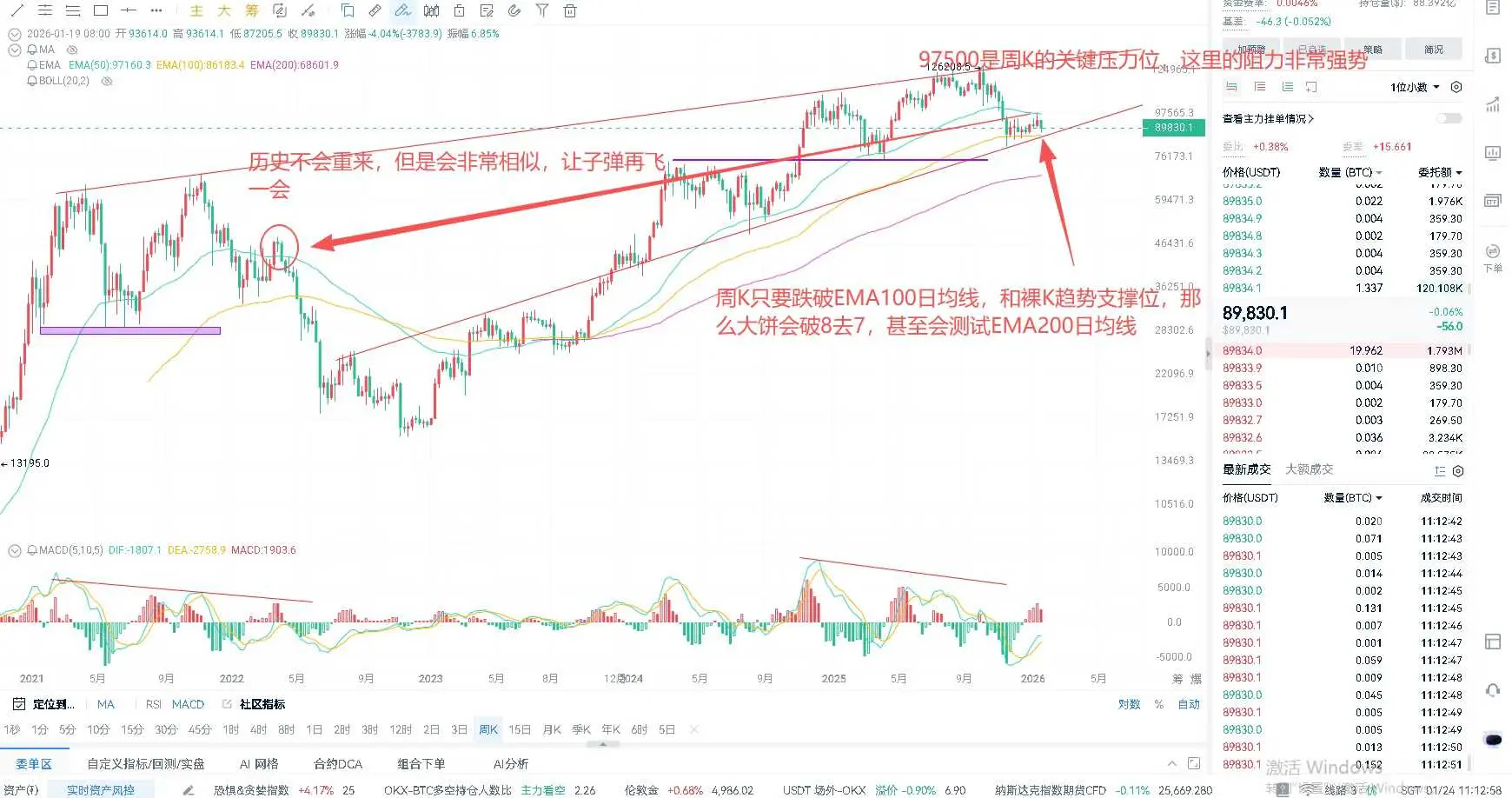

History will not repeat itself but will be very similar. Looking back, after the decline on January 17, 2020, it started to rebound and oscillate. On March 28, 2023, it reached a high of 48,200 before entering a major bear market. Then, on November 17, 2025, there was a bearish candle indicating a stop in the decline, followed by a rebound and consolidation oscillation. Bitcoin is very likely to enter a prolonged consolidation phase before moving into a major bear market. The large-scale trend has not reversed; do not be fooled by the rebound. Small-scale rebounds are normal. The upper gap is

BTC-0,08%

- Reward

- like

- Comment

- Repost

- Share

1.23 Friday Lin Man Real Trading Summary

First trade: Bitcoin short, entered at 89856, exited at 88963, gained 893 points

Second trade: Auntie short, entered at 2978, exited at 2963, gained 45 points

Third trade: Bitcoin short, entered at 89426, exited at 88649, gained 777 points

Fourth trade: Bitcoin long, entered at 88765, exited at 89690, gained 925 points

Bitcoin total gain: 2595 points, Auntie gain: 45 points

Yesterday, a total of 4 trades were executed, including 3 Bitcoin trades and 1 Auntie trade. Friday should be bearish, and this is not unfounded. The bearish trend can give up to 150

View OriginalFirst trade: Bitcoin short, entered at 89856, exited at 88963, gained 893 points

Second trade: Auntie short, entered at 2978, exited at 2963, gained 45 points

Third trade: Bitcoin short, entered at 89426, exited at 88649, gained 777 points

Fourth trade: Bitcoin long, entered at 88765, exited at 89690, gained 925 points

Bitcoin total gain: 2595 points, Auntie gain: 45 points

Yesterday, a total of 4 trades were executed, including 3 Bitcoin trades and 1 Auntie trade. Friday should be bearish, and this is not unfounded. The bearish trend can give up to 150

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More37.52K Popularity

21K Popularity

15.31K Popularity

3.87K Popularity

11.39K Popularity

Hot Gate Fun

View More- MC:$3.66KHolders:21.07%

- MC:$3.42KHolders:10.00%

- MC:$3.47KHolders:20.04%

- MC:$3.47KHolders:20.04%

- MC:$3.49KHolders:20.00%

News

View MoreParadex caused liquidation due to database maintenance errors, refunding $650,000 to 200 users

15 m

Yesterday, the US spot Ethereum ETF experienced a net outflow of $41.7 million, marking the fourth consecutive day of net outflows.

34 m

Ethereum spot ETF saw a net outflow of $41,735,800 yesterday, continuing a 4-day net outflow.

37 m

Yesterday, the US spot Bitcoin ETF experienced a net outflow of $103.5 million, marking the fourth consecutive trading day of net outflows.

38 m

Bitcoin spot ETF experienced a net outflow of $104 million yesterday, marking the fifth consecutive day of net outflows.

39 m

Pin