Post content & earn content mining yield

placeholder

PengangguranPremium

Good morning…

$BTC Bitcoin drops to 88K. No wick.

That's because of the ongoing Japanese Bond issuance, a sign that Japan will become the exit liquidity for the US. The end game is like that.

Several banks have already requested Yield Curve Control, which involves buying as many government bonds (JGB) as possible to keep the yields at that level.

While QE has a cap, for example, a maximum of 60 billion dollars per month, YCC has no cap; the BoJ will buy as much as needed.

Isn't that a clear sign that the Yen will reach 160/$, even ZH says 200/$?

What does that have to do with Bitcoin?

Bitcoin

$BTC Bitcoin drops to 88K. No wick.

That's because of the ongoing Japanese Bond issuance, a sign that Japan will become the exit liquidity for the US. The end game is like that.

Several banks have already requested Yield Curve Control, which involves buying as many government bonds (JGB) as possible to keep the yields at that level.

While QE has a cap, for example, a maximum of 60 billion dollars per month, YCC has no cap; the BoJ will buy as much as needed.

Isn't that a clear sign that the Yen will reach 160/$, even ZH says 200/$?

What does that have to do with Bitcoin?

Bitcoin

BTC-3,12%

- Reward

- like

- Comment

- Repost

- Share

The Year of the Horse Usachi is not here to explain the market, but to mock it. While others are still waiting for confirmation and drawing trend lines, this rabbit has already been rushing around wildly, riding the inertia of the Year of the Horse. It represents retail investor sentiment, community playfulness, and irrational consensus—no roadmap, no promises, only constantly shared memes and increasingly noisy chat rooms. Here, we don't sell rationality, only amplify emotions; we don't guarantee success, only guarantee participation. This is not an investment plan, but a meme conspiracy expe

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$9.1KHolders:2

23.75%

- Reward

- like

- Comment

- Repost

- Share

On January 21, 2026, the cryptocurrency market continues its weak and volatile pattern. Bitcoin repeatedly tests support in the $88,000-$90,000 range, while Ethereum battles around the $2,950-$3,000 mark, with market sentiment remaining cautious. Liquidity is relatively active during the European and American trading sessions, but there is a lack of clear directional breakthrough momentum, so attention should be paid to the effectiveness of key support levels. A break below $88,000 (BTC) and $2,900 (ETH) could trigger further corrections; conversely, if a stabilization and rebound occur, resis

View Original

- Reward

- 1

- Comment

- Repost

- Share

牛牛传奇

牛牛传奇

Created By@YearOfTheHorseMemeGlobal

Listing Progress

0.07%

MC:

$3.41K

Create My Token

- Reward

- 1

- Comment

- Repost

- Share

Christina M. Thomas will join the Corporate Finance Division as Deputy Director - #cryptocurrency #bitcoin #altcoins

BTC-3,12%

- Reward

- like

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- like

- Comment

- Repost

- Share

Recently jotting down some observations | About OWL in this Yubi Bao issue

🌀 First, the conclusion: the returns are really quite impressive

Gate's Yubi Bao this time offers a 30-day fixed-term OWL deposit, with an annualized yield directly at 200%. It’s not a long-term lock-up, nor is it some fancy strategy—just honestly locking in for 30 days to earn returns. Such an arrangement, in the current market environment, can hardly be called common.

🌀 Not a long time, and the rules are not complicated

The term is fixed at 30 days, from January 16 to February 16 (UTC+8).

Total quota is 12,800,000 O

🌀 First, the conclusion: the returns are really quite impressive

Gate's Yubi Bao this time offers a 30-day fixed-term OWL deposit, with an annualized yield directly at 200%. It’s not a long-term lock-up, nor is it some fancy strategy—just honestly locking in for 30 days to earn returns. Such an arrangement, in the current market environment, can hardly be called common.

🌀 Not a long time, and the rules are not complicated

The term is fixed at 30 days, from January 16 to February 16 (UTC+8).

Total quota is 12,800,000 O

OWL-0,6%

- Reward

- like

- Comment

- Repost

- Share

Actually, I don't want to criticize either

After all, I am deeply involved

Most likely a scam

Guess which project?

When to check the airdrop

Either KYC, registration fees, or spending money to register and only then find out you qualify for the airdrop?

All are habits!

Da Mao has always been simple, no project of Da Mao's PUA would set up a bunch of messy thresholds.

Every time, I have to bring out humanity to whip and criticize!

View OriginalAfter all, I am deeply involved

Most likely a scam

Guess which project?

When to check the airdrop

Either KYC, registration fees, or spending money to register and only then find out you qualify for the airdrop?

All are habits!

Da Mao has always been simple, no project of Da Mao's PUA would set up a bunch of messy thresholds.

Every time, I have to bring out humanity to whip and criticize!

- Reward

- like

- Comment

- Repost

- Share

1.21 Morning Market Analysis

From a technical perspective, the four-hour Bollinger Bands are clearly expanding downward. The price temporarily stabilizes near the lower band, but the middle and upper bands are simultaneously pushed down, indicating a strong bearish market sentiment. During the decline, trading volume significantly increased, especially when breaking below the key level of 90,000, with a concentrated release of sell orders, showing that the bears are in control. If subsequent rebounds lack sufficient volume, the price is likely to test lower levels again. In terms of strategy,

View OriginalFrom a technical perspective, the four-hour Bollinger Bands are clearly expanding downward. The price temporarily stabilizes near the lower band, but the middle and upper bands are simultaneously pushed down, indicating a strong bearish market sentiment. During the decline, trading volume significantly increased, especially when breaking below the key level of 90,000, with a concentrated release of sell orders, showing that the bears are in control. If subsequent rebounds lack sufficient volume, the price is likely to test lower levels again. In terms of strategy,

- Reward

- 1

- 1

- Repost

- Share

AZhouWanying :

:

New Year Wealth Explosion 🤑Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4-gold-lucky-draw?ref=VQIWBWGMCQ&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

🚨🇺🇸 Over $1.3T wiped out in U.S. stocks.

Fear is rising and markets are clearly shifting to risk-off mode

Fear is rising and markets are clearly shifting to risk-off mode

- Reward

- like

- Comment

- Repost

- Share

CTMD

CTMD

Created By@UrielHanBlackMoneyPo

Listing Progress

0.05%

MC:

$3.41K

Create My Token

#BTC Intraday Analysis

1️⃣ Structural Interpretation

Bitcoin's price today clearly weakened, briefly approaching around 95,000, then sharply falling back and dropping to approximately 88,000. It later experienced a slight rebound, with the current price around 89,000. From a structural perspective:

• Strong resistance above: encountering heavy selling pressure near the 90,000 level;

• Weak support below: rapid decline to around 88,000, short-term support is unstable;

• The overall daily rhythm leans towards a retracement and consolidation: reflecting increased short-term bearish momentum, lea

1️⃣ Structural Interpretation

Bitcoin's price today clearly weakened, briefly approaching around 95,000, then sharply falling back and dropping to approximately 88,000. It later experienced a slight rebound, with the current price around 89,000. From a structural perspective:

• Strong resistance above: encountering heavy selling pressure near the 90,000 level;

• Weak support below: rapid decline to around 88,000, short-term support is unstable;

• The overall daily rhythm leans towards a retracement and consolidation: reflecting increased short-term bearish momentum, lea

BTC-3,12%

- Reward

- 1

- Comment

- Repost

- Share

🔥 Epic Sniper! BTC Short Position Profit Surpasses 777%, Profit Storm Continues!

📊 Core Data

· Opening Average Price: 95,251.0

· Latest Price: 89,180.5

· Volatility Range: -6,070 points

· Return Rate: +777.40%

· Position Status: Bearish trend accelerating, continue holding

🎯 Trading Logic Behind Precise Layout

1. Technical Structure Recognition

· Weekly Level: Identified strong supply zone at 95,000-96,000

· Daily Confirmation: Double top pattern neckline broken, structure shifts to bearish

· Volume-Price Validation: Decline accompanied by increased trading volume, strong bearish momentum

2

📊 Core Data

· Opening Average Price: 95,251.0

· Latest Price: 89,180.5

· Volatility Range: -6,070 points

· Return Rate: +777.40%

· Position Status: Bearish trend accelerating, continue holding

🎯 Trading Logic Behind Precise Layout

1. Technical Structure Recognition

· Weekly Level: Identified strong supply zone at 95,000-96,000

· Daily Confirmation: Double top pattern neckline broken, structure shifts to bearish

· Volume-Price Validation: Decline accompanied by increased trading volume, strong bearish momentum

2

BTC-3,12%

- Reward

- like

- Comment

- Repost

- Share

Good luck and prosperity in the Year of the Horse! Just launched and about to go public. Don't miss the bottom price. The consensus in the Year of the Horse is the secret to wealth! The entire community is rushing forward. What are you waiting for? Seize this wave, go all in to get rich quickly in the crypto world, achieve financial freedom in one step, trust the consensus, increase your position, opportunities are here, speed is everything. Act now.

#PI

#PI

PI-5,35%

MC:$9.1KHolders:2

23.75%

- Reward

- 1

- Comment

- Repost

- Share

Morning View on the 21st (Recommendation: 3%, 100x leverage, total position not exceeding 5%):

ETH Long Position: Dip buy around 2848, stop loss at 2818, take profit based on rebound strength of 60-80 points, break below 200 points+

ETH Short Position: Dip sell around 2996, stop loss at 3026, no specific take profit

Remarks (Below are strong support and resistance order levels):

1. Support below 2642, consider 3% long position, stop loss at 2612, no specific take profit

2. Resistance above 3051, consider 3% short position, stop loss at 3081, no specific take profit

3. Do not over-leverage, tes

ETH Long Position: Dip buy around 2848, stop loss at 2818, take profit based on rebound strength of 60-80 points, break below 200 points+

ETH Short Position: Dip sell around 2996, stop loss at 3026, no specific take profit

Remarks (Below are strong support and resistance order levels):

1. Support below 2642, consider 3% long position, stop loss at 2612, no specific take profit

2. Resistance above 3051, consider 3% short position, stop loss at 3081, no specific take profit

3. Do not over-leverage, tes

ETH-6,46%

- Reward

- 5

- 4

- Repost

- Share

FuLuBao :

:

New Year Wealth Explosion 🤑New Year Wealth Explosion 🤑New Year Wealth Explosion 🤑New Year Wealth Explosion 🤑View More

From Hero to “Why Didn’t I Sell?” . Swing Trader’s Rollercoaster.

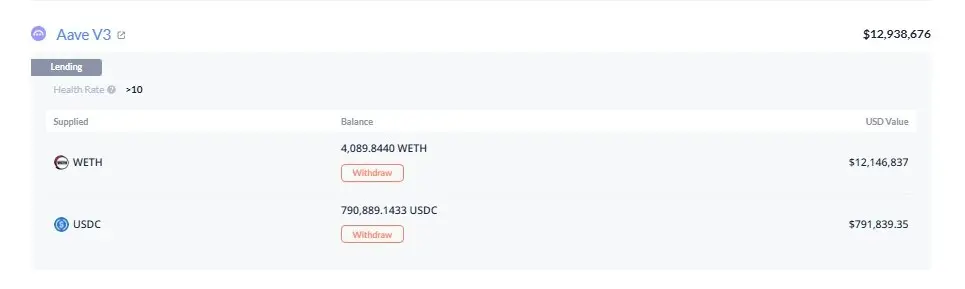

Markets have a cruel sense of humor, and nemorino.eth just got the full experience. Between late November and January 20, he stacked 9,043 WETH at an average of $3,085, riding the wave like a pro. By mid-January, the screen was glowing green, a clean $2.87M floating profit. The kind of number that makes you lean back and think, yeah… I’ve got this.

He didn’t sell. and today to the pullback. Around 14 hours ago, as $ETH slipped, he finally thinks and let go of 3,000 WETH, locking in… Brutal compared to what was sitting there ju

Markets have a cruel sense of humor, and nemorino.eth just got the full experience. Between late November and January 20, he stacked 9,043 WETH at an average of $3,085, riding the wave like a pro. By mid-January, the screen was glowing green, a clean $2.87M floating profit. The kind of number that makes you lean back and think, yeah… I’ve got this.

He didn’t sell. and today to the pullback. Around 14 hours ago, as $ETH slipped, he finally thinks and let go of 3,000 WETH, locking in… Brutal compared to what was sitting there ju

ETH-6,46%

- Reward

- like

- Comment

- Repost

- Share

BNB Market Outlook

The 4-hour decline reached 5.08%, with the price dropping to a low of $867.57. After briefly breaking below the lower Bollinger Band, a slight rebound occurred, and it is currently trading at $881.81, forming a technical divergence signal. This low point is a key support level from the previous consolidation platform.

BNB Trading Suggestion: Pull back near 878-872, then look up towards 889-900.

View OriginalThe 4-hour decline reached 5.08%, with the price dropping to a low of $867.57. After briefly breaking below the lower Bollinger Band, a slight rebound occurred, and it is currently trading at $881.81, forming a technical divergence signal. This low point is a key support level from the previous consolidation platform.

BNB Trading Suggestion: Pull back near 878-872, then look up towards 889-900.

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More19.1K Popularity

208 Popularity

55.51K Popularity

43.36K Popularity

339.78K Popularity

Hot Gate Fun

View More- MC:$3.36KHolders:10.00%

- MC:$3.41KHolders:20.05%

- MC:$3.36KHolders:10.00%

- MC:$9.1KHolders:223.75%

- MC:$3.36KHolders:10.00%

News

View MoreSpot gold breaks through $4850/oz, reaching a new high

2 m

Snap Store experiences domain hijacking attack, tampering with wallet applications to steal cryptocurrency assets

14 m

Snap Store security vulnerability allows hackers to steal users' crypto assets by hijacking expired domains

15 m

Data: If Bitcoin rebounds and breaks through $97,000, the total liquidation strength of long positions on mainstream CEXs will reach 1.489 billion.

20 m

Data: If BTC breaks through $93,803, the total liquidation strength of short positions on mainstream CEXs will reach $2.616 billion.

21 m

Pin