Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Web3 Research Weekly Report|The overall market showed a fluctuating upward trend this week; Bitcoin reached a new high.

Weekly Overview

This week, the overall cryptocurrency market is showing a volatile upward trend, influenced by the easing of risks and a large influx of external capital. The cryptocurrency market continues the momentum from last week, with a new round of liquidity and capital inflow rapidly taking effect. Of course, there was a noticeable short-term decline due to the impact of the U.S. GDP data release, but the performance of mainstream cryptocurrencies remains strong.

This week, the mainstream cryptocurrencies in the market have shown a clear upward trend in the short term. As recent risk factors gradually diminish, combined with a significant influx of external ETF funds in the short term, the cryptocurrency market has once again surpassed the 3 trillion USD mark this week.

Overall, the market has been in a critical period of structural adjustment this week, and the weekly fluctuations of the cryptocurrency market may signal a warming trend in the market ahead. The overall weekly performance of the market showed significant intraday price fluctuations, with a rapid increase as the closing period approached.

This week, the price of BTC has risen significantly, currently approaching $97,000. This is another increase after the recent new high for this cryptocurrency.

The price increase of ETH over the week is slightly larger than that of BTC. Currently, the price of this cryptocurrency has reached around 1850 USD, quickly rising within the day and breaking through key price levels, and there is a further upward trend.

This week, the price trends of key mainstream cryptocurrencies continue the recent upward momentum. Currently, the overall market capitalization of the crypto market has seen a significant increase compared to the same period last week, reaching around 3.02 trillion USD, with a 24-hour increase of approximately 2.77%. The current price of BTC is around 97,000 USD. The current price of ETH is maintained at around 1,850 USD.

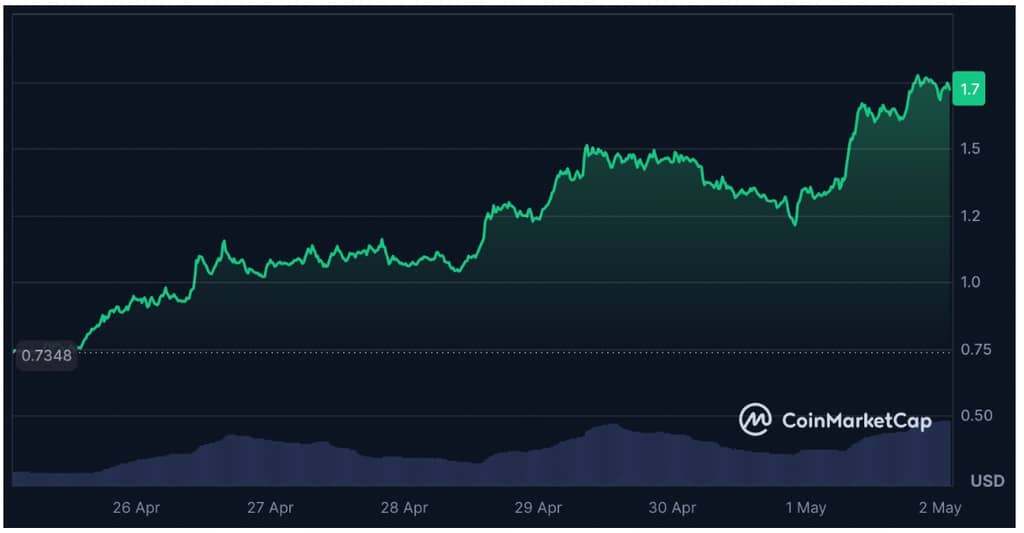

The overall cryptocurrency market rose again this week, with structural adjustments in the market playing a role, while the impact of external negative factors weakened. The top-performing coin this week was VIRTUAL, which increased by about 134% over the week, with a price around $1.71. The recent rapid rise of this coin is attributed to the liquidity in the DeFi sector and the influx of external funds.

The cryptocurrency market is likely to rise further this weekend, and the upward trend remains the main trend in the short term.

Crypto Market

🔥According to CoinDesk, the Nasdaq exchange has sent a letter to the U.S. SEC’s crypto working group, suggesting that regulators carefully define categories of digital assets and clarify the role of regulatory “referees”.

🔥According to Decrypt, since Bitcoin’s fourth halving in April 2024, the BTC price has only risen by 43.4%, far below the increases of 7,000%, 291%, and 541% recorded after the previous three halvings, marking the worst post-halving performance for Bitcoin. Analysts point out that factors such as macroeconomic uncertainty, trade policies of the Trump administration, ETF capital outflows, and changes in market structure have collectively weakened the upward effect brought by the halving.

🔥According to a report by Coingape, Citibank predicts that the total supply of stablecoins will grow to $1.6 trillion under the baseline scenario and reach $3.7 trillion under the optimistic scenario by 2030.

🔥According to Techjuice, the Trump family’s cryptocurrency project World Liberty Financial (WLFI) has signed a letter of intent with the Pakistan Crypto Council (PCC) aimed at accelerating blockchain innovation, stablecoin adoption, and DeFi integration in Pakistan.

🔥According to a report by Reuters, Nike Inc. (NKE.N) was sued on Friday by a group of buyers of Nike-themed NFTs and other crypto assets. The buyers alleged that they suffered significant losses after the company abruptly shut down the business unit responsible for creating those assets.

🔥According to a report from Cointelegraph, Deloitte’s Financial Services Center, one of the “Big Four” accounting firms, has released a new report predicting that the global real estate tokenization market is expected to reach $4 trillion by 2035, a significant increase from less than $300 billion in 2024, with a compound annual growth rate of over 27%.

🔥According to Cointelegraph, the market capitalization of stablecoins has grown by $4.58 billion in just one week, approaching the $240 billion milestone. Tether, USDC, and new competitors like USDS and RLUSD continue to drive market growth.

🔥According to Cointelegraph, the sentiment in the cryptocurrency market has warmed up this week, but analysts warn that weak market liquidity and structural issues could still lead to price volatility, especially during periods of reduced trading volume, as the crypto market remains susceptible to sudden macroeconomic news.

🔥Crypto analyst Willy Woo stated that the fundamentals of Bitcoin have turned bullish, with inflows into the network increasing, creating favorable conditions for it to break through historical highs.

🔥According to Finance Magnates, after years of market speculation, Ripple has explicitly denied plans to launch an IPO in 2025.

🔥According to The Block, the Arbitrum Foundation, an Ethereum Layer 2 network, announced its withdrawal from NVIDIA-supported Ignition AI Accelerator program due to the chip giant’s requirement not to mention the collaboration in crypto-related announcements.

🔥10x Research stated in its latest report that the cryptocurrency market surged across the board this week, with Bitcoin breaking the $95,000 mark, driven by easing macro risks, record inflows of ETF funds, and a weakening dollar.

🔥According to CoinGecko data, today marks 100 days since Trump’s inauguration, and the total market capitalization of cryptocurrencies has risen to $3.084 trillion. On the day he officially took office for his second term (January 20), the total market capitalization of cryptocurrencies was $3.621 trillion, meaning the market has evaporated $537 billion in value.

🔥According to Decrypt, CryptoQuant data shows that the supply of Bitcoin on exchanges has dropped to a seven-year low, falling to 2.488 million BTC last Friday.

🔥According to The Block, on April 25, the 30-day Pearson correlation coefficient between Bitcoin and gold reached 0.54, close to the annual high of 0.73. Previously, in February, the two had “decoupled,” with the correlation coefficient plummeting from 0.73 to -0.67 within three weeks.

A new study by the Cambridge Centre for Alternative Finance (CCAF) at the University of Cambridge has found that the proportion of sustainable energy used in Bitcoin mining has risen to 52.4%, while natural gas has replaced coal as the largest single source of energy for Bitcoin mining.

🔥Bloomberg Intelligence ETF analyst James Seyffart stated on platform X: “Many people are posting/reporting that ProShares will launch an XRP futures ETF on April 30. But we have confirmed that this is not the case. A specific launch date has not yet been determined, but we believe they will launch (XRP ETF) - and it is likely to be in the short term, and possibly in the medium term as well.”

🔥According to a report by Bitcoin.com, the latest report from Coinshares indicates that the Bitcoin network’s hash rate is expected to break the historic threshold of 1 Zettahash (ZH/s) per second as early as July this year, significantly earlier than previously predicted.

🔥 Previously, members of the crypto community disclosed that “a certain Web3 project contract was suspected to have malicious code implanted by an employee, resulting in losses of hundreds of thousands of dollars.” The developer of the DeFi trading and asset management project QuantMaster, Thomson, claimed to be the “victim of this theft incident.” With the assistance of SlowMist founder Yu Xian, a successful report has been filed.

🔥According to Cointelegraph, the Bitcoin spot ETF “IBIT” by BlackRock has seen the gap in Bitcoin holdings between it and the Strategy narrow to just 20,000 BTC.

🔥 According to PR Newswire, bankrupt crypto exchange FTX and its liquidation trust announced the launch of an asset recovery legal action, having filed a lawsuit against NFT Stars Limited and KUROSEMI INC (the operator of Delysium) for refusing to deliver the tokens agreed in the contract. FTX said that it has made several unsuccessful attempts at non-litigation negotiations, and is now contacting dozens of other token issuers to recover assets, and will take legal measures against those who refuse to cooperate.

🔥According to the official blog, the Ethereum Foundation (EF) has announced a new phase of vision statements, reaffirming its mission to maintain the openness, decentralization, and censorship resistance of Ethereum as a global shared computing platform.

🔥According to Cointelegraph, nearly 16 months after the launch of the spot Bitcoin ETF, Grayscale’s GBTC still dominates in terms of income generation, with an implied annual revenue of over $268 million—this figure exceeds the total revenue of all other Bitcoin ETFs combined ($211 million).

🔥According to Beincrypto, one of Brazil’s largest banks, Itaú, announced an initial investment of $210 million to establish Oranje, a company that will specialize in strategic Bitcoin reserve accumulation.

🔥BlockBeats news, on May 1st, Ethena Labs announced the third quarter ENA airdrop allocation, starting on May 1, 2025, at 16:00 (UTC). 3.5% of the total ENA supply will be distributed as rewards for the third quarter. There will be no qualification check period, and the distribution will occur immediately on May 1.

🔥 U.S. President Trump discusses trade agreements: I think we are doing very well. Earlier reports indicated that U.S. President Trump stated that the tariffs have not yet taken effect.

🔥According to Trader T’s monitoring, the net inflow of the US spot Bitcoin ETF on Thursday was $173 million.

🔥According to Ptotos, despite the Ethereum Foundation’s statement emphasizing its community-centric governance, the voting rights situation of co-founder Vitalik Buterin has not yet been disclosed. It is reported that Laura Shin, the author of “The Cryptopians,” has been questioning for years whether Vitalik Buterin holds three super votes or if the voting rights are the same for the four board members.

🔥 BlackRock’s Digital Asset Head Robert Mitchnick stated at the Token2049 event in Dubai that Bitcoin ETF funds are flowing in on a large scale, and the investor structure is shifting from retail to institutional.

🔥Mathew McDermott, head of digital assets at Goldman Sachs, stated at the Token2049 conference that clear regulations will make it easier for large institutions to deploy capital in the cryptocurrency space, driving its scalable growth.

🔥According to CryptoQuant analysts, Bitcoin’s realized capitalization has reached $882.228 billion, setting a new historical high.

🔥In April, ADP employment in the U.S. increased by 62,000, the smallest increase since July 2024, significantly below expectations. The forecast was 115,000, and the previous value was 155,000.

🔥 The initial value of the annualized quarterly rate of real GDP in the United States for the first quarter recorded -0.3%, hitting a new low since the second quarter of 2022. After the GDP data was released, U.S. stock index futures saw an expanded decline, with Nasdaq 100 futures down 1.4%, Dow futures down 0.45%, and S&P 500 index futures down 0.96%. BTC briefly fell below $94,500.

🔥PANews May 1 news, according to SoSoValue data, on April 30 Eastern Time, Ethereum spot ETF had a total net outflow of $2.3599 million.

🔥PANews News on May 1st, according to SoSoValue data, the total net outflow of Bitcoin spot ETFs was $56.2336 million on April 30th, Eastern Time.

Regulation & Macroeconomic Policy

🔥According to Bitcoin Laws, two Bitcoin reserve bills in Arizona will undergo a third reading next Monday and may be subject to a final vote. This could become the first state-level Bitcoin reserve bill passed by voting.

🔥According to Cointelegraph, Hester Peirce, a commissioner of the U.S. Securities and Exchange Commission (SEC) and head of the cryptocurrency assets working group, stated at the SEC’s “Know Your Custodian” roundtable that the current regulatory environment for cryptocurrency assets in the U.S. feels like playing the game “the floor is lava” in the dark, with registered institutions forced to act cautiously under unclear rules to avoid direct contact with cryptocurrency assets.

🔥 According to Jiemian News, on April 28, Emirates International Holdings (IHC), sovereign wealth fund Abu Dhabi Development Holding Company (ADQ) and First Bank Abu Dhabi (FAB) announced plans to launch a new stablecoin backed by UAE dirhams, which will be fully regulated by the UAE Central Bank and issued by FAB, the largest bank in the UAE.

🔥According to Cointelegraph, U.S. Senator Elizabeth Warren from Massachusetts is calling on government officials to address issues related to Meme coins associated with President Trump and his media company. Warren and Adam Schiff co-sent a letter to the Office of Government Ethics, requesting an investigation into the ethical risks that the Meme coin TRUMP launched by Trump may pose.

🔥According to The Block, the Arizona State Legislature has passed the Strategic Bitcoin Reserve Act SB 1025, authorizing the state treasury and pension system to invest up to 10% of available funds in digital assets such as Bitcoin.

🔥BlockBeats news, on May 1, according to Cointelegraph, the North Carolina House passed the “Digital Asset Investment Bill” (HB 92) with a vote of 71 in favor and 44 against, allowing the state treasurer to invest up to 5% of state government funds in approved cryptocurrencies. The bill has now been submitted to the state Senate for review.

Highlights of the Cryptocurrency Market

⭐️Over the past week, the cryptocurrency market has shown a continuous upward trend, gradually alleviated by external negative factors, coupled with a rapid influx of external funds. The overall liquidity and capital scale of the market have continued to rise, and the structural adjustment of the crypto market is further showing a positive and reasonable trend. In the past week, mainstream cryptocurrencies have mainly experienced short-term fluctuations, but overall, the upward trend is quite evident. Currently, it is highly likely that the market will see a series of follow-up rallies.

⭐️This week, VIRTUAL has ranked first among mainstream cryptocurrencies with an increase of about 134%. This is mainly due to the recent rapid influx of DeFi liquidity and capital, coupled with the market actions of the protocol itself. Currently, the price of VIRTUAL is at a recent high, maintaining around $1.7, with a weekly peak of about $1.77. It is currently in a state of short-term volatility, and the price may undergo further changes in the future.

Bitcoin & Ethereum Weekly Performance

Bitcoin (BTC)

This week, the price of BTC showed continuous intraday fluctuations after opening, maintaining a range of $93,000 to $95,000. As the weekend closing period approached, influenced by recent comprehensive factors, the price exhibited a continuous rebound trend, directly breaking through the key level of $95,000, and further pushing above $97,000. BTC price reached a recent high this week, with the overall market showing significant recovery. In the short term, BTC price is likely to maintain an upward trend, while small-scale fluctuations will continue to be the mainstream market behavior.

Ethereum (ETH)

The price trend of ETH this week has increased slightly more than BTC, but both have basically maintained consistency in their movements. The price of ETH broke above $1800 during the week. Currently, the price of ETH is around $1850, and the subsequent trend is likely to focus on multiple rounds of price recovery, with considerable upward potential.

Web3 Project Trends

This week, the total market value of the seven categories of projects continues to rise across the board, but most of the increases remain within a small range. This week, the overall market has continued its recent upward trend influenced by various factors, but most tracks have limited upward movement. It is expected that the current main trend will continue during the weekend closing period.

Author: Charles T., Gate.io Researcher *This article only represents the author’s views and does not constitute any trading advice. Investment carries risks, and decisions should be made cautiously. *The content of this article is original and copyrighted by Gate.io. If reprinting is required, please indicate the author and source; otherwise, legal responsibility will be pursued.