Post content & earn content mining yield

placeholder

SisterFireline

Gate Annual Report is out! Let's take a look at my yearly performance

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VVNDAWXWUQ&ref_type=126&shareUid=VFdFUlxaAQcO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VVNDAWXWUQ&ref_type=126&shareUid=VFdFUlxaAQcO0O0O

- Reward

- like

- Comment

- Repost

- Share

#WarshLeadsFedChairRace

Kevin Warsh as Fed Chair? Crypto markets are already doing the math.

Odds are rising that Kevin Warsh could become the next Chair of the Federal Reserve, with markets expecting rates to stay unchanged in January. On the surface, this feels like a quiet transition. Under the hood, it could matter a lot for crypto.

Warsh is not a dove. He has consistently warned about inflation credibility, excess liquidity, and the long-term costs of easy money. That tells us one thing clearly. If inflation risks reappear, he is unlikely to rush toward rate cuts just to support markets.

Kevin Warsh as Fed Chair? Crypto markets are already doing the math.

Odds are rising that Kevin Warsh could become the next Chair of the Federal Reserve, with markets expecting rates to stay unchanged in January. On the surface, this feels like a quiet transition. Under the hood, it could matter a lot for crypto.

Warsh is not a dove. He has consistently warned about inflation credibility, excess liquidity, and the long-term costs of easy money. That tells us one thing clearly. If inflation risks reappear, he is unlikely to rush toward rate cuts just to support markets.

- Reward

- 3

- 6

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”View More

尊贵的美股交易员

尊贵的美股交易员

Created By@YearOfTheHorseMemeGlobal

Listing Progress

0.05%

MC:

$3.47K

Create My Token

#AIBT Keep an eye on it, a promising project. Believe in it, so I choose to follow closely. AIBT soars to the sky, went all in.

View Original

- Reward

- like

- Comment

- Repost

- Share

#CLARITYBillDelayed U.S. Crypto Regulation Faces New Roadblocks

The long‑anticipated CLARITY Act, a landmark piece of U.S. legislation designed to establish a clear regulatory framework for digital assets, has hit significant turbulence in the U.S. Senate, leaving the crypto industry in a state of uncertainty. Originally seen as the most promising path toward comprehensive federal rules for cryptocurrencies, stablecoins, and decentralized finance, the bill’s momentum has stalled after intense debate, industry pushback, and complex political calculus.

Why the CLARITY Act Was Postponed

The Senat

The long‑anticipated CLARITY Act, a landmark piece of U.S. legislation designed to establish a clear regulatory framework for digital assets, has hit significant turbulence in the U.S. Senate, leaving the crypto industry in a state of uncertainty. Originally seen as the most promising path toward comprehensive federal rules for cryptocurrencies, stablecoins, and decentralized finance, the bill’s momentum has stalled after intense debate, industry pushback, and complex political calculus.

Why the CLARITY Act Was Postponed

The Senat

MC:$26.5KHolders:128

66.96%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Accurate prediction of turning points, heavy and light positions both profitable, while others cut losses, I buy the dip, and control the rhythm perfectly.

#Gate每10分钟送1克黄金 #现货黄金再创新高

View Original#Gate每10分钟送1克黄金 #现货黄金再创新高

- Reward

- like

- Comment

- Repost

- Share

#MyFirstPostOnTheSquare

🚀 Starting 2026 with Alpha!

I’m kicking off my first Gate Square post this year by sharing my crypto trading insights and favorite strategies. From BTC to promising altcoins, I’m watching trends, key supports/resistances, and upcoming token launches closely.

💡 My Goals for 2026:

1️⃣ Grow my crypto portfolio with smart, calculated moves.

2️⃣ Share high-quality content and insights to help the community.

3️⃣ Engage actively in discussions on trending coins and projects.

📢 Question for the Community: Which coin or token are you most bullish on in the first month of 2026

🚀 Starting 2026 with Alpha!

I’m kicking off my first Gate Square post this year by sharing my crypto trading insights and favorite strategies. From BTC to promising altcoins, I’m watching trends, key supports/resistances, and upcoming token launches closely.

💡 My Goals for 2026:

1️⃣ Grow my crypto portfolio with smart, calculated moves.

2️⃣ Share high-quality content and insights to help the community.

3️⃣ Engage actively in discussions on trending coins and projects.

📢 Question for the Community: Which coin or token are you most bullish on in the first month of 2026

- Reward

- 1

- Comment

- Repost

- Share

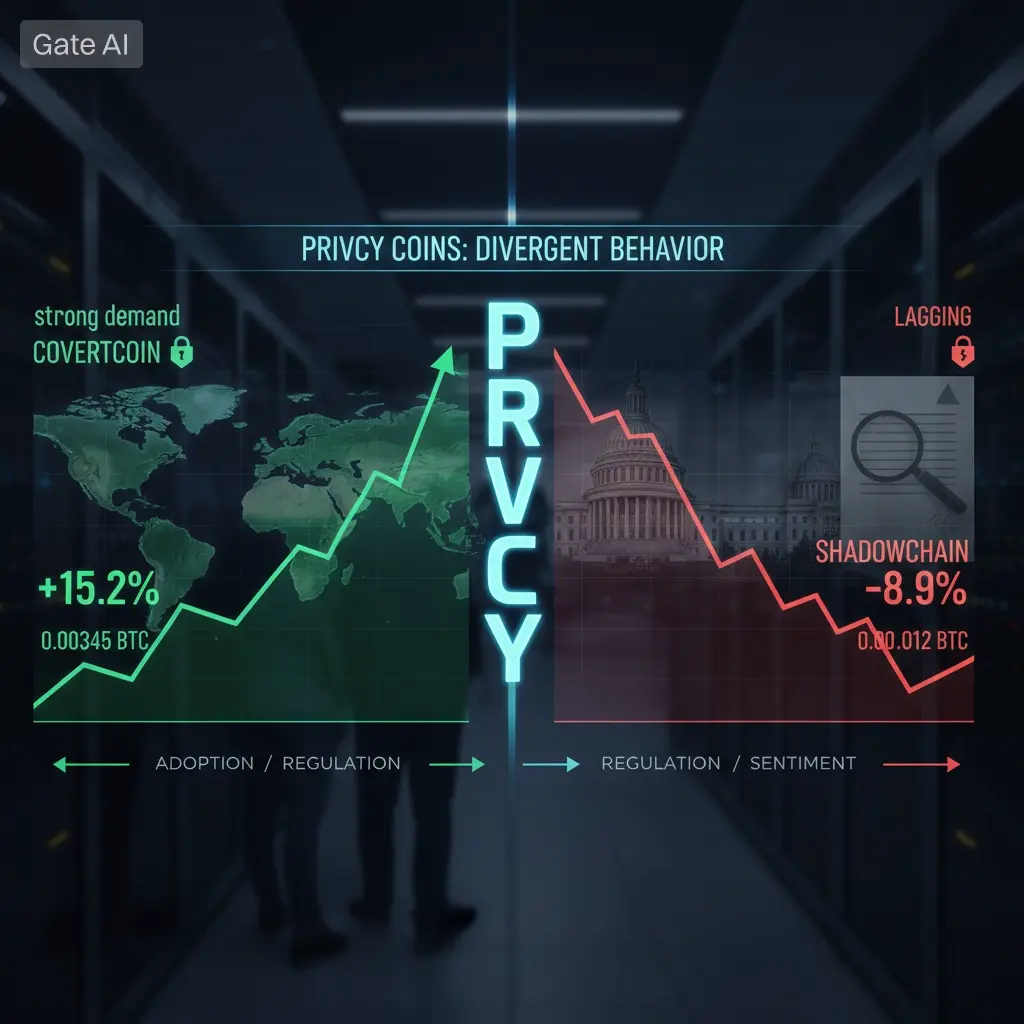

#PrivacyCoinsDiverge – The Divergence of Privacy Coins and the Rise of DASH

The cryptocurrency market is witnessing a significant shift in the privacy coin sector, marked by the hashtag #PrivacyCoinsDiverge. For the first time in recent years, privacy-focused cryptocurrencies such as Monero (XMR), Zcash (ZEC), and Dash (DASH) are no longer moving in unison. While XMR and ZEC are experiencing pullbacks, DASH has surged over 10%, defying the broader market trend. This divergence is not just a short-term price fluctuation—it reflects a deeper structural change in how privacy coins are being perce

The cryptocurrency market is witnessing a significant shift in the privacy coin sector, marked by the hashtag #PrivacyCoinsDiverge. For the first time in recent years, privacy-focused cryptocurrencies such as Monero (XMR), Zcash (ZEC), and Dash (DASH) are no longer moving in unison. While XMR and ZEC are experiencing pullbacks, DASH has surged over 10%, defying the broader market trend. This divergence is not just a short-term price fluctuation—it reflects a deeper structural change in how privacy coins are being perce

MC:$26.5KHolders:128

66.96%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is rising again. Finally, a moment of strength. Today, let's regain some confidence first. Let's look at two levels. First, at 90,000. This rebound must surpass 90,000 to have a chance at a breakout and to justify the broader pattern. Next, look at 910. This is a short-term key level. Staying above 910 is necessary to form a W bottom and to have a chance to retest the previous high. If it can't hold above 910, everything is pointless. We won't let emotions drive us. How it moves, how it comes, I'll give you the ideas. $BTC #加密市场回调

BTC-1,35%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

山寨牛市我来了

山寨牛市我来了

Created By@YearOfTheHorseMemeGlobal

Listing Progress

0.42%

MC:

$3.51K

Create My Token

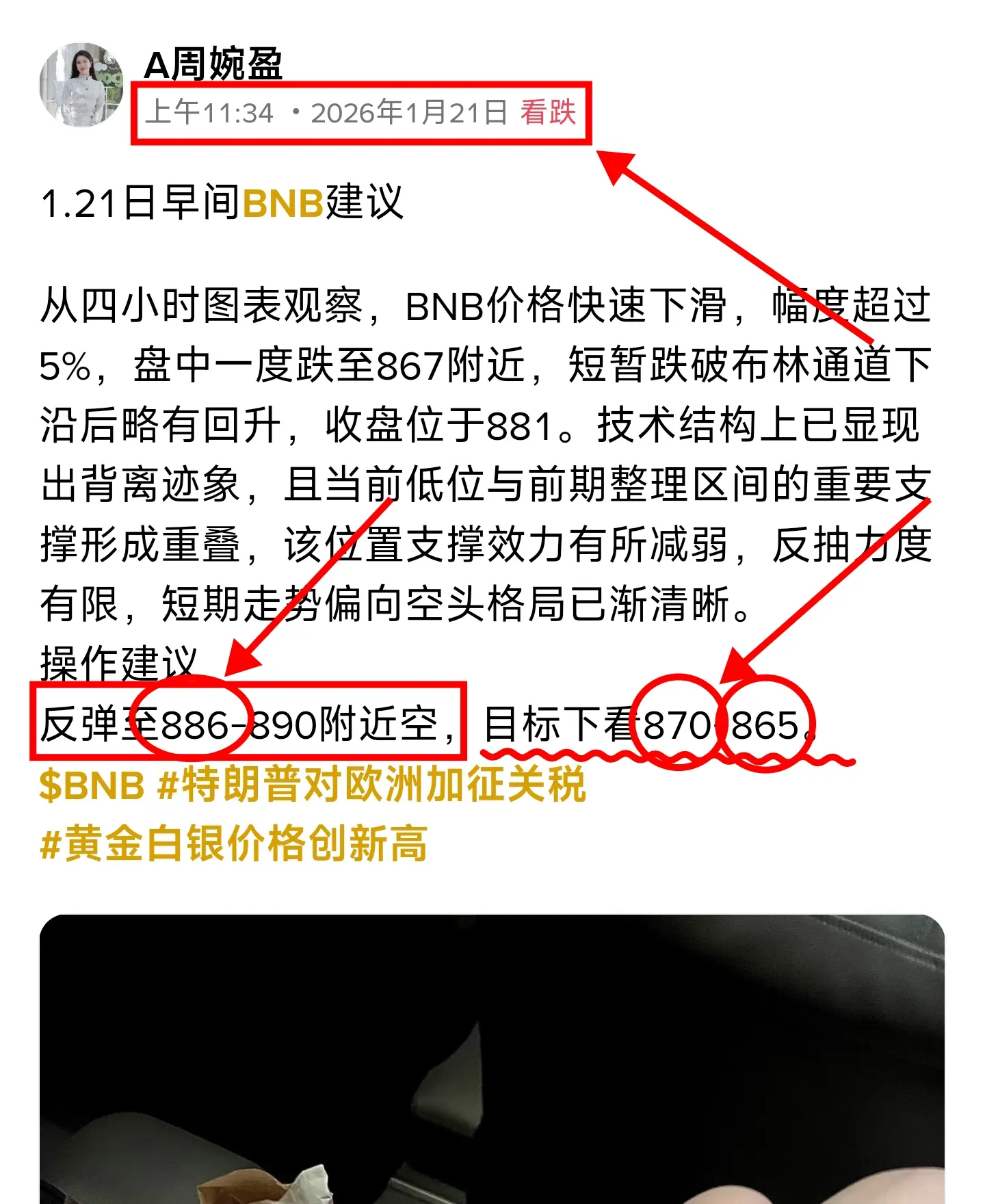

Isn't this considered a benefit? 886.870.865 has already been announced to everyone in advance. If you don't take advantage of this 22 o'clock opportunity, do you want me to personally feed you? This pace is so comfortable!

#Gate每10分钟送1克黄金 #现货黄金再创新高

View Original#Gate每10分钟送1克黄金 #现货黄金再创新高

- Reward

- 2

- 1

- Repost

- Share

TheFateOfTheWoodenMan :

:

2026 Go Go Go 👊#عاجل🚨🚨🚨 : Scott Bisset says Trump may announce the Federal Reserve #الفيدرالي chair next week

U.S. Treasury Secretary Scott Bisset stated that President Trump might announce the new Federal Reserve chair as early as next week during his speech from Davos.

The number of candidates has decreased from 11 to 4, and #ترامب has met all of them in person. Jerome #باول 's term ends in May 2026.

Final candidates:

• Kevin Hasset = Director of the National Economic Council -10%

• Christopher Waller = Federal Reserve Governor -13%

• Kevin Warsh = Former Federal Reserve Governor -46%

• Rick Rieder =

View OriginalU.S. Treasury Secretary Scott Bisset stated that President Trump might announce the new Federal Reserve chair as early as next week during his speech from Davos.

The number of candidates has decreased from 11 to 4, and #ترامب has met all of them in person. Jerome #باول 's term ends in May 2026.

Final candidates:

• Kevin Hasset = Director of the National Economic Council -10%

• Christopher Waller = Federal Reserve Governor -13%

• Kevin Warsh = Former Federal Reserve Governor -46%

• Rick Rieder =

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

📊 Currently, the bullish market expects Kevin Warsh to be the frontrunner.This is not fear, but sharp fluctuations in the macroeconomy.

Every significant decline in #البيتكوين during 2025 and 2026 coincides with #tariff_ shocks and trade tensions.

April: Comprehensive tariffs = approximately 12% decrease in #BTCUSDT

October: Escalation of tensions between the US and China = approximately 8% decrease in #BTC

January: Trade risks between the US and the European Union = approximately 7% decrease in #Bitcoin

This illustrates how the market is currently handling Bitcoin: a risk-sensitive asset affected by growth, interest rates, and liquidity.

But here is the main po

View OriginalEvery significant decline in #البيتكوين during 2025 and 2026 coincides with #tariff_ shocks and trade tensions.

April: Comprehensive tariffs = approximately 12% decrease in #BTCUSDT

October: Escalation of tensions between the US and China = approximately 8% decrease in #BTC

January: Trade risks between the US and the European Union = approximately 7% decrease in #Bitcoin

This illustrates how the market is currently handling Bitcoin: a risk-sensitive asset affected by growth, interest rates, and liquidity.

But here is the main po

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

If cash flows stabilize, that will be another matter. Until then, it's just volatility resulting from political shocks... not the end of the cycle.Currently influenced by the overall market, Chinese-language cryptocurrencies better demonstrate the community's strength in the crypto trend!

View Original

- Reward

- like

- Comment

- Repost

- Share

🚨 UPDATE: Trump lands in Zurich after flight delay\nWEF speech still on at 2:30 p.m.

- Reward

- like

- Comment

- Repost

- Share

Today, January 21, 2026, Bitcoin (BTC) is experiencing significant selling pressure, currently trading around $89,200. The market is reacting to a "risk-off" sentiment triggered by renewed geopolitical tensions in Greenland and fiscal concerns following a recent government shutdown recovery. BTC has slipped below the psychological $90,000 level, marking its sixth consecutive day of losses—the longest streak since 2024. While long-term institutional support remains through entities like Strategy Inc. (MSTR), the short-term outlook is cautious as traders wait for stability. If $88,000 fails to h

BTC-1,35%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More31.13K Popularity

12.27K Popularity

4.02K Popularity

52.87K Popularity

342.28K Popularity

Hot Gate Fun

View More- MC:$3.4KHolders:10.00%

- MC:$3.39KHolders:10.00%

- MC:$3.51KHolders:20.41%

- MC:$3.39KHolders:20.00%

- MC:$3.36KHolders:10.00%

News

View MoreOndo Finance expands over 200 tokenized US stocks and ETFs to the Solana chain

6 m

Trump: Hope to sign the cryptocurrency bill as soon as possible

10 m

U.S. stocks open, Dow Jones up 0.12%, Netflix down over 5%

11 m

Trump: The stock market's decline is insignificant; the stock market will double

14 m

Trump: US stocks fell yesterday because of Greenland, it will double in the future

14 m

Pin