Post content & earn content mining yield

placeholder

飞鱼2026祝福版

- Reward

- 1

- Comment

- Repost

- Share

#GateTradFi1gGoldGiveaway 🚀 Key Launchpad Stats (Live Now)

Subscription Window: Closing today, January 21, at 16:00 (UTC+8).

Launchpad Price: $0.01177 (Subscribed via USD1 or GUSD).

Listing Date: Spot trading for IMU/USDT is scheduled to go live tomorrow, January 22, 2026, at 14:00 (UTC).

Unlock Schedule: 100% unlock at the Token Generation Event (TGE), which is rare and highly attractive for early participants.

💡 Strategy Breakdown: Stake, Hold, or Trade?

1. The "Yield Maximizer" (Stake)

Gate is offering a massive 200% APR on USD1 for new users participating in the IMU subscription.

Subscription Window: Closing today, January 21, at 16:00 (UTC+8).

Launchpad Price: $0.01177 (Subscribed via USD1 or GUSD).

Listing Date: Spot trading for IMU/USDT is scheduled to go live tomorrow, January 22, 2026, at 14:00 (UTC).

Unlock Schedule: 100% unlock at the Token Generation Event (TGE), which is rare and highly attractive for early participants.

💡 Strategy Breakdown: Stake, Hold, or Trade?

1. The "Yield Maximizer" (Stake)

Gate is offering a massive 200% APR on USD1 for new users participating in the IMU subscription.

- Reward

- 7

- 8

- Repost

- Share

AngelEye :

:

2026 GOGOGO 👊View More

NLK

NeuroLink Token

Created By@鎮虫級婵涙笖

Listing Progress

0.05%

MC:

$3.43K

Create My Token

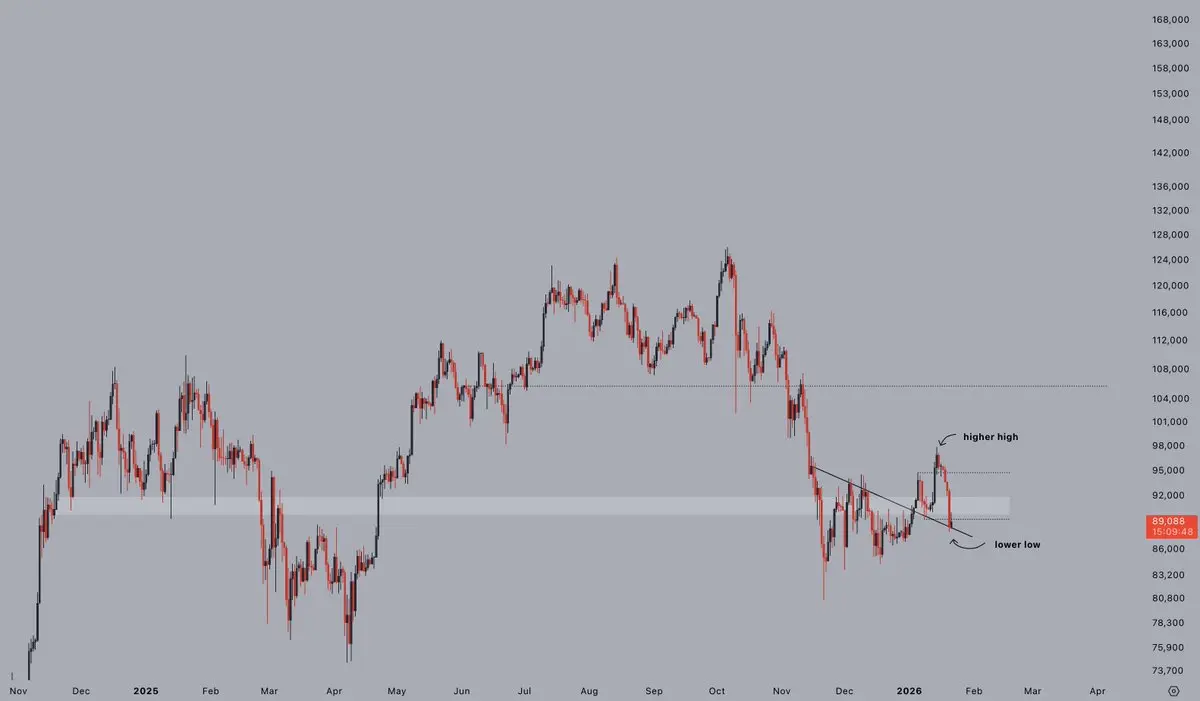

$ETH / $BTC - I think ETHBTC bottoms around here, we may go lower but we have some time to come down imo.\n\nYou know what the worst part is about \'being wrong\' this whole time about what\'s coming? It\'s the fact all I want to say to people is \'I told you so\', but the irony is when we\'re at where we are in a year+ I\'m going to be too humble to say so. 🙂

- Reward

- like

- Comment

- Repost

- Share

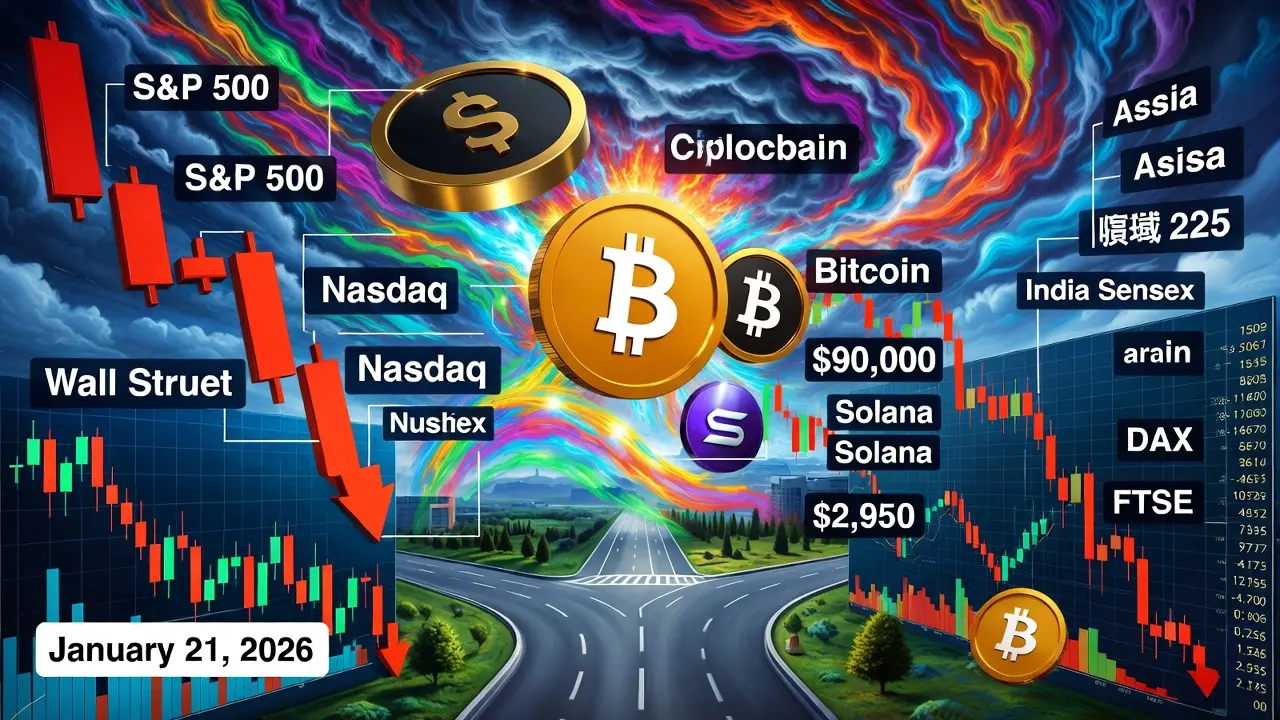

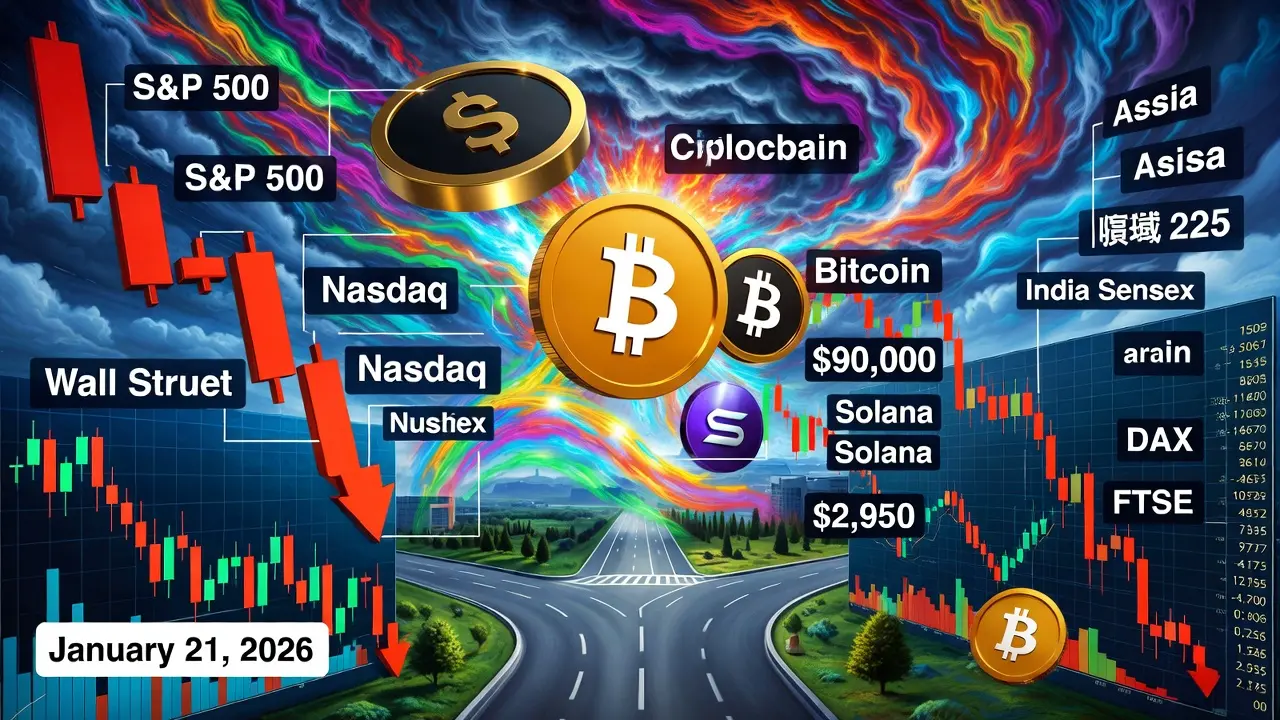

#MajorStockIndexesPlunge

Global markets are experiencing a full-blown "fault line" rupture today! The earthquake that began on Wall Street yesterday continues today, turning Asian and European terminals red. The picture reflected on screens as of January 21, 2026, is both a major test and a strategic crossroads for investors.

Markets are facing one of the most complex "risk-off" waves in recent years. There are two massive triggers behind this collapse: Donald Trump's threats of tariffs on Greenland and the historic volatility in the Japanese bond market.

Wall Street: The S&P 500 fell 2.

Global markets are experiencing a full-blown "fault line" rupture today! The earthquake that began on Wall Street yesterday continues today, turning Asian and European terminals red. The picture reflected on screens as of January 21, 2026, is both a major test and a strategic crossroads for investors.

Markets are facing one of the most complex "risk-off" waves in recent years. There are two massive triggers behind this collapse: Donald Trump's threats of tariffs on Greenland and the historic volatility in the Japanese bond market.

Wall Street: The S&P 500 fell 2.

- Reward

- 2

- 3

- Repost

- Share

GateUser-369166f8 :

:

yooooooooooooooooooooView More

Lei Jun saved my life in a past life, and I’ve paid off my Xiaomi stock this lifetime.

- 6 months, 180 days, 4 bottom-fishing attempts

- 100,000 yuan invested, gradually increasing positions, totaling around 50,000 yuan, with over 30,000 yuan remaining

As the saying goes: Making money in crypto, spending in stocks, one day you’ll want to bring it all home.

With tears, I continue to add to my position 🥹

View Original- 6 months, 180 days, 4 bottom-fishing attempts

- 100,000 yuan invested, gradually increasing positions, totaling around 50,000 yuan, with over 30,000 yuan remaining

As the saying goes: Making money in crypto, spending in stocks, one day you’ll want to bring it all home.

With tears, I continue to add to my position 🥹

- Reward

- like

- Comment

- Repost

- Share

Even if you have zero followers \n\nSay Hi, that’s how connection starts\n\nWe will follow you ✅

- Reward

- like

- Comment

- Repost

- Share

#MajorStockIndexesPlunge

Global markets are experiencing a full-blown "fault line" rupture today! The earthquake that began on Wall Street yesterday continues today, turning Asian and European terminals red. The picture reflected on screens as of January 21, 2026, is both a major test and a strategic crossroads for investors.

Markets are facing one of the most complex "risk-off" waves in recent years. There are two massive triggers behind this collapse: Donald Trump's threats of tariffs on Greenland and the historic volatility in the Japanese bond market.

Wall Street: The S&P 500 fell 2.

Global markets are experiencing a full-blown "fault line" rupture today! The earthquake that began on Wall Street yesterday continues today, turning Asian and European terminals red. The picture reflected on screens as of January 21, 2026, is both a major test and a strategic crossroads for investors.

Markets are facing one of the most complex "risk-off" waves in recent years. There are two massive triggers behind this collapse: Donald Trump's threats of tariffs on Greenland and the historic volatility in the Japanese bond market.

Wall Street: The S&P 500 fell 2.

- Reward

- 19

- 20

- Repost

- Share

Unforgettable :

:

Happy New Year! 🤑View More

January 21 SOL Technical Analysis

- Core conclusion: Daily chart is bearish, short-term weak oscillation; if the rebound is weak, the downward trend will continue, watch for breakthroughs/breakdowns of key support and resistance levels.

- Current price: $126.97 (24h fluctuation $126.3-$135.15, down -5.7%).

Key Levels and Indicators

- Daily: Break below EMA20 ($135.49), RSI 39.81 neutral to weak, MACD death cross with increasing volume, trend weakening.

- 12h: Retrace to the previous upward retracement level 0.618 at $124.80, combined with weekly moving averages support, possibly a short-term r

- Core conclusion: Daily chart is bearish, short-term weak oscillation; if the rebound is weak, the downward trend will continue, watch for breakthroughs/breakdowns of key support and resistance levels.

- Current price: $126.97 (24h fluctuation $126.3-$135.15, down -5.7%).

Key Levels and Indicators

- Daily: Break below EMA20 ($135.49), RSI 39.81 neutral to weak, MACD death cross with increasing volume, trend weakening.

- 12h: Retrace to the previous upward retracement level 0.618 at $124.80, combined with weekly moving averages support, possibly a short-term r

SOL-1,06%

- Reward

- 1

- Comment

- Repost

- Share

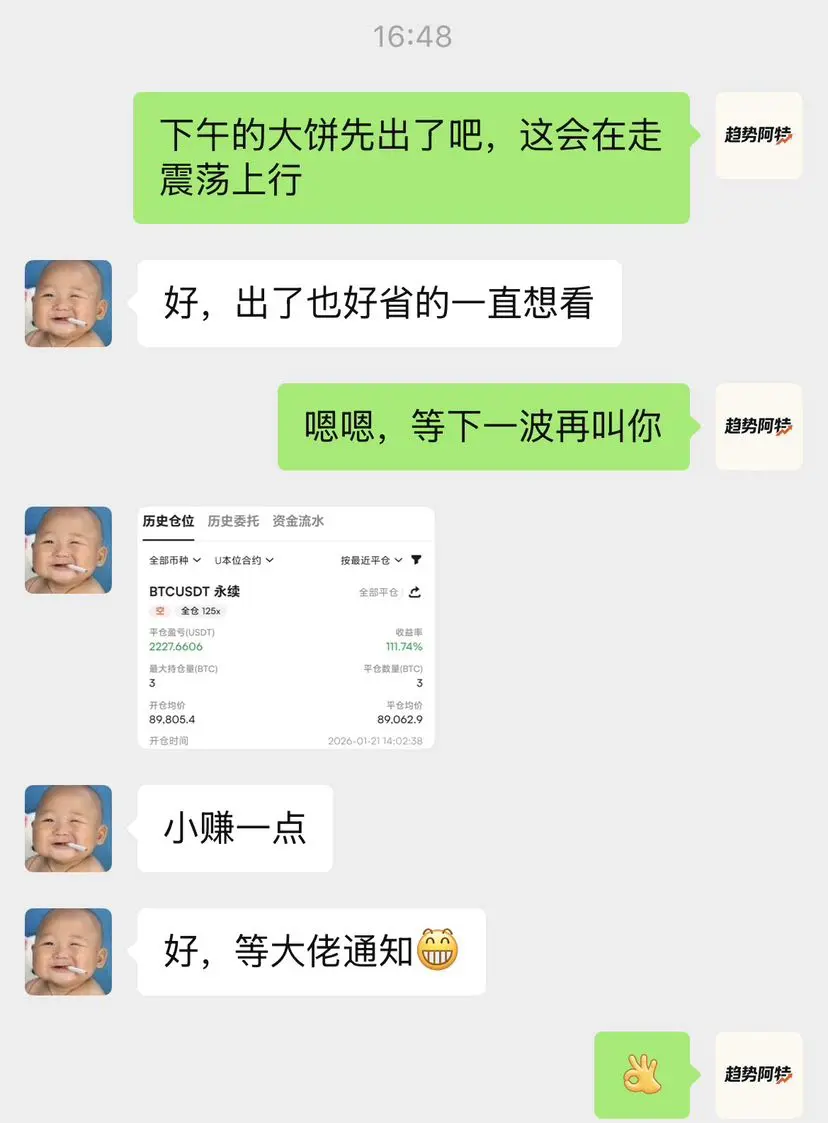

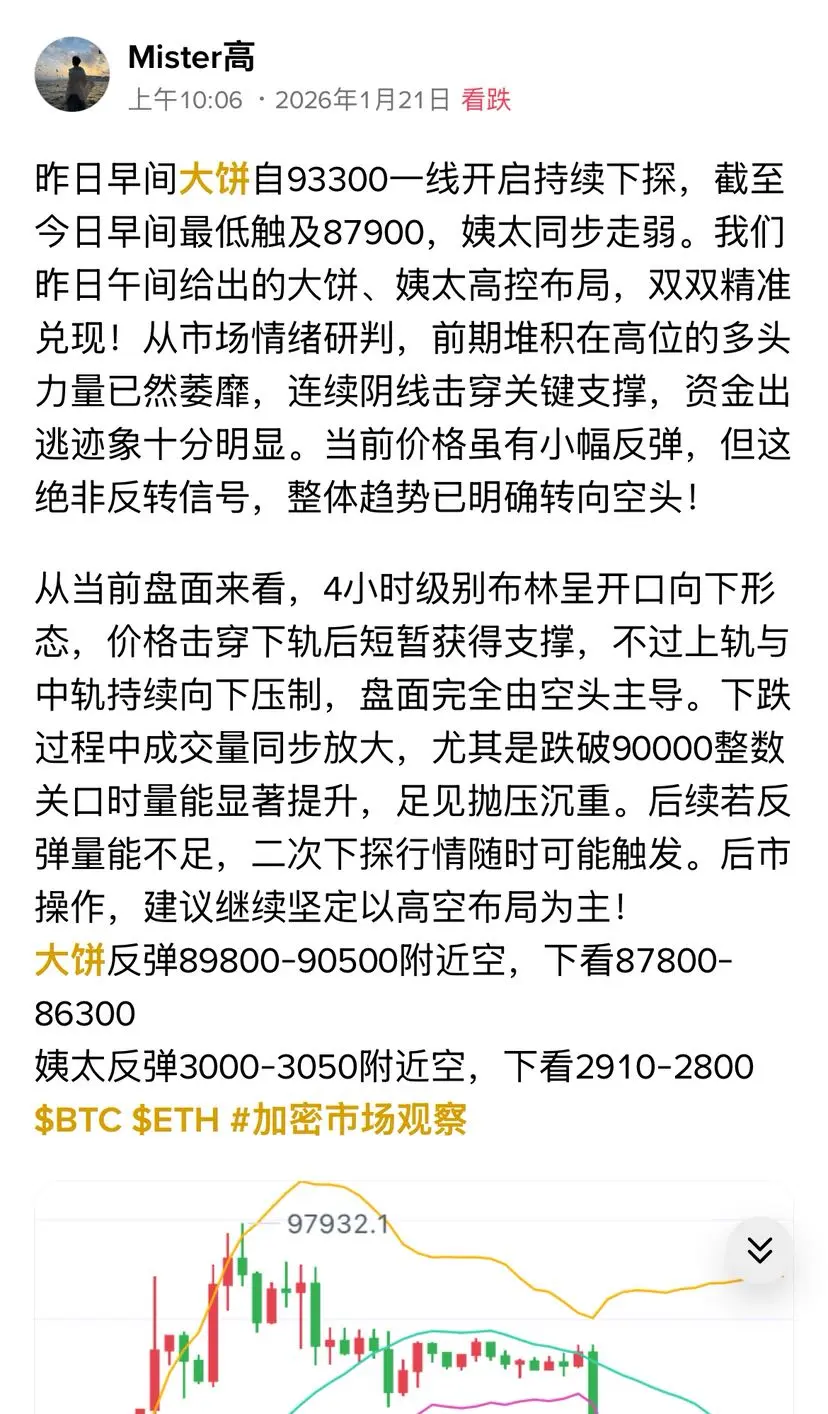

Who understands the joy of the script being fulfilled again! In the morning, the clear strategy for the big pancake mistress in the high altitude, in the afternoon, the pullback was in place, capturing 1000 points of space for the big pancake, and the mistress also gained 50 points, proof of strength!$BTC $ETH #加密市场回调

View Original

- Reward

- like

- Comment

- Repost

- Share

$TIME is quietly doing something different.\nTurning attention, access, and creator value into an on-chain asset.\nIf time is money in Web3 $TIME makes sense.\n• Attention becomes measurable value\n• Access and creator economies move on-chain

- Reward

- like

- Comment

- Repost

- Share

888888888888

财神

Created By@MakeHimBillions

Subscription Progress

0.00%

MC:

$0

Create My Token

#TariffTensionsHitCryptoMarket

Today’s global headlines are once again dominated by rising tariff tensions, and the impact is being felt immediately across financial markets especially in crypto. As fresh trade pressure builds between major economies, uncertainty is creeping back into investor sentiment.

This uncertainty is clearly visible in today’s crypto market movement. Bitcoin, Ethereum, and several altcoins are facing selling pressure as investors react to fears of slowing global trade and higher costs. When economic policies tighten, risk appetite drops and crypto is often the first ma

Today’s global headlines are once again dominated by rising tariff tensions, and the impact is being felt immediately across financial markets especially in crypto. As fresh trade pressure builds between major economies, uncertainty is creeping back into investor sentiment.

This uncertainty is clearly visible in today’s crypto market movement. Bitcoin, Ethereum, and several altcoins are facing selling pressure as investors react to fears of slowing global trade and higher costs. When economic policies tighten, risk appetite drops and crypto is often the first ma

- Reward

- 2

- 1

- Repost

- Share

GateUser-92ca882e :

:

Happy New Year! 🤑#SpotGoldHitsaNewHigh

#SpotGoldHitsaNewHigh 🪙✨

Gold has once again reminded the world why it has always been seen as the ultimate safe-haven asset. As we move deeper into 2026, global markets remain under pressure from uncertainty, geopolitical friction, and shifting monetary expectations. In such an environment, it is not surprising that investors are once again turning their attention toward gold, pushing spot prices into historic territory and creating a powerful narrative around security, trust, and long-term value.

As of January 21, 2026, spot gold crossed an important psychological and

#SpotGoldHitsaNewHigh 🪙✨

Gold has once again reminded the world why it has always been seen as the ultimate safe-haven asset. As we move deeper into 2026, global markets remain under pressure from uncertainty, geopolitical friction, and shifting monetary expectations. In such an environment, it is not surprising that investors are once again turning their attention toward gold, pushing spot prices into historic territory and creating a powerful narrative around security, trust, and long-term value.

As of January 21, 2026, spot gold crossed an important psychological and

- Reward

- 3

- 7

- Repost

- Share

Alexandera@9 :

:

gogo 2026View More

Hot Spot Tracking

- Reward

- like

- Comment

- Repost

- Share

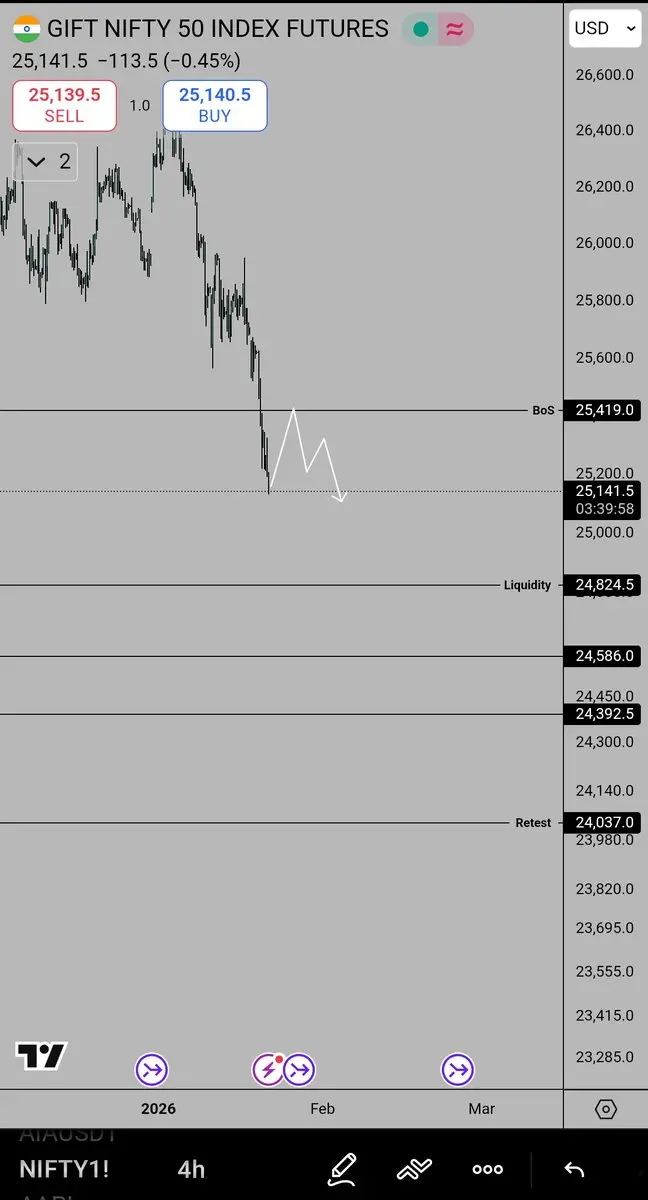

#Nifty50 retest on bearish boS Will Ensure Its Target towards 24824

- Reward

- 1

- Comment

- Repost

- Share

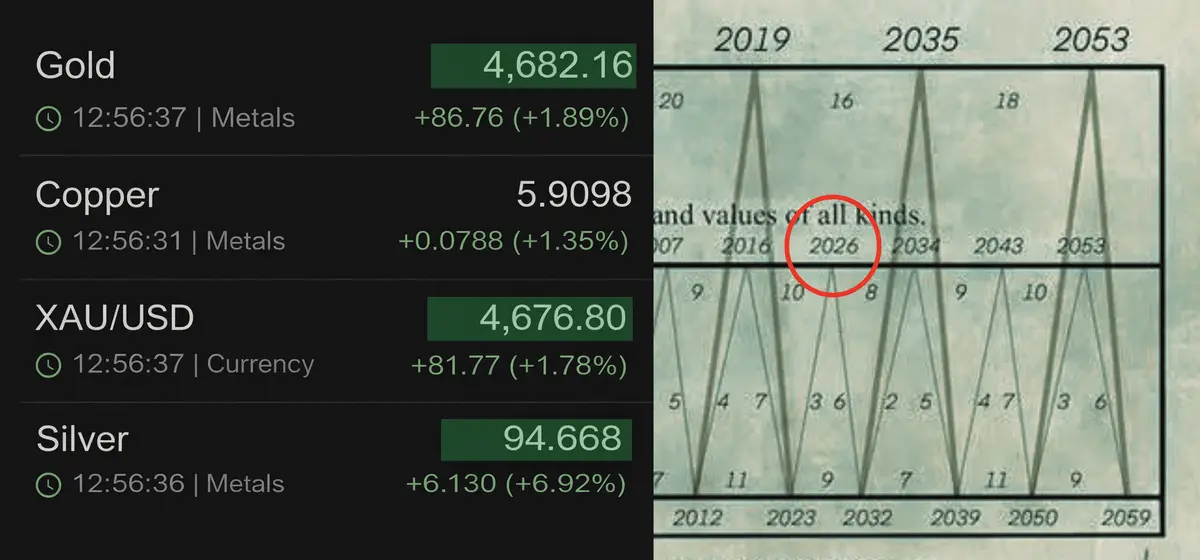

WARNING: THE SYSTEM IS COMPLETELY BROKEN

Gold: $4,689 - ATH

Silver: $94.5 - ATH

Copper: $6 - ATH

This is NOT “risk on”.

This is big money getting defensive while liquidity gets tighter.

Let me explain this in simple words.

Gold does not lead like this when everyone feels safe.

Gold leads when TRUST is fading.

Silver does not rip to $94 because “retail is excited”.

Silver rips when FEAR spreads fast.

And when copper joins at all time highs, that is the part I really hate.

Copper is the real economy metal.

So when copper pumps with gold, it screams SUPPLY STRESS + funding stress, not “healthy gr

Gold: $4,689 - ATH

Silver: $94.5 - ATH

Copper: $6 - ATH

This is NOT “risk on”.

This is big money getting defensive while liquidity gets tighter.

Let me explain this in simple words.

Gold does not lead like this when everyone feels safe.

Gold leads when TRUST is fading.

Silver does not rip to $94 because “retail is excited”.

Silver rips when FEAR spreads fast.

And when copper joins at all time highs, that is the part I really hate.

Copper is the real economy metal.

So when copper pumps with gold, it screams SUPPLY STRESS + funding stress, not “healthy gr

BTC-2,02%

- Reward

- 1

- Comment

- Repost

- Share

【$ETH Signal】Short | Weak consolidation after volume breakout

$ETH Weak consolidation after volume decline, high open interest suggests intense bulls and bears competition. Current price action indicates selling pressure continues to absorb rebounds.

🎯 Direction: Short (Short)

🎯 Entry: 2950 - 2980

🛑 Stop Loss: 3050 (Rigid Stop Loss)

🚀 Target 1: 2850

🚀 Target 2: 2750

$ETH Daily chart volume decline of -5.19%, accompanied by 16.5 billion in high trading volume and open interest, indicating a typical “price falls, open interest increases” structure. This is not a healthy correction but a

$ETH Weak consolidation after volume decline, high open interest suggests intense bulls and bears competition. Current price action indicates selling pressure continues to absorb rebounds.

🎯 Direction: Short (Short)

🎯 Entry: 2950 - 2980

🛑 Stop Loss: 3050 (Rigid Stop Loss)

🚀 Target 1: 2850

🚀 Target 2: 2750

$ETH Daily chart volume decline of -5.19%, accompanied by 16.5 billion in high trading volume and open interest, indicating a typical “price falls, open interest increases” structure. This is not a healthy correction but a

ETH-4,43%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More26.52K Popularity

8.21K Popularity

512 Popularity

47.42K Popularity

341.2K Popularity

Hot Gate Fun

View More- MC:$3.42KHolders:20.05%

- MC:$3.42KHolders:20.06%

- MC:$3.39KHolders:10.00%

- MC:$3.38KHolders:10.00%

- MC:$3.38KHolders:10.00%

News

View MoreYoung developers leverage AI technology to create an air visualization platform airo2.xyz

1 m

Vitalik proposes introducing a native DVT staking mechanism at the Ethereum protocol layer to enhance security and decentralization

1 m

Data: If ETH breaks through $3,110, the total liquidation strength of mainstream CEX short positions will reach $1.494 billion.

2 m

Data: The probability of Bitcoin reaching $100,000 in January on Polymarket has dropped to 7%.

4 m

Chairman of the Russian Energy Committee: Illegal crypto mining causes approximately $250 million in losses to Russia annually

6 m

Pin