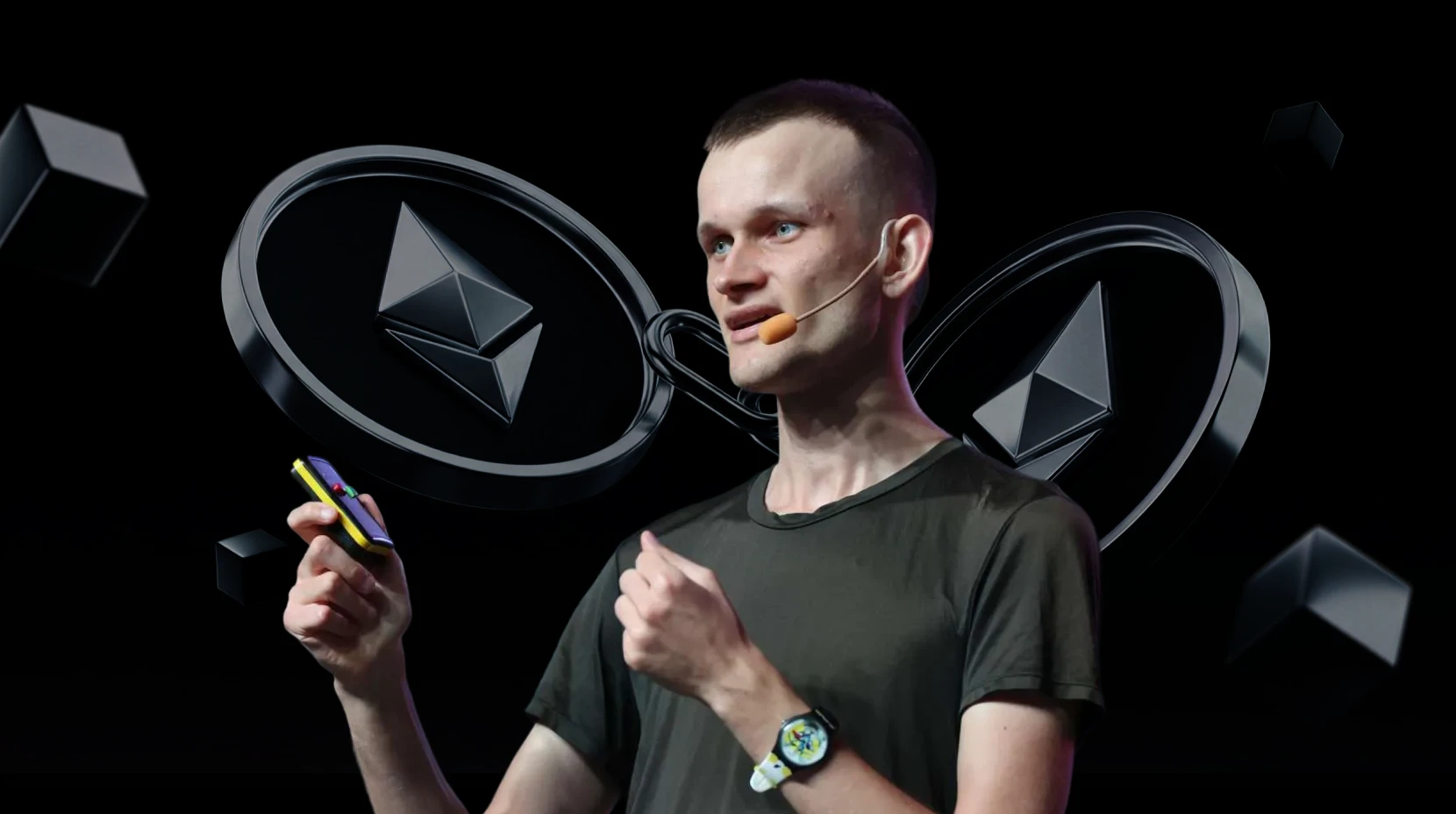

Ethereum

In the world of crypto, Ethereum is the source of innovation, where DeFi, NFTs, Layer 2, and numerous new technologies were created. One of its co-founders, Vitalik Buterin, is a key opinion leader in the crypto world. Ethereum launched a series of important upgrades to transition from proof-of-work (PoW) to proof-of-stake (PoS), which may help to break down the Blockchain Scalability Trilemma and makes Ethereum a “ultra-sound money”.

Articles (772)

Beginner

Bitcoin vs Ethereum: Fundamental Differences in BTC and ETH Design Goals

The fundamental difference between Bitcoin and Ethereum does not lie in surface features such as "whether they support smart contracts" or "how fast transactions are processed". The real distinction runs much deeper, rooted in the very missions each system was designed to fulfill from the beginning.

2026-02-14 08:45:55

Beginner

What is Gate GTETH? A Liquid Yield Model for ETH in Fast-Moving Markets

GTETH is a liquid asset model that embeds ETH staking rewards within the asset itself, enabling investors to retain complete liquidity and operational flexibility without sacrificing yield. This ETH asset management solution delivers both returns and strategic adaptability, making it ideal for navigating high-volatility markets.

2026-02-13 02:29:13

Intermediate

Ethereum 2026: Vitalik’s Bet on Trustlessness

The article traces a comprehensive vision of infrastructure-layer redecentralization — from ZK-EVM combined with block-level access lists bringing full nodes back to laptop-runnable levels, to Helios light clients enabling verifiable RPCs, ORAM/PIR for private queries, social recovery replacing fragile mnemonics, IPFS-hosted dapp UIs, and FOCIL’s forced inclusion of transactions to resist censorship.

2026-02-12 08:26:43

Beginner

Gate GTETH: Making ETH Both Profitable and Liquid in a Fast-Moving Market

In today’s crypto market, where high volatility and swift sector rotation are the norm, traditional ETH staking is exposing its liquidity limitations. GTETH overcomes these challenges with built-in yield and a no-lockup structure, giving ETH both earning potential and mobility. As a result, GTETH stands out as an asset management tool that aligns with the pace and demands of modern markets.

2026-02-11 02:41:26

Intermediate

What happened to Ethereum?

The article provides an in-depth analysis of Ethereum's predicaments and missteps on its "rollup-centric" roadmap, offering a comprehensive reflection on the underlying causes of its imbalances across technology, economic incentives, and cultural structure.

2026-02-09 08:58:24

Intermediate

Five Years Later, Vitalik Rewrites the Future He Once Envisioned for Ethereum

Vitalik has publicly dismissed the original concept of Layer 2 as Ethereum’s “branded sharding,” marking the end of the five-year rollup-driven narrative. This article analyzes gas costs, the stages of decentralization, L1 scaling acceleration, and the commercial realities facing Layer 2 to explore why the Ethereum mainnet is once again becoming faster and more affordable—and what this shift means for projects such as Arbitrum, Optimism, Base, and zkSync. As L1 takes on scaling directly, the foundational logic behind Layer 2 is undergoing a thorough reassessment.

2026-02-05 11:55:13

Intermediate

These People and Projects Are Key to ERC-8004

The Ethereum Foundation announced the upcoming launch of the ERC-8004 standard—a new protocol designed to provide on-chain identity and reputation systems for AI Agents. Alongside it, the accompanying x402 payment protocol will establish a standardized mechanism for value settlement among AI agents. This article comprehensively explains the design principles, technical functions, and ecosystem positioning of these two standards, while also outlining key participants and projects within ecosystems such as Ethereum, Base, and Solana.

2026-02-02 09:15:08

Intermediate

Ethereum’s AI Moment: Which Projects Are Worth Watching Under the ERC-8004 Standard?

Ethereum is preparing to roll out the ERC-8004 standard on its mainnet, enabling AI agents to carry portable identities, establish on-chain reputations, and access native payment capabilities. In tandem with the x402 micropayment protocol, this initiative is building the decentralized commercial infrastructure needed for AI. This article offers an in-depth look at its technical framework, real-world applications, and the ecosystem of projects likely to benefit. It also explores how Ethereum is transitioning from a settlement layer to an AI coordination layer, revealing the next phase of growth at the convergence of AI and crypto.

2026-01-28 11:17:05

Intermediate

Side Events Down Over 80%: Why ETHDenver Is Losing Its Momentum

As the number of ETHDenver 2026 side events plummets from 668 to just 56, this article examines the structural factors driving its decline. Key issues include the conference’s over-commercialization, dilution of core topics, delayed realization of expected crypto policy changes, and timing conflicts with the Lunar New Year. These trends highlight a shift in industry focus—from frenzied gatherings back to technology and sustained development.

2026-01-28 10:58:53

Intermediate

Ethereum in the New World Order

The article extends the discussion from Bitcoin's deficit accountability mechanism to the potential of Ethereum's Turing-complete smart contracts for global standardization. Moving beyond mere technical debates, it directly points to the civilizational significance of crypto protocols as higher-level organizational structures.

2026-01-27 10:40:12

Intermediate

Ethereum metrics hit record high because of cheap gas fees – because of this massive scam

The author not only outlines the cost reduction and scaling effects brought by parameter adjustments in Pectra, Fusaka, and Blob, but also uses data and specific attack techniques to reveal how fraud has been "whitewashed" as network adoption. This serves as a warning against blind metrics worship and security risks.

2026-01-26 11:38:15

Intermediate

A Decade-Long Debate at a Crossroads: Could Ethereum Finally Put an End to the "Blockchain Trilemma"?

This article offers a clear, in-depth analysis of how five years of Rollup centralization have fundamentally redefined blockchain’s underlying principles. With strong logical depth, precise technical details, and accurate historical positioning, it delivers compelling insights into Ethereum’s structural leap from the “choose two” model to achieving “all three.”

2026-01-19 10:19:04

Intermediate

Why Ethereum Urgently Needs to Go ZK

This article examines the imperative for Ethereum to implement ZK technology, detailing how zero-knowledge proofs are essential for improving mainnet efficiency and scalability. It analyzes the significant effects on node costs, TPS scaling, and Layer 2 synergy, offering key perspectives for understanding Ethereum’s future technical trajectory.

2026-01-14 10:04:29

Intermediate

Will 2026 Be a Breakout Year for Ethereum?

As we move into 2026, Ethereum faces a pivotal transformation. This article explores whether ETH can achieve a narrative shift from follower to leader, and assesses Ethereum’s long-term value proposition in the age of institutional adoption. The analysis centers on staking structures, institutional entry, core technology upgrades, and the emerging monopoly dynamics in the RWA sector.

2026-01-09 11:57:37

Intermediate

2026 ETH Update with Etherealize

Based on case studies of institutions such as J.P. Morgan, BlackRock, Fidelity, and Allianz, the article argues that Ethereum has emerged as the core platform for global asset tokenization and stablecoin deployment, predicting that ETH could achieve a "NVIDIA moment" with fivefold growth potential.

2026-01-09 10:46:19

Your Gateway to Crypto World, Subscribe to Gate for a New Perspective