XRP Price Forecast: Short-Term Could Test $1.6 Support, With 20% Upside Room for a Rebound

XRP Market Overview

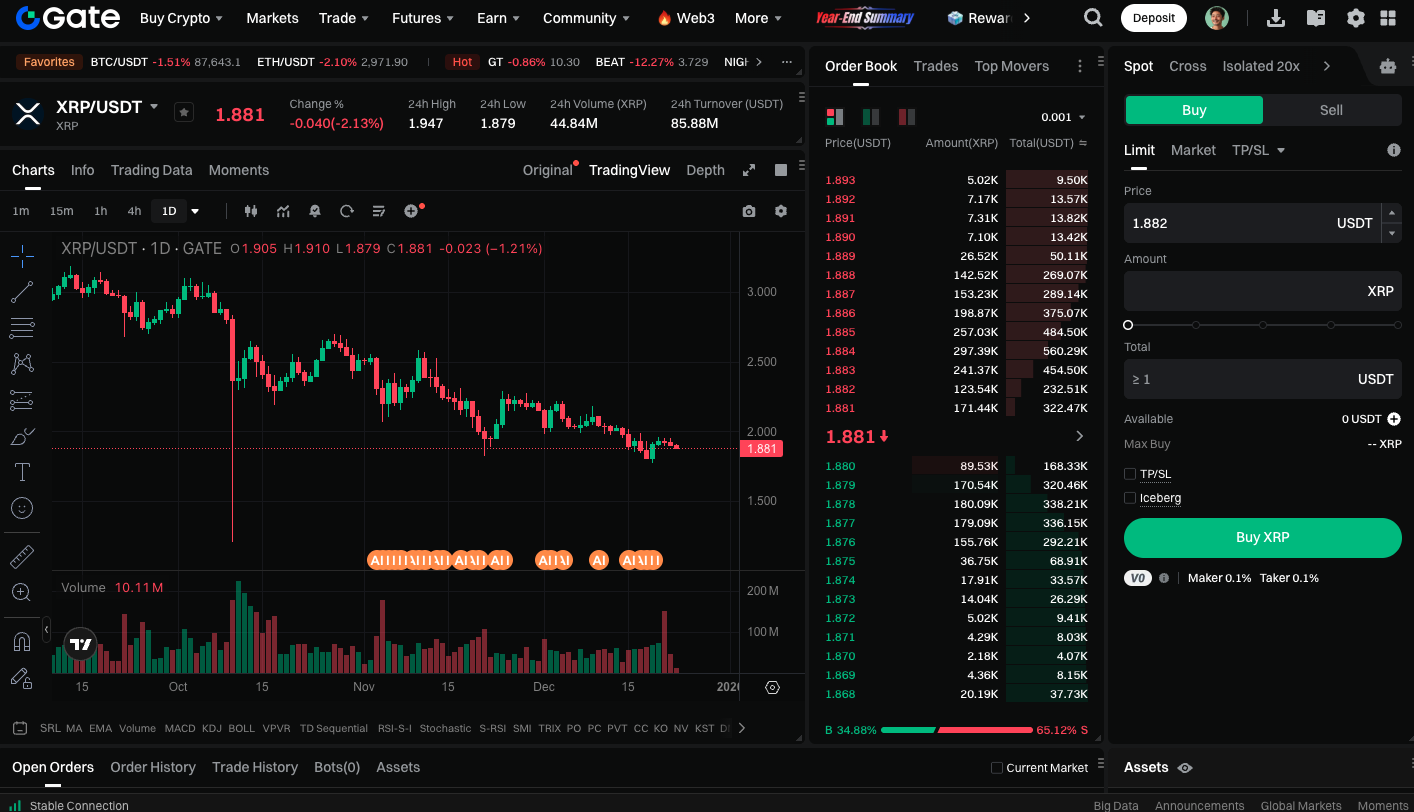

As 2025 trading draws to a close, XRP is trading in a tight range between $1.80 and $2.00. The market remains deeply divided after a year of sharp volatility—some traders are looking for a rebound, while others worry about a further breakdown. Price action within this band now serves as a key benchmark for XRP’s long-term trajectory.

Technical Support Under Pressure

Technically, XRP continues to hold above major support levels, but momentum has clearly faded. The $1.87 support has been tested repeatedly in recent sessions, and each bounce has grown weaker. Analysts warn that persistent tests of the same price zone can undermine its reliability.

A daily close below $1.60 would be a significant bearish signal for XRP. With little historical support below, the price could quickly fall toward $1.20 or even the psychological $1.00 level. In the near term, optimism is mostly driven by a TD Sequential buy signal around $1.90. However, XRP still trades below its key moving averages, so the broader trend remains bearish unless it can decisively break above the $2.50 resistance.

Fundamentals and Institutional Signals

Despite price fragility, Ripple’s ongoing progress continues to underpin its long-term outlook. Institutional inflows into the US XRP spot ETF are rising, with assets under management now surpassing $1 billion.

Ripple CEO Brad Garlinghouse has addressed market manipulation allegations, emphasizing XRP’s strong liquidity and broad market participation. The company’s application for a federally regulated national trust bank further demonstrates its commitment to operating within the established financial system rather than seeking regulatory loopholes.

Cross-Chain Interoperability and Market Sentiment

Speculation about cross-chain collaboration has also emerged. Cardano founder Charles Hoskinson has discussed potential cooperation with the XRP ecosystem in decentralized finance and privacy infrastructure. While no formal partnership exists yet, these conversations highlight XRP’s potential role in the global financial infrastructure.

Start trading XRP spot now: https://www.gate.com/trade/XRP_USDT

Conclusion

XRP is currently caught between technical headwinds and improving fundamentals. If it can hold the $1.60 support in the short term and break above $2.00, a rebound of roughly 20% remains possible. If support fails, a deeper decline could follow. Traders should closely monitor how this range resolves to position for the next market move.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution