XRP ETF Sees Over $1 Billion in Cumulative Inflows Since November Launch, Driving Institutional Capital Allocation

XRP ETF Cumulative Inflows Show Strong Performance

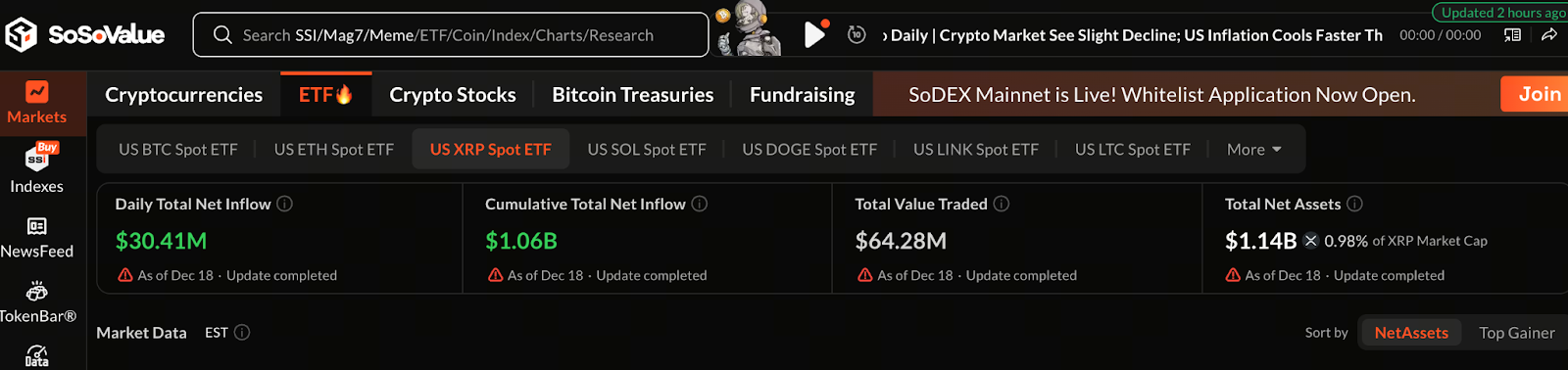

Chart: https://sosovalue.com/assets/etf/us-xrp-spot

In November 2025, the first XRP spot ETFs launched on major U.S. exchanges, drawing immediate and significant market attention. Recent data shows that cumulative capital inflows into XRP ETFs have topped $1.03 billion since listing. Achieving this scale in such a short period highlights strong capital market interest in regulated XRP investment products.

While these inflows still fall well short of those seen by Bitcoin and Ethereum ETFs, the rapid influx is impressive for an alternative crypto asset that has only recently entered mainstream finance. Notably, XRP ETFs have posted consecutive net inflows across multiple trading days, signaling that investors are steadily increasing their allocations rather than making one-off investments.

Why Institutional Capital Is Choosing XRP ETFs

From the institutional perspective, XRP ETFs are attractive primarily for their compliance and risk management advantages.

Unlike directly holding spot tokens, ETFs offer institutional investors a regulated, transparent, and supervised investment channel, reducing complexity around custody, compliance, and operations. ETFs also integrate more seamlessly into traditional asset allocation frameworks, meeting institutional requirements for risk control and auditability.

Furthermore, some institutions still view XRP’s potential in cross-border payments and settlement as part of a long-term strategic narrative. As regulatory clarity improves, the introduction of ETFs fills a previous gap, enabling institutions to allocate to XRP at scale through compliant channels.

Disconnect Between Capital Inflows and XRP Price Performance

Despite sustained ETF inflows, XRP’s price has not experienced a clear, one-sided rally in the short term. Instead, recent price action has remained range-bound, with trends shaped by macro risk sentiment and broader crypto market volatility.

This dynamic suggests that while ETF inflows provide some downside support for XRP, they are not yet sufficient to dictate short-term price trends. Hedging and selling pressure in derivatives markets persist, while some early holders have taken profits during price rebounds, offsetting the impact of new capital to some extent.

As a result, XRP’s current price movement reflects an ongoing tug-of-war between capital inflows and market supply and demand.

Potential Impact of XRP ETFs on Market Structure

From a medium- and long-term perspective, sustained ETF inflows could positively reshape the XRP market:

- Attracting longer-term capital: Increased institutional participation helps stabilize holdings

- Reducing liquidity risk: The ETF mechanism’s integration with the spot market helps smooth out short-term volatility

- Strengthening compliance: Regulated products enhance overall market transparency and institutional acceptance

These developments are expected to gradually transition the XRP market from one dominated by retail traders to a structure with greater institutional participation, laying the groundwork for long-term market growth.

Risk Factors and Key Areas for Continued Monitoring

It’s important to note that, although cumulative inflows into XRP ETFs have surpassed $1 billion, this amount remains modest relative to the overall market and is unlikely to drive decisive price movements in the short term. ETF capital flows are also highly sensitive to market risk appetite and may fluctuate if macroeconomic conditions tighten.

Moreover, XRP’s medium- and long-term performance will depend on several factors, including regulatory developments, shifts in market sentiment, technological evolution, and the broader crypto market cycle.

Conclusion

In summary, sustained inflows into XRP ETFs represent a positive and symbolic signal, demonstrating that institutional investors are gradually building exposure to XRP via compliant channels. However, ETFs primarily signal a shift in market structure and investor composition, rather than serving as a direct catalyst for rapid short-term price gains.

If capital inflows continue to grow steadily and are accompanied by ongoing improvements in market liquidity and depth, XRP’s long-term trajectory could gradually shift onto a more stable and sustainable path.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution