Why Digital Gold Bitcoin Lost to Real Gold in 2025

Remember the end of 2024, when everyone was busy predicting asset performance for 2025.

Stock investors focused on the S&P and China’s A-shares, while the crypto community placed their bets on Bitcoin.

But if someone had told you back then that the best-performing asset in 2025 wouldn’t be Bitcoin or equities, but gold—viewed unfavorably by Gen Z—you’d probably think they were joking.

Yet reality can be stranger than fiction.

Over the last five years, Bitcoin has trounced gold with more than 1,000% gains, outperforming it by almost tenfold and consistently topping annual asset rankings. But as we enter 2025, the tables have turned: since January, gold is up over 50%, while Bitcoin has only risen 15%.

Early gold buyers are reaping the rewards, while elite crypto traders have gone quiet.

Even more bizarre, gold and Bitcoin now seem to move in parallel universes: when gold climbs, Bitcoin drops; when Bitcoin falls, gold jumps.

On October 21, gold suffered a sharp setback, losing 5% in a single day, while Bitcoin, revitalized, began to rally…

Why has Bitcoin, once hailed as digital gold, become disconnected from its physical counterpart?

Gold in Turbulent Times

Who was the most aggressive gold buyer in 2025? Not retail investors, not institutions, but central banks worldwide.

The numbers are clear: in 2024, global central banks net purchased 1,045 tons of gold, breaking the 1,000-ton mark for the third consecutive year.

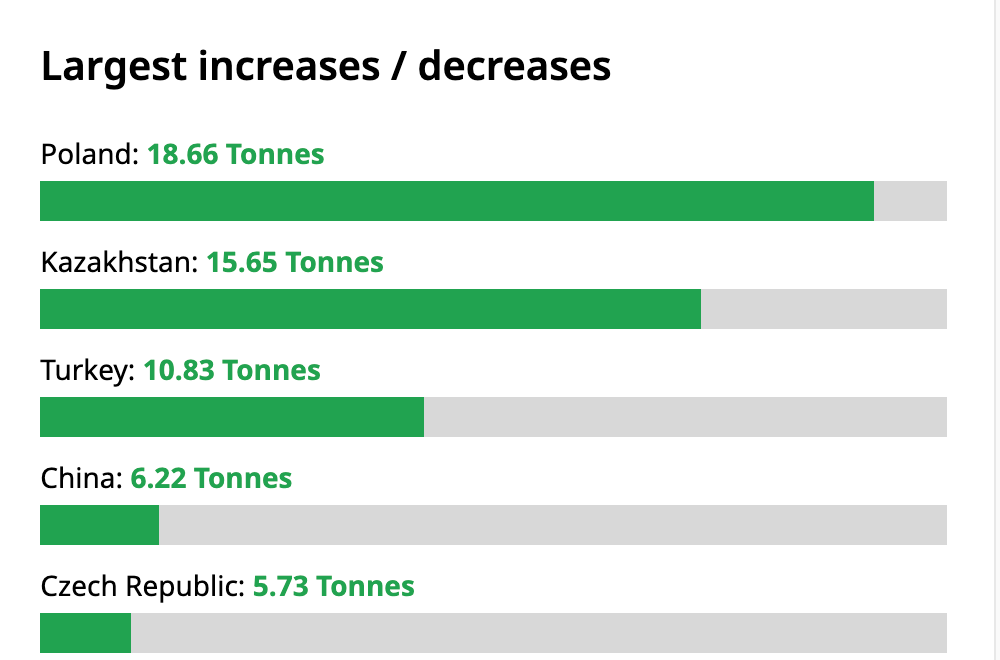

According to Q2 2025 data from the World Gold Council, Poland increased its reserves by 18.66 tons in one go, Kazakhstan followed with 15.65 tons, and China’s central bank steadily added 6.22 tons…

Why are developing countries ramping up their gold holdings?

Compare the gold reserve ratios across central banks: developed and developing nations operate in entirely different spheres.

The U.S. holds 77.85% of its reserves in gold, totaling 8,133 tons—far ahead of Germany’s 3,350 tons in second place, followed by Italy and France with 2,452 and 2,437 tons, respectively.

China’s central bank holds gold at just 6.7% of total reserves, though the absolute amount has reached 2,299 tons and continues to grow.

The contrast is stark—emerging markets have significant room to increase gold holdings. For large economies like China, the gold share is below 7%, while most developed Western countries are above 70%. This is a process of catching up: the wider the gap, the stronger the drive.

Remarkably, central banks’ share of global gold demand has soared from less than 10% in the 2000s to 20% today, providing crucial support for gold prices.

Why the sudden central bank gold rush? It’s simple: global instability, and the dollar’s reliability is in question.

Russia-Ukraine conflict, Middle East turmoil, U.S.-China trade tensions—the world is more fractured than ever.

Historically, the dollar served as the core reserve and safe haven for central banks. But with U.S. debt now at $36 trillion—124% of GDP—political uncertainty under Trump, external disputes, and internal strife, confidence has waned.

Especially after the Russia-Ukraine war began and the U.S. could freeze foreign reserves at will, countries realized: only the gold stored in their own vaults is true sovereign wealth.

Gold may not generate income, but it doesn’t vanish due to someone else’s policy decisions.

For both individuals and nations, gold is a risk hedge—the more chaotic the world, the greater the demand. Yet, when news breaks that “the Russia-Ukraine war may end,” a sharp drop in gold is no surprise.

Digital Gold or Digital Tesla?

Bitcoin may be the most awkward asset in 2025. Its narrative was “digital gold,” but it’s turned into “digital Tesla.”

Standard Chartered data shows Bitcoin’s correlation coefficient with the Nasdaq now reaches 0.5—at the start of the year, it was as high as 0.8. Its correlation with gold? Just 0.2, and at times earlier this year, zero.

In plain terms: Bitcoin is now tied to tech stocks. When Nasdaq rises, so does Bitcoin; when Nasdaq falls, Bitcoin drops too.

There is causation behind this shift.

Under the Trump administration, the U.S. went from treating Bitcoin as an “illegal cult” to welcoming it. The approval of spot Bitcoin ETFs in 2024 marked its formal integration into the dollar system.

This was meant to be positive, confirming Bitcoin’s legitimacy. But once you’re part of the system, it’s hard to resist its influence.

Bitcoin’s original appeal was its rebellious nature—not controlled by any government or central bank.

Now, Wall Street giants like BlackRock are the biggest buyers. Bitcoin’s price is dictated by the Fed and Trump, and crypto traders must monitor speeches by Powell and Trump, becoming de facto dollar macro analysts.

Globally, Bitcoin still faces the stage of widespread recognition, while gold enjoys the status of being a traditional favorite across generations.

The number of Chinese women with gold jewelry may well exceed the total number of global Bitcoin holders.

Compared to gold, Bitcoin is still young and has a long journey ahead before mainstream adoption.

Gold in One Hand, Bitcoin in the Other

Many frame gold and Bitcoin as either-or choices, but savvy investors know it’s a matter of balance.

While central banks are aggressively buying gold and prices keep climbing, this rally can’t last forever. As gold prices reach unsustainable heights, practical issues like storage, transportation, and delivery emerge—where Bitcoin’s advantages become clear.

Picture this: war breaks out, and wealthy individuals realize gold is heavy and easily noticeable—difficult to move quickly. In that moment, Bitcoin secured in a cold storage device is the optimal solution, a scenario that has occurred in Russia.

Put simply, gold is “bulky value storage,” while Bitcoin is “lightweight value storage.”

If gold prices soar to extreme levels, capital will seek alternatives with similar qualities but lower costs. In this scenario, Bitcoin could gradually break free from the dominance of the dollar and Trump’s influence, attract gold’s overflow capital, and reclaim its “digital gold” story.

In summary, the relationship between Bitcoin and gold is not about replacement—it is about succession and evolution.

Gold is the memory of wealth for human civilization; Bitcoin is the vision of wealth for the digital era.

Seventy-year-old Li Dama, a gold jewelry investor, and twenty-five-year-old programmer Li Xiaoming, a Bitcoin accumulator, each represent a vision for a brighter future.

Statement:

- This article is republished from [TechFlow]. Copyright belongs to the original author [Liam, Deep Tide TechFlow]. For any concerns regarding this republishing, please contact the Gate Learn team. The team will process requests promptly according to relevant procedures.

- Disclaimer: The opinions and views expressed in this article are the author’s own and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is referenced, reproduction, distribution, or plagiarism of the translated content is prohibited.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market