Why did Bitcoin drop ahead of the Bank of Japan's interest rate hike?

On December 15, Bitcoin dropped from $90,000 to $85,616—a single-day decline of over 5%.

There were no major shocks or negative news that day, and on-chain data showed no unusual selling pressure. If you only followed crypto news, it would be difficult to find a reasonable explanation.

Meanwhile, gold was quoted at $4,323 per ounce, down just $1 from the previous day.

One asset fell 5%, while the other barely moved.

If Bitcoin truly is “digital gold”—a tool for hedging inflation and fiat depreciation—then it should behave more like gold during risk events. Yet this time, its performance clearly resembled that of high-beta tech stocks on the Nasdaq.

What’s driving this sell-off? The answer may be found in Tokyo.

Tokyo’s Butterfly Effect

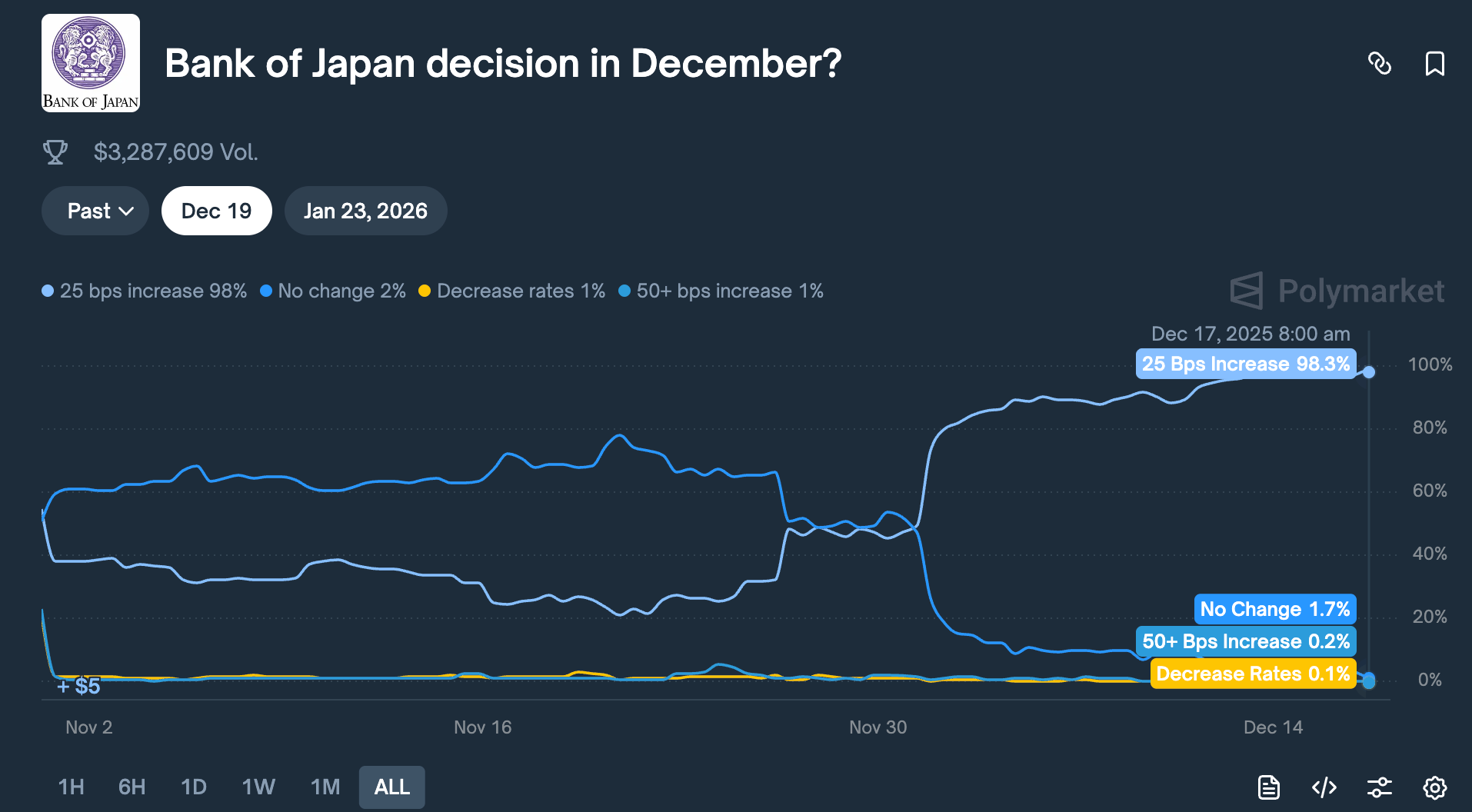

On December 19, the Bank of Japan will hold a policy meeting. Markets expect a 25-basis-point rate hike, raising the policy rate from 0.5% to 0.75%.

While 0.75% may sound modest, it’s the highest level in nearly 30 years for Japan. On prediction platforms like Polymarket, the probability of this rate hike is priced at 98%.

Why would a central bank decision in distant Tokyo cause Bitcoin to drop 5% in just 48 hours?

The answer lies in the “yen carry trade.”

The logic is straightforward:

Japanese interest rates have been near zero or even negative for years, making yen borrowing almost costless. As a result, global hedge funds, asset managers, and trading desks have borrowed large sums in yen, converted them to US dollars, and invested in higher-yielding assets—US Treasuries, US equities, or cryptocurrencies.

As long as the return on these assets exceeds the cost of borrowing yen, the yield spread is profit.

This strategy has existed for decades and is massive in scale—so large it’s hard to quantify. Conservative estimates put it at several hundred billion dollars; with derivatives exposure, some analysts believe it could reach several trillion.

Japan also holds a special status:

It is the largest foreign holder of US Treasuries, with $1.18 trillion in US government bonds.

This means changes in Japanese capital flows directly impact the world’s most important bond market—and, by extension, the pricing of all risk assets.

Now, when the Bank of Japan raises rates, the foundation of this strategy is shaken.

First, the cost of borrowing yen rises and arbitrage margins shrink. More importantly, expectations of a rate hike drive the yen higher. Since these institutions borrowed yen and converted it to dollars to invest,

they now need to sell dollar assets and convert proceeds back to yen to repay loans. The stronger the yen gets, the more assets they have to sell.

This “forced selling” isn’t selective about timing or asset class. The most liquid, easiest-to-cash-out assets get sold first.

That’s why Bitcoin, which trades 24/7, has less depth than equities, and no circuit breakers, is often the first to take the hit.

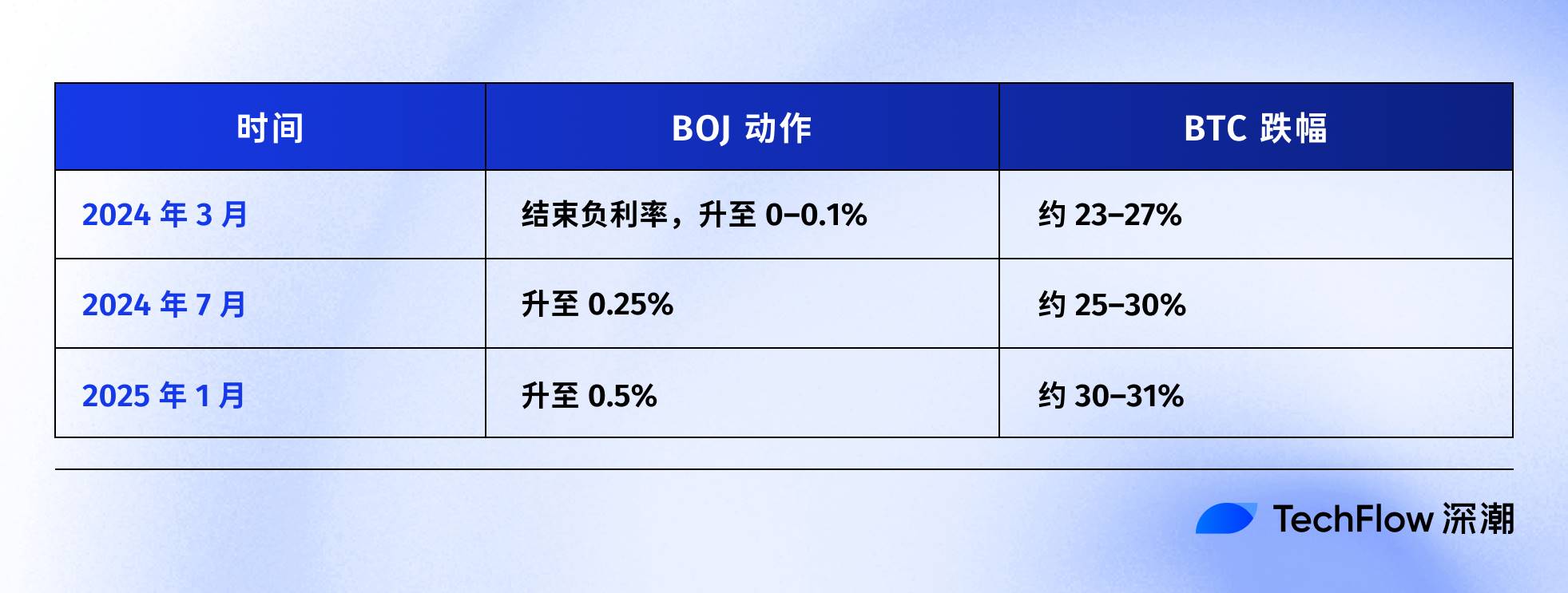

Looking at the Bank of Japan’s recent rate hike history, this hypothesis is supported by data:

The most recent case was July 31, 2024. After the BOJ raised rates to 0.25%, the yen appreciated against the dollar from 160 to below 140. BTC fell from $65,000 to $50,000 within a week—a 23% drop—wiping out $60 billion in crypto market cap.

On-chain analysts report that after each of the last three BOJ rate hikes, BTC experienced drawdowns of over 20%.

While the exact timing and magnitude vary, the direction is remarkably consistent:

Every time Japan tightens monetary policy, BTC takes the biggest hit.

That’s why I believe the events of December 15 were essentially the market “front-running.” Even before the December 19 decision, capital was already pulling out.

That day, US BTC ETFs saw net outflows of $357 million—the largest single-day outflow in two weeks. Over $600 million in leveraged crypto long positions were liquidated within 24 hours.

This likely wasn’t retail panic, but a chain reaction of arbitrage trades being unwound.

Is Bitcoin Still Digital Gold?

We’ve explained the yen carry trade mechanism, but another question remains:

Why is BTC always the first asset to be sold?

It’s often said that BTC has “good liquidity and trades 24/7.” That’s true, but not the full story.

The real reason is that, over the past two years, BTC has been repriced: it’s no longer an “alternative asset” independent of traditional finance—it’s now part of Wall Street’s risk portfolio.

In January last year, the US SEC approved spot Bitcoin ETFs—a milestone the crypto industry waited a decade for. Asset management giants like BlackRock and Fidelity can now legally include BTC in client portfolios.

Capital has flowed in, but with it came a shift in identity: BTC holders have changed.

Previously, BTC buyers were crypto natives, retail investors, and aggressive family offices.

Now, buyers include pension funds, hedge funds, and asset allocation models. These institutions also hold US stocks, Treasuries, and gold, managing risk budgets across asset classes.

When they need to reduce risk, they don’t just sell BTC or stocks—they trim all exposures proportionally.

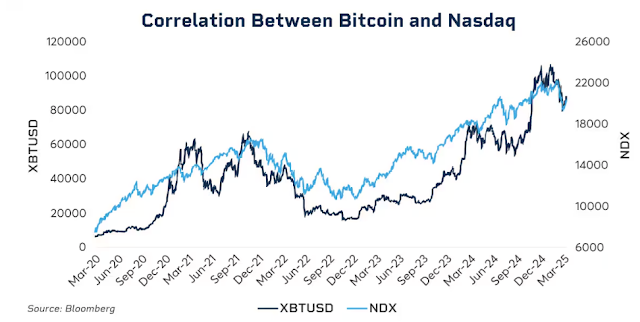

The data shows this connection.

In early 2025, the 30-day rolling correlation between BTC and the Nasdaq 100 reached 0.80—the highest since 2022. Before 2020, this correlation hovered between -0.2 and 0.2, essentially uncorrelated.

More importantly, this correlation spikes during periods of market stress.

During the March 2020 pandemic crash, the Fed’s aggressive rate hikes in 2022, and tariff concerns in early 2025, BTC and US equities became even more closely linked as risk-off sentiment intensified.

In times of panic, institutions don’t distinguish between “crypto assets” and “tech stocks”—they only see risk exposure.

This raises a tough question: does the digital gold narrative still hold?

Looking at the longer term, since 2025, gold has gained over 60%—its best year since 1979—while BTC has fallen more than 30% from its peak.

Both are touted as hedges against inflation and fiat currency depreciation, yet in the same macro environment, their paths have diverged completely.

This isn’t to say BTC’s long-term value is in doubt—its five-year compound annual return still far outpaces the S&P 500 and Nasdaq.

But at this stage, its short-term pricing logic has changed: it’s now a high-volatility, high-beta risk asset, not a safe haven.

Understanding this is key to seeing why a 25-basis-point BOJ rate hike can cause BTC to drop thousands of dollars in just 48 hours.

It’s not that Japanese investors are selling BTC; it’s that, as global liquidity tightens, institutions reduce all risk exposures in tandem—and BTC is the most volatile and liquid link in that chain.

What Will Happen on December 19?

At the time of writing, there are still two days before the BOJ policy meeting.

The market has already priced in a rate hike. Japan’s 10-year government bond yield has climbed to 1.95%, an 18-year high. The bond market has already anticipated tighter policy.

If the rate hike is fully expected, will December 19 still bring a shock?

History says yes, but the impact depends on the central bank’s language.

The effect of a policy decision isn’t just about the number—it’s about the signal. For the same 25-basis-point hike, if BOJ Governor Kazuo Ueda says, “We will assess future moves cautiously based on data,” markets may relax.

If he says, “Inflationary pressures persist and further tightening is possible,” it could trigger another wave of selling.

Japan’s current inflation is around 3%, above the BOJ’s 2% target. The market’s concern isn’t this rate hike, but whether Japan is entering a prolonged tightening cycle.

If so, unwinding the yen carry trade could become a months-long process, not a one-off event.

However, some analysts see things differently this time.

First, speculative yen positions have shifted from net short to net long. The sharp July 2024 sell-off was partly due to the market being caught off guard—there were still large short positions in the yen. Now, positioning has reversed, limiting room for surprise appreciation.

Second, Japanese government bond yields have already risen for much of the year, from 1.1% at the start to nearly 2% now. In a sense, the market has “already hiked rates,” and the BOJ is simply catching up.

Third, the Federal Reserve just cut rates by 25 basis points, and global liquidity is generally easing. Japan is tightening against the trend, but if dollar liquidity remains abundant, it could partially offset yen-side pressure.

These factors can’t guarantee BTC won’t fall, but they may mean any drop will be less severe than in previous episodes.

Historically, after BOJ rate hikes, BTC typically bottoms out one to two weeks later, then consolidates or rebounds. If this pattern holds, late December to early January could be the most volatile period—but also a potential opportunity after forced selling.

Accepted and Affected

To sum up, the logic chain is clear:

BOJ rate hike → yen carry trade unwinding → global liquidity tightening → institutions cut risk → BTC, as a high-beta asset, is sold first.

BTC itself hasn’t done anything wrong in this process.

It’s simply been placed at the end of the global macro liquidity chain—a position it can’t control.

You may not like it, but this is the new normal in the ETF era.

Before 2024, BTC’s price was mainly driven by crypto-native factors: halving cycles, on-chain data, exchange trends, and regulatory updates. Its correlation with US stocks and Treasuries was low, making it a truly “independent asset class.”

After 2024, Wall Street entered the picture.

BTC is now managed within the same risk framework as stocks and bonds. Its ownership structure and pricing logic have changed.

BTC’s market cap surged from several hundred billion to $1.7 trillion. But this brought a side effect: BTC lost its immunity to macro events.

A single Fed statement or BOJ decision can move its price by over 5% in just hours.

If you believe in the “digital gold” narrative—that BTC provides shelter in turbulent times—2025’s performance may be disappointing. At least for now, the market isn’t treating it as a safe haven.

Perhaps this is just a temporary misalignment. Maybe institutional adoption is still in its early stages, and as allocations stabilize, BTC will regain its rhythm. Maybe the next halving will again prove the dominance of crypto-native drivers…

Until then, if you hold BTC, you must accept this reality:

You’re also exposed to global liquidity. What happens in a Tokyo boardroom could have a greater impact on your account next week than any on-chain metric.

This is the price of institutionalization. Whether it’s worth it is up to each individual.

Disclaimer:

- This article is republished from [TechFlow], with copyright belonging to the original author [David]. If you object to this republication, please contact the Gate Learn team, who will address it as soon as possible in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author alone and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is mentioned, you may not copy, distribute, or plagiarize the translated article.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

BTC and Projects in The BRC-20 Ecosystem

What Is a Cold Wallet?

Blockchain Profitability & Issuance - Does It Matter?

What is the Altcoin Season Index?