What is World Liberty Financial (WLFI)?

What is WLFI?

(Source: worldlibertyfi)

WLFI (World Liberty Financial) is a DeFi ecosystem that integrates a governance token and a stablecoin. The primary objective is to advance decentralized finance and promote a USD-pegged stablecoin. WLFI’s native token is built on the Ethereum ERC-20 standard. Initially, its use was confined to governance voting within the platform. It was non-transferable. After a community governance proposal passes in July 2025, WLFI will officially enable trading functions on September 1, 2025, transforming it into a liquid asset. This structure is both a technical choice and a deliberate governance experiment by the project team to measure community engagement.

Presale and Early Fundraising

WLFI made its public debut with a token presale on October 15, 2024.

The presale was conducted in two price phases: $0.015 and $0.05 per token.

The presale raised a total of $550 million and attracted participation from over 85,000 investors.

This substantial fundraising made WLFI a market focal point even before its exchange listing.

USD1 Stablecoin

Within the WLFI ecosystem, the USD1 stablecoin is indispensable.

USD1 Peg: USD1 is backed by U.S. Treasuries, cash, and equivalent assets to ensure value stability.

Multi-chain deployment: It is currently deployed on major blockchains including Ethereum, BNB Chain, Solana, and Tron.

Use cases: Used for cross-border payments, rapid settlements, and DeFi applications, with an emphasis on low cost and global accessibility.

The introduction of USD1 is not only foundational to WLFI’s ecosystem. It also represents an extension of the digital dollar strategy, further reinforcing the U.S. dollar’s international influence.

Tokenomics

WLFI’s tokenomics are relatively complex, designed with an initial circulating supply and locked allocations to ensure both market liquidity and long-term stability.

Initial Circulating Supply

At launch, WLFI had a circulating supply of 24,669,070,265 tokens, distributed as follows:

Ecosystem incentives: 10 billion tokens to drive WLFI adoption and partnerships.

ALT5 Sigma Corporation: 7,783,585,650 tokens as part of its treasury strategy, accounting for approximately 8% of the total supply.

Liquidity and marketing: 2.88 billion tokens to support initial trading depth and marketing efforts.

Unlocked public sale allocation: 4 billion tokens for early investors, with about 20% released at launch.

Locked and Long-Term Allocations

Beyond the initial circulating supply, most WLFI tokens were locked at the project’s launch, including:

Project treasury reserves: Approximately 19.955 billion tokens, with allocation details yet to be announced.

Team allocation: Approximately 33.5 billion tokens, also subject to a vesting plan to ensure long-term incentives.

Locked public sale allocation: Approximately 16 billion tokens to be gradually released according to a predetermined schedule.

Strategic partners: Approximately 5.85 billion tokens to advance external partnerships and resource integration.

The project team designed the allocation framework to balance long-term development with short-term liquidity.

Official Buyback Activity

After WLFI officially launched, the project team’s wallet executed two purchases of 1 million USD1 each on the evening of September 1, 2025, totaling $2 million, acquiring about 6.5 million WLFI tokens. The market viewed this as an official show of support and confidence, further strengthening investor trust in WLFI.

WLFI’s Narrative Value

WLFI differentiates itself by combining financial and political elements.

Political background: Endorsement by the Trump family gives WLFI a distinctly American narrative.

Financial positioning: The launch of the USD1 stablecoin positions WLFI as an important experiment in digitalizing the U.S. dollar.

Market strategy: The large-scale presale and community governance approach invite both retail and institutional participation.

This intersection of multiple narratives has made WLFI a highly discussed project in the crypto space.

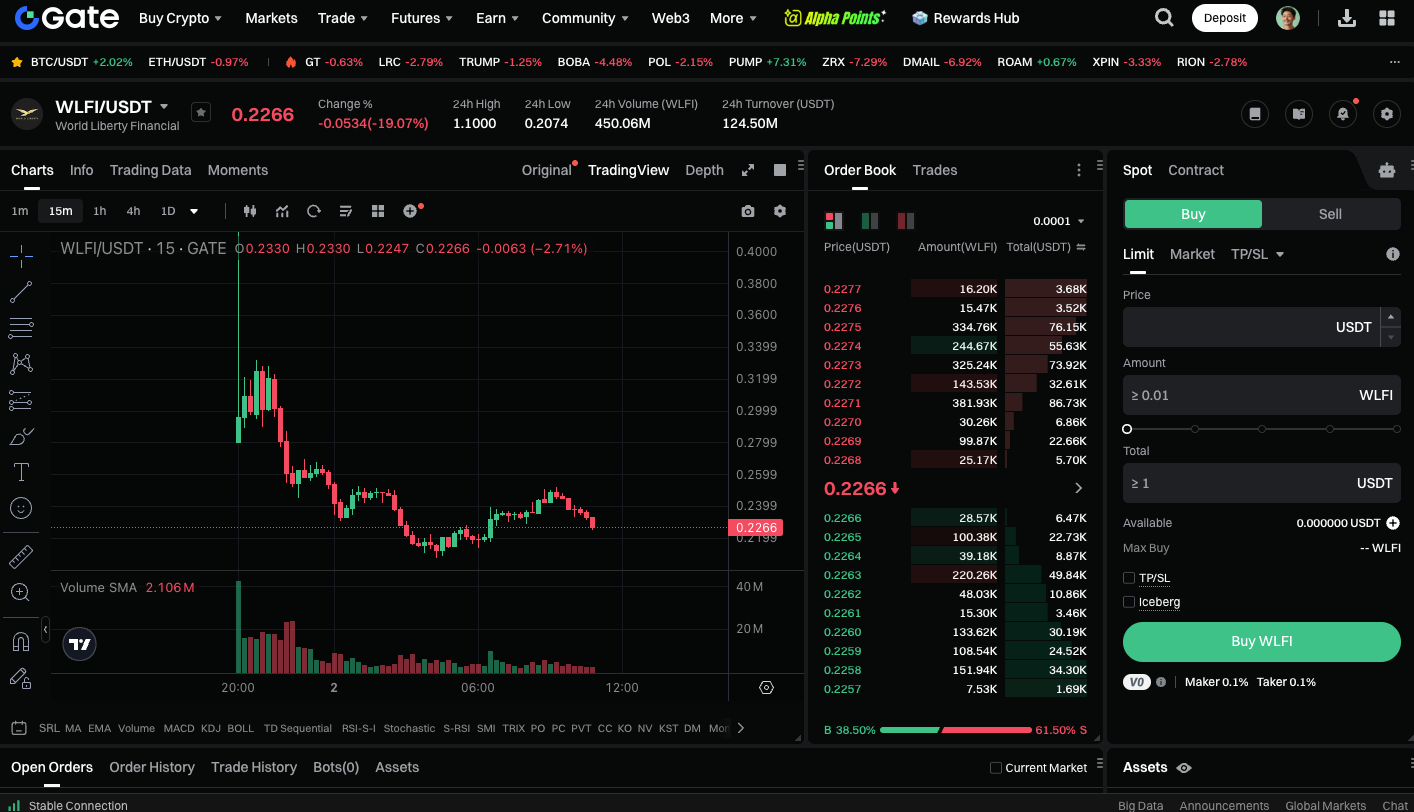

WLFI spot trading is available: https://www.gate.com/trade/WLFI_USDT

Summary

World Liberty Financial (WLFI) is more than just a new token; it is an experiment in financial sovereignty, U.S. dollar dominance, and the global adoption of cryptocurrencies. WLFI not only offers a governance token and USD1 stablecoin, but its massive fundraising, meticulous tokenomics, and backing by prominent political figures have made it one of the most discussed and controversial projects of 2024–2025. For Web3 participants, WLFI is more than an investment; it is an example of how cryptocurrencies intersect with geopolitics. As developments continue in 2025, whether WLFI can realize its ambitious vision and help renew both crypto and American leadership will remain a focal point for the market.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution