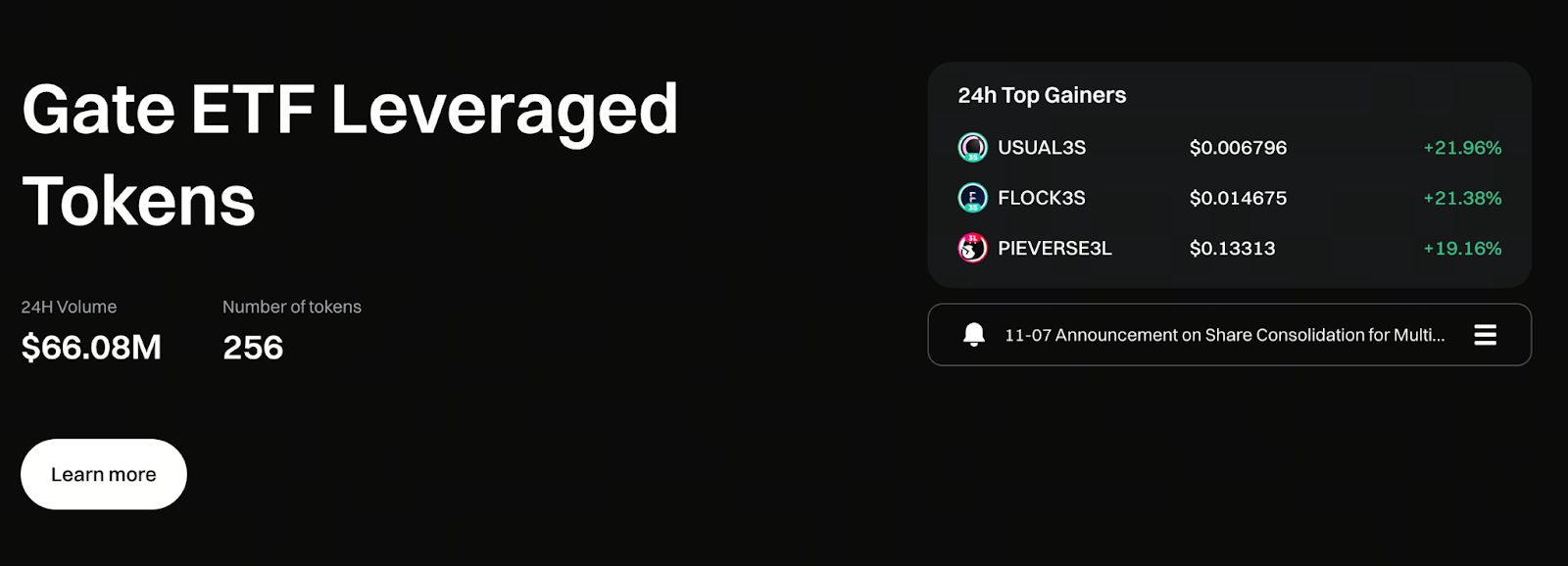

Gate Leveraged ETFs: Mechanics, Advantages, and Key Risks

ETFs: Evolving from Traditional Allocation to Strategic Tools

ETFs (Exchange-Traded Funds) were initially designed to track market performance. Investors could buy and sell them just like stocks, allowing for easy allocation across a basket of assets. Because they combine risk diversification with trading convenience, ETFs have long been a relatively stable choice in investment markets.

However, as demand for strategic trading tools has grown, traditional ETFs can no longer keep pace with the increasingly active market environment. This led to the development of leveraged ETFs, which let investors magnify the price movements of underlying assets and seize larger short-term opportunities—all without engaging with derivatives.

What Are Gate Leveraged ETF Tokens?

Gate’s leveraged ETF tokens are backed by perpetual futures positions that maintain a fixed leverage ratio (such as 3x or 5x). Users don’t need to manage margin, borrow funds, or open futures contracts. By simply trading the token on the spot market, investors can establish leveraged exposure.

Since the system centrally manages and adjusts all positions, the typical risk of forced liquidation found in traditional leveraged trading is eliminated. This significantly lowers both the entry barrier and operational stress.

Start trading Gate leveraged ETF tokens now: https://www.gate.com/leveraged-etf

How Leveraged ETFs Work

To keep each leveraged ETF’s multiple stable even during volatile markets, Gate uses several mechanisms:

1. Perpetual futures positions maintain target leverage

Each token corresponds to a dedicated futures position, with precise adjustments ensuring leverage stays within the specified range.

2. Automated daily rebalancing

The system adjusts positions daily in response to market changes, preventing leverage from drifting and keeping product performance consistent.

3. Direct spot market participation

There’s no need to interact with contracts or understand borrowing and leverage mechanics. Simply buying or selling the token delivers leveraged exposure.

4. Daily management fee ensures product stability

The platform charges a 0.1% daily fee, covering rebalancing, hedging, and contract costs so the ETF can operate smoothly over time.

Key Advantages of Leveraged ETFs

1. Amplify market trends with leverage

In trending markets, leverage magnifies both gains and losses, rapidly increasing profit potential.

2. No liquidation risk, less operational stress

All contracts are managed by the system, so there’s no risk of forced liquidation due to margin shortfall.

3. Rebalancing effect compounds returns in strong trends

When trends persist, rebalancing increases long positions, creating a compounding effect on gains.

4. Low learning curve—trades like spot

For those unfamiliar with derivatives, leveraged ETFs provide a more accessible way to implement leveraged strategies.

Risks You Must Understand Before Using

Despite their simple operation, leveraged ETFs are inherently high-volatility products. Keep the following in mind before participating:

1. Amplified volatility

Profits and losses are both multiplied, and short-term swings have a greater impact compared to spot trading.

2. Performance erosion in sideways markets

Frequent rebalancing can erode performance, so returns may be suboptimal in range-bound conditions.

3. Actual performance may deviate from the leverage multiple

Due to rebalancing and market volatility, final returns may not move in perfect proportion to the leveraged multiple of the underlying asset.

4. Long-term costs are reflected in price

Daily management and hedging fees are built into the product. Long-term holders should pay special attention to these ongoing costs.

For these reasons, leveraged ETFs are best suited for short-term strategies, periods of heightened volatility, or strong market trends—not for passive, long-term investing.

Why Is There a Management Fee?

To maintain a fixed leverage structure, the platform must cover ongoing costs, including:

- Opening and closing contract fees

- Funding rates

- Hedging and rebalancing costs

- Trading slippage

The daily 0.1% management fee covers these ongoing expenses and is a standard rate for similar leveraged ETF products.

Summary

Leveraged ETFs allow traders to amplify market volatility without trading futures, offering an efficient and user-friendly strategic tool. However, higher leverage demands a strong grasp of market timing, volatility, and cost implications. Knowing when to enter and when to avoid choppy markets is crucial to unlocking the true value of leveraged products. Used at the right time, they are excellent for maximizing capital efficiency. In uncertain or sideways markets, they may lead to capital erosion. Understand the mechanisms and manage your risk—then leveraged ETFs can become a powerful addition to your trading strategy.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution