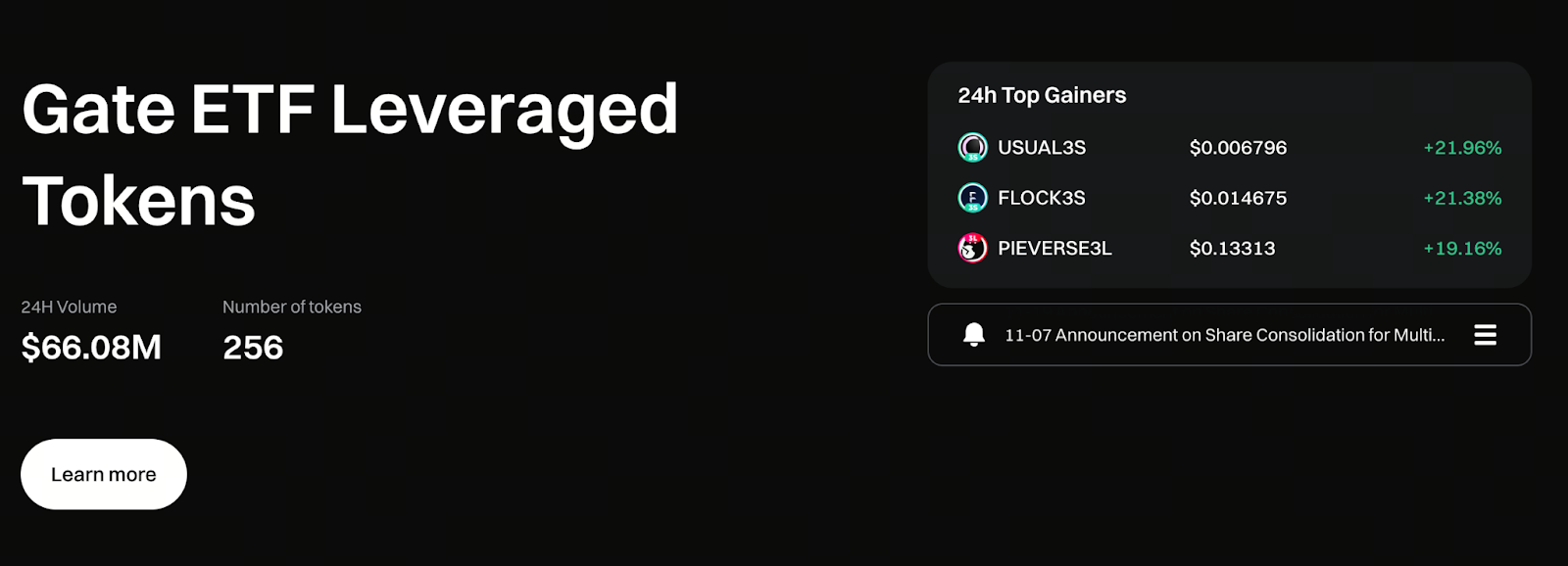

Gate ETF Leveraged Tokens Explained: An Intelligent Trading Tool to Amplify Gains in Trend Markets

Image: https://www.gate.com/leveraged-etf

Why Are More Traders Focusing on Gate ETF Leveraged Tokens?

As the crypto market matures, investors now demand more from trading tools than just “tradability.” They increasingly prioritize efficiency and risk management. Against this backdrop, Gate’s ETF leveraged tokens have become a top choice for trend-focused traders.

Unlike traditional derivatives, ETF leveraged tokens act as structured leverage instruments. They package the complexities of contract trading into tokens that can be traded directly, allowing everyday users to access high-volatility markets.

Especially during clear upward or downward trends, the leverage amplification of Gate ETF leveraged tokens makes them essential tools for many short-term and swing trading strategies.

What Are Gate ETF Leveraged Tokens?

Gate ETF leveraged tokens are tokenized products that track crypto asset price movements and automatically maintain a fixed leverage ratio.

- Take BTC3L as an example: it provides 3x long exposure to Bitcoin’s price.

- If Bitcoin rises, BTC3L’s net asset value increases by roughly three times the underlying movement.

- If Bitcoin falls, the corresponding BTC3S (3x short) may generate returns.

The platform automatically manages all leveraged exposure through perpetual contracts, so users never have to interact directly with complex derivatives.

How Do ETF Leveraged Tokens Achieve a “No Forced Liquidation” Mechanism?

This is one of the standout advantages of Gate ETF leveraged tokens. In traditional contract trading, sharp price swings can trigger forced liquidations. ETF leveraged tokens, however, use automatic rebalancing to dynamically adjust positions as prices move, always maintaining the target leverage ratio.

This means:

- No margin calls

- No forced liquidations

- The user’s maximum loss is limited to the initial investment

This design dramatically reduces the “uncontrollable risk” of leveraged trading and better aligns with the risk tolerance of typical investors.

Compounding Effect of ETF Leveraged Tokens in Trending Markets

In strong trending markets, Gate ETF leveraged tokens deliver a pronounced compounding effect. When the market moves consistently up or down, leveraged tokens accumulate returns on a daily basis, so total gains often exceed a simple multiplier calculation.

This is why ETF leveraged tokens are often called “amplifiers for trending markets.”

Keep in mind, this compounding effect is most powerful in trending markets. In sideways or choppy markets, the effect diminishes significantly.

When Are Gate ETF Leveraged Tokens the Right Tool?

Gate ETF leveraged tokens are not a one-size-fits-all solution, but they offer clear advantages in specific scenarios.

They are best suited for:

- Markets with clear, strong upward or downward trends

- Traders seeking amplified returns without managing derivatives

- Those looking to avoid forced liquidation risk

- Short-term or mid-term swing trading strategies

In volatile, range-bound markets, frequent price swings can erode net asset value, so these tokens are not ideal for long-term, passive holding without a strategy.

Management Fees and Risk Awareness: Key Points Before Investing

While Gate ETF leveraged tokens have a low barrier to entry, they are not cost-free.

ETF leveraged tokens typically charge a daily management fee to cover rebalancing and risk management. These costs are reflected in the token’s net asset value and can impact returns over the long term.

Additionally, leverage inherently means:

- Amplified profits

- Amplified risks

As a result, prudent position sizing and a clear trading time frame are essential principles when using ETF leveraged tokens.

The Role of Gate ETF Leveraged Tokens in Today’s Market Environment

As crypto ETFs gain acceptance in traditional finance, the market’s understanding of ETF structures is deepening.

Gate ETF leveraged tokens are not conventional securities ETFs, but their ETF-like design makes leveraged trading more intuitive and accessible.

With tightening regulations and higher barriers to derivatives trading, these products offer traders a more flexible alternative.

Conclusion: Use Leverage as a Tool, Not a Risk

The core value of Gate ETF leveraged tokens is not to encourage unlimited leverage, but to simplify complex leveraged trading into a manageable tool through structured design.

- In trending markets, they effectively amplify returns from correct market calls.

- For risk management, their no forced liquidation mechanism reduces exposure to extreme events.

When used appropriately, Gate ETF leveraged tokens can be a vital component of a trend trading strategy—not a risk amplifier.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution