Farcaster acquires Clanker to fill its financial gap, is the social track gaining momentum again?

Recently, decentralized social protocol Farcaster announced its acquisition of Clanker, a leading token issuance platform on the Base chain. Once the deal closed, Farcaster immediately announced that Clanker would initiate a buyback program and measures to reduce token supply, committing two-thirds of protocol revenue to ongoing CLANKER token repurchases.

The CLANKER token price soared following the announcement, with its weekly gain now exceeding 400%. While the acquisition outwardly reflects Farcaster’s strategy to build a value capture mechanism via Clanker, it may also signal an emerging trend in the decentralized social sector.

Clanker’s One-Click AI Token Issuance Empowers Farcaster

Farcaster’s decision to strategically acquire Clanker stems from its AI-powered, innovative business model and robust revenue generation.

Clanker, deployed on the Base chain, distinguishes itself through its AI Agent-driven one-click token issuance. Users can easily mint ERC-20 tokens without any coding expertise, significantly simplifying token creation and reducing technical barriers.

Importantly, Clanker allows users to issue tokens directly on Farcaster by tagging (@clanker), creating a new SocialFi model. Here, the AI Agent becomes more than a chat tool—it acts as efficient and profitable Web3 financial infrastructure. By merging AI automation with social media immediacy and community momentum, Clanker translates social sentiment into on-chain financial actions, significantly reducing friction from “social interaction” to “on-chain transaction.”

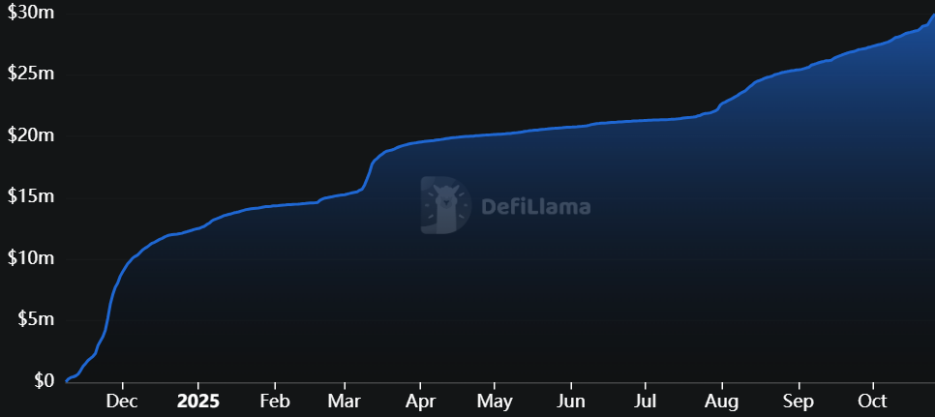

Clanker’s revenue performance is equally impressive. According to clanker.world, since its November launch, Clanker has generated nearly $30 million in cumulative fees.

The protocol’s income derives from a 1% transaction fee on every Clanker-issued token trade on Uniswap V3. Of this, 60% goes to the protocol and 40% to token creators. An anonymous Clanker co-founder noted that Clanker generated profit from day one, with a lean team and low operational expenses, resulting in most revenue being net profit, and positioning Clanker among Base’s most profitable projects.

Decentralized Social Sector Shifts Toward “Social Graph + Financialization” Integration

Farcaster’s acquisition of Clanker suggests the decentralized social sector is moving past traditional social graph competition and toward embedded financialization and direct value capture.

Clanker’s token deployment tools will be integrated into Farcaster’s social graph, representing a deeper convergence of artificial intelligence (AI) and SocialFi. This creates a unified and highly functional ecosystem, potentially establishing Farcaster as the leading platform for community token launches.

This acquisition marks Farcaster’s evolution from a pure decentralized social protocol to a comprehensive ecosystem blending social, creation, and issuance. While decentralized protocols like Lens focus on data ownership, Farcaster aims to monetize via Clanker. Clanker’s capabilities help Farcaster offer users a streamlined path from “idea” (posting) to “financial product” (token issuance), solidifying its role as the Base chain’s decentralized social hub and boosting network effects and competitiveness.

A heated bidding contest for Clanker drew wide market attention before the acquisition. According to founder Jack Dishman, crypto wallet provider Rainbow nearly initiated a buyout in August, offering 4% of its soon-to-launch RNBW token’s supply to acquire Clanker and integrate its token launch features. Clanker, however, deemed Rainbow’s offer unsuitable and declined. Rainbow responded by threatening to publish the proposal letter if Clanker refused. Despite Clanker’s repeated rejection, Rainbow released the acquisition terms without Clanker’s consent, further aggravating Clanker due to Rainbow’s communications and conduct.

Farcaster’s proposal offered strong strategic synergy and a shared ecosystem. Jack Dishman emphasized, “Clanker’s success is inseparable from Farcaster,” noting its foundation in Farcaster’s open social graph and thriving ecosystem, demonstrating strategic alignment. Farcaster’s offer respected Clanker’s independence and community interests. First, Farcaster retained Clanker’s original token system and committed to using two-thirds of protocol revenue for CLANKER buybacks. Second, Farcaster destroyed the early protocol fee pool and locked 7% of total supply in single-sided liquidity, reducing circulating supply and maximizing token holder value.

Compared to Pump.fun, Clanker Prioritizes Creator Incentives

Clanker’s success is not mere imitation; its business model is distinct from Solana’s meme token launchpad, Pump.fun.

The key difference is in their incentive structures. Clanker uses a creator economy model focused on long-term incentives and ongoing rewards. Tokens issued through Clanker trade on Uniswap V3, and creators receive a continuous share of fees (40%). This incentivizes Farcaster creators to treat meme tokens as a sustainable revenue stream, closely linking their interests to long-term liquidity and trading volume, which aligns with Farcaster’s decentralized social principles.

Pump.fun, on the other hand, rewards early adopters and price discovery via a bonding curve, and moves tokens to a DEX after reaching a certain market cap. While this model supports short-term speculation and fair launches, it offers less sustained income for creators compared to Clanker’s revenue-sharing approach.

On liquidity management and trading mechanisms, the platforms differ. Clanker employs a continual 1% Uniswap V3 trading fee, emphasizing lasting liquidity and fee generation. This ensures liquidity remains on Uniswap V3, is transparent, controllable, and maintains depth and reliability, attracting more traders.

Pump.fun relies on bonding curves for price discovery, only listing tokens on DEX once a market cap threshold is met. While this helps mitigate selling pressure, it lacks the robust DeFi infrastructure and advanced liquidity management that Clanker provides.

Statement:

- This article is republished from [PANews]; copyright remains with the original author [J.A.E]. For republication concerns, contact the Gate Learn team, which will address the matter promptly in accordance with our procedures.

- Disclaimer: The views and opinions in this article are those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is expressly referenced, translated articles may not be copied, distributed, or used without permission.

Related Articles

Reshaping Web3 Community Reward Models with RWA Yields

Gate Research: Exploring the SocialFi Landscape in 2024: Insights on the Path Forward, Market Trends, and Future Directions

An Overview of Musk's Love-Hate Relationship with DOGE

A Beginner's Guide to the SuperRare NFT Market

The Importance of On-chain Reputation