Digital banks no longer conduct banking business; the real goldmine lies in stablecoins and identity verification.

Where Does the Real Value of Digital Banks Flow?

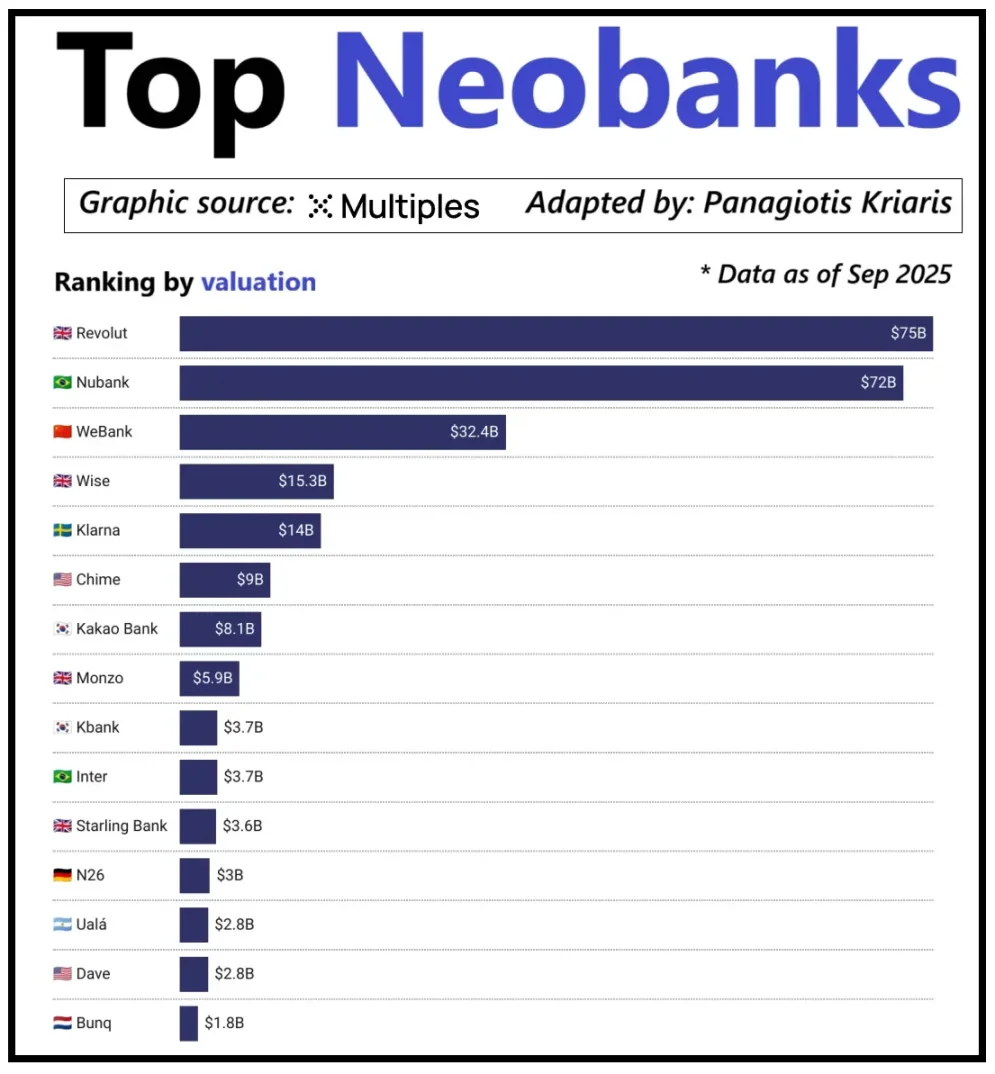

Globally, top digital banks are valued not just by their user numbers, but by their ability to generate revenue per user. Revolut is a classic case: while it has fewer users than Brazil’s Nubank, its valuation has surpassed Nubank’s. The key difference is Revolut’s diversified revenue streams, spanning foreign exchange, securities trading, wealth management, and premium services. In contrast, Nubank’s expansion relies mainly on credit and interest income, not card fees. China’s WeBank has taken a unique path, focusing on extreme cost control and deep integration with Tencent’s ecosystem to drive growth.

Valuations of Leading Emerging Digital Banks

Crypto digital banks have now reached a similar turning point. The “wallet + bank card” model is no longer a viable business strategy—any provider can easily launch these services. What truly sets platforms apart is their chosen path to monetization: some earn interest on user balances, some profit from stablecoin payment flows, and a few bet their growth on stablecoin issuance and management, the most stable and predictable revenue source in the space.

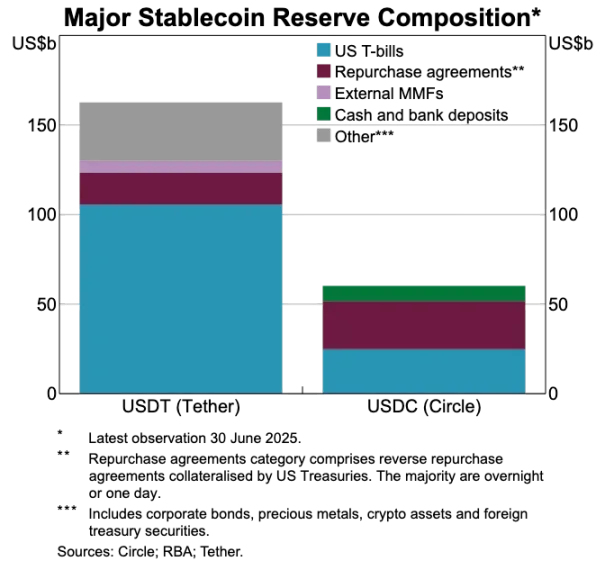

This explains why stablecoins are becoming increasingly important. For reserve-backed stablecoins, core profits come from investing reserves in short-term government bonds or cash equivalents, with the resulting interest going to the stablecoin issuer—not to digital banks that simply offer stablecoin holding or spending. This profit model isn’t unique to crypto: in traditional finance, digital banks also don’t earn interest on deposits—the partner banks holding the funds do. Stablecoins make this “yield separation” model even more transparent and concentrated: the entity holding government bonds or cash earns the interest, while consumer-facing apps focus on user acquisition and product experience.

As stablecoin adoption grows, a clear tension emerges: platforms driving user growth, transaction matching, and trust rarely benefit from reserve income. This value gap is pushing companies to vertically integrate—moving beyond frontend tools to control custody and fund management.

That’s why companies like Stripe and Circle are ramping up their stablecoin strategies. They’re not just distributing stablecoins—they’re moving into settlement and reserve management, which are the core profit centers. Stripe, for example, launched its own blockchain, Tempo, purpose-built for low-cost, instant stablecoin transfers. Instead of relying on Ethereum or Solana, Stripe built its own transaction channels, controlling settlement, fees, and throughput for stronger economics.

Circle’s approach is similar: it built Arc, a dedicated settlement network for USDC. With Arc, institutions can transfer USDC instantly, without public chain congestion or high fees. In essence, Arc is an independent USDC backend, freeing Circle from external infrastructure constraints.

Privacy is another major driver. As Prathik explains in Making Blockchains Great Again, public chains record every stablecoin transfer on an open ledger. While this suits open finance, it creates risks for payroll, vendor payments, and treasury management, where transaction amounts, counterparties, and payment methods are sensitive business information.

In practice, public chain transparency lets third parties reconstruct a company’s finances using blockchain explorers and analytics tools. Arc, however, allows institutional USDC transfers to settle off-chain, preserving fast settlement while keeping transaction details confidential.

USDT vs. USDC Asset Reserve Comparison

Stablecoins Are Breaking the Old Payment System

If stablecoins are the true value engine, legacy payment systems look increasingly outdated. Today’s payment flows involve multiple intermediaries: acquiring gateways aggregate funds, processors route transactions, card networks authorize, and both parties’ banks settle. Each step adds cost and delay.

Stablecoins cut out this entire chain. Transfers need no card networks, acquirers, or batch settlement windows—they’re direct, peer-to-peer, and instant on the underlying network. This is a game-changer for digital banks: if users can transfer funds instantly elsewhere, they won’t tolerate slow, expensive internal transfers. Digital banks must either deeply integrate stablecoin rails or risk becoming the slowest link in the payment chain.

This shift is transforming digital banks’ business models. Traditionally, they earned steady fees from card transactions because payment networks controlled the flow. In a stablecoin-dominated world, that margin disappears: peer-to-peer stablecoin transfers have no fees, so digital banks relying on card income face a zero-fee battleground.

As a result, digital banks are evolving from card issuers to payment routers. As payments shift from cards to stablecoins, digital banks must become the core nodes for stablecoin flows. Those able to efficiently handle stablecoin transactions will lead the market—once users set a platform as their default transfer channel, they’re unlikely to switch.

Identity Is Becoming the New Account Standard

As stablecoins make payments faster and cheaper, identity verification emerges as the next critical bottleneck. In traditional finance, identity is handled separately: banks collect documents, store data, and run background checks. But for instant wallet transfers, every transaction depends on a trusted identity system—without it, compliance, anti-fraud, and permissions break down.

That’s why identity and payments are converging. The market is moving away from fragmented, platform-specific KYC to portable, cross-service, cross-border identity systems.

This shift is already underway in Europe, where the EU Digital Identity Wallet is being deployed. Instead of requiring each bank or app to verify identity, the EU has created a government-backed identity wallet for all residents and businesses. This wallet stores identities, certified credentials (age, residency, licenses, tax info), supports e-signatures, and includes payment features. Users can verify identity, selectively share info, and pay—all in one seamless process.

If the EU Digital Identity Wallet succeeds, Europe’s banking architecture will be fundamentally restructured: identity replaces the bank account as the core gateway to financial services. Identity becomes a public good, narrowing the gap between banks and digital banks—unless they can build value-added services on top of this trusted system.

The crypto industry is heading the same way. On-chain identity projects have been in the works for years. While there’s no perfect solution yet, they all aim to let users prove identity or facts without being locked to a single platform.

Representative examples include:

- Worldcoin: Building a global proof-of-personhood system, verifying unique human identity without exposing privacy.

- Gitcoin Passport: Aggregates reputation and verification credentials to reduce Sybil attack risks in governance and rewards.

- Polygon ID, zkPass, and ZK-proof frameworks: Let users prove facts without revealing underlying data.

- Ethereum Name Service (ENS) + off-chain credentials: Allow wallets to show not just balances but also social identities and verification attributes.

The common goal is clear: users can prove identity or facts on their own, with credentials not locked to one platform. This matches the EU’s vision—a credential that travels with users across apps, eliminating repeated verification.

This trend will also reshape digital bank operations. Today, digital banks treat identity as a control point: user registration and platform review create platform-tied accounts. When identity becomes portable, digital banks become service providers connecting to trusted identity systems. This streamlines onboarding, cuts compliance costs, and reduces redundant reviews—making crypto wallets, not bank accounts, the core holder of assets and identity.

Looking Ahead: Key Trends

In short, the old pillars of digital banking are losing their edge: user base, bank cards, and even sleek interfaces are no longer moats. True differentiation now comes from three areas: the profit engine, the fund transfer rails, and the identity system a digital bank adopts. All other features will converge and become interchangeable.

The winners won’t be lightweight traditional banks, but wallet-first financial systems. They’ll anchor themselves to a core profit engine, which defines their profit margin and market position. These engines fall into three types:

Interest-Driven Digital Banks

These platforms win by becoming the go-to place for users to store stablecoins. By aggregating large balances, they earn from stablecoin interest, on-chain yields, staking, and restaking—without needing a massive user base. Their edge: holding assets is more profitable than moving them. These banks look like consumer apps but are actually modern savings platforms disguised as wallets, delivering a seamless “deposit and earn” experience.

Payment Flow-Driven Digital Banks

These platforms thrive on transaction volume. They become the main channel for stablecoin payments, deeply integrating with merchants, fiat-crypto exchange, and cross-border payments. Like global payment giants, they earn slim margins per transaction but make up for it in scale. Their moat is user habit and reliability—being the default for moving money.

Stablecoin Infrastructure Digital Banks

This is the deepest and most lucrative segment. These banks don’t just move stablecoins—they aim to control issuance or the underlying infrastructure, spanning issuance, redemption, reserve management, and settlement. The profit pool is largest here, because controlling reserves means controlling yield. These banks blend consumer features with infrastructure ambitions, evolving toward full-featured financial networks, not just apps.

In summary, interest-driven banks earn from deposits, payment-driven banks from transfers, and infrastructure banks profit from every action.

I expect the market to split into two camps: consumer-facing platforms that integrate existing infrastructure, offering simplicity but low switching costs; and core value aggregators focused on stablecoin issuance, transaction routing, settlement, and identity integration.

The latter won’t just be apps—they’ll be infrastructure providers in consumer-facing form, with high user stickiness as they quietly become the backbone of on-chain value flows.

Statement:

- This article is reprinted from [Foresight News], with copyright belonging to the original author [Vaidik Mandloi]. If you have concerns regarding this reprint, please contact the Gate Learn team, which will promptly address the matter according to established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Without mentioning Gate, reproduction, distribution, or plagiarism of the translated article is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.