Boom, Bust, and Exit: The Disillusionment of Traditional VCs in Web3

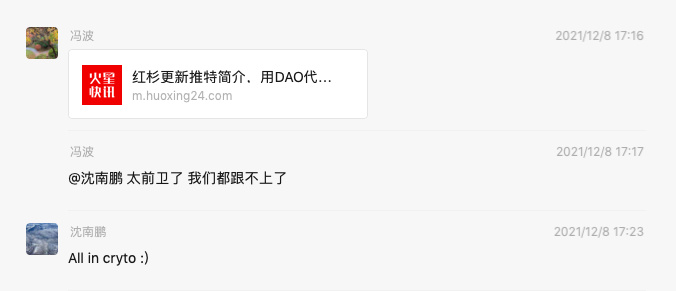

“All in Crypto!”

In 2021, Shen Nanpeng, the leader of Sequoia China, typed these words into a WeChat group. The screenshot quickly circulated through countless investor circles, echoing like a rallying cry that fueled market enthusiasm to new heights.

The market was riding a wave of collective euphoria. Coinbase had just been listed on Nasdaq, FTX was hailed as “the next Wall Street titan,” and nearly every established VC brandished the “crypto-friendly” label.

“This is a once-in-30-years technology wave,” some proclaimed. Sequoia’s statement became the definitive symbol of that bull run.

But just four years later, those words sound almost ironic. Many institutions that pledged to go “All in Web3” have quietly exited, downsized sharply, or pivoted to the AI boom.

These cycles of shifting capital are a stark reminder of the brutal realities of market timing.

So where are Asia’s traditional VCs who bet on Web3 during the last cycle now?

Pioneers in the Wild West Era

Back in 2012, Coinbase was newly founded, and Brian Armstrong and Fred Ehrsam were fresh-faced entrepreneurs in San Francisco. Bitcoin was dismissed as a geek’s novelty, trading for mere dollars.

During a YC demo day, IDG Capital placed an angel round bet on Coinbase. By the time Coinbase went public in 2021, that investment returned thousands of times its original value.

The story played out just as dramatically in China.

In 2013, OKCoin secured investments from Tim Draper and Mike Cai. That same year, Huobi raised funds from ZhenFund, and the following year, Sequoia China joined in. Huobi’s 2018 disclosures reported Sequoia China holding a 23.3% equity stake, second only to founder Li Lin.

Also in 2013, Lightspeed Venture Partners’ Cao Dayong first pitched Bitcoin to Zhao Changpeng during a card game, saying, “You should dive into Bitcoin or blockchain entrepreneurship.”

Zhao Changpeng sold his home in Shanghai and went all in on Bitcoin. The rest is history: in 2017, he launched Binance, and within just 165 days, Binance became the world’s top crypto spot exchange. Zhao rose to become the richest Chinese in the crypto industry.

Unlike its competitors, Binance struggled with early fundraising, relying mainly on investments from Pan City Capital (founded by Chen Weixing of Kuaidi Dache), Black Hole Capital (under R&F’s Zhang Liang), and several internet and blockchain entrepreneurs.

One notable episode: Sequoia China almost acquired about 10% of Binance at an $80 million valuation in August 2017, but the deal collapsed due to Binance’s own decisions. Sequoia later sued Binance, and tensions ran high between the two sides.

In 2014, angel investor Wang Lijie put 200,000 RMB into the domestic blockchain project NEO (Antshares)—a move that became the watershed investment of his career.

Between 2012 and 2014, native crypto VCs were still in their infancy. It was the traditional VCs who propped up half of Web3’s landscape—in the three major exchanges, Bitmain, imToken, and more, Sequoia, IDG, and other established investors played a vital role.

Then, 2017 brought the mania.

The ICO boom sent countless tokens soaring. Already profitable, Wang Lijie sold his NEO at 1.5 RMB, but its rally continued—eventually peaking above 1,000 RMB, a cumulative gain of over 6,000 times in three years.

The surge spurred Wang Lijie into a buying frenzy: “I’d sleep at 1 a.m., wake at 5 a.m., meet project founders, read whitepapers all day—on average, I invested $2 million worth of ETH daily.” When invited for tea, he quipped, “You’re costing me money.”

At a Macau blockchain summit in January 2018, Wang said, “I made more this past month than in the last seven years combined.”

Similarly, in early 2018, ZhenFund founder Xu Xiaoping shared a “for internal circulation only” speech in a 500-member WeChat group, declaring blockchain “a technological revolution where compliance brings prosperity and resistance spells doom—faster and more thorough than the internet or mobile internet.” He urged everyone to embrace this revolution.

Their remarks marked the absolute peak of that bull cycle.

But in 2018, the ICO bubble burst. Thousands of tokens neared zero, market caps of star projects evaporated, and Bitcoin slumped from nearly $20,000 to just above $3,000—an over 80% drop.

By year-end, “crypto” had become a dirty word among investors.

“At a venture event in Beijing, a partner joked, ‘If your startup fails, just issue a token.’ The crowd roared, but I felt nothing but embarrassment,” recalled former blockchain entrepreneur Leo.

By late 2018, the industry hit pause. WeChat groups fell silent overnight, project chats shared only Pinduoduo referral links. On March 12, 2020, the market suffered a single-day crash—Bitcoin plunged 50%, evoking doomsday fears.

“Forget traditional VCs looking down on crypto—even I thought the industry was finished,” said Leo.

Both founders and investors became punchlines for the mainstream. As Sun Yuchen remembered, Wang Xiaochuan’s scornful look called him a scammer without words.

By 2018, the crypto sector had gone from wealth-creation epicenter to the bottom of the social pecking order.

Traditional VCs Return to the Arena

In hindsight, March 12, 2020 was the deepest valley for crypto in the decade.

Social feeds were flooded with red candlestick charts; many thought the final blow had landed, and the industry was finished.

But the turnaround was swift and sharp. The Federal Reserve’s unprecedented liquidity injection lifted the market from the brink—Bitcoin soared more than sixfold in a year, becoming the post-pandemic star asset.

The true turning point for traditional VCs, however, was Coinbase’s IPO.

In April 2021, this nine-year-old exchange rang the Nasdaq bell, proving that crypto companies could go public and delivering thousandfold returns for early investors like IDG.

Coinbase’s listing sent shockwaves from Wall Street to Beijing’s Liangmaqiao financial district. Crypto journalist Liam recalls traditional VC professionals reaching out to him for in-person briefings on the crypto landscape.

Yet, Leo notes, it wasn’t just the promise of wealth that brought traditional VCs back.

“These people always wear the mask of elitism—buying coins secretly in bear markets but never admitting it. What stripped off that mask was the shift in narrative: from Crypto to Web3.”

Chris Dixon, head of a16z Crypto, pioneered this transformation. “Investing in crypto” sounded like speculation, but “investing in the next-gen internet” carried a mission and moral legitimacy. Criticizing Facebook and Google’s monopolies and championing decentralization and fairness won applause. DeFi’s wild rise and the NFT explosion naturally fit this new narrative framework.

The Web3 narrative lifted the moral burden for traditional VCs.

Will, a top-tier fintech investor, recalls: “We experienced a shift. Initially, we treated crypto as an extension of consumer internet, but that didn’t hold. Fintech was the real driver that changed our view.”

To him, the Web3 boom emerged as mobile internet waned and AI dawned. Capital needed a new story, so blockchain was shoehorned into the internet narrative. But the real breakthrough was the awakening of financial utility. “Look at the big winners—they’re all finance-related. Uniswap is an exchange, Aave does lending, Compound manages wealth. Even NFTs are fundamentally financialized assets.”

FTX was another catalyst.

SBF’s “financial prodigy” persona won the hearts of nearly every major traditional VC, stoked FOMO, and fueled a flurry of high-profile deals worldwide.

In Beijing, investors scrambled at networking events to buy early shares of FTX or Opensea, envying those ahead of the curve.

This cycle also kickstarted unprecedented talent migration: some left Sequoia and IDG for crypto funds, some crypto VCs moved to traditional firms to helm “Web3 divisions.” The two-way flow of capital and talent brought crypto to mainstream investor narratives for the first time.

2021’s bull market felt like a jubilant festival.

WeChat groups were buzzing—with more traditional VCs, family offices, and internet giants than ever.

NFTs were all the rage—senior investors changed their avatars to bored apes, punks, and other high-value collectibles. Even bitcoin skeptics like Zhu Xiaohu joined in. Conference halls, once filled with crypto-native founders, now featured elite partners from legacy VCs.

Traditional VCs entered Web3 in different ways—direct investments drove valuations higher, LP positions in crypto VCs (Sequoia China became a Binance Labs LP after reconciling with Binance), and direct Bitcoin purchases on secondary markets.

Crypto VCs, legacy VCs, exchanges, and project teams became deeply intertwined, escalating project valuations with every move. Everyone anticipated an even grander bull run—but beneath the clamor, risk was quietly brewing.

The VC Downturn

If 2021’s bull market was paradise, 2022 turned into a nightmare in an instant.

FTX’s rise and fall marked the cycle’s extremes. The LUNA and FTX collapses not only shattered market confidence, but dragged major VCs into deep losses—Sequoia, Temasek, and others suffered massive setbacks, and Temasek faced national scrutiny in Singapore’s parliament.

Once the bubble burst, countless high-flying crypto projects saw their valuations evaporate. Unlike crypto VCs who tend to place smaller “syndicate” bets, traditional VCs invested big—often tens of millions per deal. They also bought large tranches of SAFT, providing exit liquidity to crypto VCs throughout the cycle.

But what truly stung traditional VCs was the breakneck pace of narrative change in crypto, undermining conventional investment logic—projects once considered promising were sometimes discarded after only a few months, leaving investors stuck with illiquid equity and little recourse.

Ethereum’s L2 sector is a prime example. In 2023, Scroll raised funds at a $1.8 billion valuation with Sequoia China and Qiming among its investors. Yet, by September 11, Scroll had suspended DAO governance, its core team resigned, and its market value plummeted to $268 million—an 85% loss for those VCs.

Meanwhile, exchanges and market makers gained even greater dominance, further marginalizing traditional VCs.

Investor Zhe commented candidly: “Projects valued under $30–40 million that make it onto Binance can still make money—two or three times after their lockup. Anything pricier goes to OKX or smaller exchanges, and that’s a loss.”

To him, profitability now depends on just three things:

Getting listed on Binance;

Favorable token allocation;

Project teams willing to “feed” investors.

“Exchanges hold all the cards and take the biggest cut. Whatever’s left is down to luck.”

Zhe summed up the pain felt by many traditional VCs.

In the primary market, their role is increasingly that of “porters”—funding projects, only to see exchanges scoop up the lion’s share. Some investors complain, “You don’t need the primary market anymore; projects can make money just listing on Binance Alpha—why reward VCs?”

With old capital logic failing, traditional VCs have shifted focus. As Will put it, Web3’s heyday coincided with the waning of mobile internet and the rise of AI—a “gap period.” But once ChatGPT appeared, a new North Star captured everyone’s attention.

Capital, talent, and narrative instantly redirected to AI. VC professionals who once championed Web3 on social media swiftly embraced an “AI investor” identity.

Former VC Zac observed that during the 2022–2023 peak, many traditional VCs were still exploring Web3—but now, 90% have left. He predicts that if the Asia-Pacific crypto primary market stays quiet for another half-year to year, even more will exit.

No Longer Going All-In

In 2025, the Web3 primary market resembles a shrinking chessboard.

The frenzy has faded; only a few players remain, but new dynamics are quietly emerging.

Sequoia Capital’s moves, as ever, set the tone for traditional VCs.

Rootdata reports Sequoia China has invested in seven projects in 2025—including OpenMind, Yuanci Tech, Donut, ARAI, RedotPay, SOLO, and SoSoValue—followed by IDG Capital, GSR Ventures, and Vertex. Qiming Venture Partners’ last Web3 investment dates to July 2024.

Zac notes: “You can count the number of traditional VCs still looking at Web3 on one hand.”

He is blunt about the decline in project quality.

“Teams pursuing PMF and lasting user value get less positive feedback than those focused on attention economics and active market making,” Zac says.

Meanwhile, crypto treasury companies like MicroStrategy and BMNR have emerged as new investment options—but they also drain liquidity from an already shrinking primary crypto market.

“Do you know how many PIPE deals are out there?” asks Draper Dragon partner Wang Yuehua. “At least 15, each needing $500 million. That’s $7.5 billion. Nearly all the big money is on Wall Street, and they’re backing PIPE.”

PIPE (Private Investment in Public Equity) refers to listed firms issuing discounted shares or convertible bonds to select institutional investors to raise funds quickly.

Many public companies, previously disconnected from crypto, now raise sizable PIPE funding, acquire BTC, ETH, SOL, and transform into crypto treasury operations. Investors entering at a discount often reap significant returns.

“That’s why the primary market is drying up,” says Wang. “Big money prefers PIPE’s certainty—why take early-stage risks?”

Some leave, some persist. Will still believes in Web3 and AI, and is willing to back public goods that appear to have “no business model.”

“Not everyone needs to chase commercial returns,” Will says. “Great projects often start as simple public goods. Satoshi created Bitcoin with no pre-mining or fundraising, yet delivered the most successful financial innovation ever.”

Dawn on the Horizon

Several key events in 2025 are transforming the landscape.

Circle’s IPO ignited stablecoins and RWA (Real-World Assets), bringing them to center stage.

This stablecoin giant debuted on the NYSE at a $4.5 billion valuation, providing traditional VCs a rare, “non-token” exit. Bullish and Figure followed suit, boosting investor optimism.

“We don’t touch pure token plays, but we’re bullish on stablecoins and RWA,” say multiple traditional VC investors. The logic is clear: huge addressable market, predictable cash flows, and a visible regulatory roadmap.

Stablecoins offer a “bank-like” business model—reserve interest, issuance/redemption/settlement fees, and compliance/custody/clearing service fees drive sustainable profits.

RWAs bring receivables, treasuries, mortgage/real estate, and fund shares on-chain, profiting from issuance, matching, custody, and transfer fees and spreads.

If the last generation of US-listed crypto firms focused on exchanges, miners, and asset managers, the new wave centers on stablecoins and RWA.

Meanwhile, the boundary between stocks and tokens is blurring.

The “MicroStrategy tactic”—using the treasury to invest in digital assets—has many imitators. Public companies raise equity or PIPE funding, purchase BTC, ETH, SOL, and become “coin stocks.”

Behind these leaders stand figures like Peter Thiel and other legacy VCs. Some institutions directly entered the market: China Renaissance invested $100 million in BNB, publicly allocating crypto assets.

“Traditional finance is embracing crypto,” says Wang. “Nasdaq put $50 million into Gemini—it’s not just a deal, it’s a shift in attitude.”

This shift is evident among LPs as well. Sources report that sovereign wealth funds, pension funds, and university endowments are re-evaluating crypto asset allocations.

In the last ten years, capital has ebbed and flowed. Asia’s traditional VCs once propelled exchanges to the stage, chanted “All in” during bull runs, and ended up on the periphery of the crypto world.

While things may seem quiet now, the future could hold a new dawn.

As Will maintains: “Traditional VCs will allocate more to fintech investments connected to crypto.”

Will legacy VCs return in force? No one can say for sure. The one thing that’s certain: crypto’s momentum isn’t stopping anytime soon.

Statement:

- This article is reproduced from [TechFlow], copyright belongs to the original authors [Ada & Liam, Deep Tide TechFlow]. If you have concerns regarding this republishing, please contact the Gate Learn team for prompt resolution in accordance with relevant procedures.

- Disclaimer: The viewpoints and opinions expressed herein reflect the author’s individual views and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team and may not be copied, distributed, or plagiarized unless explicitly citing Gate as the source.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?