Berachain (BERA) Price Prediction: Price Trends and Influencing Factors

What is Berachain?

Berachain, a Layer 1 public chain composed of memes, Degen spirit, and innovative token economics, finally launched its mainnet on February 6, 2025, during the highly anticipated Q5, signaling the official awakening of the great bear in the bear market. On the same day of the mainnet launch, the official released the tokenomics and further revealed Berachain’s deep ambitions for the operation of the Web3 ecosystem and DeFi protocols.

As a chain that carries its own culture, Berachain is not just playing with sentiment; it is attempting to reshape the way on-chain participation and value accumulation work through a new Proof of Liquidity (PoL) consensus mechanism and a unique dual-token model.

The valuation and chip structure of Berachain

Berachain’s Series B funding has reached a valuation of 1.5 billion USD, corresponding to a fundamental ceiling for future token prices. The Series A was led by Polychain with 42 million USD, while the Series B was led by Framework Ventures and Brevan Howard Digital, amounting to 100 million USD, with participation from giants like Samsung Next and Amber Group. Judging by the investment lineup and capital scale, Bera is undoubtedly a chain that has reached its peak right from the start; however, price is not just built on valuation but also depends on the distribution of tokens and the rhythm of their release:

- Core Contributors: 16.8%

- Investors: 34.3%

- Airdrop: 15.8%

- Community Incentive: 13.1%

- Ecosystem Incentive: 20%

(Source: docs.berachain)

According to the official unlocking plan, the tokens of investors and the team will be unlocked linearly one year after the mainnet launch, indicating that the selling pressure within the first 12 months is controllable, while the selling pressure from investors and early participants will officially commence in 2026.

Proof of Liquidity of Berachain

PoL is the core innovation of Berachain. It is similar to PoS, but emphasizes the connection between on-chain liquidity participation and actual contributions. On Berachain, what is staked is not only BERA, but also the liquidity of various DeFi protocols, application contributions, and even behavioral achievements. PoL brings three core transformations:

1. From TVL games → Behavior-oriented economy

It’s not just about the depth of the liquidity pool, but also encourages trading volume, usage rate, community behavior, and so on.

2. DeFi Farming → Action-Driven Subsidy

Completing perpetual contract trades, importing users, and accomplishing game tasks can all generate value.

3. Incentive model modularization and creativity

Like PuffPaw, it can provide feedback based on the habits of using the application, similar to daily login rewards on the blockchain.

This design makes PoL a blockchain-level perpetual subsidy, full of incentives for both protocol creators and users, rather than a short-term influx of TVL into the game.

Berachain’s dual-token model

Berachain adopts a dual token mechanism of $BEAR + $BGT:

- $BEAR: The main token used for paying fees, staking, and governance.

- $BGT: A governance weight and PoL incentive token that cannot be traded directly.

The current biggest challenge is: $BGT is too powerful, but cannot be directly converted to BERA, which reduces user demand for $BEAR. To address this, the Berachain team is considering the following strategies:

1. Bribery Commission Reflow Agreement

- Convert BGT bribery income into Honey (stablecoin) and then pair it with BERA for liquidity provision.

- Establish Protocol-Owned Liquidity (POL).

2. Incentivize LP to build long-term income assets

- Generate a continuous influx of assets through daily transaction fees of about $50,000.

- This model has more long-term value than buybacks and helps stabilize coin prices and depth.

The key to Berachain’s price growth

According to core developer Smokey, the four indicators to measure the success of Berachain are:

- Total amount of bribery funds

- On-chain transaction volume

- Transaction fee income

- DEX Activity Level

Currently, Berachain is focusing on the total amount of bribes as the most important economic source for the ecosystem. In the future, if it can make up for this through protocol liquidity and transaction fee income, a positive cycle of on-chain economy will be achieved. It references the lessons learned from Solana: the value brought by trading volume needs to be complemented by a long-term accumulation and destruction mechanism. If Berachain can follow a similar trajectory, BERA is expected to establish medium- to long-term price support.

Price prediction for BERA

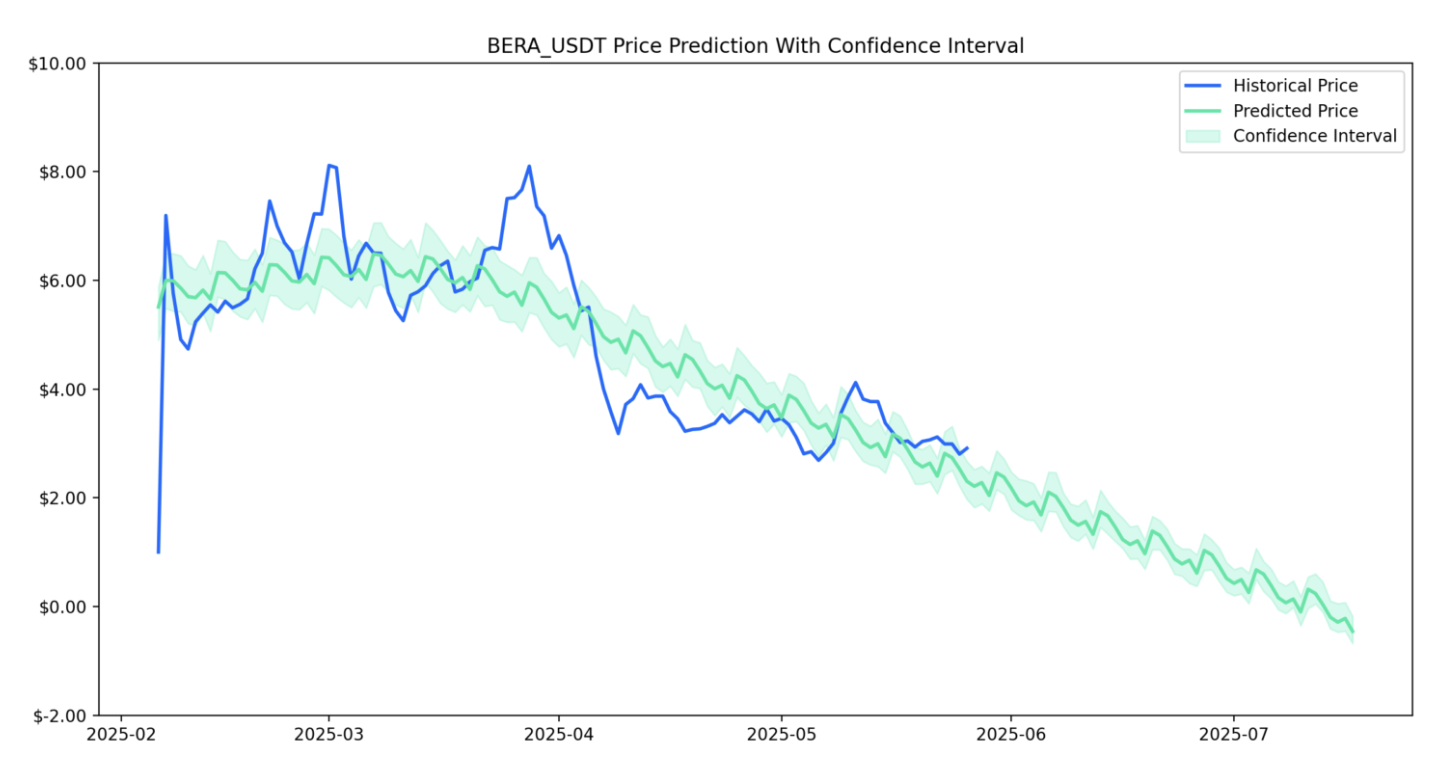

By calculating data through AI models and referencing past BERA prices and related information, predictions for future prices are made, solely for data sharing and not as investment advice. Refer to the chart below:

BERA Price Prediction Trend

BERA Price Prediction and Confidence Interval

Start trading BERA spot immediately:https://www.gate.com/trade/BERA_USDT

Summary

Berachain is not a public chain that relies solely on memes; it is built on the spirit of Degen, with PoL as its blood, BGT as its power, and BEAR as its foundation, creating a new narrative space that incentivizes the value of creative actions.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data