Gate Ventures Research Insights: ReFi Innovation and the Dawn of a New Era for Consumer Applications

Gate Ventures

Introduction

Web3, through blockchain technology, has built an economic paradigm and cultural system that is fundamentally different from the off-chain world. This paradigm shift demonstrates unlimited potential, but it also brings compatibility challenges with Web2. For mass adoption, Web2 users often hold entirely different means of production and property. We envision that if the assets currently held by Web2 users could be brought on-chain, it would not only inject greater momentum into the on-chain economy but also enable users to gain more economic value. At the same time, this would enrich the categories of off-chain assets available to on-chain applications, driving greater diversity within the blockchain ecosystem.

In this context, WiFi Master Key serves as a typical example. Founded in 2012, during the transition period from 3G to 4G in China when mobile data costs were very high, WiFi Master Key solved the pain point of limited public networks and costly private networks through network sharing. Its main business model was to encourage users to share their home WiFi, creating a shared WiFi ecosystem. At its peak, WiFi Master Key reached 900 million total users and 370 million monthly active users (MAU). The app rose during the wave of demand but later declined due to changes in the times. On one hand, mobile data costs in China rapidly decreased, with telecom operators offering low-cost home WiFi and unlimited mobile data, while public WiFi infrastructure was increasingly deployed. On the other hand, the app’s reliance on cracking others’ WiFi passwords for sharing led to higher costs and poor connection quality, which eventually caused user dissatisfaction and loss of market dominance.

From this example, we can see that WiFi Master Key leveraged an existing massive WiFi infrastructure to build a reusable shared network. With near-free internet access, it managed to reach almost one billion users. Web2 users inherently possess massive-scale assets, but due to the natural incompatibility with Web3’s asset properties, these assets cannot fully unleash their value.

At the same time, we recognize that many existing Web2 infrastructures can further unlock their potential through Web3’s global liquidity, open and shared economy, verifiable blockchain consensus, and DeFi features. We call this model ReFi (Repurpose Fi).

ReFi is fundamentally different from current DePIN projects. DePIN devices often require hardware purchases, yet these devices usually have limited scalability. To truly succeed, they need localized sales networks and supply chains. However, for products intended to satisfy essential needs, simply offering “money-making opportunities” is not enough; the product itself must be competitive and meet user demands. Many teams lack both the funding and the capability to build a complete ecosystem, and instead rely on KOLs or large resellers to promote mining machines, which often devolves into simple Ponzi-like schemes.

In contrast, ReFi repurposes the existing stock of assets within the global market of 8 billion users, eliminating the need for additional hardware production and distribution, thereby significantly lowering entry barriers.

We will highlight some of the potential benefits that could arise once Web2 assets are brought on-chain, providing the community with entrepreneurial inspiration. This model directly avoids the “showcase-style” business model of DePIN that depends on hardware production and sales, and instead brings existing Web2 assets broadly on-chain, helping entrepreneurs succeed.

Case Studies

WiFi

When tokenomics is combined with WiFi, we find that if the existing large-scale WiFi infrastructure can be directly opened to third-party users, individuals can earn income through WiFi leasing and sharing, while projects can incentivize this behavior by issuing tokens.

This model mainly targets users who want free and fast outdoor WiFi, typically those who need to stay in a certain place for a longer period. On the other side are households with existing WiFi infrastructure. With the significant decline in mobile data costs, offering free WiFi alone has become less appealing, especially when slower speeds and lag are the trade-offs. However, the introduction of tokenomics can strongly motivate these users to re-open their network resources, enabling value exchange and revenue sharing.

In 2023, the global WiFi market was valued at 14.5 billion USD and is projected to reach 39.4 billion USD by 2028, with a compound annual growth rate (CAGR) of 22.2%. Meanwhile, the mobile data market is expected to generate revenues of 0.6 trillion USD in 2024. From 2024 to 2029, it is projected to grow at a CAGR of 4.30%, reaching 0.8 trillion USD by 2029. These figures suggest that a WiFi-sharing model integrated with tokenomics could secure a strong position within this rapidly expanding market.

Bandwidth

Grass is a successful example of ReFi. Its goal is to allow unused internet bandwidth to be contributed directly in exchange for rewards. In today’s market, large companies already utilize residential proxy networks, accessing the internet through millions of users’ local bandwidth. This makes servers recognize the traffic as coming from real users, helping companies avoid DDoS attacks on single nodes. Residential proxies are widely used in web scraping and data analysis, market research, social media management, and electronic ticketing.

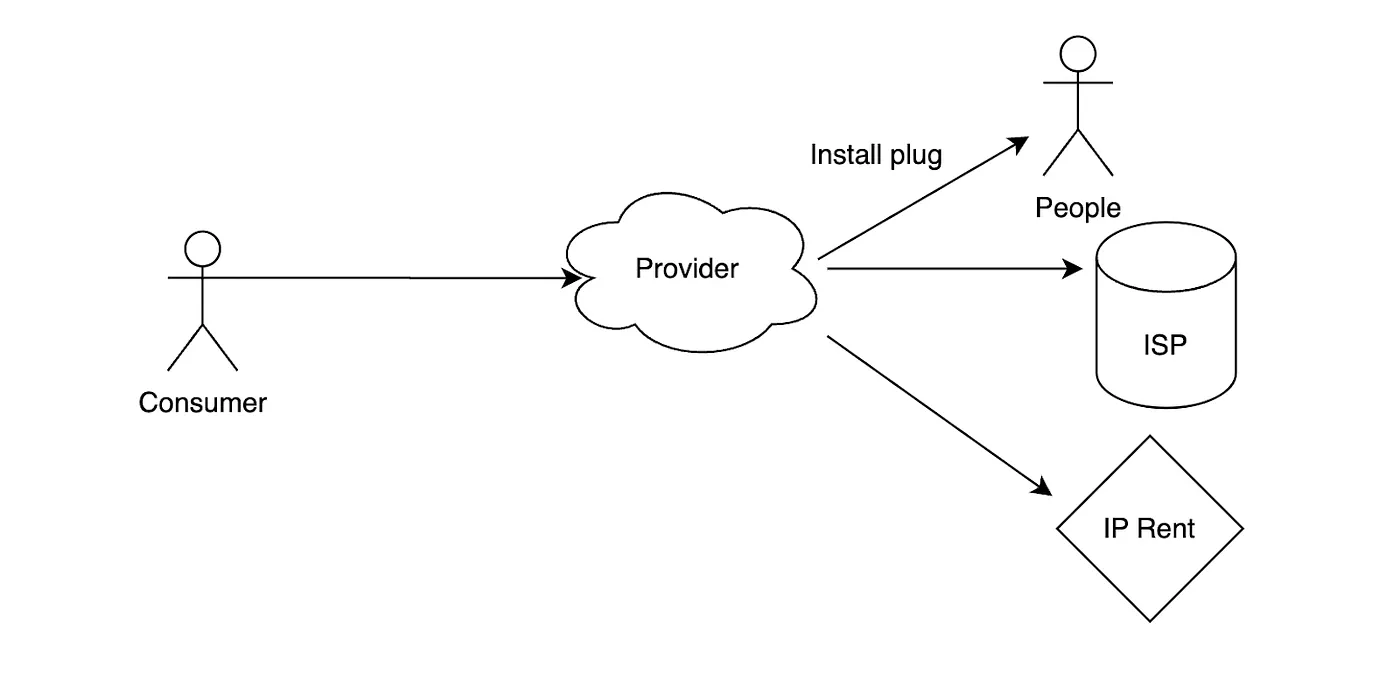

In the past, companies in need of residential proxies typically purchased services from proxy providers. These providers obtained residential IPs through three main channels: tricking users into installing plugins, purchasing from ISPs, or acquiring from IP lessors. However, they never compensated the end users who were the actual source of these valuable proxies. Grass aims to change this by allowing users to contribute their unused internet bandwidth, turning it into a proxy resource for large companies that need to access the web. This approach makes the market more open and transparent.

For consumers, the current market remains relatively small. In 2023, the global residential proxy services market had sales of about 620 million USD, and it is projected to grow to 840 million USD by 2030, with a compound annual growth rate (CAGR) of 4.6%.

Data

The contribution of Web2 users’ data also represents a breakthrough potential track, especially as today’s LLMs and AI agents face challenges around computing power and access to high-quality data. Scale AI has been particularly notable in this area, with the slogan “Empower AI with your data.”

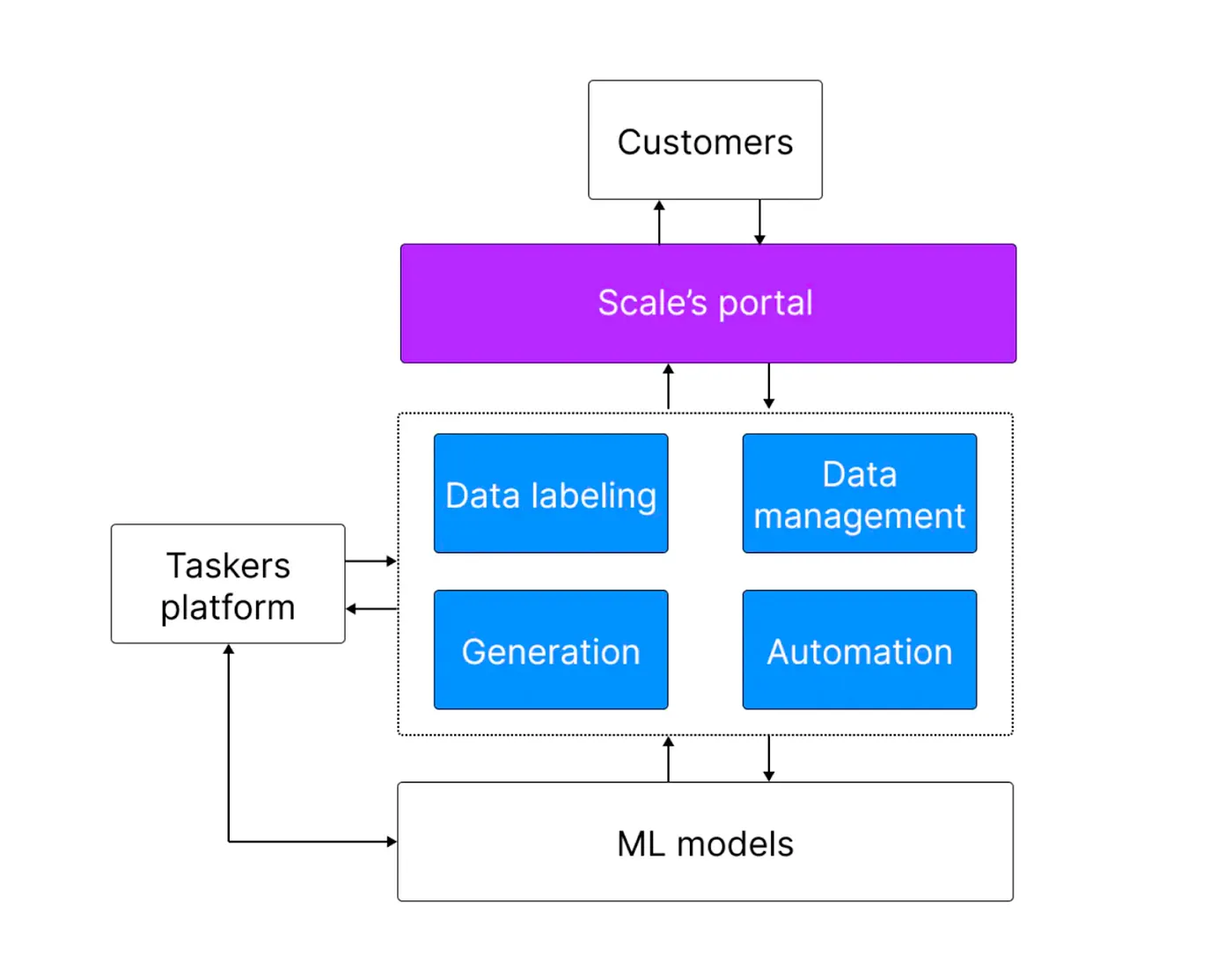

Scale AI Business Model, source: Scale AI

Scale AI’s core business model revolves around connecting user data. Its task platform links cost-effective data workers from Southeast Asia, who label the data uploaded by users and then feed this data into large models while also rating the outputs of those models. Data plays an extremely important role in training LLMs or specialized models. Some even describe Scale AI as “the one selling shovels.” The average hourly wage of data labelers is around 1–2 USD, and this low-cost labor structure has enabled Scale AI to scale operations efficiently.

For Web3 projects, tokens can be used to incentivize workers, potentially raising their hourly pay significantly. We’ve observed that Vana, backed by Paradigm, follows a similar Data DAO model. While its business model is well-structured, it may face challenges within the Web3 environment that prioritizes attention-driven investment. The main issue lies in its narrow reach—since it interfaces with Data DAOs, user awareness is relatively low, which in turn limits buy-side demand for its token.

A more positive example is Aggregata, which directly targets retailers. It allows ChatGPT conversation data to be uploaded to Aggregata for further model training. Aggregata has already secured investment from Binance Labs. We believe token-based incentive distribution can effectively reward both data providers and data labelers, ensuring that most of the profits flow to participants in the ecosystem, rather than being concentrated solely on the platform.

In 2024, the global data labeling market is valued at 838.2 million USD and is projected to reach 10.346 billion USD by 2033, with a compound annual growth rate (CAGR) of 32.2%.

Energy

Daylight is another successful case, with the slogan “Repurpose your surplus energy, becoming a new revenue.” The company has raised 13.2 million USD across two funding rounds led by a16z and Lattice Fund. Daylight focuses on edge-grid management and generation, using tokenization to incentivize households to install devices such as solar panels and water heaters. These devices can be controlled via smartphones, with users earning tokens as rewards. By introducing token incentives, Daylight promotes the adoption of clean energy while balancing the load of centralized grids.

This model is closer to DePIN. However, if improvements could be made without requiring consumers to purchase new electronic equipment—by repurposing existing clean energy infrastructure through tokenization—the approach would be much easier to scale. Essentially, Daylight is selling clean energy devices, whereas the core of ReFi lies in repurposing already-existing, large-scale asset bases. A feasible model might be to collaborate with existing manufacturers to establish a system or specification standard, enabling their clean energy devices to directly connect on-chain for token rewards. We look forward to teams innovating in this area.

According to reports, the global power generation equipment market was valued at 110.4 billion USD in 2022 and is expected to reach 173.1 billion USD by 2032, with a CAGR of 4.8% from 2023 to 2032.

Conclusion

In this article, we identified the natural incompatibility between Web3 and Web2 users, particularly regarding Web2 assets. To address this, we propose a new direction: ReFi (Repurpose Finance). By leveraging Web2’s massive existing infrastructure and user-owned assets, and channeling them on-chain through blockchain technology and tokenomics, we can unlock new layers of potential.

The essence of ReFi lies in repurposing widely used resources that already exist—household GPUs, WiFi networks, bandwidth, data, and energy—building upon their large-scale foundations. While the concept of ReFi is not entirely new, its biggest difference from DePIN is that it requires no new hardware purchases. Instead, it applies tokenomics to repurpose existing stock markets at scale.

That said, real demand and efficiency must be carefully considered. Some repurposing directions may not be ideal. For instance, using bandwidth for residential proxy networks (like Grass) has limited market size, though the demand does not require high efficiency. On the other hand, contributing bandwidth for AI data transfers or GPUs for LLM training may not be realistic under current technical conditions, as these applications demand extremely high efficiency, making commercialization difficult.

We look forward to seeing more ReFi application scenarios that allow entrepreneurs to directly leverage the assets of the world’s 8 billion Web2 users. With blockchain’s global liquidity, distributed state storage, and tokenomics, these assets can be integrated into the Web3 ecosystem, opening up a new era of value creation and resource utilization.

Disclaimer

This content does not constitute an offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decision. Please note that Gate.io and/or Gate Ventures may restrict or prohibit some or all services for users from restricted regions. Refer to the applicable user agreement for more information.

About Gate Ventures

Gate Ventures is the venture capital arm of Gate.io, focusing on investments in decentralized infrastructure, ecosystems, and applications that will reshape the world in the Web3 era. Gate Ventures partners with global industry leaders to empower innovative teams and startups that redefine social and financial interactions.

Official website: https://www.gate.com/ventures

Thanks for your attention.

Share

Content