EVO vs MANA: The Battle for Blockchain Gaming Supremacy

Introduction: EVO vs MANA Investment Comparison

In the cryptocurrency market, the comparison between Devomon (EVO) and Decentraland (MANA) has always been a topic that investors can't avoid. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different cryptocurrency asset positioning.

Devomon (EVO): Since its launch, it has gained market recognition for its anime-inspired brand and blockchain integration for gaming assets.

Decentraland (MANA): Launched in 2017, it has been hailed as a pioneer in blockchain-based virtual worlds, being one of the most traded and valued cryptocurrencies in the metaverse sector.

This article will comprehensively analyze the investment value comparison between EVO and MANA, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

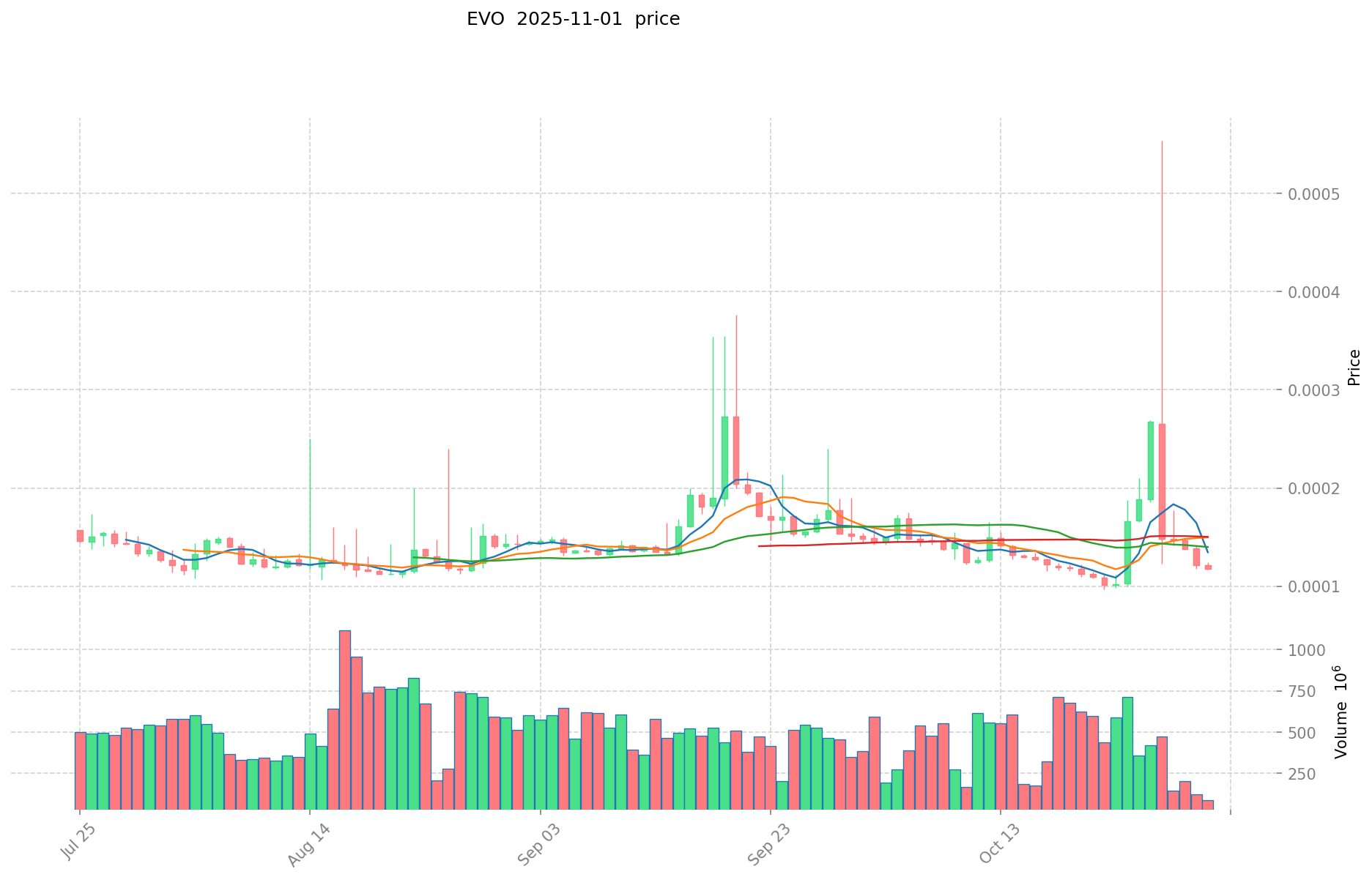

I. Price History Comparison and Current Market Status

EVO (Coin A) and MANA (Coin B) Historical Price Trends

- 2024: EVO launched its initial offering, causing the price to surge.

- 2021: MANA experienced a significant price increase due to the metaverse hype.

- Comparative analysis: During the recent market cycle, EVO dropped from its all-time high of $0.0195 to a low of $0.0000964, while MANA declined from its peak of $5.85 to current levels around $0.23.

Current Market Situation (2025-11-02)

- EVO current price: $0.0001203

- MANA current price: $0.2338

- 24-hour trading volume: EVO $39,361.22 vs MANA $141,095.15

- Market Sentiment Index (Fear & Greed Index): 33 (Fear)

Click to view real-time prices:

- Check EVO current price Market Price

- Check MANA current price Market Price

II. Key Factors Affecting Investment Value of EVO vs MANA

Market Demand and Competition Analysis

- EVO: Fighting games have advantages of being easier to understand compared to real-time strategy games, creating exciting moments that are accessible to viewers and players

- MANA: Management discussion and analysis appears to be a key component affecting its investment value in corporate contexts

Market Positioning and Growth Factors

- Market drivers: Ecological investment, inflation, and asset rotation appear to be major investment drivers in the broader market

- Competitive landscape: EVO's fighting games show popularity advantage with accessible gaming experiences

- Industry evolution: Service quality and technological innovation are becoming increasingly important factors for success

Risk Assessment Framework

- Investment risk models: Traditional investment risk evaluations are being enhanced with game theory interactions

- Regional considerations: Geographic factors may impact investment decisions within competitive markets

- Institutional factors: Government intervention represents a demand-side factor that influences entrepreneurial opportunities

Value Generation Mechanisms

- Core value propositions: Technical innovation and service quality improvement are pathways to value creation

- Synergistic effects: Unique synergies and value generation can enhance capabilities

- Evolution patterns: Historical development trajectories from initial offerings to industry leadership positions may provide insights into future growth potential

III. 2025-2030 Price Prediction: EVO vs MANA

Short-term Prediction (2025)

- EVO: Conservative $0.000070818 - $0.0001221 | Optimistic $0.0001221 - $0.000135531

- MANA: Conservative $0.158576 - $0.2332 | Optimistic $0.2332 - $0.249524

Mid-term Prediction (2027)

- EVO may enter a growth phase, with expected prices ranging from $0.000070623097875 to $0.00018555872775

- MANA may enter a stable growth phase, with expected prices ranging from $0.2409758208 to $0.3137706

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- EVO: Base scenario $0.000240037316212 - $0.000292845525779 | Optimistic scenario $0.000292845525779+

- MANA: Base scenario $0.356027655555 - $0.36670848522165 | Optimistic scenario $0.36670848522165+

Disclaimer: This information is for educational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

EVO:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.000135531 | 0.0001221 | 0.000070818 | 1 |

| 2026 | 0.000148137825 | 0.0001288155 | 0.00009789978 | 7 |

| 2027 | 0.00018555872775 | 0.0001384766625 | 0.000070623097875 | 15 |

| 2028 | 0.000241406365736 | 0.000162017695125 | 0.000085869378416 | 34 |

| 2029 | 0.000278362601994 | 0.00020171203043 | 0.00015935250404 | 67 |

| 2030 | 0.000292845525779 | 0.000240037316212 | 0.00020403171878 | 99 |

MANA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.249524 | 0.2332 | 0.158576 | 0 |

| 2026 | 0.26067096 | 0.241362 | 0.21239856 | 3 |

| 2027 | 0.3137706 | 0.25101648 | 0.2409758208 | 7 |

| 2028 | 0.296513217 | 0.28239354 | 0.183555801 | 20 |

| 2029 | 0.42260193261 | 0.2894533785 | 0.18525016224 | 23 |

| 2030 | 0.36670848522165 | 0.356027655555 | 0.2990632306662 | 52 |

IV. Investment Strategy Comparison: EVO vs MANA

Long-term vs Short-term Investment Strategies

- EVO: Suitable for investors focused on gaming ecosystems and potential growth in blockchain-based entertainment

- MANA: Suitable for investors interested in metaverse development and virtual real estate

Risk Management and Asset Allocation

- Conservative investors: EVO 20% vs MANA 80%

- Aggressive investors: EVO 60% vs MANA 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- EVO: Highly volatile due to smaller market cap and newer project status

- MANA: Susceptible to overall crypto market trends and metaverse hype cycles

Technical Risk

- EVO: Scalability, network stability

- MANA: Platform adoption, smart contract vulnerabilities

Regulatory Risk

- Global regulatory policies may impact both differently, with potential restrictions on gaming tokens or virtual asset platforms

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- EVO advantages: Gaming focus, potential for rapid growth, lower entry point

- MANA advantages: Established metaverse platform, larger market cap, more liquidity

✅ Investment Advice:

- New investors: Consider a small allocation to MANA as part of a diversified crypto portfolio

- Experienced investors: Balanced approach with both EVO and MANA, adjusting based on risk tolerance

- Institutional investors: Focus on MANA for its larger market cap and established ecosystem, with potential small allocation to EVO for higher risk-reward

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between EVO and MANA? A: EVO focuses on gaming and anime-inspired assets, while MANA is centered around metaverse and virtual real estate. EVO is a newer project with a smaller market cap, whereas MANA is more established with a larger market presence.

Q2: Which coin has shown better price performance recently? A: Based on the current market data, MANA has shown better price stability and higher trading volumes compared to EVO. However, EVO, being a newer project, may have more potential for rapid growth.

Q3: What are the key risk factors for investing in EVO and MANA? A: For EVO, major risks include high volatility due to smaller market cap, scalability issues, and network stability. MANA faces risks related to overall crypto market trends, metaverse hype cycles, and potential smart contract vulnerabilities.

Q4: How do the long-term price predictions for EVO and MANA compare? A: By 2030, EVO is predicted to reach between $0.000240037316212 and $0.000292845525779 in the base scenario, while MANA is expected to be between $0.356027655555 and $0.36670848522165. Both have potential for higher prices in optimistic scenarios.

Q5: What investment strategies are recommended for EVO and MANA? A: For conservative investors, a portfolio allocation of 20% EVO and 80% MANA is suggested. Aggressive investors might consider 60% EVO and 40% MANA. New investors are advised to start with a small allocation to MANA, while experienced investors might balance both.

Q6: How might regulatory risks affect EVO and MANA differently? A: Regulatory policies could impact both tokens, but EVO might face more scrutiny due to its focus on gaming assets, while MANA could be affected by regulations on virtual asset platforms and metaverse-related activities.

Q7: Which coin is considered a better buy for institutional investors? A: Institutional investors are generally advised to focus more on MANA due to its larger market cap and established ecosystem. However, a small allocation to EVO could be considered for higher risk-reward potential.

Share

Content