CELB ve LRC: Dil modeli performansını geliştirmeye yönelik iki farklı yaklaşımın karşılaştırılması

Giriş: CELB ve LRC Yatırımı Karşılaştırması

Kripto para piyasasında CeluvPlay ile Loopring’in karşılaştırılması, yatırımcılar için kaçınılmaz bir gündem olmuştur. Her iki proje, piyasa değeri sıralaması, kullanım alanları ve fiyat performansı bakımından belirgin farklılıklar gösterirken, aynı zamanda kripto varlıklar arasında farklı konumları temsil etmektedir.

CeluvPlay (CELB): Lansmanından bu yana Web3 oyun ve eğlence ekosistemiyle piyasa tarafından değer görmüştür.

Loopring (LRC): 2017’den beri merkeziyetsiz borsa protokolü olarak tanınmakta olup, Ethereum ekosisteminin önde gelen projeleri arasındadır.

Bu makalede, CELB ile LRC’nin yatırım değerini; tarihsel fiyat hareketleri, arz mekanizmaları, kurumsal benimseme, teknolojik ekosistemler ve gelecek öngörüleri üzerinden kapsamlı şekilde analiz edeceğiz ve yatırımcıların en çok merak ettiği şu soruya yanıt arayacağız:

"Şu anda hangisi daha cazip bir yatırım?"

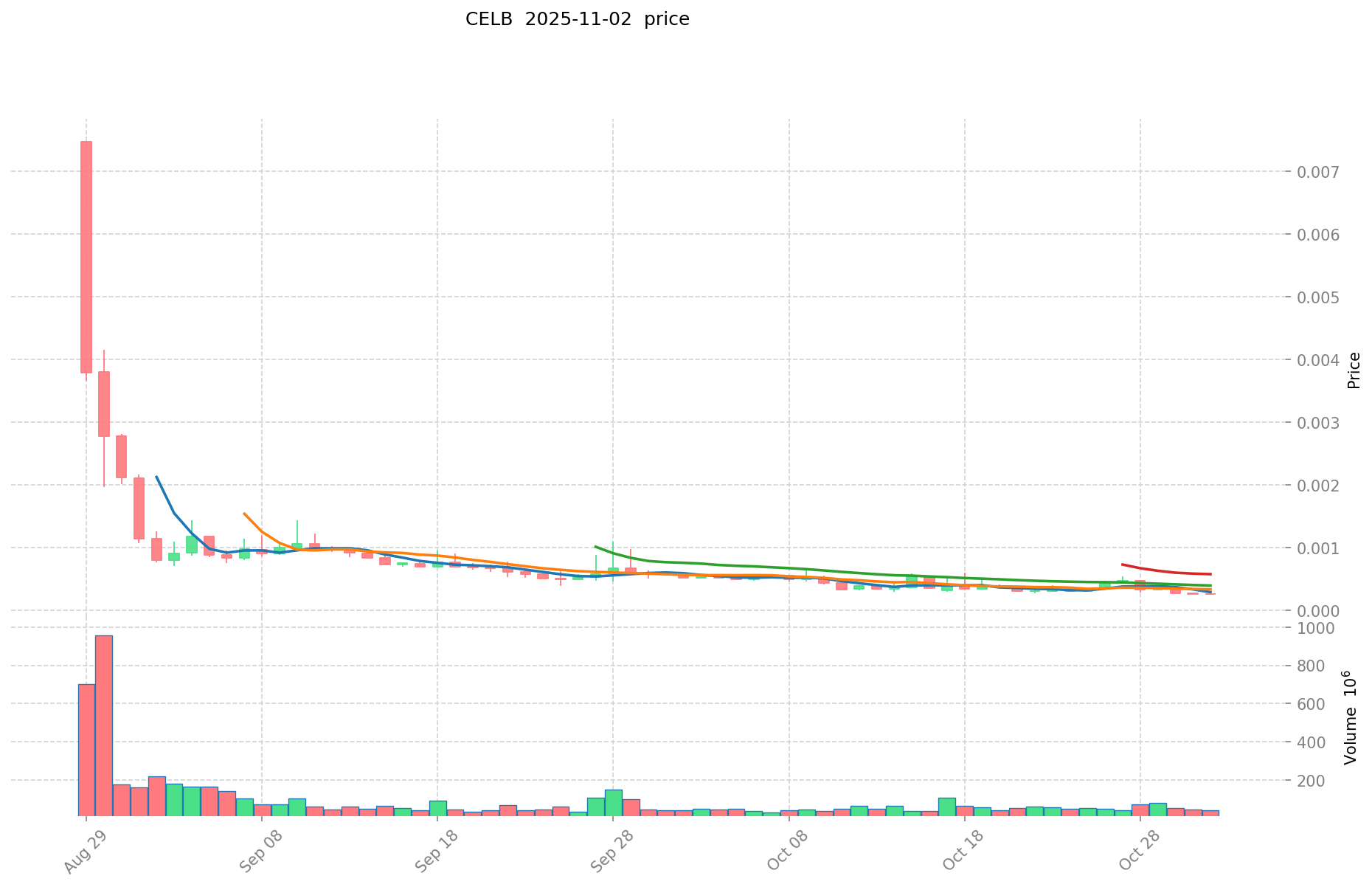

I. Fiyat Geçmişi Karşılaştırması ve Güncel Piyasa Durumu

CeluvPlay (CELB) ve Loopring (LRC) Tarihsel Fiyat Eğilimleri

- 2025: CELB yüksek volatilite yaşadı ve 29 Ağustos 2025’te $0,00747 ile zirveye ulaştı.

- 2021: LRC’de ciddi fiyat artışı görüldü ve 10 Kasım 2021’de $3,75 ile tüm zamanların en yüksek seviyesine çıktı.

- Karşılaştırmalı analiz: Son piyasa döngüsünde CELB, $0,00747’den mevcut $0,0002525 seviyesine inerken; LRC ise $3,75’ten $0,06656’ya geriledi.

Güncel Piyasa Durumu (02 Kasım 2025)

- CELB güncel fiyatı: $0,0002525

- LRC güncel fiyatı: $0,06656

- 24 saatlik işlem hacmi: $9.877,93 (CELB) | $162.784,82 (LRC)

- Piyasa Duyarlılık Endeksi (Korku & Açgözlülük Endeksi): 33 (Korku)

Anlık fiyatları görmek için tıklayın:

- CELB güncel fiyatı için Piyasa Fiyatı

- LRC güncel fiyatı için Piyasa Fiyatı

CELB ve LRC’nin Yatırım Değeri Kriterleri

Sunulan referanslarda yer alan sınırlı bilgiler nedeniyle CELB ve LRC (Loopring) tokenları arasında eksiksiz bir karşılaştırma yapmak mümkün değildir. Referanslarda token ekonomisi, teknik detaylar, kurumsal benimseme veya piyasa uygulamaları hakkında yeterli veri bulunmamaktadır.

Referanslarda verilen tek anlamlı bilgi; kripto varlıklara yatırım değerinin genellikle aşağıdaki unsurlara bağlı olduğudur:

- Teknolojik yenilik

- Uygulama alanları

- Piyasa talebi

- Proje geliştirme ilerlemesi

- Topluluk desteği

- Piyasa dalgalanmaları

- Düzenleyici ortam

CELB ile LRC’nin yatırım değerini detaylı analiz etmek için her iki tokenın arz mekanizmaları, kurumsal benimseme eğilimleri, teknik geliştirme yol haritaları ve farklı makroekonomik koşullardaki performanslarına dair özel verilere ihtiyaç vardır.

III. 2025-2030 Fiyat Tahmini: CELB ve LRC

Kısa Vadeli Tahmin (2025)

- CELB: Muhafazakâr $0,000128367 - $0,0002517 | İyimser $0,0002517 - $0,000322176

- LRC: Muhafazakâr $0,040014 - $0,06669 | İyimser $0,06669 - $0,0853632

Orta Vadeli Tahmin (2027)

- CELB büyüme aşamasına girebilir, tahmini fiyat aralığı: $0,000199565379 - $0,000322374843

- LRC yükseliş dönemine girebilir, tahmini fiyat aralığı: $0,0705526848 - $0,09965566728

- Temel etkenler: Kurumsal sermaye girişi, ETF gelişimi, ekosistem büyümesi

Uzun Vadeli Tahmin (2030)

- CELB: Temel senaryo $0,000438556694709 - $0,000481930433747 | İyimser senaryo $0,000481930433747 - $0,000520484868446

- LRC: Temel senaryo $0,078451752366351 - $0,10601588157615 | İyimser senaryo $0,10601588157615 - $0,156903504732702

Feragatname: Yukarıdaki tahminler tarihsel veriler ve piyasa analizine dayanmaktadır. Kripto para piyasalarında yüksek volatilite ve ani değişimler yaşanabilir. Bu tahminler finansal tavsiye değildir. Yatırım kararı almadan önce mutlaka kendi araştırmanızı yapınız.

CELB:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0.000322176 | 0.0002517 | 0.000128367 | 0 |

| 2026 | 0.00032710932 | 0.000286938 | 0.00023815854 | 13 |

| 2027 | 0.000322374843 | 0.00030702366 | 0.000199565379 | 21 |

| 2028 | 0.00046575489222 | 0.0003146992515 | 0.000305258273955 | 24 |

| 2029 | 0.000573633795634 | 0.00039022707186 | 0.000265354408864 | 54 |

| 2030 | 0.000520484868446 | 0.000481930433747 | 0.000438556694709 | 90 |

LRC:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0.0853632 | 0.06669 | 0.040014 | 0 |

| 2026 | 0.100355112 | 0.0760266 | 0.04941729 | 14 |

| 2027 | 0.09965566728 | 0.088190856 | 0.0705526848 | 32 |

| 2028 | 0.103315587804 | 0.09392326164 | 0.0864094007088 | 40 |

| 2029 | 0.1134123384303 | 0.098619424722 | 0.06015784908042 | 48 |

| 2030 | 0.156903504732702 | 0.10601588157615 | 0.078451752366351 | 59 |

IV. Yatırım Stratejisi Karşılaştırması: CELB ve LRC

Uzun Vadeli ve Kısa Vadeli Yatırım Stratejileri

- CELB: Web3 oyun ve eğlence ekosistemine ilgi duyan yatırımcılar için uygundur

- LRC: Merkeziyetsiz borsa protokolleri ve Ethereum ekosistemine odaklanan yatırımcılar için uygundur

Risk Yönetimi ve Varlık Dağılımı

- Muhafazakâr yatırımcılar: CELB %30, LRC %70

- Agresif yatırımcılar: CELB %60, LRC %40

- Koruma araçları: Stabilcoin portföyü, opsiyonlar, çapraz para portföyleri

V. Potansiyel Risk Karşılaştırması

Piyasa Riski

- CELB: Yeni olması nedeniyle daha yüksek volatilite riski

- LRC: Ethereum ekosisteminin genel performansına bağlılık riski

Teknik Risk

- CELB: Ölçeklenebilirlik ve ağ istikrarı ile ilgili riskler

- LRC: Akıllı sözleşme açıkları ve Ethereum ağ tıkanıklığı potansiyeli

Düzenleyici Risk

- Küresel düzenleyici politikalar, oyun tokenları ve merkeziyetsiz borsalar üzerinde farklı etkiler yaratabilir ve her iki tokenı farklı biçimde etkileyebilir

VI. Sonuç: Hangisi Daha Avantajlı Bir Alım?

📌 Yatırım Değeri Özeti:

- CELB avantajları: Gelişen Web3 oyun sektörüne erişim

- LRC avantajları: Ethereum ekosisteminde köklü varlık, merkeziyetsiz borsa teknolojisine odaklanma

✅ Yatırım Tavsiyesi:

- Yeni yatırımcılar: LRC’nin uzun vadeli piyasa varlığı nedeniyle dengeli ve hafif LRC ağırlıklı portföy düşünülebilir

- Deneyimli yatırımcılar: Risk toleransı ve ekosisteme olan inanca göre değerlendirme yapılmalı

- Kurumsal yatırımcılar: Her iki projenin temelleri ve piyasa konumlandırması hakkında detaylı analiz yapılmalı

⚠️ Risk Uyarısı: Kripto para piyasalarında yüksek volatilite söz konusudur. Bu makale yatırım tavsiyesi niteliği taşımamaktadır. None

VII. Sıkça Sorulan Sorular

S1: CELB ile LRC arasındaki temel farklar nelerdir? C: CELB, Web3 oyun ve eğlence ekosistemine odaklanırken; LRC, Ethereum ekosisteminde merkeziyetsiz borsa protokolüdür. CELB daha yeni ve volatil bir proje, LRC ise 2017’den beri faaliyette ve daha köklü bir geçmişe sahip.

S2: Tarihsel olarak hangi token daha iyi performans gösterdi? C: Mevcut verilere göre LRC, Kasım 2021’de $3,75 ile zirveye ulaştı ve tarihsel olarak daha güçlü performans sergiledi. CELB’in en yüksek seviyesi Ağustos 2025’te $0,00747 olup, sonrasında ciddi bir geri çekilme yaşadı.

S3: 2030 yılı için CELB ve LRC fiyat tahminleri nedir? C: CELB için temel senaryoda $0,000438556694709 - $0,000481930433747, iyimser senaryoda ise $0,000481930433747 - $0,000520484868446 arası tahmin edilmektedir. LRC için ise temel senaryo $0,078451752366351 - $0,10601588157615, iyimser senaryo ise $0,10601588157615 - $0,156903504732702 arasıdır.

S4: Yatırımcılar CELB ve LRC arasında varlıklarını nasıl dağıtmalı? C: Muhafazakâr yatırımcılar için CELB %30, LRC %70; agresif yatırımcılar için CELB %60, LRC %40 önerilebilir. Ancak dağılımlar bireysel risk toleransı ve piyasa koşullarına göre şekillendirilmelidir.

S5: CELB ve LRC yatırımlarındaki ana riskler nelerdir? C: Her iki token da kripto para volatilitesi nedeniyle piyasa riski taşır. CELB’de ölçeklenebilirlik ve ağ istikrarı kaynaklı teknik riskler öne çıkarken, LRC için akıllı sözleşme açıkları ve Ethereum ağ tıkanıklığı riskleri söz konusudur. Her ikisi de düzenleyici risklere açıktır ve bu riskler oyun tokenları ile merkeziyetsiz borsaları ayrı biçimde etkileyebilir.

S6: Uzun vadeli yatırım için hangi token daha uygun? C: Yatırım tercihi, ilgili ekosistemlere olan inanca bağlıdır. LRC, Ethereum ekosistemindeki köklü varlığıyla uzun vadeli yatırım için daha uygun olabilir; CELB ise Web3 oyun ve eğlence sektörüne güvenenler için cazip bir seçenek sunar.

S7: Güncel piyasa koşulları CELB ve LRC’yi nasıl etkiliyor? C: 2 Kasım 2025 itibarıyla piyasa duyarlılık endeksi (Korku & Açgözlülük Endeksi) 33 seviyesinde ve piyasada korku hakim. Bu durum her iki token için olumsuz bir ortam yaratabilir; ancak etkiler, projelerin kendi piyasa dinamikleri ve ekosistem gelişmelerine göre değişkenlik gösterebilir.

Hooked Protocol (HOOK) iyi bir yatırım mı?: Riskler, potansiyel getiriler ve piyasa görünümü üzerine kapsamlı bir analiz

GT Token 2025'te: Yatırımcılar için Alım, Staking ve Kullanım Alanları

MASA ve GRT: Merkeziyetsiz uygulamalar için önde gelen iki Web3 altyapı çözümünün karşılaştırılması

Gomble (GM) iyi bir yatırım mı?: Otomotiv üreticisinin finansal performansı ve gelecekteki beklentilerinin analizi

2025 IDOL Fiyat Tahmini: Dijital Eğlence Token’inin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

AKI ve SNX: Böbrek Hasarı Değerlendirmesindeki Farkların Anlaşılması

AVAAI Nedir: Gelişmiş Sanal Yapay Zekâ Asistanları ve Uygulamalarına Kapsamlı Rehber

Wall Street Pepe Token’ı Keşfedin: Lansman Detayları, Öngörüler ve Satın Alma Kılavuzu

2025 BZZ Fiyat Tahmini: Uzman Analizi ve Swarm'ın Yerel Token'ı İçin Piyasa Görünümü

Zincirler arası ticaret artık daha basit: Hyperswap'ın en yeni lansmanını ve airdrop'un temel noktalarını keşfedin