B3X vs ETC: Comparing Two Leading Blockchain Platforms for Enterprise Solutions

Introduction: B3X vs ETC Investment Comparison

In the cryptocurrency market, the comparison between Bnext (B3X) vs Ethereum Classic (ETC) has always been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positions in crypto assets.

Bnext (B3X): Since its launch in 2022, it has gained market recognition for its focus on innovative financial services and remittance solutions.

Ethereum Classic (ETC): Established in 2016, it has been hailed as a decentralized platform for smart contracts, representing one of the most traded and valuable cryptocurrencies globally.

This article will comprehensively analyze the investment value comparison between B3X and ETC, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

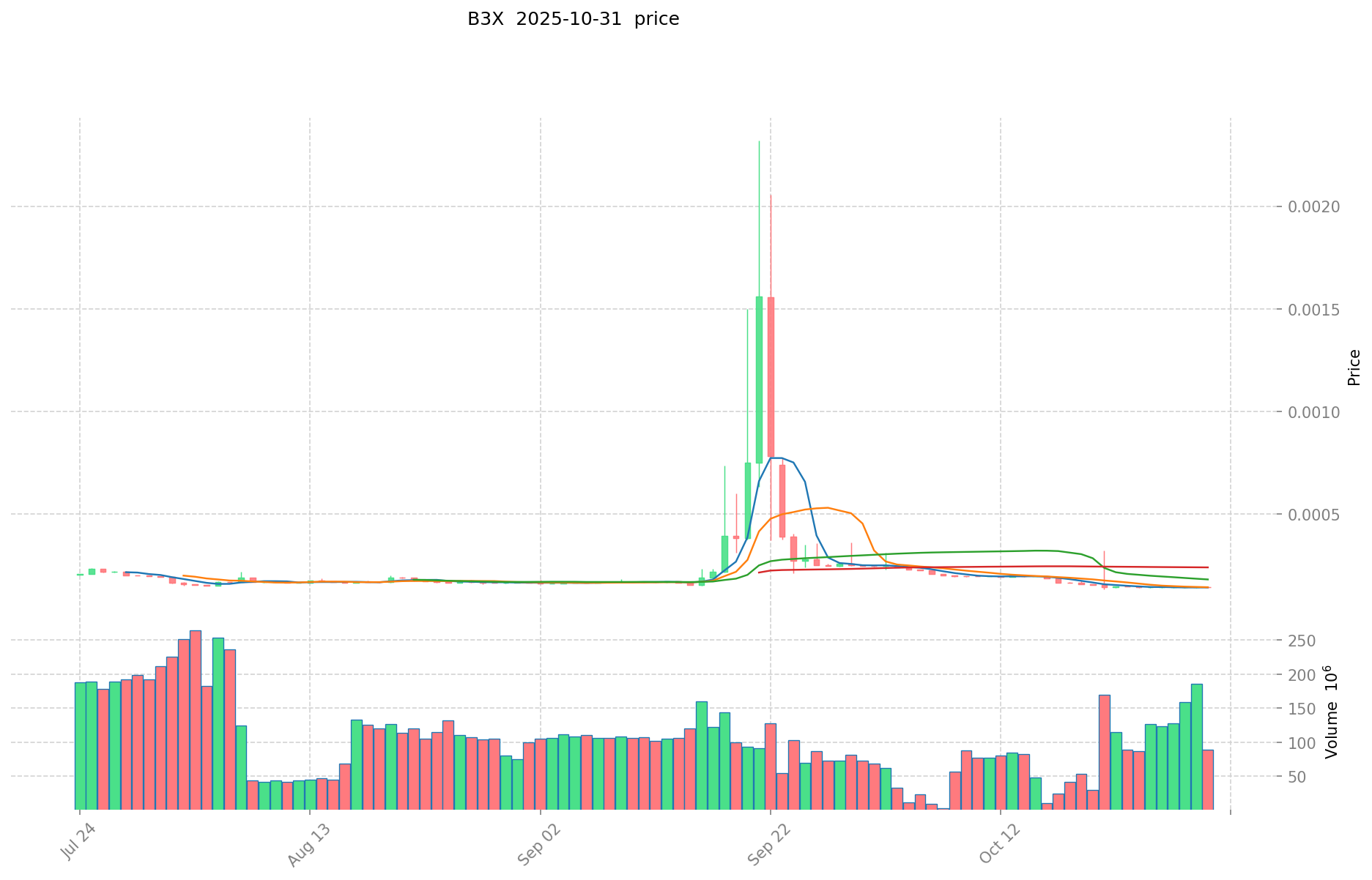

I. Price History Comparison and Current Market Status

B3X and ETC Historical Price Trends

- 2022: B3X launched its IEO in March, becoming the first financial platform to issue tokens in Spain.

- 2021: ETC reached its all-time high of $167.09 on May 7, 2021.

- Comparative analysis: In the recent market cycle, B3X has declined from its high of $0.02009271 to its current price of $0.0001416, while ETC has fallen from its peak of $167.09 to the current $15.737.

Current Market Situation (October 31, 2025)

- B3X current price: $0.0001416

- ETC current price: $15.737

- 24-hour trading volume: B3X $9,202.70 vs ETC $2,796,753.72

- Market Sentiment Index (Fear & Greed Index): 29 (Fear)

Click to view real-time prices:

- Check B3X current price Market Price

- Check ETC current price Market Price

Key Factors Affecting B3X vs ETC Investment Value

Financial Performance and Management Capability

- B3X: Annual revenue reached $778.3 million in 2024, representing a 13.4% growth compared to $686.4 million in 2023

- ETC: Financial performance data not specified in the provided materials

- 📌 Historical pattern: Improved management capabilities help balance cost pressures and drive growth

Risk Management and Investment Considerations

- Ownership changes: From an economic perspective, ownership changes imply transfer of all associated risks

- Risk factors: Investors need comprehensive understanding of all risk factors before making investment decisions

- Investment portfolio considerations: Asset allocation should be adjusted timely to balance investment risks and returns

Macroeconomic Factors and Market Cycle

- Inflation impact: Money value is affected by inflation, deflation, timing, politics, and economic factors

- Economic environment: Rapidly changing economic environments create both challenges and opportunities

- Performance metrics: Return rates, weighted average returns over 5-year periods are important performance indicators

Regulatory Environment and Governance

- Regulatory frameworks: Securities laws and regulations establish the foundation for market operations

- Corporate governance: Core values like integrity and agility guide strategic frameworks

- ESG considerations: Setting new goals and indicators to address challenges from changing economic environments

III. 2025-2030 Price Prediction: B3X vs ETC

Short-term Prediction (2025)

- B3X: Conservative $0.000095341 - $0.0001423 | Optimistic $0.0001423 - $0.000179298

- ETC: Conservative $14.64285 - $15.745 | Optimistic $15.745 - $20.62595

Mid-term Prediction (2027)

- B3X may enter a growth phase, with prices expected between $0.00017122681515 - $0.00019700289485

- ETC may enter a steady growth phase, with prices expected between $16.30782470625 - $22.44724106625

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- B3X: Base scenario $0.000174628629378 - $0.000268659429813 | Optimistic scenario $0.000268659429813 - $0.000330451098669

- ETC: Base scenario $17.23288443192956 - $25.342477105778765 | Optimistic scenario $25.342477105778765 - $35.732892719148059

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

B3X:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.000179298 | 0.0001423 | 0.000095341 | 0 |

| 2026 | 0.00020743071 | 0.000160799 | 0.00009326342 | 13 |

| 2027 | 0.00019700289485 | 0.000184114855 | 0.00017122681515 | 29 |

| 2028 | 0.000268688013644 | 0.000190558874925 | 0.000165786221184 | 33 |

| 2029 | 0.000307695415341 | 0.000229623444284 | 0.000119404191027 | 61 |

| 2030 | 0.000330451098669 | 0.000268659429813 | 0.000174628629378 | 88 |

ETC:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 20.62595 | 15.745 | 14.64285 | 0 |

| 2026 | 20.18587725 | 18.185475 | 14.9120895 | 15 |

| 2027 | 22.44724106625 | 19.185676125 | 16.30782470625 | 21 |

| 2028 | 22.68993986923125 | 20.816458595625 | 11.2408876416375 | 32 |

| 2029 | 28.931754979129406 | 21.753199232428125 | 12.616855554808312 | 38 |

| 2030 | 35.732892719148059 | 25.342477105778765 | 17.23288443192956 | 60 |

IV. Investment Strategy Comparison: B3X vs ETC

Long-term vs Short-term Investment Strategy

- B3X: Suitable for investors focused on innovative financial services and remittance solutions

- ETC: Suitable for investors seeking established platforms with smart contract capabilities

Risk Management and Asset Allocation

- Conservative investors: B3X: 20% vs ETC: 80%

- Aggressive investors: B3X: 40% vs ETC: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- B3X: Higher volatility due to lower market cap and trading volume

- ETC: Susceptible to overall cryptocurrency market trends

Technical Risk

- B3X: Scalability, network stability

- ETC: Mining centralization, security vulnerabilities

Regulatory Risk

- Global regulatory policies may have different impacts on both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- B3X advantages: Focus on innovative financial services, potential for growth in remittance solutions

- ETC advantages: Established platform, higher liquidity, smart contract capabilities

✅ Investment Advice:

- Novice investors: Consider allocating a small portion to ETC for exposure to established cryptocurrencies

- Experienced investors: Diversify between B3X and ETC based on risk tolerance and market outlook

- Institutional investors: Conduct thorough due diligence on both assets, considering B3X for potential growth and ETC for established market presence

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between B3X and ETC? A: B3X focuses on innovative financial services and remittance solutions, launched in 2022. ETC is an established platform for smart contracts, launched in 2016. B3X has a lower market cap and trading volume, while ETC has higher liquidity and a more established presence in the cryptocurrency market.

Q2: Which asset has shown better price performance historically? A: Based on the provided data, ETC has shown better historical price performance. It reached an all-time high of $167.09 in May 2021, while B3X's highest price was $0.02009271. However, both assets have experienced significant declines from their peaks.

Q3: What are the price predictions for B3X and ETC by 2030? A: By 2030, B3X is predicted to reach $0.000268659429813 - $0.000330451098669 in an optimistic scenario. ETC is expected to reach $25.342477105778765 - $35.732892719148059 in an optimistic scenario. These predictions are subject to market conditions and should not be considered as financial advice.

Q4: How should investors allocate their portfolio between B3X and ETC? A: Conservative investors might consider allocating 20% to B3X and 80% to ETC. More aggressive investors could opt for 40% B3X and 60% ETC. However, individual allocations should be based on personal risk tolerance and market outlook.

Q5: What are the main risks associated with investing in B3X and ETC? A: Both assets face market risks related to cryptocurrency volatility. B3X has higher volatility due to its lower market cap and trading volume. ETC faces risks of mining centralization and potential security vulnerabilities. Both are subject to regulatory risks as global policies evolve.

Q6: Which asset is more suitable for novice investors? A: For novice investors, ETC might be more suitable due to its established presence in the market and higher liquidity. However, it's advisable to start with a small allocation and thoroughly research before investing in any cryptocurrency.

Q7: How do macroeconomic factors affect the investment value of B3X and ETC? A: Macroeconomic factors such as inflation, economic environment, and market cycles can significantly impact both assets. These factors affect the overall cryptocurrency market sentiment and can influence price movements and investor behavior for both B3X and ETC.

Share

Content