ALA vs BTC: The Battle for Crypto Supremacy in the Health and Wellness Space

Introduction: ALA vs BTC Investment Comparison

In the cryptocurrency market, ALA vs BTC comparison has always been a topic that investors cannot avoid. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different cryptocurrency asset positioning.

Alanyaspor Fan Token (ALA): Since its launch, it has gained market recognition for its positioning as a fan token that strengthens the relationship between fans and the football club.

Bitcoin (BTC): Since its inception in 2008, it has been hailed as "digital gold" and is one of the cryptocurrencies with the highest global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between ALA and BTC, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, and attempt to answer the question that investors are most concerned about:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

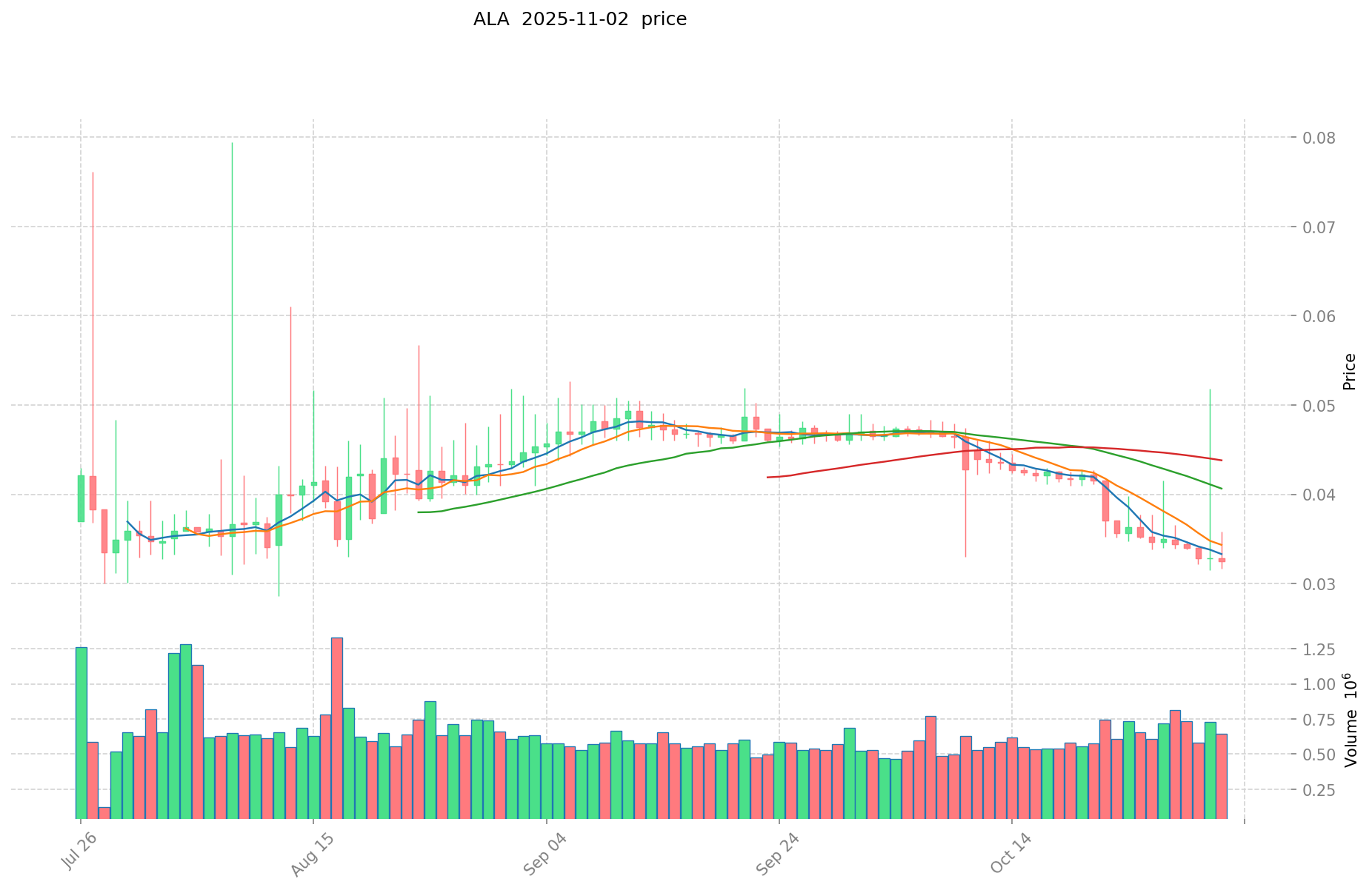

ALA and BTC Historical Price Trends

- 2021: ALA reached its all-time high of $2.09 on November 13, 2021.

- 2025: BTC hit a new all-time high of $126,080 on October 7, 2025.

- Comparative analysis: In the current market cycle, ALA has dropped from its high of $2.09 to a low of $0.02911178, while BTC has shown significant growth, reaching new highs.

Current Market Situation (2025-11-02)

- ALA current price: $0.03243

- BTC current price: $110,775.7

- 24-hour trading volume: $17,578.07 (ALA) vs $601,713,546.33 (BTC)

- Market Sentiment Index (Fear & Greed Index): 33 (Fear)

Click to view real-time prices:

- View ALA current price Market Price

- View BTC current price Market Price

II. Core Factors Affecting the Investment Value of TAO vs BTC

Supply Mechanism Comparison (Tokenomics)

- Bitcoin (BTC): Fixed maximum supply of 21 million coins with halving mechanism occurring approximately every four years, creating scarcity and deflationary characteristics

- Bittensor (TAO): Maximum supply of 21 million tokens, mirroring Bitcoin's scarcity model but tied to AI and machine learning incentive structures

- 📌 Historical Pattern: Bitcoin's halving cycles have historically triggered bull markets, while TAO's value is driven by adoption of its decentralized machine learning network

Institutional Adoption and Market Applications

- Institutional Holdings: Bitcoin has gained significant institutional adoption with major companies like MicroStrategy and investment firms adding BTC to their balance sheets, while TAO is still in earlier stages of institutional recognition

- Enterprise Adoption: Bitcoin is increasingly used as a reserve asset and settlement layer, while Bittensor focuses on decentralized AI infrastructure and machine learning applications

- Regulatory Attitudes: Bitcoin has established regulatory frameworks in many jurisdictions, while AI-focused cryptocurrencies like TAO face an evolving regulatory landscape

Technical Development and Ecosystem Building

- Bittensor Technical Development: Focused on creating decentralized machine learning networks where AI nodes collaborate and receive token incentives, transforming machine learning into tradable commodities

- Bitcoin Technical Development: Continues to focus on security, scalability improvements via Lightning Network, and maintaining its role as a store of value

- Ecosystem Comparison: Bitcoin has a mature ecosystem focused on financial applications, while Bittensor is building a specialized ecosystem for decentralized AI and machine learning services

Macroeconomic Environment and Market Cycles

- Inflation Performance: Bitcoin has established itself as "digital gold" with strong anti-inflationary properties, while TAO's inflation resistance is tied to the growing value of AI technologies

- Monetary Policy Impact: Both are affected by interest rates and USD strength, though Bitcoin has longer historical data showing these correlations

- Geopolitical Factors: Bitcoin benefits from global demand for censorship-resistant assets, while Bittensor's value proposition centers on democratizing AI development away from large centralized companies

III. 2025-2030 Price Prediction: ALA vs BTC

Short-term Prediction (2025)

- ALA: Conservative $0.0168064 - $0.03232 | Optimistic $0.03232 - $0.0446016

- BTC: Conservative $94,111.575 - $110,719.5 | Optimistic $110,719.5 - $148,364.13

Mid-term Prediction (2027)

- ALA may enter a growth phase, with estimated prices ranging from $0.0246341424 to $0.054518184

- BTC may enter a consolidation phase, with estimated prices ranging from $110,175.3136575 to $146,900.41821

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- ALA: Base scenario $0.0552887329071 - $0.080721550044366 | Optimistic scenario $0.080721550044366+

- BTC: Base scenario $207,945.7031106 - $278,647.242168204 | Optimistic scenario $278,647.242168204+

Disclaimer: The above predictions are based on historical data and market analysis. Cryptocurrency markets are highly volatile and subject to rapid changes. These forecasts should not be considered as financial advice. Always conduct your own research before making investment decisions.

ALA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0446016 | 0.03232 | 0.0168064 | 0 |

| 2026 | 0.04230688 | 0.0384608 | 0.029230208 | 18 |

| 2027 | 0.054518184 | 0.04038384 | 0.0246341424 | 24 |

| 2028 | 0.05172160308 | 0.047451012 | 0.03416472864 | 46 |

| 2029 | 0.0609911582742 | 0.04958630754 | 0.0461152660122 | 52 |

| 2030 | 0.080721550044366 | 0.0552887329071 | 0.046995422971035 | 70 |

BTC:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 148364.13 | 110719.5 | 94111.575 | 0 |

| 2026 | 142495.9965 | 129541.815 | 124360.1424 | 17 |

| 2027 | 146900.41821 | 136018.90575 | 110175.3136575 | 22 |

| 2028 | 198043.526772 | 141459.66198 | 127313.695782 | 27 |

| 2029 | 246139.8118452 | 169751.594376 | 140893.82333208 | 53 |

| 2030 | 278647.242168204 | 207945.7031106 | 135164.70702189 | 87 |

IV. Investment Strategy Comparison: ALA vs BTC

Long-term vs Short-term Investment Strategies

- ALA: Suitable for investors interested in fan tokens and sports-related blockchain applications

- BTC: Suitable for investors seeking a store of value and long-term growth potential

Risk Management and Asset Allocation

- Conservative investors: ALA: 5% vs BTC: 95%

- Aggressive investors: ALA: 20% vs BTC: 80%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- ALA: High volatility due to smaller market cap and limited adoption

- BTC: Susceptible to macroeconomic factors and regulatory news

Technical Risk

- ALA: Scalability, network stability

- BTC: Mining centralization, potential security vulnerabilities

Regulatory Risk

- Global regulatory policies may have different impacts on both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- ALA advantages: Niche market in fan tokens, potential for growth in sports-related blockchain applications

- BTC advantages: Established market leader, strong brand recognition, increasing institutional adoption

✅ Investment Advice:

- New investors: Consider a small allocation to BTC as part of a diversified portfolio

- Experienced investors: Allocate majority to BTC, with a small position in ALA for potential high-risk, high-reward opportunity

- Institutional investors: Focus on BTC for its established market presence and regulatory clarity

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between ALA and BTC? A: ALA is a fan token for Alanyaspor football club, while BTC is the first and largest cryptocurrency. BTC has a much larger market cap, higher trading volume, and is widely recognized as a store of value. ALA has a more niche use case in the sports and fan engagement sector.

Q2: Which has performed better historically, ALA or BTC? A: BTC has shown significantly better historical performance. While ALA reached its all-time high of $2.09 in November 2021, it has since declined to around $0.03. BTC, on the other hand, reached a new all-time high of $126,080 in October 2025 and is currently trading around $110,775.

Q3: How do the supply mechanisms of ALA and BTC compare? A: BTC has a fixed maximum supply of 21 million coins with a halving mechanism occurring approximately every four years. ALA's supply mechanism is not specified in the given information, but as a fan token, it likely has a different tokenomic structure than BTC.

Q4: What are the key factors affecting the investment value of ALA and BTC? A: Key factors include price history, market capitalization, trading volume, institutional adoption, technical development, regulatory environment, and macroeconomic conditions. BTC generally has stronger fundamentals in most of these areas compared to ALA.

Q5: What are the predicted price ranges for ALA and BTC in 2030? A: According to the provided predictions, ALA's base scenario for 2030 is $0.0552887329071 - $0.080721550044366, with an optimistic scenario above $0.080721550044366. BTC's base scenario for 2030 is $207,945.7031106 - $278,647.242168204, with an optimistic scenario above $278,647.242168204.

Q6: How should investors allocate their portfolio between ALA and BTC? A: Conservative investors might consider allocating 5% to ALA and 95% to BTC, while more aggressive investors might allocate 20% to ALA and 80% to BTC. However, individual allocations should be based on personal risk tolerance and investment goals.

Q7: What are the main risks associated with investing in ALA and BTC? A: Both face market risks due to the volatile nature of cryptocurrencies. ALA has higher volatility risk due to its smaller market cap and limited adoption. BTC faces risks related to macroeconomic factors and regulatory changes. Both also have technical risks, with ALA potentially facing scalability and network stability issues, while BTC could be affected by mining centralization and potential security vulnerabilities.

Share

Content